Public offering semi -annual report!A shares have reversed, which funds cross the beef and bear?What are "weak bases"?

Author:Daily Economic News Time:2022.07.01

In the first half of 2022, the global capital market was ups and downs, and the A -share market experienced a huge "V" type reversal. Turn over?

Looking back on A shares for half a year: from extremely cold to recovery

Earlier this year, the Shanghai Index gradually fell from 3,500 points. At that time, the market could not see signs of falling, although the Fed's expectations were already very high. However, from the domestic point of view, the asymmetric "interest rate cut" of LPR also indicates that the domestic economy is stable, and the real estate is not wrong.

However, a series of uncertain variables have triggered a unilateral plunge of the market.

One is the Russian conflict. The outbreak of the incident was on February 21, which brought a huge impact on the global capital market. The response of the A shares was still lagging. It only reacted in early March, and the first wave of miserable kills occurred on March 16. At that time, the famous private equity, Dan Bin, announced the clearance. In terms of public funds, the theme of science and technology board theme funds have already retracted more than 30%of the year, and smart cars and electronic information have fallen miserable.

There are very few anti -declining funds, and products that lay out real estate, coal, and pork sectors can be profitable. In addition, overseas oil LOF products also made enough money this year for 3 months.

After the plunge on March 16, the market rebounded slightly, but in mid -to -late April, the most tragic wave of killing this year broke out. It took only more than a week that the Shanghai Index fell from more than 3,100 to the lowest point in the first half of this year. At this stage, the epidemic has become the biggest variable that affects the market.

In the field of fund, as of the end of April, active stock funds have almost lost money, and only two products make money. Among the hybrid funds, several products managed by Wanjia Fund Company Huang Hai have achieved more than 30%of the revenue, which has established the position of the hundred -year champion fund manager this year. Whether it is a stock type or a mixed type, the magic weapon that can be profitable is coal and real estate.

In April, this wave of plunge has fallen the valuation of the A -share market to a very low level in history. At this time, Cai Songsong's products have lost nearly 50%since this year.

After entering May, the market began to passion for various profit and air factors. Especially in US stocks, the Fed's interest rate hikes settled, and US stocks encountered a continuous plunge. At this time, A shares no longer followed the decline in US stocks, which also largely established confidence. This month, the strong rebound of the New Energy Circuit Fund has become the biggest highlight of the market, and some products have risen by 30%a month. By June, the new energy fund, which was red and purple last year, finally began to turn losses.

Stock "Niuji" TOP20 List: Stock Back to Heating British Da Na Cong

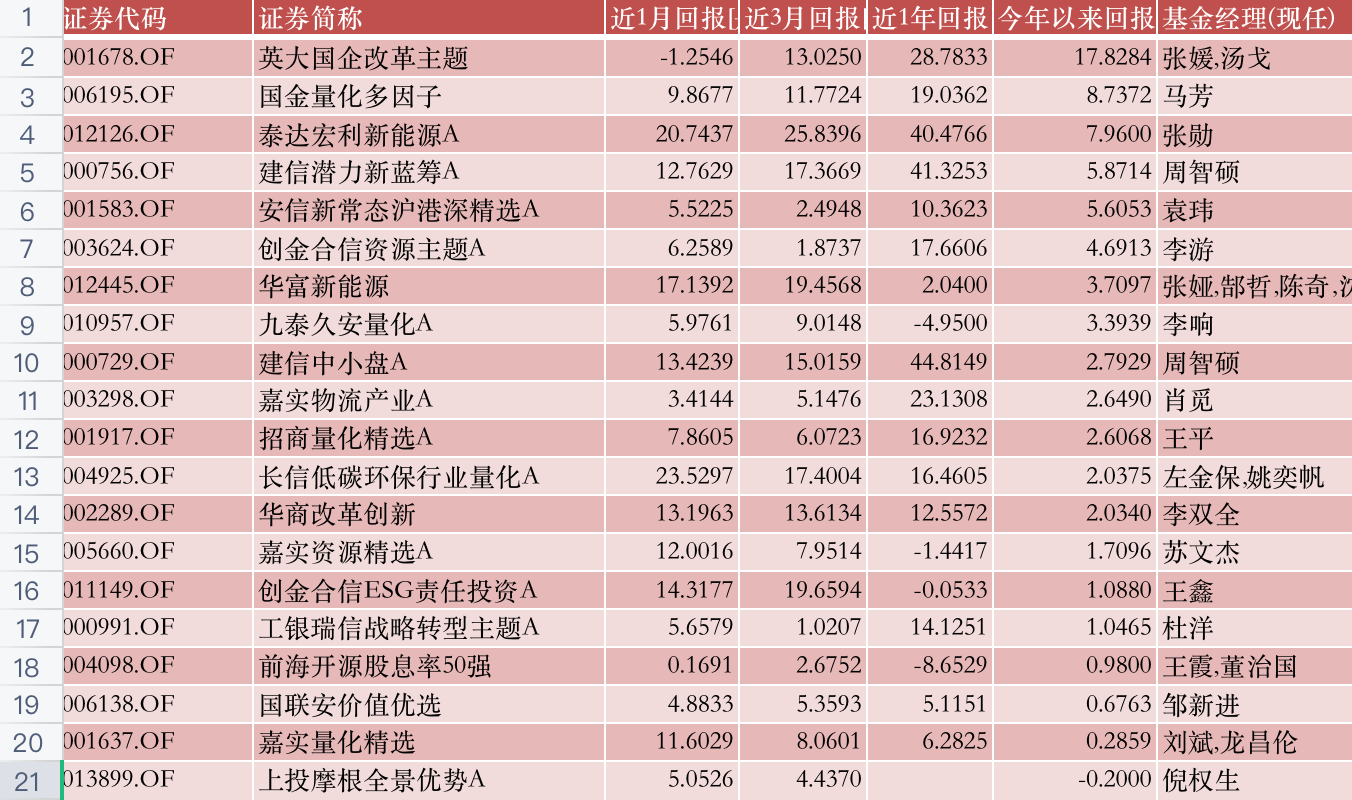

In the first half of this year, active stock funds had almost appeared in the embarrassment of "the entire army was overwhelmed". As of the end of April, only two products achieved positive returns.

However, with the recovery of the market in May and June, the performance of active stock funds has gradually recovered. As of the net worth as of June 30, the number of active stock funds with popularity in the first half of the year began to increase, but it still did not make enough 20 products. In the past few months, the theme of the reform of the leading state -owned state -owned enterprise has always been the champion of active stock funds with a large advantage. Its earnings in the first half of the year reached 17.83%. The benefits of other products are less than 10%. The Shangtou Morgan panoramic advantage A, which just squeezed into the "TOP20" list, has not yet become popular in the first half of the year.

Of course, some products issued in the market low in the first half of this year have also achieved more than 20%of positive returns, but due to the lack of establishment of the list, this list has not been counted.

The reason why British -General's state -owned enterprise reform can win in the first half of the year is mainly fund managers Zhang Yuan and Tang Ge heavy warehouse deploy coal stocks and petroleum stocks. Among the top ten heavy stocks, there are 7 coal stocks, and Zijin Mining and Petrochemical are held. Shuangxiong. It is precisely because of such a highly concentrated layout that the product has retracted a small retreat in the first half of the year and has maintained a trend of shocks.

It is worth noting that most of the products in the "TOP20" list of active stock funds come from small fund companies, and the scale is small. For example, the reform of the British -General State -owned Enterprise of the Champion Products, the scale at the end of the first quarter was only 73 million.

The relatively large scale is Du Yang's strategic transformation theme of the ICBC's Credit Suisse Crippy Credit. The size of this product is 4.8 billion, and the performance in the past one, two years and nearly 3 years has been very good.

Unlike the reform of the British -General State -owned Enterprise, the strategic transformation of the ICBC's Credit Credit has only one point in the first half of the year, but it still avoids a large retracement in the first half of the year, which is very important for large -scale products.

Take a look at the TOP10 list of passive index funds, and the products on this list are still mainly based on coal, bank ETF, and LOF.

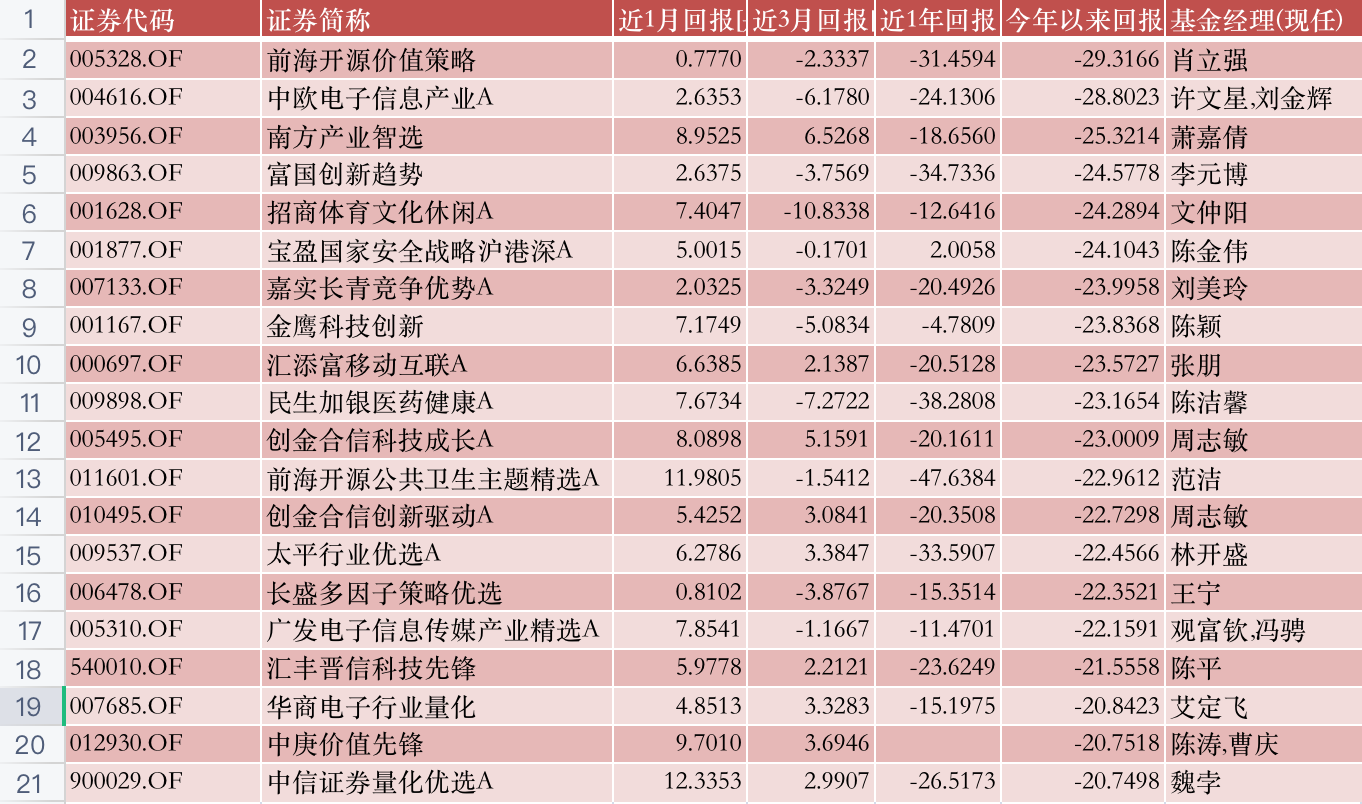

Stock "weak base" TOP20 list: more than 20 products lost 20%+

As of the end of June, the performance of stock funds has risen significantly, but some products still "can't afford to fall to the ground."

According to statistics, more than 20 stock funds still have more than 20%this year. Among them, the worst performance is Xiao Liqiang's management of Qianhai's open source value strategy, which has lost 29.32%this year. In addition, Xu Wenxing and Liu Jinhui jointly managed the China -Europe electronic information industry, which has also lost 28.8%this year.

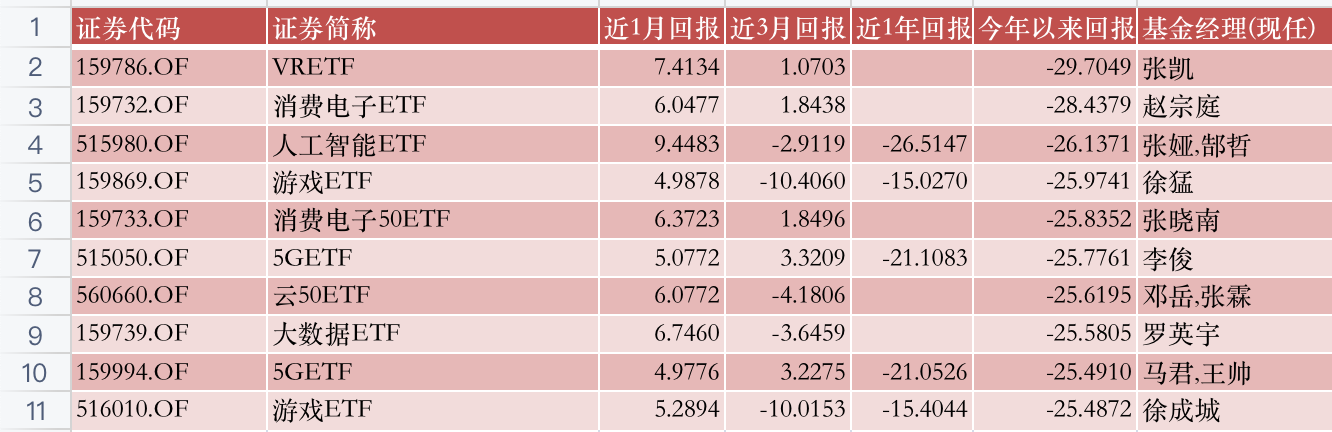

In fact, since May, some stock funds have passed through bulls and successfully completed "redemption". Taking Huaxia Energy Innovation as an example, the largest retracement this year was as high as 33%. However, in the past two months, with the strong rebound of the new energy track, the revenue of Huaxia Energy's innovation once became popular during the year. As of the end of June, it only lost 1.85%. At the same time, almost all products that lay out new energy tracks have also achieved a sharp rise in net worth. Today, the products that are still "falling to the ground" are only the theme funds of the two major tracks of technology and medicine. Take a look at the "weak base" TOP10 list of passive index funds.

Compared with the list last month, VR, consumer electronics, artificial intelligence, software, big data, computer, cloud computing, etc. are still the hardest hit areas. Essence

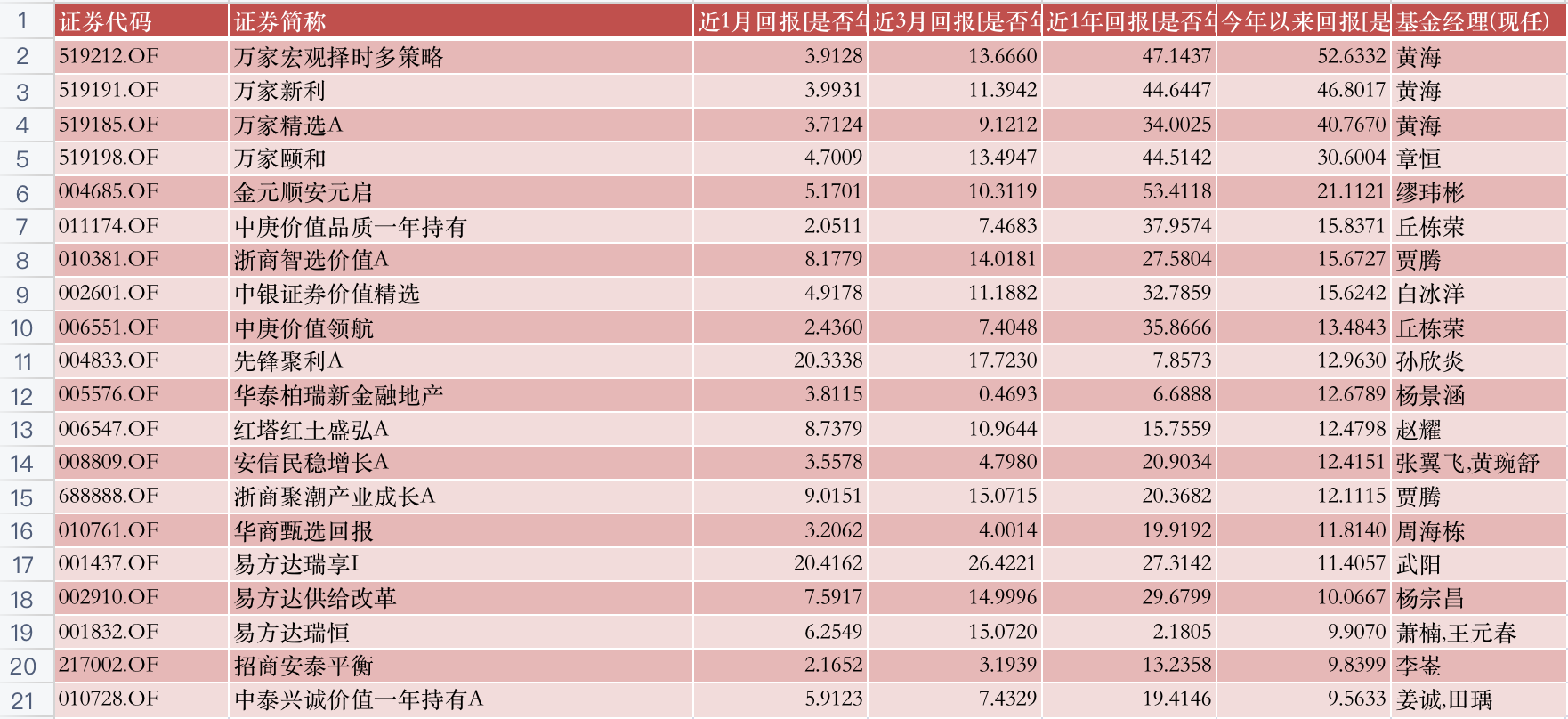

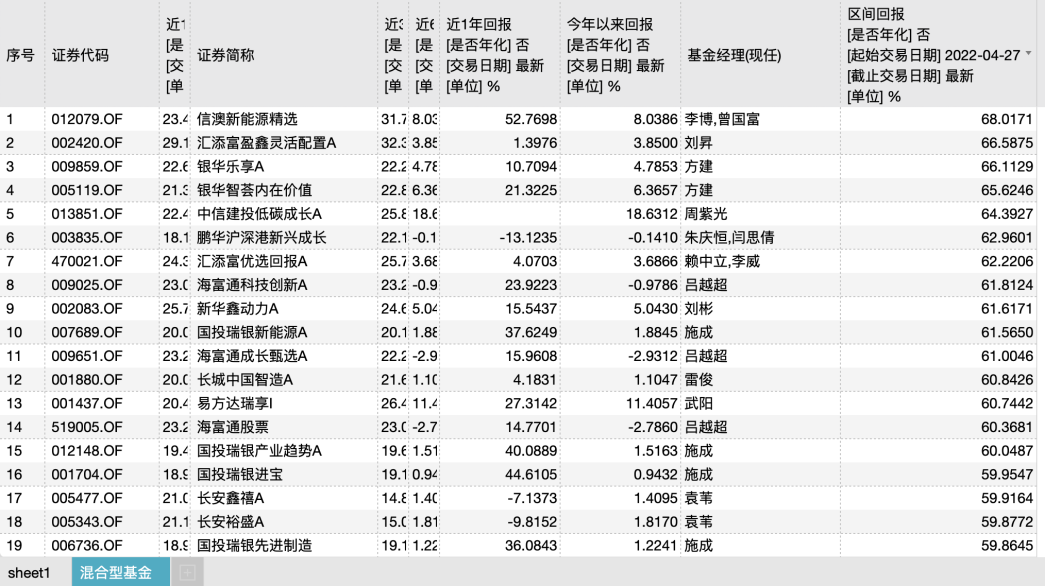

Mixed "Niu Ji" TOP20 List: Wanjia Huanghai won the top three

In the field of public funds, the highest attention is the ranking of the ranking of hybrid funds. For fund managers, every year's championship can be famous for this battle. For example, Cui Yilong last year, Zhao Li, Lu Bin in 2020, and Liu Gehi in 2019.

In the first half of this year, the champion fund manager had almost no suspense. Since February, the top three of the mixed funds have been included by the Yellow Sea of Wanjia Fund. Until the end of June, the ranking has not changed. The Wanjia macro -selection strategy, Wanjia Xinli, and Wanjia selection are ranked first to third. And compared with the end of May, the benefits of the above three products are still increasing. Wanjia's macro -selection strategy has reached 52.63%this year, which is far ahead. The fourth ranking is also a subsidiary of Wanjia Fund Company. Wan Jiayi managed by Zhang Heng also obtained 30%of the income.

From the perspective of investment style, the Huanghai mainly deployed coal and real estate stocks, while Zhang Heng's layout direction is coal and manufacturing.

Of course, the same problem to face the products of the Wanjia Fund in the second half of the year is that the current product scale is relatively small, but with the improvement of popularity, the scale will increase significantly. Then, as the scale increases, it also brings a higher difficulty to the fund manager's investment. This is actually a problem that many so -called "small and beautiful" products are facing the same. Once the scale increases, can there be good benefits.

It is worth noting that the two products managed by Zhong Geng Fund Qiu Dongrong have entered the TOP20 list of hybrid funds. Among them, Zhong Geng's value and quality of the one -year holding period was 15.84%in the first half of this year, ranking sixth; Zhong Geng value was 13.48%, ranking ninth.

The scale of Zhong Geng's value quality holds 5.8 billion in one year, and the scale of Zhong Geng value is close to 8 billion, all of which are large -scale products. The reason why Qiu Dongrong can achieve better results is that in addition to the stock selection style that he has long adhered to low -valuation investment concepts for a long time, he may also have a lot to do with his ability to control risk control. An important means of Qiu Dongrong's risk control is strict control. Under the sharp fall on March 17, the entire valuation level was low, and Qiu Dongrong opened decisively to subscribe, but only 3 months later. By June 22, after the market rebounded sharply, Qiu Dongrong suspended large purchase and protection investors again. Interest, this operation is still rare among the current public fund managers.

What needs to be focused on the bottom of the market on April 27, the most fiercely rebounded hybrid funds are almost clear and the products that lay out new energy tracks. Among them, Cinda Australia New Energy's selected rebound was as high as 68%, and more than 10 products increased by more than 60%. There are also a very good performance last year. There are several products such as SDICS Board Industrial Trends, which have been managed. The interval returns are close to 60%. It is with the strong situation in the past two months that the new energy theme fund has completed self -redemption and successfully crossed the beef and bear. The benefits of these products have finally become popular this year.

It is not difficult to find that after nearly two months of positioning in the UBS industry, it is not difficult to find that although the new energy track stocks have fluctuated violently, the fund manager did not conduct large -scale positioning of stocks, but it also increased. In other words, the new energy circuit has carried the plunge in the first half of this year.

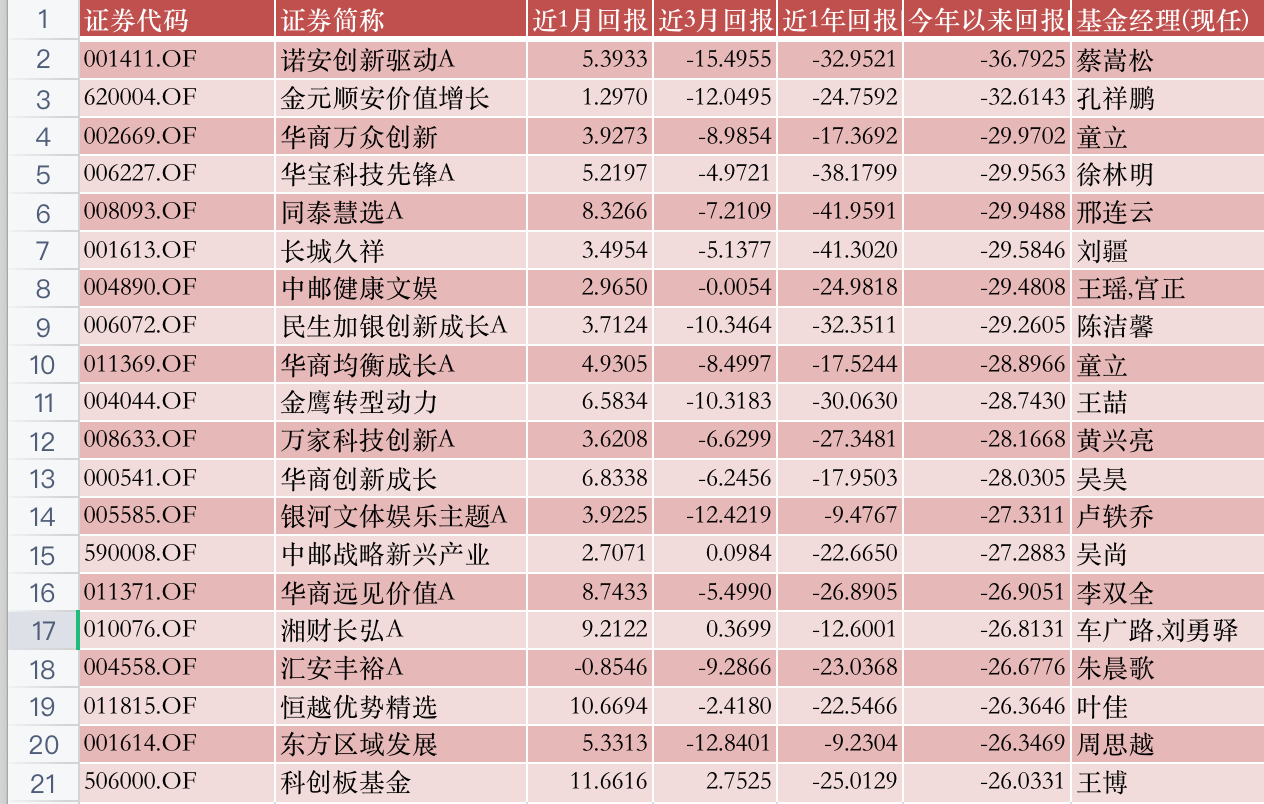

Mixed Fund "weak base" TOP20 list: Cai Songsong's bottom half a year

In the first half of this year, for Cai Songsong, the former top -flow fund manager, it was a dark moment. The Nuoan innovation driving losses of the Nuoan's innovation was 36.79%, and the performance ranked at the bottom of the first half of the year. Although the net value of the product has rebounded slightly in the last month, in the case of a strong rebound in the broader market, I still did not see a good change, which really disappointed the holder.

The other two products managed by Cai Songsong have a mixed growth of Nuoan, with a scale of 24.6 billion, and have lost 23.32%this year; Noon and Xin have been flexibly allocated, and this year has lost 24.55%, ranking back.

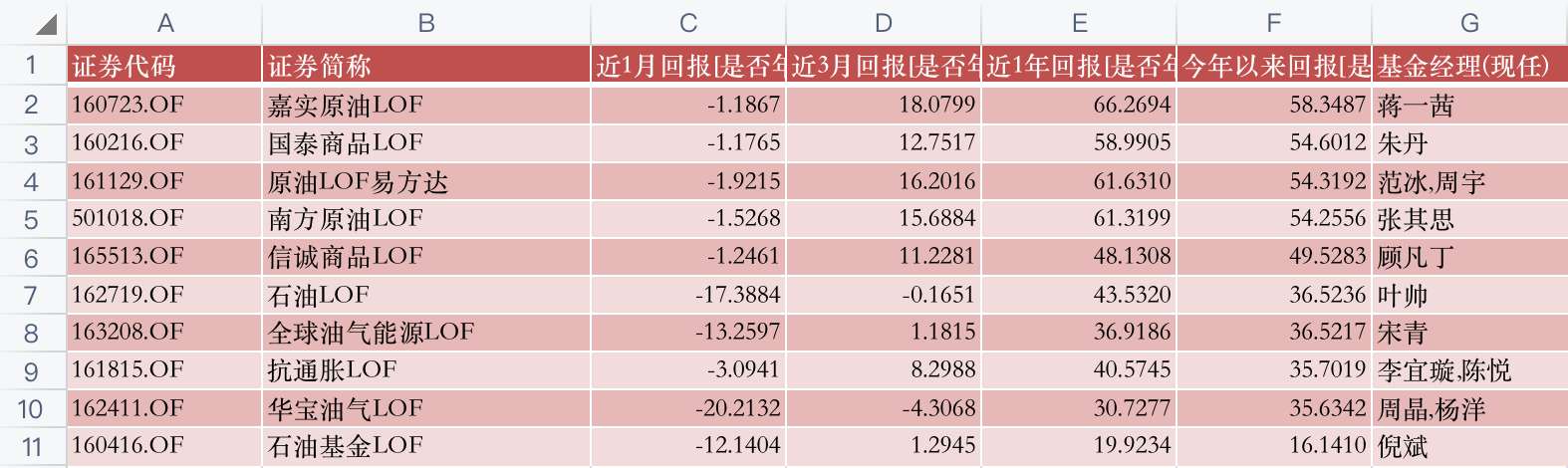

Qdii "Niu Ji" TOP10: Petroleum and Gold continue to strengthen

Looking at the "Niuji" TOP10 list of QDII products, it is still mainly based on the theme funds such as oil and gold. Among them, the first echelon is the LOF of petroleum, with the highest revenue of more than 50%. The second echelon is gold.

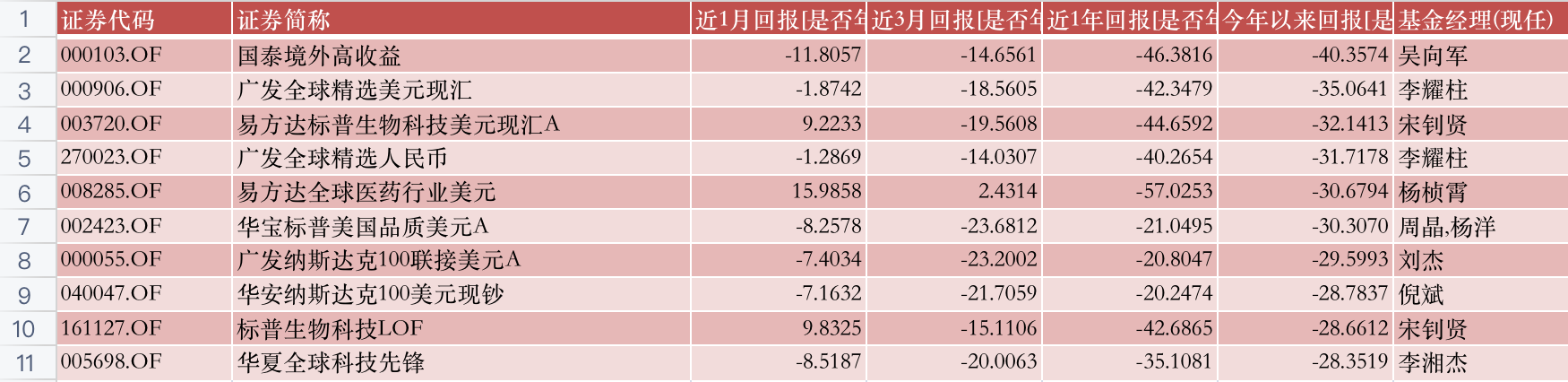

QDII "weak base" TOP10 list: QDII performance differentiation intensifier

Since the beginning of this year, the performance of QDII products has been significantly intensified, and the performance of good performance can earn more than 50%. Those who have poor performance and the number one ranking will lose 40%. The most unfortunate product is Cathay Pacific's high income overseas, and the income has been -40.36%since this year. In addition, there are a lot of QDII products with more than 20%of losses, and products that lay out overseas biomedical tracks are generally poorly performing, which naturally has a lot to do with US stocks encountering bear markets this year.

"Double Ten Fund Manager" tracking: performance generally rebounded

Finally, take a look at the performance of the double ten fund manager in the first half of the year. In the Public Fund Monthly, we screened eight double fund managers based on the "Fund Small" intelligent strategy. These 8 double -ten fund managers are Fu Pengbo, Cao Mingchang, Zhu Shaoxing, Wang Keyu, Zhou Weiwen, Du Meng, Xu Lirong and Tao Can.

("Double Ten": refers to the fund manager with an investment period of more than 10 years or more than 15%an annualized return)

As of the end of June, the best performance was the national rich potential group managed by Xu Lirong, which lost 5.4%. The new Blue Blues managed by Zhou Weiwen lost 5.6%. The worst performance was Ruiyuan's growth value managed by Fu Pengbo and Zhu Xi, with a loss of 15.93%.

Although the performance of these 8 double -ten fund managers has not become popular in the first half of the year, compared with the end of May, there is still a large rebound. At the end of May, Ruiyuan's growth value lost 28%, and the best performance of China -EU was found to be 15.39%. In addition, from the perspective of annualized income since the establishment of these products, it remains above 10%, and the highest Tao Can has reached 24%.

Outlook in the second half of the year: Can new energy be bullish at the end of the year?

In the monthly report last month, we focused on the opportunities brought by the recovery of the tourism hotel sector industry, and shared the Hua'an Media Internet Mixed (001071) managed by Hu Yibin. Judging from the market performance in June, Hua'an Media's Internet mixed performance performed well, with a monthly income of 12.3%. Since this year, it has only lost less than 8 points.

Then, with the beginning of the market in the second half of the year, new changes have taken place in the market pattern. Can the new energy track funds return to the bull market. Can this grand occasion continue to the end of the year?

In this report, we shared the latest views of Cui Yilong, the manager of last year's champion fund.

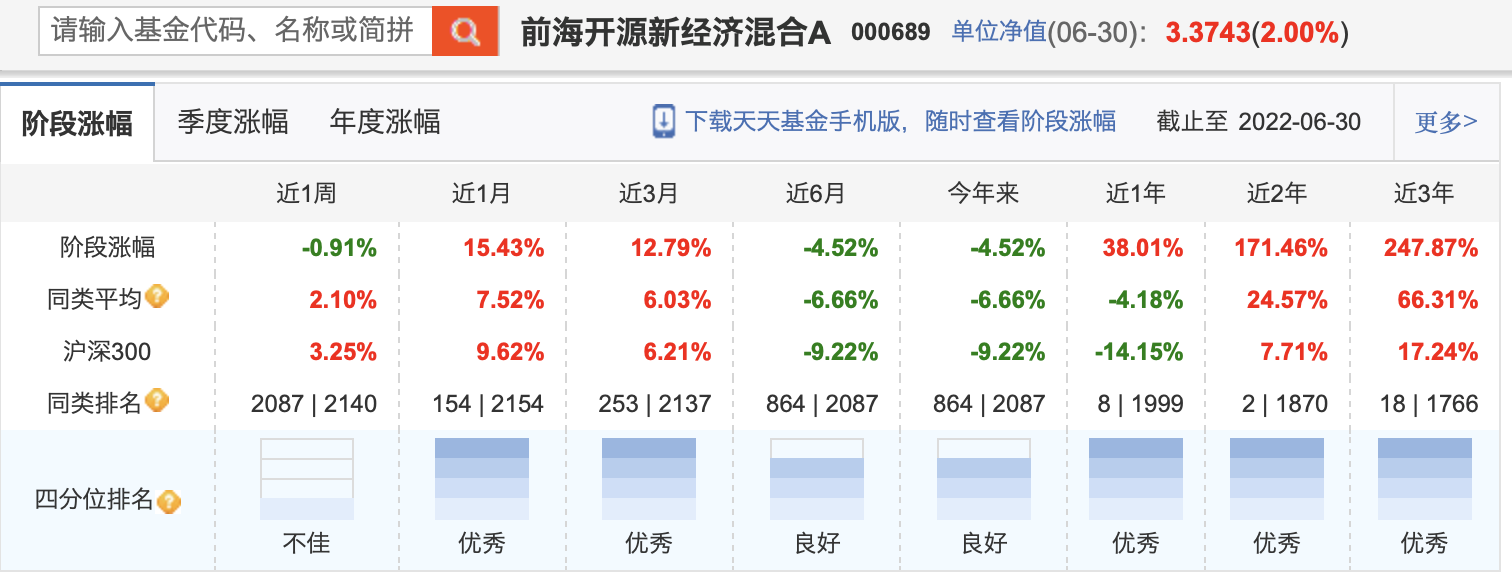

In the first half of this year, affected by the "champion curse", the Qianhai Kaiyuan New Economy managed by Cui Yilong once ranked at the bottom of the market. However, with the rebound in the past two months, the product had only lost 4.52%by the end of June. It should be said that Cui Yilong survived the most difficult months.

Regarding the new energy track in the second half of the year, Cui Yilong said that in the second half of the year, he is still firmly optimistic about the market's market.

In the fundamental perspective of the medium and long term, he saw that many potential needs were still not met. For example, the more excellent new energy vehicles may not be ranked until a few months or even half a year after the order; the demand for photovoltaic at home and abroad is still very strong under the premise of such high product prices.

In the second half of the year, he firmly believes that the fundamentals of the new energy sector will be better.

In addition to the two directions of the lithium battery and photovoltaic, he is still optimistic about new energy operators.

Cui Yilong believes that the current technological technology of the overall new energy industry is also in a rapid increase period. He currently pays more attention to new technologies.

For example, new technologies such as photovoltaic heterogeneity batteries, silicon pieces, and granular silicon are emerging endlessly, and they are gradually commercialization, and the penetration rate is rapidly increasing.

In terms of lithium battery, it includes fast charging materials, high -voltage materials, lithium manganese phosphate, and the next generation of materials that can increase lithium iron phosphate performance by one step, as well as high -nickel ternary positive poles, silicon carbon negative electrodes, etc.

From the perspective of terminal manufacturing, larger monomer batteries will bring some technical improvements.

But the development of the overall technology is still in the ideal ceiling. Even if everyone thinks that the level of technology is already in a very competitive state, the future development space is still very large.

Daily Economic News

- END -

The embassy in Australia reminds Chinese citizens to beware of investment scams

The Australian Competition and Consumer Association (ACCC) recently issued a reminder that from January 1st to May 1st, Australian citizens lost $ 205 million due to fraud, an increase of 166%over the

Yu Minhong confirmed that some institutions dig into Dong Yuhui: I don't want to make them a tool for making money. This is not my attitude towards New Oriental

According to the China Economic Weekly, the New Oriental Live Teachers represented...