A -share sector said | Half -year ending deep "V" trend rose over 500 points.

Author:Cover news Time:2022.07.03

Cover Journalist Zhu Ning

On July 1, the Shanghai Index shook a narrow range in the morning and fell slightly in the afternoon. Essence

As of the close, the Shanghai Index fell 0.32%at 3387.64 points, the Shenzhen Index fell 0.28%at 12860.36 points, the GEM index fell 1.02%to 2781.94 points, and the total transaction between the two cities was 1051.3 billion yuan.

In the first half of this year, after experiencing multiple impacts such as the Russian -Ukraine conflict and the Federal Reserve's sharp interest rate hikes, the global stock market averaged the market that disappointed investors. At the same time, the S & P 500 Index will also set the worst performance in the past half of the past few decades.

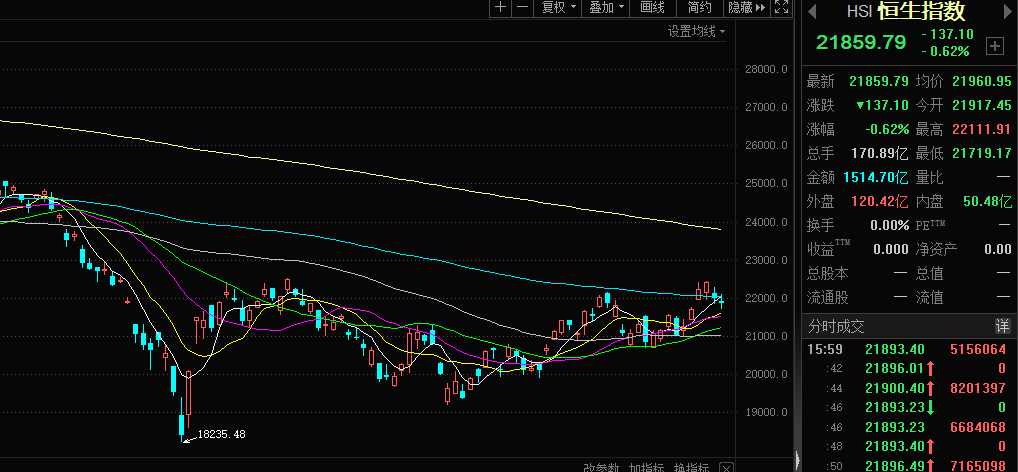

In contrast, although A shares and Hong Kong stocks fell fiercely at the beginning of the year, a round of rebound opened from the end of April made its decline relatively ease. As of July 1st, the Shanghai Stock Exchange Index fell 6.93%in the first half of the year, and the Hang Seng Index closed down 6.57%.

Exponent annual amplitude exceeds 20%

A shares rebound strong after May

In the first half of the year, the A -share market has fallen sharply by the internal and external unfavorable factors, but as of now, the Shanghai Stock Exchange Index has fallen by 6.93%in the past six months, and its performance in major financial markets worldwide is still more eye -catching.

From the perspective of the overall index, at the beginning of this year, the Shanghai Index gradually fell from 3500 points. After the Russian -Ukraine conflict caused a unilateral plunge in the market, this incident brought a huge impact on the capital market. In terms of public funds, some theme funds have retracted more than 30%of the year.

After the plunge in mid -March in the early stage, the market rebounded slightly, but in mid -to -late April, due to the affected affected by the epidemic, the most tragic wave of killing this year broke out. In less than ten trading days, the Shanghai Index fell from more than 3,100 to the lowest point in the first half of this year.

After entering May, the market began to passion for various profit and air factors. Especially in US stocks, the Fed's interest rate hikes settled, and US stocks encountered a continuous plunge. The reporter noticed that at this time, A shares no longer followed the decline in U.S. stocks. At the same time, the strong rebound of the New Energy Circuit Fund became the biggest highlight of the market. Some products rose 30%a month. As of June, some theme funds finally began to turn losses. After the operation of these three stages, in the first half of this year, the Shanghai Index completed a huge "V" reverse.

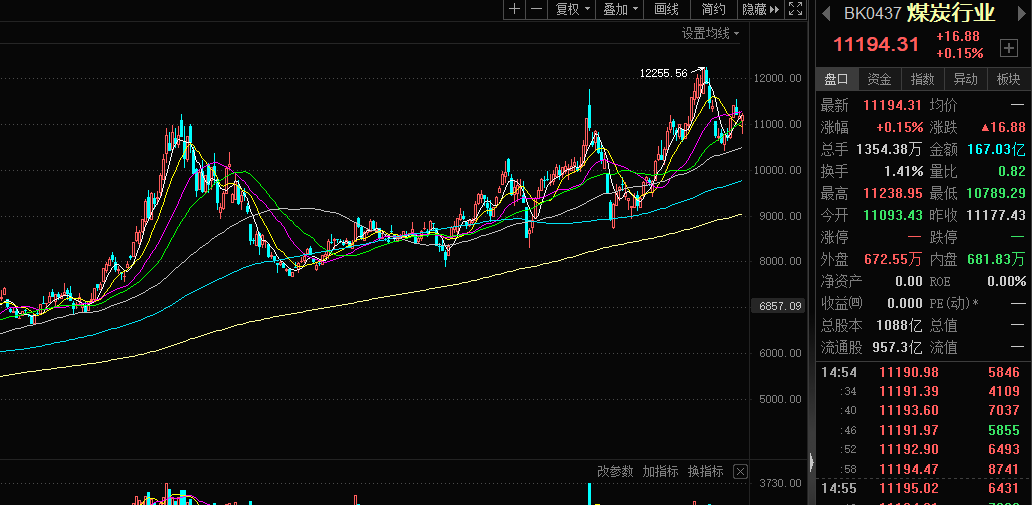

Energy prices rose to the increase in plates

From the perspective of the industry, since this year, the recovery of energy and epidemic has become the main tone of A shares. The four industries including silicon energy, hotel catering, coal, and tourism sector have increased by more than 28%! In addition, duty -free shops, energy -saving buildings and other industries have increased by more than 10%.

Among them, Silicon Energy is proud of the entire market with a 37.75%increase. The reporter noticed that the strong silicon energy is directly related to the continued high price of silicon materials. In 2022, the price of silicon material is still steady, and the current price is approaching the historical high in the third quarter of last year. The high -priced silicon material link also brings a high level of profitability to relevant companies in the short term.

In the first half of the year, the overall increase in the coal sector exceeded 45%, and became the most retrograde sector when the index was adjusted. The reason why coal was relatively strong in the first half of the year, from the context of the continuous fermentation of Russia and Ukraine's conflict, global coal prices continued to soar.

Data show that from January to April 2022, the total profit of the coal industry was 344.28 billion yuan, an increase of 199.3%year-on-year. In the second quarter, most coal prices continued the high prosperity of the previous quarter. The average price of power coal rose 2.3%-5.3%month-on-month.

Focus on the main line of economic recovery

Regarding the reasons for the "V" trend of the A -share deep "V", the reporter interviewed Zhou Maohua, an analyst of Everbright Bank. It believes that in addition to a series of peripherals in the early stage, the mood of the stock market has caused the stock market to fall, and some reasons may promote the stock market before the end of April. The rise, thereby accumulating a certain profit disk. The short -term profit set caused a certain adjustment of the broader market.

Judging from the current stock market trend, Zhou Maohua said: "At present, the fundamentals are steadily recovering, corporate profit prospects are optimistic, policy support, and valuations are still low. The reasons for the trend in this environment are not sufficient; Looking at, the market optimism is still upper to the wind. "

Regarding the trend of A -share market market and the follow -up market attention section, Xu Tian, a private equity fund manager, told reporters that from an optimistic perspective, the U.S. interest rate hikes, the influence of the Russian -Ukraine conflict, and the domestic epidemic rebound will gradually weaken. Continuous efforts, capital growth will also slowly recover.

As for the attention section, Xu Tian said that he should focus on the main line of economic recovery. In the macro background of economic recovery, the growth sector of high prosperity has a profit advantage. In the first quarter report of the A -share listed company in 2022, most of the upstream resources, new energy, part of consumption and growth are relatively bright, including photovoltaic, wind power, military, semiconductor sector, which shows that the cost pressure is greater pressure. In the context, the mainstream growth direction profit level can still maintain high prosperity. Secondly, with the relief of the epidemic, the logistics continues to recover. It is expected that the consumption elasticity is expected to be selected after the recovery of the epidemic control, and the relevant consumer sector can also pay more attention.

Hualong Securities believes that the main index of A -share index equity risk premium shows that the market is still in the bottom area of history and has the value of mid -term allocation.Although the index continues to rebound up after the low point of the low point on April 27, the relative position is still not high, and it still has a good layout opportunity.Most of the industry valuations are also in a reasonable range. After the adjustment of the early high valuation sector, the configuration value has been configured. In the second half of the year, the relevant low valuation sector will usher in investment opportunities.In terms of industry configuration and strategy selection, the main line of growth must be focused on the main line of growth, configuration of high -quality low valuation targets, large consumption, stable growth, and high -tech growth manufacturing are the three main lines with growth definition.

- END -

Five companies including China Baowu officially converted to state -owned capital investment companies

In order to implement the Party Central Committee and the State Council on deepening the reform and deployment of the reform of state -owned capital investment companies and further improving the accu

Fed's radical interest rate hike impact international market

Xinhua News Agency, New York, June 15th: The Fed's radical interest rate hike impacts the international marketXinhua News Agency reporter Liu YanFaced with the continuous high inflation, the Federal R...