The total scale of public fund funds exceeds 26 trillion yuan experts: will innovate in the second half of the year

Author:Securities daily Time:2022.07.01

The total scale of public funds exceeded 26 trillion yuan at the end of May.

On the evening of June 29, the latest public fund market data announced by the China Securities Investment Fund Industry Association (hereinafter referred to as the "China Foundation Association") showed that as of May 2022, a total of 153 public fund managers in my country have managed 9,872 public offerings Fund products, a total of 2.626 trillion yuan in net value of the product assets.

Public fund -funded scale

Rising for 2 consecutive months

Specifically, as of the end of May 2022, there were 139 fund management companies in my country, an increase of one from the end of April, of which 45 foreign investment fund management companies were added in a single month; To 94. There are 12 securities companies or securities company asset management subsidiaries and 2 insurance asset management companies that have obtained public fund management qualifications.

In addition, as of the end of May 2022, the total net value of public fund assets managed by the 153 institutions a total of 2.6.26 trillion yuan, the highest scale of the historically at the end of February 2.6.34 trillion yuan. Two months climbed. At the same time, the total share of public funds has continued to increase, with a single monthly share of 3.7 trillion yuan, and the total share of 2.398 trillion yuan at the end of May will reach a new high in recent years.

Since this year, despite the large fluctuations in the A -share market, the total scale of public fund management has achieved steadily growth. From 25.56 trillion yuan at the end of last year to 2.6.26 trillion yuan at the end of May this year. It is around 77 trillion yuan; at the same time, the fund share has increased from 2.178 trillion yuan at the end of last year to 2.3.98 trillion copies at the end of May this year, an increase of 2.2 trillion copies in the first five months of this year.

Shanghai Securities Fund Evaluation Research Center Advanced Fund Analyst and Ph.D. Sun Guiping told reporters from the Securities Daily that with the surge in short -term wealth management such as funding such as funding, the interbank deposit index funds have become explosive products, which has driven the scale of new funds to welcome Come to rebound. Since the beginning of this year, due to the continuous adjustment of the capital market, the fund issuance market has been cold, and the issuance scale of the new fund has rebounded since the bottom of February, especially in May due to the "explosive" issuance of the second batch of interbank deposit index funds in May The impact is significantly improved.

"The capital market has gradually recovered, driving the net value of the stock fund rebound, and the fund size has risen significantly." Sun Guiping believes that at the end of April 2022, the A -share market rebounded significantly. The bond market also performed well in May. The yield of the CSI TOE index in May was 0.66%, which was a new high since February.

According to Tian Lihui, the dean of the Institute of Financial Development of Nankai University, the high -quality development of my country's economic toughness and the high -quality development of listed companies have attracted various types of capital to borrow public funds.

Public offering products will become more diverse

Innovative products are constantly emerging

According to data released by the China -Foundation Association, in May, different types of fund product share and net worth rising and falling were large.

From the perspective of the share, as of the end of May 2022, the highest increase among the open funds was bond funds, with a single monthly share of 2.24 trillion copies, reaching 3.96 trillion copies at the end of May; followed by currency funds, a single monthly share increased by 2,200,000. 100 million copies reached 1.103 trillion yuan at the end of May; QDII funds rose 9.89 billion yuan in a single monthly share, reaching 2.25 trillion copies at the end of May. The share of stock funds and hybrid funds has declined, and the monthly share of stock funds has decreased by 10.131 billion yuan, and at the end of May to 1.76 trillion copies; the monthly share of the hybrid fund decreased by 79.667 billion, and the end of May to 3.98 trillion copies.

At the same time, as of the end of May 2022, stock funds, mixed funds, bond funds, currency funds and QDII fund's net asset value were 2.26 trillion yuan, 5.02 trillion yuan, 4.49 trillion yuan, 11.04 trillion yuan, and 2.26 trillion yuan. Essence Compared with the end of April, the net asset value of various types of funds has increased to varying degrees. Among them, bond funds have increased by 6.4%from the previous month, which is the most popular product that was most popular in the month.

Sun Guiping said that from the perspective of data, the share of various funds is large compared to the end of April. Among them, the share of the currency funds and bond funds of partially closed has increased significantly, and the share of equity and hybrid funds of partial equity has declined. The reason is related to the performance of the two stocks of this year. The stock market has been adjusted significantly from the end of 2021 to the end of April this year, and the bond market has performed steadily this year. Although the equity market fluctuated and recovered in May, there were also a few investors who reduced their positions at a high high, which led to a slight decline in the share of partial equity funds. In May, the debt market also performed well, which attracted a large amount of low -risk funds. However, as the wealth value of the market recovered, the net value of various types of fund assets increased to varying degrees compared with the end of April, of which solid -income products grew the most.

Tian Lihui believes that the scale of public funds in the second half of the year will grow steadily. This year, it is expected to reach 3 billion yuan, a record high.

Sun Guiping also predicts that the total scale of public fund management is expected to reach 3 billion yuan at the end of this year.In the future, the development of public funds will show three major trends: First, the recovery of the capital market will drive the fund issuance market to recover, and the issuance of new funds is expected to speed up, especially the issuance of partial equity funds is expected to recover; the second is the "inclusive finance" attribute of public fundsThe further confirmation and performance; the third is that as the public offering licenses gradually let go of different types of institutions, public offering products will become more diverse, and future innovative products will continue to emerge.[Editor in charge: You Suhang]

![]()

- END -

Five Pharmaceutical and Medical Device Enterprises in Tai'an are listed on the list

Qilu.com · Lightning News, July 4th. Recently, the list of Specialty Specialty SMEs in Shandong Province was announced in 2022. Five companies in Tai'an Pharmaceutical and Medical Device Industry C...

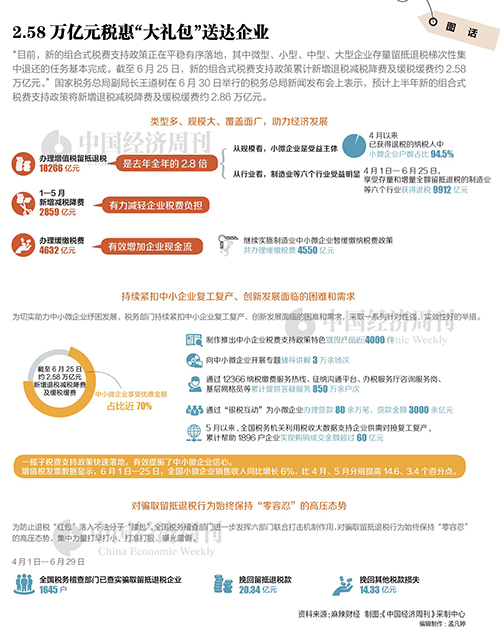

Photo | 2.58 trillion yuan of tax and benefit "big gift package" for enterprises

At present, the new combined tax support policy is landing steadily and orderly, o...