Xinling Electric IPO Pain Point: More than 50%of the R & D staff has low academic qualifications. Dealers are mostly former employees

Author:Discovery net Time:2022.07.01

The degree of more than half R & D of Xinling Electric is a college and below, and its research and development level has been questioned. In addition, most of the distribution customers of Xinling Electric are former employees and have doubts about transactions.

On April 26, Xinling Electric Co., Ltd. (hereinafter referred to as: Xinling Electric) was approved on the GEM of the Shenzhen Stock Exchange, and the registration was submitted on May 27.

Public information shows that Xinling Electric's public offering of this public offering shall not exceed 25.619 million shares, accounting for 25%of the company's total share capital after the issuance. It is expected to raise 413 million yuan, of which 291 million yuan are used for industrial automation control electrical component intelligent manufacturing plant construction projects, 65 million yuan for electromagnetic relay, micro -switch production line construction projects, and 57 million yuan for smart power distribution appliance production lines construction project.

However, it is worth noting that the degree of more than half of the research and development personnel of Xinling Electric is a college and below, and its R & D level has been questioned. In addition, most of the distribution customers of Xinling Electric are former employees and have doubts about transactions. In response to the above issues, I found that the network sent an interview letter to the public mailbox of Xinling Electric to send a question to the request. However, as of the time, Xinling Electric did not give a reasonable explanation.

R & D personnel below college degree accounted for more than 50%

According to the prospectus, Xinling Electric Owners engaged in the research and development, production and sales of low -voltage electrical products. The main products include relay, power distribution control, electrical transmission and control, instrumentation, sensors, switches, switches, and a total of tens of thousands of tens of thousands. Product specifications product system.

From 2019 to 2021, Xinling Electric's operating income was 376 million yuan, 445 million yuan, and 521 million yuan, respectively, with a year-on-year growth rate of 552%, 18.6%, and 17%. , 84 million yuan and 082 million yuan, a year-on-year growth rate of -10.37%, 72.17%, and -1.64%, respectively.

Picture source: Wind (Xinling Electric)

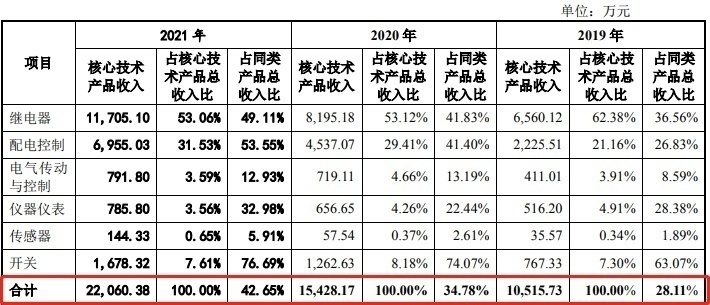

It is worth mentioning that Xinling Electric has a total of 38 core technologies, such as multi -purpose relay structure invention technology, multi -time -based small relay technology, and high -precision encoder phase array technology. Since 2009, it has been rated as a national high -tech national high -tech enterprise. However, the proportion of product revenue formed by Xinling Electric's core technology is low, and it is concentrated in relay and power distribution control products. According to the prospectus, from 2019 to 2021, the proportion of product revenue formed by Xinling Electric's core technology accounted for 28.11%, 34.78%, and 42.65%, respectively.

Picture source: prospectus (Xinling Electric)

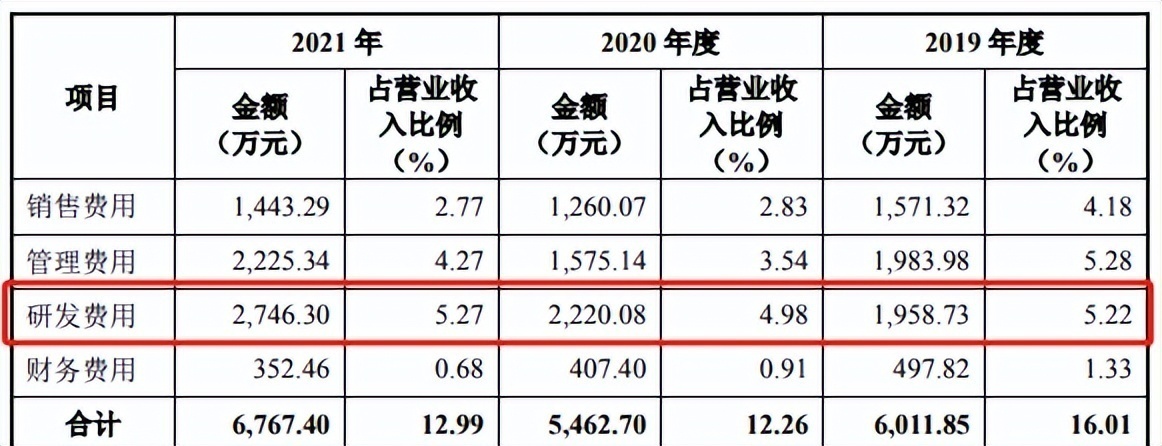

Analysts said that the product revenue formed by Xinling Electric's core technology accounted for a relatively low level of product revenue may be related to the company's R & D level. During the reporting period, Xinling Electric's research and development costs were 19.5873 million yuan, 22.08 million yuan, and 27.463 million yuan, respectively, accounting for 5.22%, 4.98%, and 5.27%of operating income, respectively. The investment in R & D expenses of Xinling Electric has increased year by year, and the R & D cost rate is higher than that of peer comparison companies.

Picture source: prospectus (Xinling Electric)

However, compared to comparable companies, Xinling Electric is slightly inferior to patents. The prospectus shows that as of 2021, Xinling Electric has obtained 370 patents, of which only 14 invention patents, accounting for 5%of the total patent. The proportion of the invention patent of the company's three friends and the company's invention is about 16%, and the number of invention patents of Tianzheng Electric accounts for about 14%, which is higher than Xinling Electric.

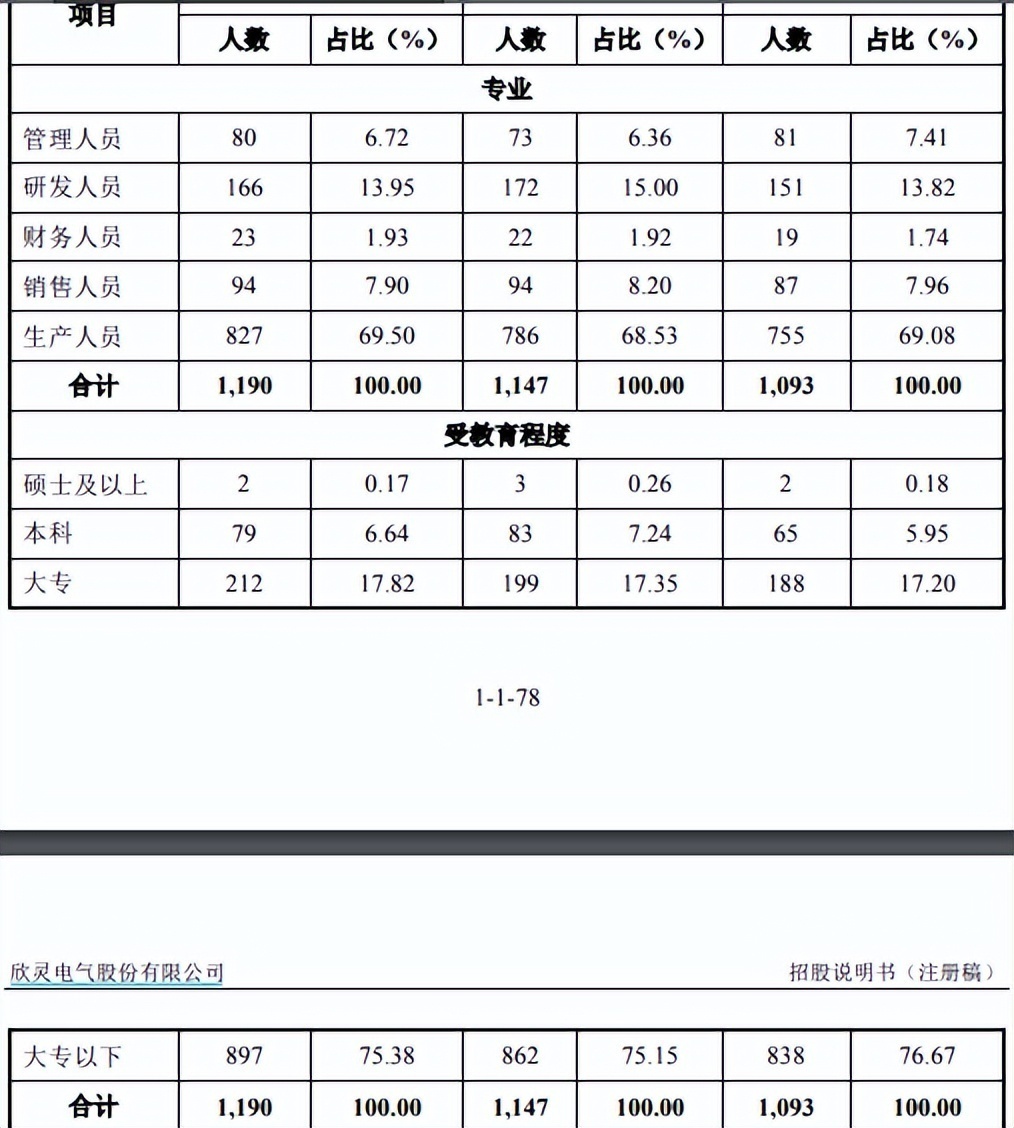

In addition, the R & D team of Xinling Electric needs to be strengthened. The prospectus shows that in 2021, its R & D personnel were 166, accounting for 13.95%of the total number of employees of the company, of which 3 were core technicians. Although the proportion of Xinling Electric R & D personnel is at a high level in the comparison company, the professional ability of its R & D personnel may still be improved.

Through inquiry the prospectus, the three core technicians of Xinling Electric are not high. Liu Chaoru and Zheng Xiaolong are undergraduate degree, while Zhou Guoqiang is a college degree. It should be noted that in 2021, the total number of Xinling Electric employees was 1,190, including 2 people and above, 79 undergraduate, 212 college colleges, and 897 below colleges, that is, 166 R & D personnel in Xinling Electric China It is a college degree and below.

Picture source: prospectus (Xinling Electric)

Industry insiders said that core technology is the core competitiveness of Xinling Electric and the basis for future development. If the company lacks excellent technical talents, the company's R & D and technological innovation may face stagnation, which will adversely affect the company's future development.

The relationship with dealers is complicated

Xinling Electric Sales mainly adopts the combination of distribution and direct sales, in which the sales revenue generated by the distribution model accounts for nearly half of the main business income. According to the prospectus, from 2019 to 2021, the sales revenue of the top five distributing customers in Xinling Electric was 53 million yuan, 50 million yuan and 48 million yuan, respectively, accounting for 14.11%, 11.29%and 9.13%of operating income, respectively. Essence

It is worth noting that most of the distributors of Xinling Electric have inextricable relationships with them. Among the top five distributing customers, Shanghai Baiwei Electric Co., Ltd. (hereinafter referred to as: Shanghai Baiwei) was established in 2020. It was established that year, Xinling Electric sold its sales of 8.2415 million yuan, ranking the fourth largest customer of the company. In 2021 Rate to the third largest customer of Xinling Electric. Picture source: prospectus (Xinling Electric)

It should be noted that Shanghai Baiwei is the establishment of Zhou Rulu, a salesman of Shanghai Jinzhou, and Zhou Ruyi, the actual controller of Shanghai Jinzhou. Due to the poor operation of Shanghai Jinzhou, Zhou Royi and Xin Ling Electric established Xinling Intelligence in 2019, and transferred Shanghai Jinzhou's customer resources to Xinling Smart.

Regarding the relationship between Zhou Rulu and Zhou Ruyi, Xin Ling Electric said that Zhou Rulu and Zhou Ruyi were the same village, and they were the same for generations, but there was no relationship between the two parties. In other words, Zhou Rulu is the former employee of the Xinling Electric Party.

In addition, the actual controller of Xinling Electric's main distribution customers Hangzhou Huanya Electronics Co., Ltd., Suzhou Yilaida Control System Co., Ltd., Ningbo Qizhou Qipeng Electromechanical Equipment Co., Ltd. and other enterprises have all been employees of the company. Interestingly, Xinling Electric also paid salary for the actual controllers of the 8 dealers and paid social security.

What's more interesting is that Xinling Electric still has some former employees to set up a dealer. This can not help wondering whether Xinling Electric has other capital business exchanges and interest arrangements with dealers.

(Reporter Luo Xuefeng Financial Researcher Tenghui said)

- END -

When we grab the agriculture, keep the harvest!The production of the "Sanxia" production of 100 acres of farmland in Weicheng District, Weifang City realizes the full mechanization

Qilu.com · Lightning News June 15th The Wind Blowing Maiyao Waves, it was anothe...

Just now, foreign capital ran nearly 10 billion!What is the reason for A shares?The Taiwan Army was "major accidents", the rocket launched the explosion, and the whole car exploded!Mount Fuji or eruption?The Day Police Department is fully prepared!

China Fund News TaylorBrothers and sisters, today the A -share market is still str...