The difference between the first tail is 40%!The half -year performance of the long holding fund is here

Author:China Fund News Time:2022.07.02

China Fund reporter Zhang Ling

Since this year, with the intensification of market fluctuations, fund companies are constantly adjusting their issuance strategies. Since June, there are many public offerings of the densely affiliated chief.

Many people in the industry said that the long -holding period can help products to avoid market fluctuations and increase investment win rates, but from the perspective of market changes, if the time is wrong, it will also affect the foundation experience. It is recommended that investors configure the products according to their own needs while doing well to obtain a better investment experience.

The long -term holding fund has emerged again

Wind data shows that as of June 30, the first -year and three -year public fund products that have been established since this year have exceeded two hundred, of which more than half are the one -year holding fund; the 21 three -year funds that have been established The cumulative issuance scale exceeds 20 billion yuan.

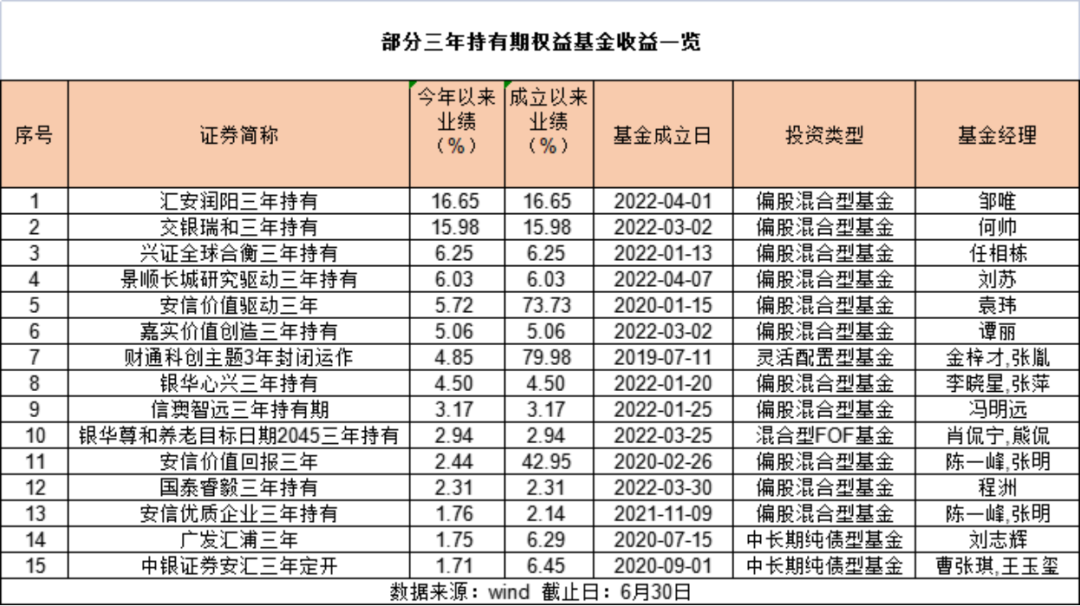

From the perspective of income, as of June 30, the one -year product that expired for the expiration period has been negative since this year, and 70%has gained a return since its establishment. In terms of three -year products, the 30 funds that have completed the first operation cycle currently have achieved positive income since its establishment. The benefits exceeded 256%.

In this regard, Jiang Yuwen, the FOF Investment Department of the Castrol Fund, said that there are three main reasons for the performance of long -holding fund products. First, from the perspective of investment, fund managers in the market have different investment preferences, and some are better at long -term investment. No matter where the market is built, fund managers can pay more attention to investment research during this period. In the market ranking factors, the investment cycle and investment rhythm can be complied with the shares in the process of investment. Second, long -holding products do not need to worry too much about liquidity management. Fund managers' control in positions and stocks is more calm. Third, from the perspective of investor holding experience, the holding of the holding of the period can standardize the operation, overcome the pursuit of investment, or avoid short -term fluctuations in the market.

Wei Yan, Assistant General Manager of Hui'an Fund, also believes that long -holding products can first give the fund manager full of fault tolerance and play, and secondly, it can avoid the passive selling of fund managers in scale fluctuations, thereby increasing the winning rate of investment.

Time affects the foundation experience

It is worth noting that although the long -holding period can avoid market fluctuations and increase investment winning rates, from the perspective of market changes this year, the timing will still affect the foundation experience of investors. Taking the three -year product as an example, due to the market shock, as of June 30, more than 70 % of the three -year holding funds have been negative since this year, of which the highest income Hui'an Runyang held 16.65 %, Compared with -21.97%in the end, is nearly 40 percentage points. The first -year product of holding the period has exceeded 41%of the income since this year.

"Investors' layout of holding -off products, especially long -term holding products, are highly likely to make money." Gast China Fund Jiang Yuwen said, especially at the low -ending of the low -term holding of the product. It will be better. Although it is difficult to issue products at a relatively low historical low -level product, it is more difficult to issue products against human sales fund, but it is more appropriate to issue products at the bottom of the market.

"One year or three years of holding products can provide better benefits distribution, but which one is better in the one -year and three -year period. From the perspective of absolute income, it is full of random probability. Further analysis, for one -year products, a certain time selection ability is required. Because the probability of one year's time index is relatively high, the requirements for timing ability accuracy are higher. For the three -year -old product product, as long as the point is not at the high top of the market, there is a high probability that there will be relatively good positive income in three years.

Hui'an Fund Wei Yan said that for investment, the layout of the low level is very important, and it is not different because this product is open or three -year, because it also determines the winning rate and odds. Among them, the goal of the three -year fund is to earn "height" money. It is not important to rise in the middle or decline. It is important that the "height" of the head and end. The longer the time, the greater the probability of obtaining the income.

"Fund making money and not making money is that the reason is that it can't hold it. Good performance makes fund managers a star, but most of the people in the net value of the star fund are made of wave bands and make small money. Time, in fact, I hope to let customers eat the whole fish completely. "Wei Yan added.

Configure the product according to the needs combination

As one of the earliest public offering of three -year products, Hui'an Fund Wei Yan revealed that the company's main layout was a three -year product. He believes that the three -year product is the first to prevent risk, followed by gains. "Three -year products need to be inferior. The most important thing is the three -year trend of industry development, and then the development of corporate development at the micro level. Therefore, we emphasize that it is best to have three years of products. The investment methodology starting from the mid -view level is relatively high in return. "

On the suggestion of investors, Wei Yan believes that, from the perspective of asset allocation, equity assets should be configured for long -term unused money. Second, three -year products means locking liquid The partial stocks are well matched and the liquidity arrangements are made; in the end, in practice, after the three -year product of the excellent fund manager is configured, you can consider the open product of the fund manager and the strategy at the same time. For example, in the form of fixed investment. "Three -year products are locked, but the open style can be available or stopped. The combination of the two can enjoy the long -term investment experience and can also take into account the liquidity of funds." Garrier Fund Jiang Yuwen said For those, the first must do its own asset planning, and make appropriate asset allocation according to their own needs. You can use some positions to invest in equity assets. In the future, such products should be matched with their own liquidity and holding cycle to ensure that the products invested should match their own financial planning and funding needs.

Secondly, it is necessary to do a good job of proper expected management. Fund managers who can issue three -year holdings or longer hold -up products must have been experienced by market. It can achieve annualized performance of more than less than less. The advantage of this type of product is to standardize the loss of investors' buying and selling behaviors to avoid the losses caused by the short -term transactions of chasing up and killing.

Third, we must choose a good fund manager, and at the same time increase the accumulation of the knowledge of the fund market. While handing over the money to the excellent fund manager to take care of it, it also needs to pay for a certain time to learn knowledge as part of the long -term asset allocation plan.

"For institutions, whether it is a sales agency or a fund company, it should strictly screen the products managed by excellent fund managers to issue or promote it." Jiang Yuwen said.

Edit: Xiao Mo

- END -

In May, the total social financing of Hebei Province increased by 680.61 billion yuan

The press conference on the press conference of Hebei Province's financial assista...

Special inspection of Shifang Market Supervision Bureau to carry out summer grain acquisition meteri

In order to effectively protect the legitimate rights and interests of the majorit...