The relationship between Audi semiconductor and the controlling shareholder is unable to skim the power semiconductor gross profit margin or relies on the affiliates to increase

Author:Jin Ziyan Time:2022.07.01

"Golden Syllabus" northern capital center Yan Yuan/Author Bai Qiwan Yue Yingwei/Risk Control

In recent years, while the development of the semiconductor industry, the problem of "card neck" in the core technology of the industry has gradually emerged. Among them, the current domestic vehicle -level power semiconductor is mainly monopolized by foreign head manufacturers, with a low domestic rate. BYD Co., Ltd. (hereinafter referred to as "BYD shares"), which was listed on the Shenzhen Stock Exchange in 2011, was listed on the listing subsidiary BYD Semiconductor Co., Ltd. (hereinafter referred to as "AIDI semi -guide"), which has attracted much attention.

Behind listing, in recent years, the growth rate of the industries and downstream markets of the Audi semi -guidance have slowed down, and it also faces the test of "retreat" of new energy vehicle subsidies. In 2019, the market size of the Audi semi -guided seminars grew zero. As far as the Audi semi -guide itself is concerned, the performance of the performance in 2021 has returned to the correction after the growth rate. Behind the soaring performance, the revenue of the Audi semiconductor sales power semiconductor products accounted for more than 80 %. The gross profit margin of related parties to sell the product is higher than the same value. Is there a suspicion of the product's dependence on the "high" of the related parties? On the other hand, the AD semi -guidance and controlling shareholders and controlling shareholders have a vision of confusing operations, and their independence is doubtful.

1. The growth rate of downstream subsidies to "retreat" market growth, future growth ability or pressure

The changes in the demand for downstream industry are one of the factors that affect the income of the upstream industry. In recent years, the market size growth rate of Audi semi -guidance and the market size of major products has slowed to varying degrees.

1.1 2017-2020 The domestic semiconductor market size has slowed down, of which in 2019, it has fallen into negative growth

According to the prospectus signed (hereinafter referred to as the "prospectus") signed on April 11, 2022, the Audi semiconductor is a semiconductor industry. , Production and sales.

According to the prospectus and the signing date of January 16, 2022 (hereinafter referred to as the "January 2022 Edition of the Prospectus"), from 2018 to 2021, the sales revenue of Audi semi-guided domestic sales revenue was 1.249 billion yuan and 1.024 billion yuan, respectively. Yuan, 1.359 billion yuan, and 3.033 billion yuan, accounting for 94.16%, 95.39%, 95.52%, and 97.01%of the current main business revenue, respectively.

In other words, the domestic market is the main sales market of ADIDA.

However, in recent years, the growth rate of the domestic semiconductor market has slowed down.

According to the prospectus quoted from Wind, WSTS data, from 2015 to 2020, the domestic semiconductor market size was US $ 98.6 billion, $ 107.5 billion, US $ 131.5 billion, $ 157.9 billion, $ 144.1 billion, and $ 151.5 billion.

According to the research of the Northern Capital Center of "Jin Securities", from 2016-2020, the year-on-year growth rate of the domestic semiconductor market was 9.03%, 22.33%, 20.08%, -8.74%, and 5.14%.

From the above data, from 2017 to 2020, the growth rate of the domestic semiconductor market was declining as a whole, and in 2019, its growth rate dropped to negative values.

In addition, the market size growth has slowed down in the semi -guidance area.

1.2 In 2019, the domestic car regulatory semiconductor market size has grown in zero -growth

The prospectus shows that since its establishment, the Audi semiconductor is centered on car -level semiconductors.

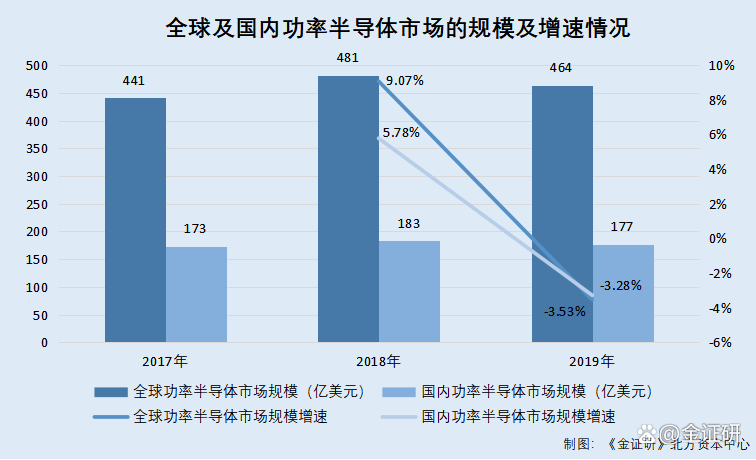

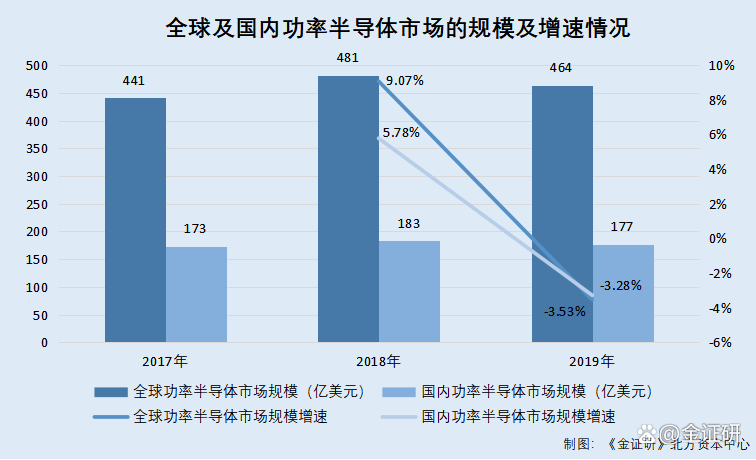

According to data from OMDIA, from 2015 to 2019, the global semiconductor market size was 29.2 billion US dollars, US $ 32.2 billion, US $ 37.8 billion, $ 41.7 billion, and $ 41.2 billion. During the same period, the size of the domestic semiconductor market in the country was US $ 7.1 billion, US $ 8 billion, US $ 9.8 billion, $ 11.2 billion, and $ 11.2 billion.

According to the research of the Northern Capital Center of "Jin Securities", from 2016-2019, the year-on-year growth rate of the global semiconductor market size was 10.27%, 17.39%, 10.32%, and-1.2%. During the same period, the year -on -year growth rates of the domestic semiconductor market of auto regulations were 12.68%, 22.5%, 14.29%, and 0%, respectively.

It is not difficult to see that from 2017-2019, the market size growth rate of global and domestic semiconductor-level semiconductors has declined to varying degrees. Among them, in 2019, the global semiconductor market size growth rate is negative. During the same period, the size of the domestic semiconductor market in the country was zero.

At the same time, in 2021, the power semiconductor products that contributed more than 40 % of the main business income to the Audi semi -guidance were facing the dilemma of market size to grow.

1.3 In 2019, the growth rate of domestic and global power semiconductor markets has been in a negative growth

According to the prospectus, the main business of the Audi semiconductor can be divided into five major sections: power semiconductor, intelligent control IC, intelligent sensor, photoelectric semiconductor, manufacturing and service.

According to the prospectus and January 2022, the prospectus of January 2022, 2018-2021, the sales revenue of Audi semiconductor product sales of semiconductor products was 438 million yuan, 297 million yuan, 461 million yuan, and 1.351 billion yuan, accounting for the Audi semi-guide The proportion of main business revenue in the current business is 33.04%, 27.7%, 32.41%, and 43.22%, respectively. In the same period, the power semiconductor was the highest proportion of Audi semiconductor sales revenue. According to Suzhou Dongwei Semiconductor Co., Ltd. (hereinafter referred to as "East Micro-Director"), the prospectus signed on January 28, 2022 quoted data from OMDIA. From 2017 to 2019, the market size of global power semiconductor was 44.1 billion, respectively. US dollars, $ 48.1 billion, and $ 46.4 billion. During the same period, the market size of domestic power semiconductors was US $ 17.3 billion, US $ 18.3 billion, and $ 17.7 billion.

After calculation, from 2018 to 2019, the market size growth rate of global power semiconductors was 9.07%and-3.53%, respectively. During the same period, the market size of domestic power semiconductors was 5.78%and-3.28%year-on-year.

It can be seen that in 2019, the market size growth rate of global and domestic power semiconductors has grown.

1.4 The subsidy of the main downstream new energy vehicles shall implement the decline system, and the subsidy standard declines

According to the prospectus, the products of the Audi semi -directed products are widely used in new energy vehicles, industry, home appliances, new energy, consumer electronics and other fields. Among them, new energy vehicles are an important downstream application field of Audi semi -guide products.

At the same time, according to the January 2022 version of the prospectus, the AD semi-guide said that from the influence of the fluctuations of the new energy vehicle industry in the main downstream field of product applications from 2018-2020 and 2021, the Audi semi-guided 2019 Operating income decreased by 18.22%compared with its 2018, and its recovery increased in 2020, an increase of 31.46%over 2019.

That is, the field of new energy vehicles is an important downstream area of Audi semi -guide products.

According to the public information released by the National Information Center on March 28, 2018, during the "Thirteenth Five -Year Plan" period, domestic subsidy policies were implemented for pure electric vehicles, plug -in hybrid vehicles and fuel cell vehicles, and reduced subsidy standards year by year. The specific method of retreating in this policy is that from 2017-2020, except for fuel cell vehicles, other new energy model subsidy standards have been receded. Among them, the subsidy standards from 2017-2018 decreased by 20%based on 2016, and the subsidy standards for 2019-2020 fell 40%based on 2016.

At the same time, according to Document [2020] No. 593, in 2021, the subsidy standard for new energy vehicle is 20%on the basis of 2020.

According to Caijian [2021] No. 466, in 2022, the subsidy standard for new energy vehicle is 30%on the basis of 2021.

It can be seen that in recent years, the growth rate of the market size of the Audi semi -guided industry and its segments has slowed down. Vehicle -level semiconductor as the core business of Audi semiconductor. However, in 2019, the domestic market size of automobile regulations is "stopped". During the same period, the domestic and global market size of AD semiconductor power semiconductor was in negative growth. In addition, the new energy vehicle field, as the main downstream field of Audi, has receded its subsidy standards year by year. Based on this, downstream growth has slowed down, and Audi semi -guided future growth or pressure.

2. Power semiconductor -associated sales accounted for more than 80 %.

The changes in operating income and net profit are the embodiment of the continuous profitability of enterprises. From 2019-2020, the growth rate of the II semi-guided net profit has been "reversing" for two consecutive years. In 2019, its operating income growth rate also increased negatively.

2.1 Revenue net profit has fallen into negative growth, rapid growth in 2021

According to the prospectus and January 2022, in 2018-2021, the operating income of Audi semi-guided operation was 1.34 billion yuan, 1.096 billion yuan, 1.441 billion yuan, and 3.166 billion yuan. During the same period, AD's semi -guided net profit was 104 million yuan, 85 million yuan, 59 million yuan, and 381 million yuan, respectively.

According to the research of the Northern Capital Center of "Golden Syllabus", from 2019-2021, the year-on-year growth rate of Audi semi-conductive operating income was -18.22%, 31.46%, and 119.68%, respectively, and the growth rate of net profit was -18.07%,- 31.11%, 549.54%.

It can be seen that in 2019, the operating income growth rate of Audi semi-guided operation was negative, and from 2019 to 2020, the net profit growth rate of Audi semi-guided "driving". Until 2021, AD's semi -guided performance increased rapidly.

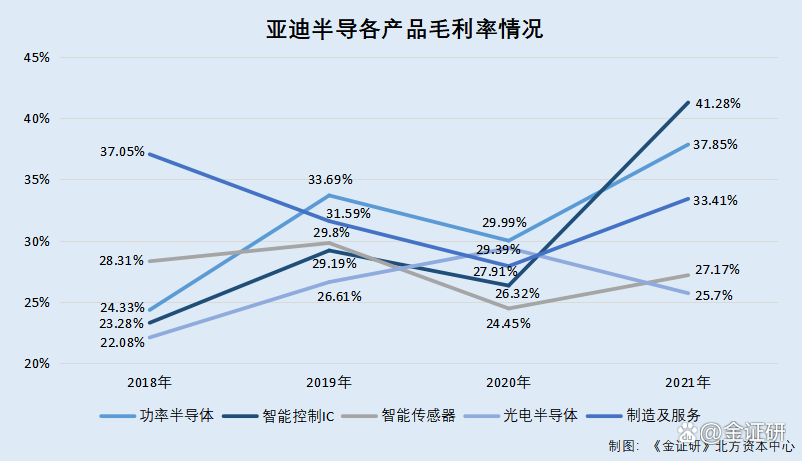

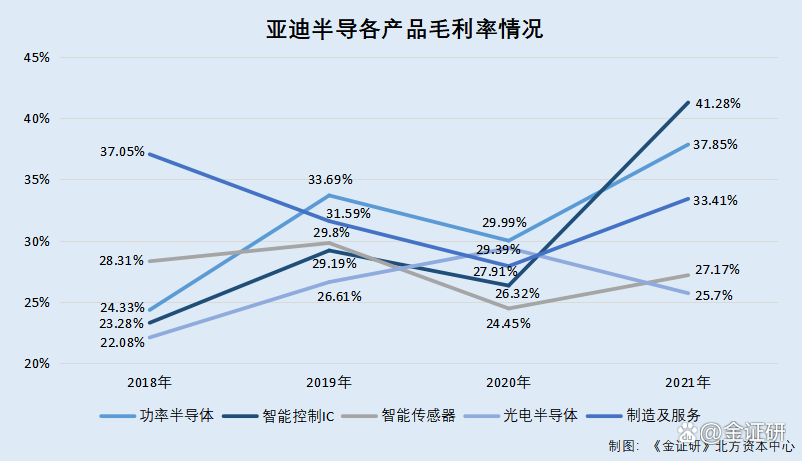

It is worth noting that in 2020, in addition to photoelectric semiconductors, the gross profit margin of Audi semiconductor semiconductor, intelligent control IC, intelligent sensor, manufacturing and service business has declined.

2.2 Power semiconductor association sales accounted for more than 80 %, and the gross profit margin of related parties was higher than the average of comparable peers.

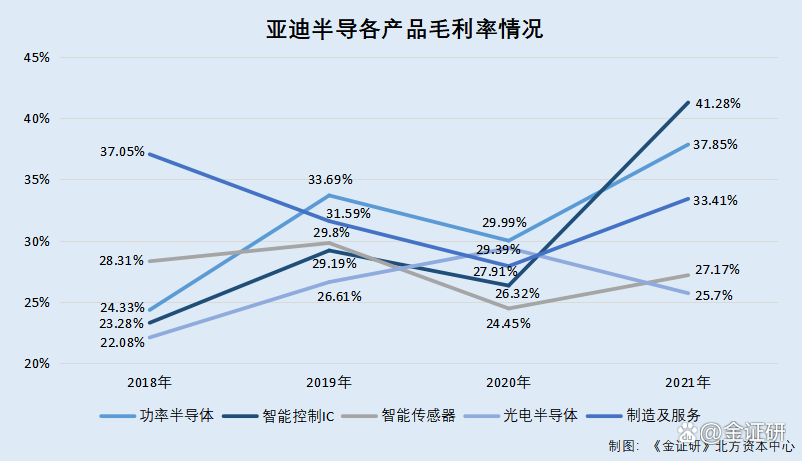

According to the prospectus and January 2022, in 2018-2021, the main business revenue of the Audi semi-guide was 1.326 billion yuan, 1.074 billion yuan, 1.423 billion yuan, and 3.127 billion yuan. During the same period, the sales revenue of the Audi semiconductor semiconductor products was 438 million yuan, 297 million yuan, 461 million yuan, and 1.351 billion yuan, respectively; the sales revenue of intelligent control ICs was 129 million yuan, 154 million yuan, and 187 million yuan. , 421 million yuan; the sales revenue of smart sensors was 248 million yuan, 194 million yuan, 323 million yuan, and 602 million yuan; the sales revenue of photoelectric semiconductors was 325 million yuan, 298 million yuan, 320 million yuan, 585 million yuan, ; Manufacturing and service sales revenue was 186 million yuan, 131 million yuan, 132 million yuan, and 168 million yuan, respectively. From 2018 to 2021, the gross profit margin of Audi semiconductor semiconductor was 24.33%, 33.69%, 29.99%, and 37.85%, respectively. During the same period, the gross profit margin of the Audi semi -guided intelligent control IC was 23.28%, 29.19%, 26.32%, and 41.28%, respectively. The gross margin of smart sensors was 28.31%, 29.8%, 24.45%, and 27.17%. 22.08%, 26.61%, 29.39%, and 25.7%were respectively, and the gross profit margins of manufacturing and services were 37.05%, 31.59%, 27.91%, and 33.41%.

It can be seen that, except for photoelectric semiconductors, in 2021, the gross profit margin of Audi semi -guided other products has increased compared to 2020.

As far as the Audi semiconductor product is concerned, its gross profit margin or dependence is concerned.

According to the prospectus and the January 2022 version of the prospectus, on the power semiconductor business sector, the comparison companies selected by the Audi semiconductor are the comparison companies of the same industry in Jiaxing Ste Semiconductor Co., Ltd. Silan Microelectronics Co., Ltd. (hereinafter referred to as "Silan WeChat") and China Resources Microelectronics Co., Ltd. (hereinafter referred to as "China Resources Micro").

From 2018-2021, the gross profit margin of the Audi semiconductor semiconductor business was 24.33%, 33.69%, 29.99%, and 37.85%, respectively. During the same period, the gross profit margin of the Sida semi -guided IGBT module was 29.44%, 30.81%, 31.99%, and 37.14%, respectively, and the gross profit margin of the Silan micro -device was 26.84%, 21.85%, 24.34%, and 32.89%, respectively.

From 2018 to 2020, the gross profit margin of China Resources Microcontroller's semi-conductive business was 33.83%, 28.46%, and 30.86%, respectively. Because the name of the same product in each year may be different, China Resources Micro 2020 data is the gross profit margin of the product and solution sector.

According to the annual report of China Resources Micro 2021, in 2021, the gross profit margin of China Resources Micro products and the plan sector was 37.43%.

According to the research of the Northern Capital Center of the "Syllarsians", from 2018-2021, the average gross profit margin of the above-mentioned industry comparable companies in the same industry was 30.04%, 27.04%, 29.06%, and 35.82%, respectively.

That is, from 2019 to 2021, the gross profit margin of the Audi semiconductor semiconductor business is higher than the average gross profit margin of comparable peers, respectively, 6.65 percentage points, 0.93 percentage points, and 2.03 percentage points. In 2018, the gross profit margin of the Audi semiconductor semiconductor business was lower than the average gross profit margin of comparable peers of 5.71 percentage points.

In fact, the gross profit margin of the Audi semiconductor semiconductor, the gross profit margin level sold to related parties is higher than comparable companies.

According to the "reply to the second round of review and inquiry letter of the first round of the stock issued shares for the first public issuance of the stock and the listing of the AD semi-guided semi-guided semi-guide" on January 13, 2022, 2018-2020 and 2020 From January to June 2021, the sales revenue of Audi semiconductor semiconductor products was 438 million yuan, 297 million yuan, 461 million yuan, and 465 million yuan. Among them, sales to related parties accounted for 90.71%, 80.51%, 83.91%, and 84.73%, respectively.

This means that from 2018 to 2020 and January to June 2021, the percentage of Audi semiconductor sales of semiconductor products to related parties was more than 80 %.

According to the January 2022 version of the prospectus and prospectus, from 2018 to 2021, as far as the power semiconductor business is concerned, the gross profit margin sold to related parties to related parties is 24.4%, 36.2%, 33.01%, and 38.72%, respectively.

The above-mentioned calculations know that from 2018 to 2021, the average gross profit margin of the Audi semiconductor semiconductor was 30.04%, 27.04%, 29.06%, and 35.82%, respectively.

According to the research of the Northern Capital Center of Golden Syllabus, from 2018-2021, the gross profit margin of the Audi semiconductor to sell power semiconductor products to it is compared with the average gross profit margin of the comparable power semiconductor. 9.16%, 3.95%, 2.9%.

It can be seen that in the power semiconductor sector, from 2019-2021, the gross profit margin sold by the Audi semiconductor to it is higher than the gross profit margin value of comparable semiconductor products. In addition, in 2020, Audi semi -guided net profit or government subsidies depend on tax incentives and government subsidies.

2.3 2020, tax discounts and government subsidies account for more than 50 % of the net profit

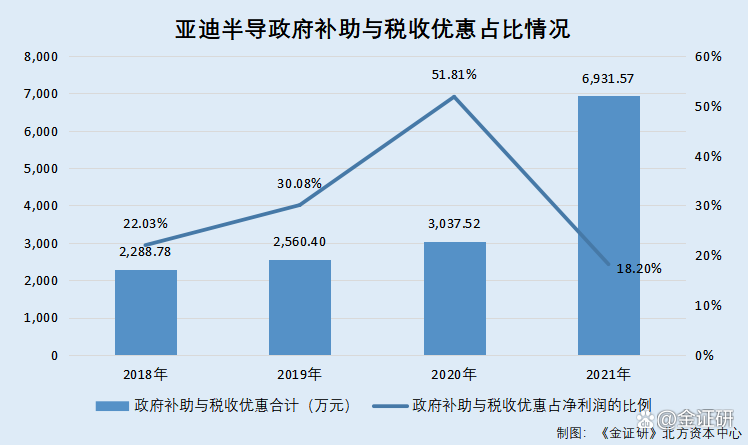

According to the prospectus and January 2022, in 2018-2021, the total amount of Audi semi-conductive tax discounts was 17.5524 million yuan, 9.1558 million yuan, 97.695 million yuan, and 4,847,300 yuan. During the same period, the government subsidies that were semi -guided into the current profit and loss were 5.335 million yuan, RMB 164.48 million, 20.607 million yuan, and 20.84 million yuan.

According to the research of the Northern Capital Center of "Jin Securities", from 2018-2021, the amount of tax discounts and government subsidies in the Audi semi-guided tax was 22.8878 million yuan, RMB 25.604 million, 3,037,200 yuan, and 69.3157 million yuan, accounting for its current net profit of its current profit. The proportion was 22.03%, 30.08%, 51.81%, and 18.2%.

It is not difficult to see that from 2018 to 2020, the proportion of AD's semi-guided government subsidies and tax discounts accounted for its net profit.

In addition, from 2018 to 2020, the III deduction of the average net assets of the average net assets after the constant profit or loss declined year by year.

It is not difficult to see that in 2020, the proportion of Audi semi -guided tax discounts and government subsidies accounted for more than 50 %. In 2021, the AD semi -guided performance experienced the growth rate after negative growth, and it doubled the growth trend. Behind this, from January to June, 2018-2020 and 2021, Audi semiconductor-oriented sales power semiconductor product revenue accounted for more than 80 %, but since 2019, the gross profit margin of the Audi semiconductor to related parties sells the product. Higher than the same value.

On the other hand, the situation of the "collision" of the Audi semi -guidance and its controlling shareholder is also worthy of attention.

3. The "collision" with the controlling shareholder and related parties, merged under the same control and staged the overlapping clouds in assets

Enterprise contact telephone number, email and mailing address, as the "business card" of the daily business business of the enterprise, should be unique to the enterprise itself. However, during the reporting period, the relationship between the Audi semi -guidance and its controlling shareholder and other controlling shareholders was "unclear".

3.1 2018-2021, the telephone number shared with the controlling shareholder

According to the prospectus, as of April 11, 2022, as of the signing of the prospectus, the controlling shareholder of the AD semi -directed was BYD. BYD's shares holding a semi -guided shareholding ratio of 72.3%.

However, from 2018 to 2021, the Audi semi-guidance and its controlling shareholder BYD shared telephone number.

According to data from the Market Supervision and Administration Bureau, as of June 25, 2022, 2018-2021, AD's semi-guided corporate contact number was 0755-8988888, 136 **** 2882, 0755-8988888, 898888888.

According to data from the Market Supervision and Administration Bureau, BYD shares were established on February 10, 1995. Its business scope is the production and sales of lithium ion batteries and other batteries, chargers, electronic products and instruments. From 2018 to 202, BYD's corporate contact number was 0755-89888888, 136 **** 2882, 0755-8988888, 898888888.

In other words, from 2018 to 2021, the Audi semi-guided corporate contact phone number is consistent with the corporate contact number of its controlling shareholder.

In addition to the shared telephone, there are also shared mailboxes controlled by the AD semi -guide and controlling shareholders.

3.2 2018-2021, shared enterprise emails controlled by the controlling shareholder

According to data from the Market Supervision and Administration Bureau, from 2018 to 2021, the Emperor's semi-guided enterprise mailbox was [email protected].

According to the prospectus, as of December 31, 2021, BYD Communication Signal Co., Ltd. (hereinafter referred to as "BYD Communication") was an enterprise controlled by the AD semiconductor controlling shareholder BYD. That is, BYD Communication is an AD semi -guide party.

According to the prospectus, in 2021, the Audi semi -guidance provided labor services to BYD, with a transaction amount of RMB 1.14 million.

According to data from the Market Supervision and Administration Bureau, BYD Communications was established on October 26, 2017, 2018-2021, and BYD Communication's e-mail boxes are [email protected].

The problem has not ended. The AD semi -guide acquisition of its wholly -owned subsidiary of its controlling shareholder control company, and the subsidiary's corporate contact number has not changed.

3.3 After the subsidiary of the Audi semi -guide acquisition, the subsidiary's corporate contact phone number is still the same as the former controlling shareholder

According to the prospectus, as of April 11, 2022, the signing of the prospectus, Guangdong BYD Energy Conservation Technology Co., Ltd. (hereinafter referred to as "Energy -saving Technology") is a wholly -owned subsidiary of ADIDE. Group, intelligent security products and other photoelectric semiconductor -related products related to technology development, manufacturing, sales and contract energy management. According to the prospectus, energy -saving technology was originally a wholly -owned subsidiary of Huizhou BYD Industrial Co., Ltd. (hereinafter referred to as "Huizhou BYD").

On November 20, 2019, the AD semi -guide and Huizhou BYD signed the Equity Transfer Agreement. The agreement stipulates that Huizhou BYD will transfer 100%of the equity of energy -saving technology held to ADIDA semi -guide at a price of 38.22 million yuan. On November 21, 2019, Energy Conservation Technology handled the registration of industrial and commercial changes on the matter.

According to the prospectus, as of December 31, 2021, Huizhou BYD was controlled by BYD, the controlling shareholder of AD.

However, after the energy -saving technology was acquired by the Audi semi -guidance, its corporate phone calls have not changed, and they are consistent with BYD's corporate phone calls in Huizhou.

According to data from the Market Supervision and Administration Bureau, from 2018 to 2021, the corporate contact number of energy-saving technology was 0752-5118888.

Huizhou BYD was founded on June 12, 2006. From 2018 to 2021, the corporate contact number of Huizhou BYD was 0752-5118888.

That is to say, before and after the acquisition of Energy Conservation Technology by the AD semi -guide, its corporate telephones are consistent with the corporate telephone number of Huizhou BYD, and Huizhou BYD also is also the controlling company of the Audi semiconductor controlling shareholder.

It is worth mentioning that the operating address of the Audi semi -guided new subsidiaries overlaps with the registered address of the company controlled by a listed company.

3.4 In 2021, the AD semi -guide subsidiary and a listed company control the address of the control enterprise overlap

According to the prospectus, as of April 11, 2022, Jinan BYD Semiconductor Co., Ltd. (hereinafter referred to as "Jinan Semiconductor") was an Audi semiconductor subsidiary. Among them, the AD semiconductor's shareholding in Jinan semiconductor was 77.75%. Jinan Semiconductor was established on August 24, 2021. Its registered place and main production and operation site are room 218-02-19, West Tower, No. 7617, Gaoxin District Airport Road, Jinan City, Shandong Province.

However, the registered place of Jinan semiconductor and the main production and operation site overlap with a listed company controlling the address.

According to data from the Market Supervision and Administration Bureau, China Gongxing Technology Co., Ltd. (hereinafter referred to as "Star Mobile Technology") was established on September 3, 2021. Its business scope is engineering and technical research and experimental development, general equipment manufacturing, electronic meta Yuan Device wholesale, electronic component and electromechanical component equipment sales. As of June 25, 2022, Xingdong Technology's residence was Room 218-02-19, West Tower, No. 7617, No. 7617, Jinan High-tech Zone Road, Shandong Province.

According to China Industry Technology Production Co., Ltd. (hereinafter referred to as "Huagong Technology") in 2021, Huagong Technology indirectly holds 100%equity of Xingmong Technology. The registration place of Xingmong Technology is Room 218-02-19, No. 7617, No. 7617, High-tech Zone Road, Jinan City, Shandong Province.

According to Oriental Fortune CHOICE data, Huagong Technology is a listed company on the main board of Shenzhen Stock Exchange.

According to the prospectus, as of April 11, 2022, the Rental Real Estate related to the production and operation of the Audi semiconductor and its subsidiaries did not include the main business place for Jinan Semiconductor.

That is to say, Jinan Semiconductor, a subsidiary of the Audi semiconductor, was established on August 24, 2021. Its company's address is "overlap" with the Xingmong Technology Residence established on September 3, 2021, and the Star Mobile Technology Department is listed. The reason why the company's Huagong Technology Control Enterprises? It is not known yet.

From the above situations, from 2018 to 2021, the AD semi-guidance and its controlling shareholder BYD shares were "collided", and they also controlled the shareholder of BYD communications controlled by the controlling shareholder. Not only that, in 2019, the Audi semi -guide acquisition of affiliate energy saving technologies, and energy -saving technology has become an AD semi -guide subsidiary, and it still has a telephone number with its former controlling shareholder Huizhou BYD. What's even more strange is that the residence of the listed company Huagong Technology Holdings subsidiaries overlap with the address of Jinan Semiconductor, a subsidiary of the Audi semiconductor holding. At this point, Audi semi -guide independence has doubts.

The riverside collapse from the ant hole, peeling out the doubt behind the AD semi -guided listing, and it needs to face the test of "capital".

- END -

The latest announcement of Henan!

On the evening of July 11, the Henan Banking Insurance Regulatory Bureau and the H...

91 billion yuan, the first listed bank will pay money next week

The most love section of A shares -listed banks are issuing 2021 cash red envelopes.According to the statistics of Wind Stock News, three listed banks will implement dividends next week, namely Bank