[Burning Index] Huang Aizhou: Financial Technology has returned to the origin of technology service finance

Author:WEMONEY Research Room Time:2022.07.01

On June 30, 2022, the press conference of the China Financial Technology Burning Index (2022) and the second "Fintech Index Forum" was successfully held in the National Financial and Development Laboratory. The theme of this forum is "Deepening Digital Technology Finance Application Promoting Fintech Return to the Origin."

The forum is hosted by the National Financial and Development Laboratory, the Institute of Finance of the Chinese Academy of Social Sciences, and the digital dissemination of the People's Daily, hosted by the Financial Science and Technology Research Office of the Institute of Finance of the Chinese Academy of Social Sciences, and the WEMONEY Research Office provides special support.

The forum invited the leaders, experts and scholars, media, financial institutions and other industry elites such as financial regulatory regulatory authorities to gather to discuss the development trends and latest achievements of the fintech industry.

At the meeting, Huang Aizhou, the partner of KPMG China Fintech, delivered a keynote speech entitled "Observation of China and Global Financial Technology Trends in 2022".

01. The development trend of China Fintech

Huang Aizhou said that with the continuous deepening of supervision, fintech has returned to the origin of technology services, which can better help the high -quality development of the real economy.

It is mainly reflected in two aspects. On the one hand, technology help data assets transform into credit assets and help small and micro enterprises that "specialize in specialized" grow. The second aspect is that technological innovation has penetrated into the full chain of financial services, which effectively reduces transaction costs.

Huang Aizhou made the following analysis on the development of fintech in six fields:

The first is wealth technology. Financial technology enables the wealth management methods to be richer, can meet the needs of residential asset allocation at different levels of residential assets, and activates the long -tail incremental market for wealth management.

In addition, the diversification of high net worth groups and the acceleration of fragmentation of the wealth management industry, and the TAMP model asset management platform has developed well. Residents' asset allocation is more diversified, and the proportion of equity assets has been further increased.

Secondly, insurance technology. In the overall digital transformation of the insurance industry, insurance technology leads the supply -side reform of the industry and will usher in new opportunities for the digital economy. The first is from "product -centric" to "customer -centric", and insurance services continue to innovate and optimize; second, technology has accelerated the upgrade of insurance services, and the insurance business has shifted from multiple scenarios to the whole scene.

The third is the relationship between the balance and inclusiveness of inclusive technology and innovation, and promotes the healthy development of inclusive technology. At the same time, through the sustainable development business such as empowering rural revitalization, many applications of "new blue oceans" have been given. The relationship between the steady and innovative development of financial financial and innovative development has prompted participating in the division of labor in the market to be more accurate and stimulated the development potential of inclusive technology.

The fourth is the introduction of supply chain technology and blockchain technology, which effectively solves the pain points of supply chain finance. The vertical segment of the industry is the direction of fintech to help supply chain finance. The industry's application prospects will be very broad. In addition, technology promotes the decentralization of supply chain finance and develops towards the trend of industrialization and ecology.

The fifth is the mobile payment technology. Mobile payment and cross -border payment have grown rapidly. The epidemic stimulates the demand for cross -border transactions, and the scale of the cross -border payment market has increased further. In the future, the integration of omni -channel payment will become an important trend in the development of financial enterprises. Digital RMB has begun to take shape, and the application scenarios will gradually be enriched, and it will reshape my country's payment system to some extent.

The sixth is regulatory technology. Regulatory technology can be divided into two categories, one is regulatory technology, and the other is compliance technology. Regulatory scientific and technological services have gradually tended to be intelligent, secure, and high, and continue to expand to the full chain of financial supervision. Compliance technology is integrated from local to full stack, and compliance applications have begun to develop to E-GRC compliance technology solutions with one-stop, full process, and full data chain.

02. The development trend of global fintech

2021 is the highest investment of global fintech investment, reaching 5,684 transactions, with a total amount of $ 210 billion.

Fintech investment is very strong, and both venture capital and private equity investment have reached a new high. The investment field is mainly concentrated in cryptocurrency, blockchain, wealth technology, network security technology and other aspects.

In Huang Aizhou, this is related to the development of foreign epidemic and the changes in the policy supervision environment. 2021 is the year when the epidemic rebounds. From the data collected, in the first half of 2022, the investment momentum fell again.

Regarding the development situation of international fintech, Huang Aizhou proposed six trends and made the following analysis:

First of all, large -scale "buy first and then pay" technology transactions have emerged in various regions. "Buy first and then pay" technology is already very familiar with China, and has been trying in China a few years ago. Internationally, it has just ushered in an upsurge. Since the first half of 2021 to the first half of 2022, Block (formerly SQUARE), which has the main business of "buy first and then pay", spent $ 29 billion to acquire AFTERPAY Australia. This transaction has become this year. This transaction has become this year The maximum fintech transaction.

The second trend is that the bank's core system substitution has received increasing attention. Global financial institutions are doing data transformation, facing great pressure to reduce dependence on original infrastructure to improve core system relations.

Head banks began to cooperate with fintech companies to acquire some fintech companies. In the second half of 2021, Morgan Chase announced that the bank would transform the core bank platform of the British Thought Machine. During this period, Thought Machine raised $ 200 million, Morgan Chase also participated in the investment. The cloud replacement of the bank's core system is accelerating. The third trend is the market's interest in data interconnection and analysis. From 2021 to 2022, at home and abroad, they are facing a relatively severe data management environment. Everyone has improved personal data protection and company data protection. At the same time, everyone has begun to think about whether these data can be transformed into more effective borrowing, insurance, or anti -money laundering and anti -fraud decisions to better promote the company's business and development. Therefore, fintech companies with digital conversion capabilities are more popular in the market.

The fourth trend is that fintech companies will shape data institutions. Many fintech companies will reshape themselves into data institutions and data providers that only provide payment and other financial services, so that they can stand out in the eyes of investors and markets.

The fifth trend is that ESG Fintech companies will enjoy considerable growth. As ESG issues have attracted more and more attention, the priority order has been continuously advanced, and the interest in fintech companies with ESG business capabilities is also heating up, including companies focusing on climate change, decarburization and dual -loop economy.

The sixth trend is that transactions in relatively lagging regions will receive more attention. Investors will pay more attention to areas where financial services are relatively lagging behind, and conduct more transactions in Africa, Southeast Asia, Latin America, Middle East and other regions.

Huang Aizhou said that fintech investment has entered a stable period in China, and there will be no other large -scale acquisition and acquisitions. With the launch of the new round of fintech planning for the central bank, the development of China Fintech has gradually entered a good situation. At present, fintech in various segmented tracks such as insurance, supply chain, finance, inclusive finance, payment, and regulatory technology in wealth management, the tracks such as insurance, supply chain, finance, inclusive finance, payment, and supervision technology are already booming.

On the whole, my country's fintech in 2022 will continue to develop steadily. In contrast, although foreign fintech has set a historical high in 2021, its investment in financing has reached a record high, but in 2022, it has fallen. The hot investment field is mainly concentrated in the fields of payment, consumer credit, cryptocurrency, ETA and other fields.

Huang Aizhou uses "two flowers and two tables and one branch" to describe the current development trend of fintech at home and abroad.

- END -

Many indicators show that the Yangtze River Delta economy has gradually stabilized and accelerated recovery

Xinhua News Agency, Beijing, June 28th.Xinhua News Agency reporterWith a series of...

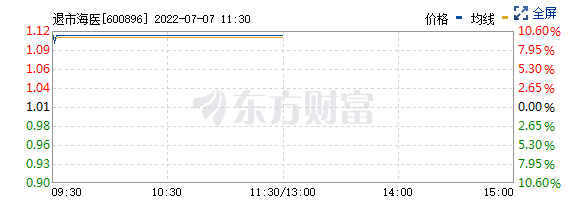

Nearly half a year after "loss", Dong Qing's husband suddenly returned!He was a well -known capital of Shanghai, but now the company's stock price has fallen 95%!

On July 7, a daily limit stock was worth talking about, that was the delisting sea...