Listed banks are eye -catching. Is it better to buy bank stocks?

Author:Fuzhou Evening News Time:2022.07.01

lose

"It's better to buy bank stocks and wait for dividends." focus.

Indeed, since this year,

Bank deposits and financial interest rates continue to decline.

The news of some wealth management falling below net worth has also caused heated discussions.

at the same time,

Currently at the peak of the division of listed banks,

A -share listed bank 2021 annual dividend

The total amount will exceed 540 billion yuan,

A record high over the years.

Image source: Wind interface;

As of June 15, 2022

So, which type of bank "cash red envelope" is richer? Is investment bank stocks really more "fragrant" than buying bank wealth management products? Reporter conducted an interview.

01

More than 40 billion yuan in dividends have been "arrived"

According to the practice of previous years,

Before the end of July, the listed bank will complete dividend dividends.

According to Wind data statistics,

This year, of the 42 A -share listed banks,

Only Zhengzhou Bank and Zhejiang Commercial Bank proposed not to make cash dividends,

The remaining 40 banks will give back to shareholders with "real gold and silver".

in,

15 banks have disclosed to the outside world

2021 dividend implementation announcement,

The 15 bank dividend plans are still in the board of directors.

10 bank profit distribution plans have been passed by the shareholders' meeting.

截至6月20日,已有15家银行完成分红,包括张家港行、瑞丰银行、苏州银行、江阴银行、江苏银行、青岛银行、常熟银行、华夏银行、贵阳银行、紫金银行、苏农银行、 Industrial Bank, Bank of Nanjing, Bank of Xi'an and Xiamen, a total of 43.9867.8 billion yuan in cash to shareholders.

From the overall situation, the data shows that in 2021, 40 A -share listed banks had a total cash dividend of 549.107 billion yuan, a total dividend of a record high, an increase of 12.2%year -on -year.

In terms of banks that have completed dividends, the annual cash dividend of Industrial Bank has the highest total annual cash dividend, reaching 21.501 billion yuan, and the equally highest dividend per share before tax is 1.04 yuan. In terms of dividend rates, Bank of Jiangsu is the highest at 6.86%; the highest proportion of cash dividends is Qingdao Bank, with 31.86%.

02

These banks are the most generous gift package

Q

So, which bank's "cash red envelope" is the most generous?

A

From the perspective of different types of banks, state -owned banks are still the "main force" of cash dividends. In 2021, the six major banks cash dividends totaling 382.193 billion yuan, accounting for nearly 70 % of the total cash dividend of listed banks.

The reporter sorted out and found that ICBC is the only A -share listed bank with a cash divide of 100 billion yuan, with a total cash of 104.534 billion yuan. The total number of landscapes of Agricultural Bank of China, Bank of China, Construction Bank, Bank of Communications and Postal Savings Bank was 72.376 billion yuan, 6506 billion yuan, 9104 billion yuan, 26.363 billion yuan, and 22.856 billion yuan, respectively.

From the perspective of the shares, the eight banks distributed a total of 116.51 billion yuan, accounting for 21.2%of the total cash dividend ratio of listed banks. Among them, China Merchants Bank ranks first in stock banks with a total cash dividend of 38.385 billion yuan. In terms of urban commercial banks, 17 banks have a total of 39.09 billion yuan in cash dividends, of which the total amount of cash dividends of Bank of Beijing, Bank of Jiangsu and Bank of Shanghai ranked among the top three, respectively, with 6.449 billion yuan, 5.908 billion yuan and 5.683 billion yuan. In terms of rural commercial banks, 10 banks have a total of 11.314 billion yuan in cash dividends. Among them, the total cash dividend, the dividend and dividend rate of the Shanghai Farmers and Commerce Bank of China are topped.

03

The average dividend rate of listed banks exceeds 4%

It is worth mentioning that compared with the situation that bank wealth management products have fallen below the net value since this year, the dividend rate of listed banks seems to be "fragrant". According to Wind statistics, the average dividend rate of 40 listed banks with cash dividends in 2021 was 4.85%, with a total of 25 listed banks' dividend rates of more than 4%. Among them, Shanghai Farmers and Commercial Bank, Bank of Communications, Bank of China, and Agricultural Bank of China exceeded 7%in 2021.

In contrast, the "Annual Report of the China Banking Management Market (2021)" previously released by the banking wealth management custody center shows that in each month of 2021, the average annualized return on the weighted bank wealth management products is 3.97%, and the lowest is the lowest is the lowest as a minimum. 2.29%. If this comparisons, the dividend rate of more than 60 % of the listed banks in 2021 is higher than the yield of bank wealth management products.

The manager Huang of the Fuzhou Sales Department of Shen Wanhongyuan Securities calculated a account for reporters: Take Agricultural Bank of China as an example. The bank was listed in July 2010. It is assumed that it will be bought after the market in 2010. The yield is about 5%. If you calculate the dividend and re -invest, the yield is higher.

04

Is it better to buy bank stocks?

Q

So, is it really better to buy bank stocks?

In this regard, experts analyzed.

"The share dividend rate and bank wealth management rate belong to two different financial assets investment income. From the perspective Affected by the company's stock price, the company's dividend, and the stock investment is related to the time to enter the market. "Manager Huang said that buying bank wealth management and investment bank stocks are different financial products. The underlying assets of wealth management products are mostly allocated fixed income products, such as bonds , Even if the extreme market is broken, the retracement is relatively controllable even if the extreme market is broken; however, if it is purchased, it is a equity investment, and the retracement of the stock price is relatively uncontrollable. In addition, although some banks' stocks have a high dividend rate, the premise of being able to enjoy dividends is that listed banks have stable operation, continuous dividend plans, relatively stable stock prices, and long share holdings. It depends on the fact that the bank's fundamentals, profitability, and asset quality are important. It is recommended that investors make reasonable asset allocation based on their own risk preferences. At present, just in terms of yields, holding bank stocks is not easy to make big money because the profit growth rate is not high, but the risk is low. Buying dips, patience to hold, is still a relatively stable investment direction.

- END -

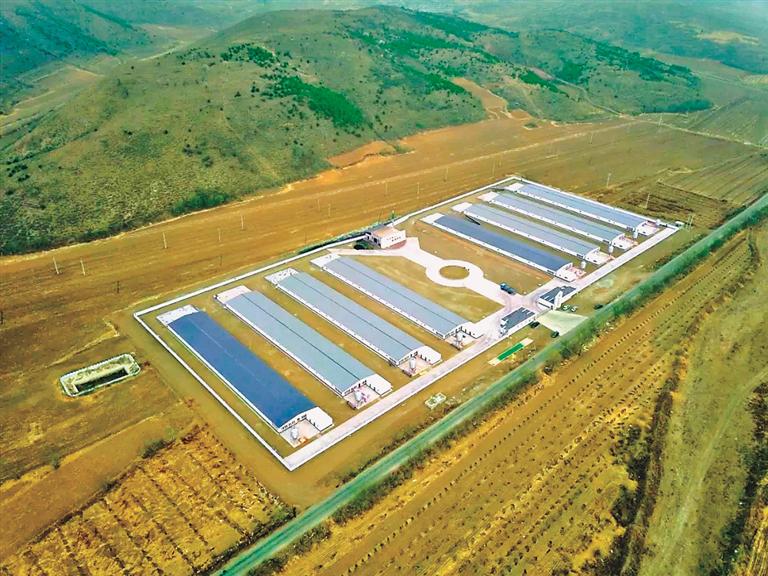

New Era of Endering New Journal | Seeing Highlands of Industrial Creation of Biological Silicon Valley

Dabei Nong Ecological Farm.Harbin Dabei Nong Husbandry Technology Co., Ltd..Invest...

Payment license test: Kailian Pay and other eight suspended censorship, many prepaid card companies take the initiative to retreat

Huaxia Times (chinatimes.net.cn) reporter Fu Bixiao Beijing reportOn June 26, the ...