Weekend Securities 丨 Institutional Institutions Pulse Security In the second half of the year: repair is already on the road, the mid -length line can be expected

Author:Financial Investment News Time:2022.07.01

A total of 2205 words in this article

About 3 minutes after reading

Lin Ke, a reporter from the Financial Investment Newspaper

After the experience continued to fall, A shares began to stabilize the rebound in May and June, especially when the overall performance of the peripheral market was poor in June, A shares became the "most beautiful" of the global capital market in June.

With the gradual recovery of market confidence and the gradual improvement of market emotions, more investors have begun to pay attention to the market in the second half of the year, and look forward to more exciting. Judging from the latest 2022 strategy released by major securities firms, the continuous improvement of the market is the mainstream view and has a medium and long -term investment value.

&&& CICC: More positive catalyst support

The market environment from 2022 is more challenging than we expect at the beginning of the year. Looking forward to the second half of the year, we believe that overseas transitions from transactions from transactions to "how to get out of stagnation" in transactions, and China strives to "steadily grow" in the prevention and control of the epidemic. The current valuation of the Chinese stock market is at a low level of historical interval and has the mid -line value. In the second half of the year, the inner and outer environment of the market may still face certain challenges, and more active catalyst support is required. We suggest that investors seek "stability" first, and then wait for the opportunity to "enter". Considering that the market valuation is relatively low, the Chinese policy is continuously growing, and the market effect is sensitive to the policy effects, the specific time points of the switching of "guarding" and "attack" must pay great attention to the efforts and potential effects of steady growth.

The main line continues to be "steady growth". In the first half of the year, we insisted on making good relative benefits based on the strategy of "steady growth" and a relatively low -profile high valuation growth. At present, we continue to focus on "stability" and pay attention to the following three directions. The first is some areas related to "steady growth" or policy support: infrastructure (traditional infrastructure and some new infrastructure), building materials, automobiles and housing -related industries with policy expectations or actual policy support; High and relatively high -level correlation with macro volatility, especially some high -dividend areas: such as infrastructure, power and public utilization, hydropower, etc.; The third is that the fundamentals may be bottomed out, or the supply is limited, or the degree of prosperity is in Continue to improve some areas: agriculture, partial colors and some chemical industries, coal, photovoltaic and military industry, etc. We are still standardized or low -ended in growth sections with high valuations, high expectations, and high positions.

&&& &&& Xingshang Securities: Follow the six major directions in the second half of the year

Since May, the "New Half Army" restoration market is performed and led the market as scheduled. However, so far, the market's differences in the "new semi -army" have been intensified again: on the one hand, under the accelerated tightening of the Fed and under the turbulence of the overseas market, the Chinese and American markets, especially the risk preferences, have a greater influence of scientific and technological growth direction. Whether it can continue to be decoupled. On the other hand, after the significant rise since May and the short -term relative income, the "new semi -army" crowded was significantly recovered. And we believe that the main line of the market in the second half of the year will further focus on science and technology innovation represented by the "new semi -army". Therefore, if the "new half army" enters the shock, it will be a layout window.

In terms of capital, with the gradual restoration of risk appetite, the fund issuance has shown signs of recovery, foreign capital continues to flow, and the absolute income agency is also increasing the position. In the second half of the year, the pattern of the stock game is expected to gradually be broken, and incremental funds will "pour" the market, especially the "new half army" of the institutional heavy position.

Structurally, in the second half of the year, the market style is expected to gradually return to scientific and technological growth. It is recommended to focus on the six major directions of "specialized specialty". The first is new energy (new energy vehicles, photovoltaic, wind power, UHV, etc.); the second is the new generation of information and communication technology (artificial intelligence, big data, cloud computing, 5G, etc.); third is high -end manufacturing (smart CNC machine tools , Robot, advanced rail transit equipment, etc.); fourth is biomedicine (innovative drugs, CXO, medical equipment and diagnostic equipment, etc.); fifth is military industry (missile equipment, military electronic components, space stations, aerospace aircraft, etc.); Sixth, food safety (seed industry, biotechnology, fertilizer, etc.).

&&& &&& Guohai Securities: valuation will usher in repair

In terms of economy, the global economic recovery momentum has weakened, the Sino -US economy deviates, and the domestic economic recovery momentum is weak. It needs to rely on domestic demand to make efforts. The overall pattern of domestic demand and foreign demand is downward. In the domestic demand, the infrastructure is stable, and the real estate, consumption and services will usher in repair. In the chain of foreign demand, exports and manufacture are tough.

In terms of policy, the total domestic currency policy space is constrained, and the possibility of non -symmetrical interest rate reduction is still based on structural tools in the second half of the year. This year's fiscal expenditure is obvious. Special bonds, reserved tax refund and other existing instruments have entered the final stage. In the second half of the year, we will pay attention to the introduction of incremental policy tools such as special government bonds and supplementary mortgage loans.

In the industry configuration, the style of the second half of the year is balanced. Consumption and growth will be better than cycles and finance. The industry configuration will pay attention to the three main lines. Main line 1: The demand under macro -driven changes, pay attention to optional consumption and real estate post -cycle industries, such as building decoration, home appliances, home furnishings, cars; main line two: the prosperity under policy -driven ,如军工、光伏风电、半导体设备、芯片、互联网等;主线三:疫情新常态驱动的“新+”主题,如新消费(小家电、预制菜、团购、消费电子)、新医药(疫苗、 Traditional Chinese medicine, testing), new infrastructure (new energy, data centers, industrial Internet) and other tracks. &&& &&& Ping An Securities: Growth is an important configuration direction in the second half of the year

In the country, the economy is expected to recover but limited elasticity, and the risk of inflation in the mid -term; the liquidity is still abundant, and the risk -free interest rate is expected to maintain a low level of fluctuations; the stable growth policy is densely landed. Compared with 2020 It also supports structural transformation and is more focused on traditional industries. Among them, consumption and new infrastructure are highlights, and the effects of the second half of the year will gradually appear; corporate profitability will be differentiated, and the traditional energy and new energy industry chain will maintain high prosperity.

Market selection value or growth? From the perspective of historical three -round stable growth, market performance in different stages of economic growth has different performances. On the whole, we believe that the choice of this round of market is more similar to 2020, and growth is still an important direction of the market in the second half of the year.

The current market's main index valuation has returned below the historical average, and the earnings ratio of 300 Shanghai and Shenzhen bonds is more than 75%of the relatively high level. It shows that entering the medium and long -term configuration range, the valuation of the growth sector is more relatively flexible. Structurally, pay attention to the inflation sector+low -carbon economy+digital economy. The first is the inflation section. The epidemic and epidemic have repeatedly impacted the supply side of the global industrial chain with the Russian and Ukraine conflict. Energy prices may maintain a high level. It is a low -carbon economy that has continued to support the policy, that is, the new energy industry chain (photovoltaic, wind power, energy storage)+new energy vehicle industry chain; third, the digital economy of the medium and long -term strategic direction, that is, the intelligent automotive industry chain (hybrid vehicle, hybrid vehicle, hybrid vehicle, hybrid vehicle, hybrid vehicle, Car chip)+intelligent manufacturing (industrial Internet, data center).

&&& &&& Guojin Securities: Focus on growth and pay attention to consumption

In the second half of the year, the three basic assumptions were interpreted: the epidemic was efficiently cleared, the policy supported the economy, and the upstream price increased. First of all, the three arrows that are efficiently cleared in the domestic epidemic are: normalized nucleic acid, domestic special effects medicine and the elderly vaccine. Secondly, the demands of the policy on the policy have been significantly strengthened under the circumstances of the domestic epidemic. The worst stage of the current economy has passed. Do not underestimate the economic power of the policy. Finally, under the double pressure of supply and demand, the trend of price increases in resource products in the second half of this year may slow down.

From the market style research and judgment, it is recommended to focus on growth and pay attention to consumption. The first is the growth counterattack, improvement of profit margins, and relatively improved performance. From the perspective of relative performance, the improvement of midstream and downstream profit margins will drive the performance of the relative value sector to dominate. Most of the upstream resource products industry belongs to the value style. Under the trend of upstream resource price increases, the net profit growth rate of value sectors has improved significantly. However, with the improvement of midstream and downstream profit margins, the relative performance of the growth sector concentrated in the middle and lower reaches will improve significantly.

Secondly, consumption after epidemic: business consumption recovers faster, and durable consumption waiting policies. The recovery of some consumer products depends mainly on the repair of consumer scenarios, such as business consumption -related mid -to -high -end liquor. The recovery of durable consumer goods is greatly affected by residents' income, and policy boosting consumption is the biggest marginal change in the durable consumer goods industry.

In terms of industry configuration, investors are advised to pay attention to scenery storage network, high boom TMT, consumption, and brokers.

"Northeast Securities: In the second half of the year to the bottom to the upward

In the second half of the year, the profit turning point of the market is an anchor of the market turning point and style turning point. In the first half of the year, the market performance was consistent with the judgment of our spring strategy, that is, the decline in profit decline and the market. At the same time, internal and external factors suppressed market risk preferences, and the value sector was relatively high. Looking forward to the second half of the year, the emergence of the profit turning point of the profitability of credit is the main line of the market; with the profit turning point as an anchor, the market turning point and style turning point will also appear, showing different trends and styles in the two stages of profit building and profitability.

Looking forward to the market in the second half of the year, the market still fluctuates at the bottom of the third quarter. In the second half of the year, the market trend is from the bottom to the upward, the turning point of the bear to the beef. In terms of valuation and emotions, the valuation of small and medium -sized disks is relatively good, and the emotional indicators are at a historical low. External liquidity contraction and geographical conflict are the main factor of suppressing risk preferences. After the implementation of important domestic meetings, it is expected to significantly improve market sentiment.

In the industry configuration, it is recommended that investors pay attention to infrastructure, automobiles, and military industries that are concerned about G -end demand. Circuit and high -growth direction of electric new, consumer, electronics, and TMT of independent industrial cycles. Specifically, during the profit of profit building, the G -end demand of infrastructure and automobile sectors has strong support; military industry performed well in the downward period of market profitability, the equipment upgrades, and the demand is strong under geopolitical conflict. The growth tracks such as new, consumption, and electronics are relatively strong, of which lithium battery, semiconductor equipment, and materials are highly elastic. From the perspective of historical review, the policy reversal will make the TMT industry valuation high probability; in the prosperity, media and computers benefit from policy relaxation and localization, and communication and electronics benefit from a new round of digital equipment and product demand. Recommendation in the second half of the year: Focus on the digital economy, the reform of state -owned enterprises, and the universe. In the second half of the year, the stable growth policy has been further implemented, and the direction of national strategic orientation+economic driving effect has a chance. &&& Fanlian Securities: Market emotions will gradually recover

Since April, the Politburo Conference, the National Assembly, the Council of the Golden Stability Committee, and the Party have repeatedly expressed their support to support the development of the capital market, put forward higher requirements for deepening the capital market reform, respond to market concerns in time, actively introduce long -term investors, maintain capital, maintain capital The market is running smoothly, the A -share market has entered the bottoming stage, the net outflow of funds has improved, and the fund positions are still high. It is expected that in the second half of the year, the issuance of partial stock funds is expected to recover. Market emotions are gradually recovered.

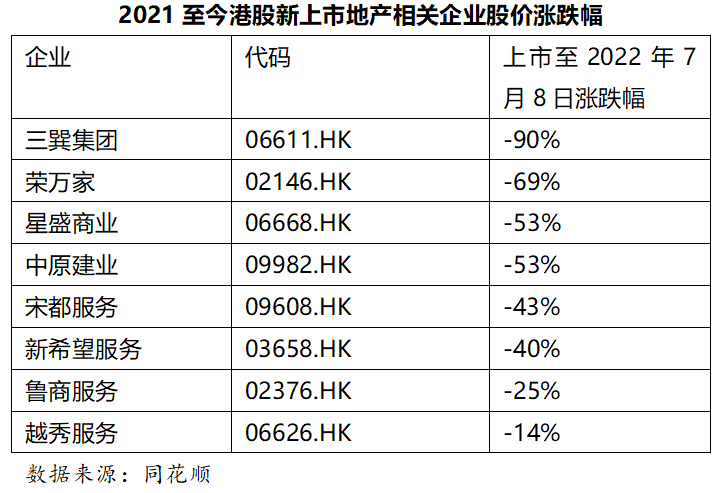

In terms of industry configuration, the three main lines are worthy of attention. The first is that infrastructure investment is the most important starting point for steady growth. With the support of the project reserves and the support of funds, it will continue to make efforts. In addition to the acceleration of infrastructure investment, as one of the pillar industries of the national economy, real estate is signs of heating both ends of the market supply and demand. The main line of allocation in the real estate sector mainly includes: 1) Under the recovery of the prosperity of the real estate chain, the maintenance tasks are clear, and the demand in the field of building and building materials is supported. 2) Multiple measures, large -scale housing companies and state -owned background housing companies in the real estate development sector are worthy of attention.

The second is the main line of inflation benefits and profit rebounds, and the consumer section must be selected. It is estimated that the epidemic situation in the second half of 2022 will stabilize, and the domestic supply chain will gradually digest the epidemic impact. If the political risk of overseas ground is slowed down, the price of commodities is expected to fall at a high level. The domestic PPI will enter the downward channel, and the CPI will show a quarterly rise. Poor convergence of PPI and CPI growth will bring configuration opportunities. The cost pressure pressure in the consumer field must be alleviated, and the industry's fundamental improvement is strong. Among them, the basic aspects of agriculture, forestry, animal husbandry and fishing and pig farming are expected to improve.

The third is the main line of prosperity, advanced manufacturing and new energy sectors. In terms of market emotions, it is expected to be repaired under demand recovery and performance. From the perspective of valuation, after nearly half a year's callback, the current energy sector and advanced manufacturing main sub -sectors have fallen significantly. As the repair and performance of market confidence continue to be firm, the rebound of the relevant sector may exceed expectations.

&&& South Securities: The growth style is relatively tough

In the short period of short cycle in the first half of the year, the epidemic disturbances, the tightening cycle under the global high inflation and the outbreak of the Russian -Ukraine conflict broke out and long -term stagnation environment. The downward pressure continued to increase, the GPD growth rate in the first quarter of 2022 was 4.8%. When the domestic economy see the inflection point entering the grounding period, the correlation between A shares and overseas markets will weaken, and it will be manifested as a fluctuation state of "me as the main". This year, the domestic economic short -cycle inflection point will be seen in the third quarter, and the market narrative in the fourth quarter will be converted to the policy redeem and economic restoration logic of "me -oriented".

From the perspective of the market style, the actual interest rate of the United States and the growth/value style of A -share growth/value style of the United States are negative. With the attenuation of overseas economic momentum, it has further impact on risk assets. It is expected that the US TIPS will fall in the second half of 2022. Overseas assets will begin. The worst economic expectations, but the domestic growth style will show relatively toughness. At the same time, interest rates have some forward -looking at the bottom of the economic cycle. When the economy is completed, the interest rate -sensitive assets can be allocated.

From the perspective of configuration, it is recommended to grow steadily in the short -term equilibrium configuration. In the second half of the year, it is optimistic about growth, especially the media, military industry, and electronics. Over time, when the economic bottom -up signal is gradually emerging, the market's expectations of the market will start to swing up. The domestic interest rate terminal will respond in advance, and the rebound of the growth sector will usher in disturbances, and the large financial -sensitive sector will perform.

Edit | Chen Yuhe School Inspection | Yuan Steel Review | Miao Xi

- END -

From January to May, Quanzhou's economy is stable and good, and the industry's leading indicators run well

The reporter learned from the Quanzhou Statistics Bureau that from January to May, Quanzhou's economy was stable. In May, the city's economy was generally good, and the development momentum in the fie...

After the determination, Longhu wisdom creates life "not fast"

Don't like noisy, don't like to make fun.Wen 丨 Chinese Shang Tao Lue YuntanThe ho...