Guide medical examination: Guoshou Shou Insurance will launch a "one -stop" service model to customers and families

Author:Henan Legal Daily Time:2022.07.01

In recent years, the new crown pneumonia epidemic that has swept the world has had unprecedented impact on the insurance industry. Facing the adverse factors such as offline business development, the "insurance examination" launched by China Life Insurance Co., Ltd. (hereinafter referred to as "China Life Insurance Company") has become more and more popular with customers. Adhering to the business concept of independent innovation, relying on the advantages of digital platforms, China Life Insurance Company combines AI capabilities and traditional insurance fields, and establishes interactive bridges on the customer and sales side. It is recommended that customers go to the "one -stop" comprehensive service model for insurance configuration. Important breakthroughs have been achieved in the fields of service processes, insurance policies, guarantee evaluation, and customer operations, optimizing and improving the customer's experience, and injecting technological momentum into the company's high -quality development.

Intelligent finishing home policy, planning premium expenditure plan

As the head enterprise in the domestic life insurance market, the Chinese Life Insurance Corporation has accumulated a large number of customers and huge amounts of insurance policies for many years. For the first time, the "policy medical examination" will be based on guarantee as the core insurance configuration scheme to the family field. Based on artificial intelligence AI modeling, draw customer family maps, and cover hundreds of millions of families. At the same time, relying on the National Life Big Data Platform, intelligently organize a billion -level huge amount of policy, through face recognition identity authentication, quickly and efficiently organize family policies for customers, and complete the complicated and complicated handmade paper insurance policies in the past. Update, automation, and intelligence have completely solved the problems of forgetting orders purchased by customers, loss of paper insurance policies, and incomplete policies information, clearly displaying the insurance benefits of customers' families, and helping customers with scientific insurance expenditure programs.

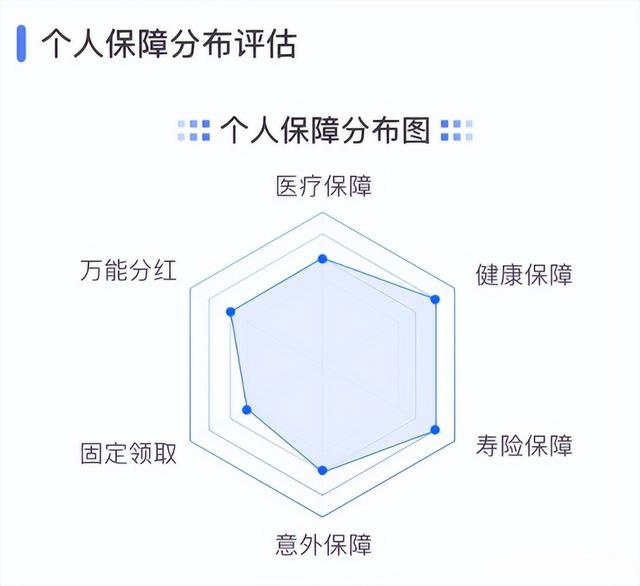

Intelligent split protection responsibility, analyze home security distribution

Family is the basic cell of society. In recent years, family security has gradually become the mainstream of social insurance demand. With family security as the core, China Life and Life Insurance Company will atomic division of the protection responsibilities of more than 3,000 insurance products, covering six categories including life insurance, accidents, health, medical care, fixed collection, and financial planning. , Disability, Critical illness, minor illness, medical care, allowance, annuity, dividend and other twelve categories to build a guarantee calculation model. Draw the guarantee distribution map of each family member and generate a family security assessment report.

Suggestions for customized exclusive insurance allocation, scientifically improve family security

In order to create a suggestion of intelligent insurance allocation covering the real guarantee needs of customers and families, the "policy medical examination" project is equipped with the industry's leading National Life Hybrid Cloud Platform, combined with the Tencent social system, and build online planning services on the WeChat social chain to help help. Sales staff conduct customer customization, refined operation and intelligent services. Create the professional capabilities of sales staff through the WeChat circle of friends and shape the personal professional brand image. Help customers predict home risks, analyze the current guarantee gap, recommendation

Want to ensure the quota and help improve the customer's family guarantee.

The "policy medical examination" project pioneered the online insurance service model, focusing on the core needs of family security, and with various types of services of professional intelligence, once it was launched, it detained the enthusiasm for the use of sales staff inside the system. As of now, the amount of medical examination services in the policy has exceeded 8.33 million, with a total of 597,000 sales personnel and 4.83 million customers, which effectively enhances the marketing service enthusiasm of sales staff and effectively improved the customer's insurance experience.

The "policy medical examination", as an important part of the digital customer operation system of China Life and Life Insurance Company, is an empowerment business with science and technology to bring subversive changes to customer service. The project has reached a high level in the industry in terms of the richness, online, and intelligentization of supporting functions. Family security assessment, smart insurance solutions, and friends circle assistants are at the forefront of the industry. In the future, China Life and Life Insurance Corporation will continue to strengthen the construction of "science and technology national life", promote the "policy medical examination" service project, and strive to create a better, more convenient, smarter and more intimate high -quality service experience for customers. ⑦

- END -

There is a tide of disconnection from the rotten tail, and the owner accuses the bank's funds inadequate

Recently, the news of the bad tail building has gradually increased, and it also m...

The establishment of the prefabricated vegetable industry alliance in Sichuan Province is optimistic about future trillion industries

In the next few years, the domestic prefabricated vegetable industry may jump into...