Remain tax refund stimulus Enterprise innovation vitality

Author:State Administration of Taxati Time:2022.07.03

Since the beginning of this year, the Party Central Committee and the State Council have implemented major decision -making arrangements for large -scale VAT reserves. The tax department has resolutely implemented it, continuously released the dividend of retirement tax refund policies, resolved difficulties for enterprises, helped enterprises research and development innovation, and developed.

Removal tax refund adds to the innovation and development of enterprises

Recently, the taxation department of Henan Province visited the relevant enterprises in the field to understand the situation of corporate policies and promoted the implementation of the tax refund policy.

Henan Jiyuan Iron and Steel (Group) Co., Ltd. is a large national steel backbone enterprise, which produces about 70%of Henan's market demand for long industrial steel. In recent years, the steel homogeneity of ordinary industries has been serious, and the fierce competition in the industry and the inversion of technological upgrades have brought a huge impact on it. "With the strong support of tax preferential policies, the company has continuously increased the investment and innovation investment, and successfully realized a series of special steel products such as the gorgeous transformation from general to excellent, from excellent to special, and from special -to -special steel, and wind power bearing steel. The supply should be required. "When the change of the company, Lu Jin, the director of the company's finance department, was very emotional.

"As of now, the company has received a value -added tax of 108 million yuan." According to Lu Jin, the company plans to use all the money for equipment transformation and product technology research and development. about. "The preferential tax and fee preferential policies have given us great development. In the next step, we will connect the consumption end and quality supply side, strengthen research and development, do excellent characteristics, and build first -class enterprises." Lu Jin said.

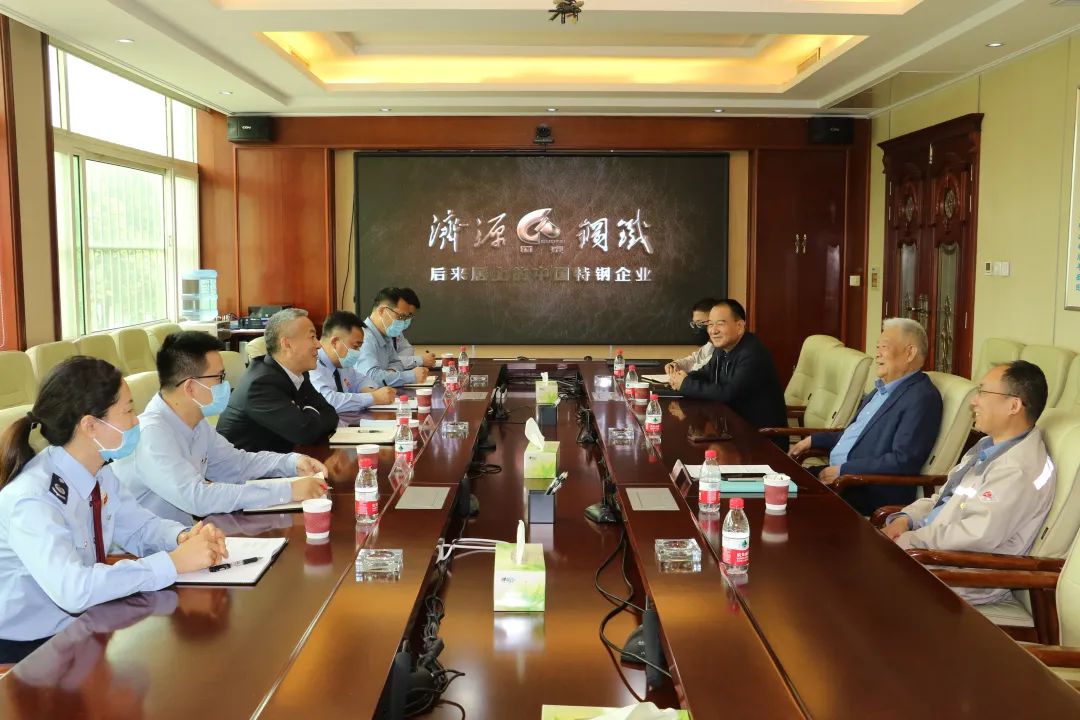

The picture shows the tax cadres of the Jiyuan Products City Integration Demonstration Zone in Henan Province visited the Iron and Steel Corporation to explain the new combined tax support policies to help enterprises relieve difficulties. Lu Bifeng/Photo

In the critical period of the third -generation variable platform electric vehicle EN00 project, the product is the first high -end intelligent pure electric model during the company's new energy transformation stage. As the vehicle manufacturing industry, a large amount of funds need to be invested in the construction of the factory and production line, the development of the model, and the development of the mold inspection.

"The company enjoyed a total of 9.17 million yuan in tax refund in April and May. The support of these real gold and silver effectively improved our company's cash flow, provided a strong guarantee for the company's maintenance of normal operation. A better buffer provides a better buffer during the pain period. "Zhao Feng, the company's financial person in charge, said that in addition to the timely and full payment of employees' wages, materials, etc. In the next step, the company also intends to invest 10 million yuan for scientific and technological research and development. At the same time, it has expanded high -tech talents to truly lead the development through innovation.

Innovation is to grasp development, and innovation is the future. With the continuous implementation of the large -scale value -added tax retaining policy, the continuous implementation of the decline and stability of the decline will become more innovative and stronger in development.

Tax rebate bonus stimulates the "little giant" innovation vitality

"Specialized new" enterprise is the vitality carrier of innovation power and the backbone of the strong chain. Since the beginning of this year, the taxation department of Anhui Province has settled a new combination of tax support policies, continuously improved the quality and efficiency of tax services, increased support for "specialized new" enterprises, and effectively resolved difficulties for enterprises.

"We can be at the forefront of the industry in the R & D of MEMS inertial sensor, and the support of tax preferential policies such as deduction and value -added tax refund from R & D expenses is inseparable." Manager Lin Ming said.

The picture shows tax cadres in Huizhou District, Huangshan City, Anhui Province, entered the material company to understand the production conditions of the enterprise and promote the combined tax support policy. Mei Zhenxin/Photo

It is understood that the company's annual technology research and development investment accounts for more than 20%of sales revenue. In the past three years, the company has enjoyed a total of 67.38 million yuan in R & D expenses of high -tech enterprises. This year, the company also enjoyed a tax refund of 922,000 yuan. "The falling bag of tax dividends allows the company to have ample funds for product development. This year, it is expected to go further on the development of high -precision positioning service products." Talking about the future development of the company, Lin Ming is full of confidence.

After the increase in enterprise R & D investment, once the sales of the initial sales will not be able to keep up with a large amount of value -added tax deductible, squeezing the corporate funds. This year, with the implementation of the new policy of the VAT reserved tax refund, this problem was solved.

"The tax refund of 8.09 million yuan is exactly the time when we are the most difficult, and the subsequent innovation and development are guaranteed." Wang Zhihong, the head of the first batch of special specialized "little giants" and Huangshan Shenjian New Materials Co., Ltd. Said happily.

The tax refund funds are sent "timely rain" to "China Core"

Daoyuan Technology is the leading enterprise of the electronic information industry in Yangzhou City, Jiangsu Province. Affected by the epidemic situation in the first half of this year, the company's last round of 350 million yuan of financing negotiation projects was forced to strand in the last round of the company; sales staff could not go out and lead to Shanghai, Beijing, Jiangxi and other places. The market development plan was suspended, and the new sales target of 300 million yuan was affected; coupled with poor logistics, which caused the company's product value of 40 million yuan in product backlogs, a series of problems brought greater financial pressure to the company.

"Cash flow is the lifeline of the enterprise. The country has introduced a large -scale VAT tax refund policy this time, bringing a lot of mobile funds to the company, so that we have more confidence in cope with the epidemic, and also have high -quality development." Sahawa, head of the Finance Department of Yuan Technology Group Co., Ltd., said.

The picture shows tax cadres from Jiangdu District, Yangzhou City, Jiangsu Province come to technology companies to visit the need to solve problems for enterprises.

"After understanding the difficulty of Daomei Technology, we got in touch with the company for the first time and taught them to handle the value -added tax retain tax refund." According to the relevant person in charge of the Taxation Bureau of Jiangdu District, Yangzhou City, the State Administration of Taxation.

"The 2.46 million yuan value -added tax refund has provided sufficient funding guarantee for our company to continue to accelerate the development of new products, and injects confidence and motivation into our capital increase and production." Cheng Yin said.

In order to achieve the "premature retreat, fast retreat, retreat, and refund" of tax refund, the taxation department of Jiangdu District, Yangzhou City made full use of tax big data to carry out intelligent analysis, and through "one enterprise, one policy" accurate service, "online+offline"Fine counseling and "simplified office+fast -moving" streamlined process, "special class+special window" accurately tracking the full chain model, helping taxes and fees support policies, and empowering enterprises as soon as possible.

Source: Henan Economic Daily, Anhui Daily, Economic Reference Network

Editor in charge: Heqi

- END -

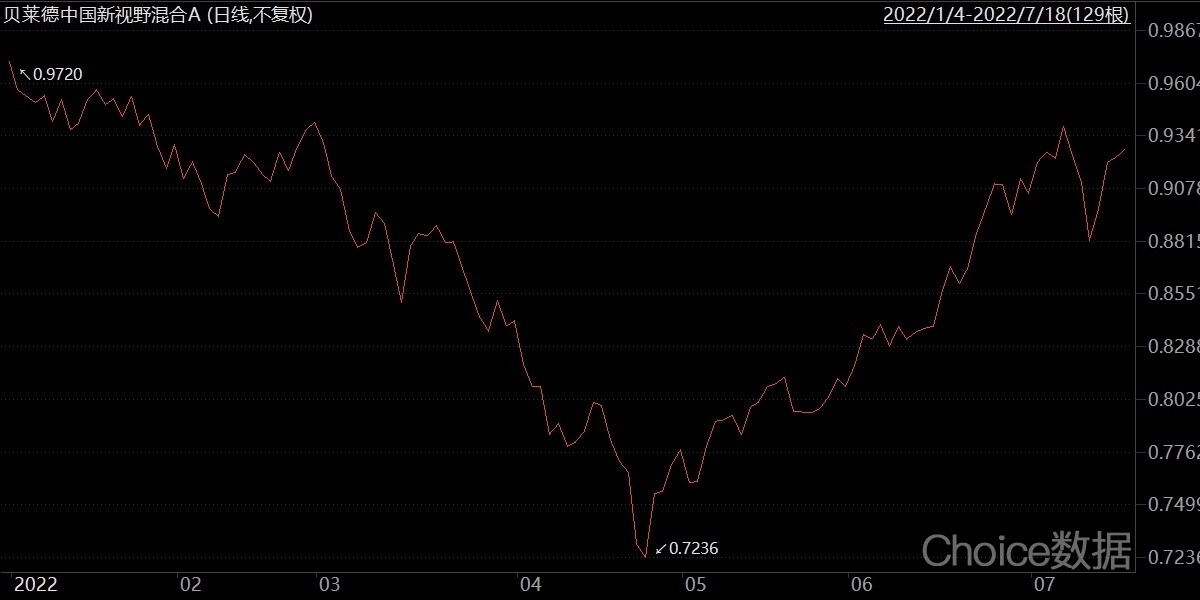

Berlaide's new vision mixed in 2022: The stock position increase and the net worth rebounded significantly

On July 19, 2022, the Berlaide Fund announced that its product was reported in the...

The price of pork appeared "ten consecutive rises", and the Development and Reform Commission "shot" to suppress pig prices

On July 5th, Capital State learned that on the 20227, the Price Department of the Development and Reform Commission organized the recent rising price of pigs and organized industry associations, some