At the end of May, Xinjiang transportation, warehousing and postal loan balance increased by 17.8% year -on -year

Author:Tianshan.com Time:2022.07.01

Tianshan News (Reporter Wang Yongfei) The reporter learned from the Urumqi Center Sub -branch of the People's Bank of China: Since the beginning of this year, the People's Bank of China Urumqi Center Sub -branch has strengthened financial support, actively guided financial institutions to strengthen bank -enterprise docking, innovate financial products, and go all out Solving financing problems, ensuring the smooth flow of logistics, and promoting the stable supply chain of the industrial chain. As of the end of May, Xinjiang's balance of transportation, warehousing and postal industry loans was 245.44 billion yuan, a year -on -year increase of 17.8%.

Since the beginning of this year, the People's Bank of China Urumqi Center Sub -branch has strengthened communication and cooperation with the transportation department, established a list of enterprise list push mechanisms, held a promotion meeting to improve the efficiency of banking and enterprise financing docking. There are 46,000 households.

At the same time, the People's Bank of China Urumqi Central Sub -branch comprehensively used a variety of monetary policy tools such as re -loan and re -discounting to guide financial institutions to increase the credit support for small and micro enterprises and individual industrial and commercial households affected by the epidemic of transportation, warehousing, and logistics. Since the beginning of this year, the People's Bank of China Urumqi Center Sub -branch has used the cumulative branch loan to issue 770 million yuan to transportation companies and individuals, benefiting 120 market entities, and use reimbursement as transportation enterprises to apply for discounting 720 million yuan to support 98 enterprises to obtain obtain Bill financing.

In addition, in response to the situation where the current transportation industry is affected by a greater impact and lack of mortgage in enterprises, the People's Bank of China Urumqi Center Sub -branch guides financial institutions to flexibly respond to different financing problems of enterprises by making full use of the account receivable platform and carrying out supply chain finance. ; Guiding financial institutions to innovate the "one credit, circular use" with the loan repayment model, increase the support of credit loans, and meet the financing needs of transportation and logistics enterprises.

Altai Hongji Transportation Co., Ltd. is a small and micro enterprise that is general of ordinary cargo transportation and cargo transportation agent. Financing has the characteristics of urgent demand, short term, and mortgage lack of mortgage. Waiting for expenses.

After understanding the difficulties of the enterprise, in May, the Central Branch of the People's Bank of China in the Central Branch of the People's Bank of China actively guided the ICBC Haba River Sub -branch to issue 2.9 million yuan in credit loans to the enterprise through online operation. Enterprise financing problems have reduced the financial cost of corporate.

- END -

How to recover the Chinese economy is these two data

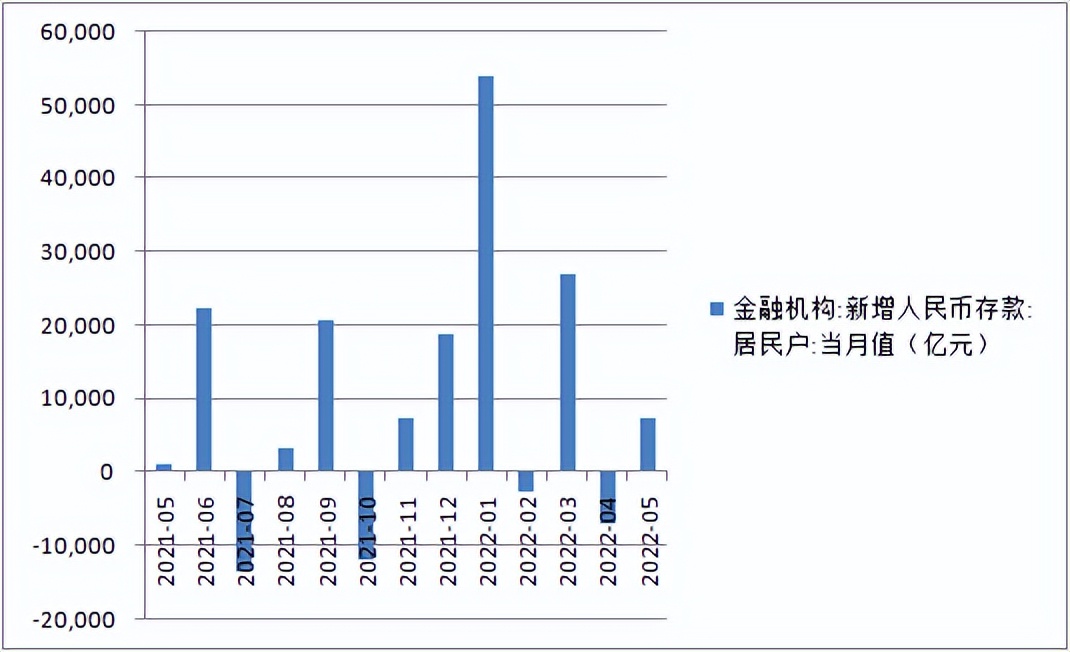

01The Chinese are depositing money at an unprecedented speed.In the first five mon...

The second round of the online business bank's capital increase and share expansion was approved, and what signal to release

On the occasion of the 7th anniversary of the opening of the economic observation ...