Taxation Bureau of Guangming District: Bring the "True Gold and Silver" policy dividend to the enterprise

Author:Light news Time:2022.07.01

Since the beginning of this year, a series of combined tax support policies have been introduced in the country, provinces and cities, which are key measures to stabilize the macroeconomic market, which is of particular significance for stabilizing expectations and helping enterprises' rescue.

After the introduction of the new combined tax support policy this year, the Taxation Bureau of Guangming District has strengthened work overall work, deepened data support, refined tutoring training, promoted the implementation of preferential taxes and fees, and brought the policy dividends of real gold and silver.

Strengthen overall planning

Tax and fees support policies quickly landing

The Light Taxation Bureau established the Leading Group for Tax Return and issued a work plan for the first time. The leaders of the bureau led the team to conduct a big visit, and talked with the company's boss, management and finance personnel to "face face -to -face" to understand the implementation of the combined tax support policy, listening to the opinions and suggestions of the enterprise, and the first batch of large enterprises and " Little Giant "60 companies.

For taxpayers, the District Taxation Bureau uses the "Cloud Tax Medical" studio to carry out online "cloud training". At present, a total of 6 online special training is held to train more than 3,000 households. For tax cadres, the backbone of the business participation in the training of tax refund business organized by the General Administration and Municipal Bureau, and conducted secondary training in the district bureau based on the training content of the Municipal Bureau. Combined with the situation of reserved enterprises at the end of the previous large period, the District Taxation Bureau gives full play to the role of "chief liaison officer" in large enterprises to answer doubts for large and medium -sized enterprises with large and large and medium -sized enterprises in the jurisdiction. "Inform and" one enterprise, one policy "personalized counseling and other mechanisms to do a good job of guidance, timely understand the actual difficulties and tax refund willingness of the enterprise, and solve its actual problems and difficulties in a targetedness.

The business backbone of the Light Taxation Bureau discusses industrial analysis data.

For the peak of possible people, the District Taxation Bureau will do a good job in the prevention and control of equipment, systems, networks, and epidemic in advance; formulate emergency plans for tax service departments, and start publicity and training. At the same time, play the role of online channels such as the Electronic Taxation Bureau, the remote office system, and the "cloud tax medicine" platform, and arrange for the fine soldiers to slowly pay some taxes and fees for small and medium -sized enterprises in the manufacturing industry. Quickly do.

Welfare

Difficulties in various market entities

The new combined tax support policy in 2022 can be summarized as "refund, reduction, exemption, and slow."

The large -scale value -added tax retain tax refund is the most complicated policy in the new combined tax support policies and the most benefit of market players. In terms of scale, small and micro enterprises accounted for the majority of enterprises that have obtained tax refund in Guangming District. From the perspective of industry types, the manufacturing industry has benefited significantly; in early 2022, the state clarified that small and medium -sized enterprises in the manufacturing industry continued to delay the payment of some taxes and fees in the fourth quarter of 2021, and delayed the payment of some taxes and fees in the first quarter of 2022. Most of the manufacturing industries in Guangming District have enjoyed taxes and fees. Among them, value -added tax, corporate income tax and urban construction tax are the three largest taxes on the largest scale; among the new combined tax support policies, part of the tax exemption policies have a greater support for private market entities such as small enterprises, which is greatly supported, which is greatly great, which is greatly great, which is greatly great, greatly, and greatly, it is greatly. Promote the stable and healthy development of small and medium -sized enterprises with relatively weak small and medium -sized enterprises.

The rapidly landing tax preferential policy sent taxpayers to real gold and silver, and the taxpayer has a higher sense of gain. Since the implementation of the tax refund and tax reduction policy, the District Taxation Bureau has received many thank you letters and flags. The financial personnel of Shenzhen Avipus Technology Co., Ltd. in the area under their jurisdiction specifically praised the high -efficiency service of the Guangming District Taxation Bureau in the circle of friends.

The Taxation Bureau of Guangming District has formulated a personalized policy assistance plan through big data screening, and in -depth enterprises carry out "one -to -one" precise counseling.

"Putting water and fish"

New kinetic energy for breeding tax sources

The new combined tax support policy, in the short term, is difficult to relieve difficulties in the short term. In the long run, it is also "water -raising fish and fishing" and raising taxes. It is of great significance to boosting confidence in the development of various market entities.

From the perspective of productive indicators, from January to May, the power consumption of key tax sources in the region increased by 8.5%compared with the same period last year. This shows that policies such as value -added tax retaining tax refunds have made great efforts to alleviate the pressure of corporate funds, and the enthusiasm of production and investment has been improved. For example, Xinwangda Electric Vehicle Battery Co., Ltd. stated that after receiving an increase of more than 50 million yuan in tax refund, the planned funds were planned for equipment purchase, production line construction, research and development investment, etc., further increase the company's mass production capacity, strengthen enterprise innovation Ability and core competitiveness.

The business cost of enterprises has been reduced, and development expectations are more stable. More employment positions are intuitive. From January to May of this year, the number of employees in key tax sources in the region increased by 1.1%compared with the same period last year. The employment of social stable jobs was supported by tax and fees.

New combined tax support policies, balanced the relationship between "reduction and collection", and taxes that refund and deduct exemptions in the early stage will bring tax growth factors in the later period. For example, the large -scale tax refund policy implemented from April will be refunded in advance of the amount of input tax deducted by the enterprise in the future, and directly provides a cash flow that can be dominated by the investment expansion of the enterprise. At the same time, with the continuous expansion of the production and operation activities of enterprises, new input tax will continue to generate a virtuous circle between the upstream and downstream supply chain and the VAT deduction chain of the enterprise.

Return, reduce, free, slow

Tax refund: The scope of the total amount of value -added tax increases will be refunded on a monthly basis, and the scope of the tax increase of the tax increase of value -added tax will be expanded to the six major industries including manufacturing and eligible small and micro enterprises; tax reduction: tax reduction of corporate income tax and local "six tax taxes Tax reduction policy;

Duty -free: VAT small -scale taxpayers are exempt from VAT policies;

Slow tax: Continuing the implementation of the policy of delaying part of the tax and fees of small and medium -sized enterprises in manufacturing.

■ Highlight 1

The "Intelligent Tax Bright" team landed with data support policies

"Intelligent Tax Bright" is a data team made by the District Taxation Bureau. During this round of tax and fees supporting policy implementation, the team used information and big data to carry out preliminary data calculation work, and to support the policy with solid data support.

The District Taxation Bureau builds a "tax -related data pool" that spans organizational income, collection management, and tax services: open up data barriers from different departments and different systems, and comprehensively grasp the enterprise industry, credit rating, sales, and stock retention to the retention of stocks. For key information, accurately calculate the list of enterprises such as the expansion of the new policy of "six taxes and two fees"; at the same time, accurately screen the list of enterprises with urgent tax refund from key information, and arrange tax cadres to pass the grid group,@等 等, etc. Intervention in counseling in advance; lock the "zombie enterprise" in advance according to the main information information and the newly established enterprise into the new item, and include the "graylist" to prevent tax refund risks.

■ Highlight 2

"Cloud Tax Medicine" remotely help the company to help enterprises prevent illness and treat illness

The "Cloud Tax Medicine" team was founded in the early days of the outbreak of the epidemic in 2020. It was one of the non -contact tax measures launched by the District Taxation Bureau. The team consists of more than 30 professional talents and jobs who have obtained the "Three Divisions" (tax division, registered accountant, lawyer) certificate. The physical examination, "diagnosis of pulse" and direct professional services, strive to achieve preventing diseases and cure. At present, 60 enterprises have been included in the direct connection and direct service (including 28 new "small giants" enterprises in the national and provincial specialized specialty). Through the "Wangwen Question" work method, more than 200 households are diagnosed with pulse development for the development of the enterprise.

■ Typical case

A thank you letter saying the service warmth

"A good business environment, a strong policy support, warm -hearted tax service, let us be full of confidence in the company's development and bright future!" Recently, the District Taxation Bureau received the thank you letter from Shenzhen Innovation Technology Co., Ltd. Essence

The letter was sent to the company's chairman He Guang and Wang Junmin, the head of finance. He Guang told reporters that innovation is an innovative small and micro enterprise dedicated to the research and development of smart kitchen appliances. "During the epidemic period, people's houses were cooking at home and brought us opportunities. But the shortage of funds is the biggest problem." He Guang introduced that the company's monthly salary expenditure was nearly 800,000 yuan, and the rent of the factory of the plant, the cost of water and electricity, and other expenses of more than 100,000 yuan per month. At the most difficult time, the company's order volume decreased by 30%a month.

In April of this year, Wang Junmin, the person in charge of finance, received a call from the District Taxation Bureau to know that the VAT reserved tax refund was reserved. He made an online application under the guidance of tax personnel. "After applying many times, the system prompts that the conditions are not met. At that time, we almost wanted to give up. The staff tirelessly helped us analyze it, only to find that there was a data that was made wrong." He Guang said that the company had successfully enjoyed more than 400,000 yuan in tax refund. The model solves the pressure of the company's capital turnover, and the R & D has also continued and deepened, which virtually enhances the company's ability to deal with the risk of epidemic.

"Benefiting from national tax preferential policies and a good business environment in Shenzhen, now our monthly orders have increased by 30%compared to the previous epidemic, and profits have returned to the previous level." He Guang said.

Bright News All Media Reporter Wang Xiaodong

Correspondent Zhu Guimei Huang Haitao

Edit Guo Haoyang

- END -

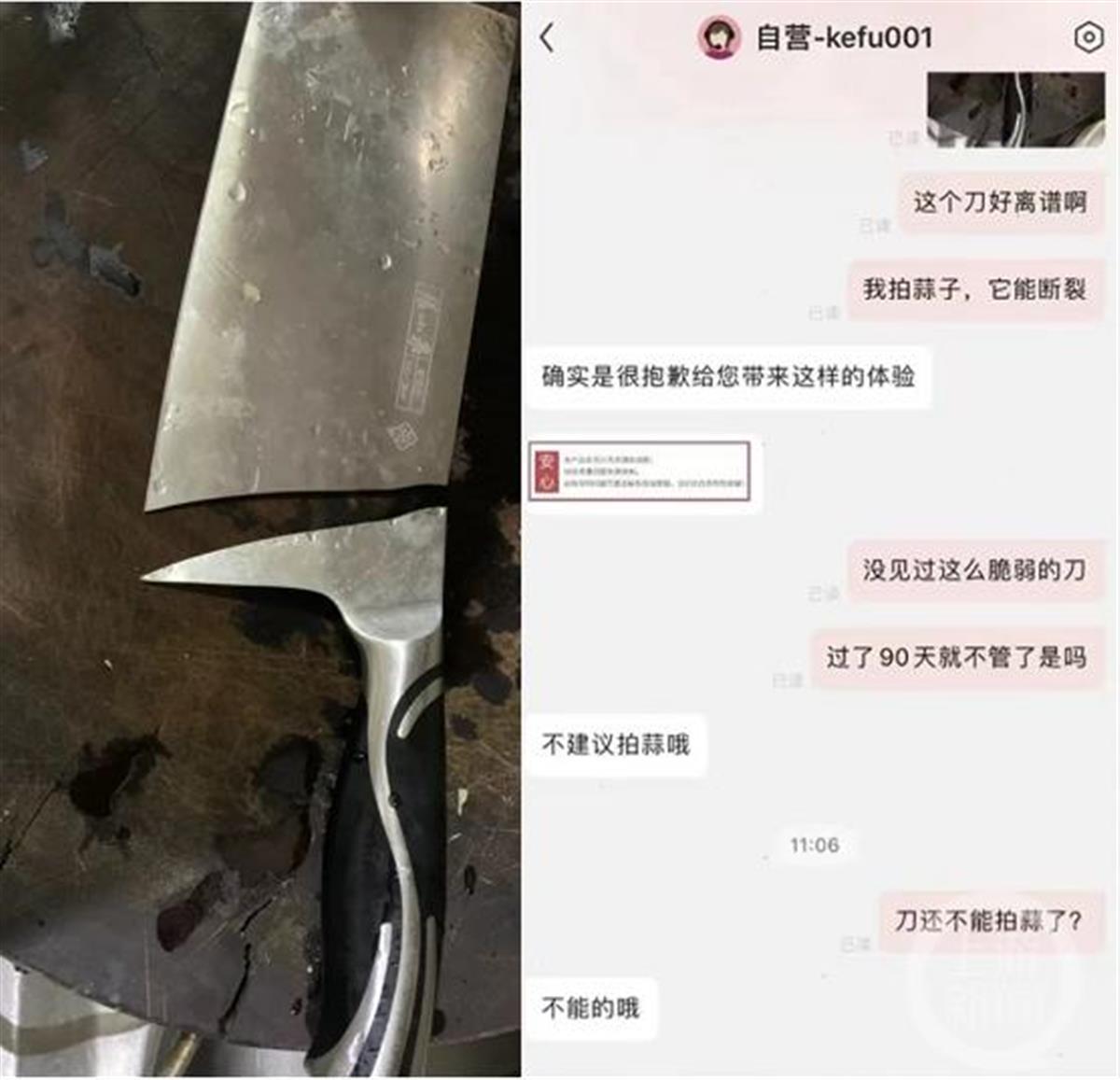

Extremely review | Zhang Xiaoquan kitchen knife can't shoot garlic. Is the old name really "pretending to be garlic"?

Ji Mu News commentator Qu JingZhang Xiaoquan kitchen knife took the garlic and it ...

Shandong Gold Group signed a strategic cooperation agreement with Inspur Group

On the afternoon of June 21, Shandong Gold Group and Inspur Group signed a strateg...