The "Xing" of Agricultural Insurance and "Sleeping": Nearly 40 insurance companies competed each other. Last year, the premium growth rate was about 20%, but the underwriting profit margin was only 0.4%

Author:Daily Economic News Time:2022.06.30

In February 2022, the State Council of the Central Committee of the Communist Party of China issued the "Opinions of the Central Committee of the Communist Party of China on the key work of the comprehensive promotion of rural rejuvenation in 2022". The opinions emphasized that in 2022, the full cost insurance and planting income insurance in the three major grain crops should be achieved in 2022. The full coverage of Grain County, which also puts forward higher requirements for further improving the level of agricultural insurance protection.

"With the further advancement of the rural revitalization strategy, there are more and more expectations given by agricultural insurance." Talking about the development prospects of agricultural insurance, many property insurance companies have expressed their future in interviews with "Daily Economic News" reporters. Can be expected.

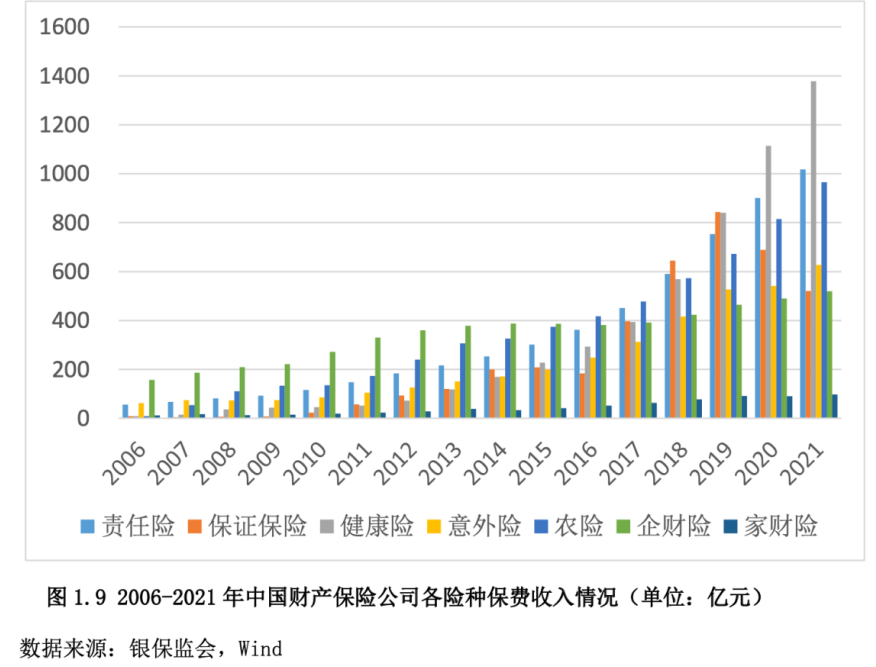

According to data from the CBRC, in recent years, my country's agricultural insurance premiums have remained at about 20%, and non -auto insurance businesses such as health insurance and liability insurance have maintained a high -speed growth trend. In 2021, the national agricultural insurance realized premium revenue of 97.6 billion yuan.

In the industry, it is expected that by 2025, the scale of agricultural insurance premiums is expected to surpass liability insurance, and it will become the second largest non -auto insurance types after health insurance.

However, at the same time as the scale of scale, in recent years, agricultural insurance operations have also faced the current status of underwriting profits. It is understood that with the continuous expansion of the operating entity and the fierce competition raising operating costs, the agricultural insurance underwriting profits have "turned negatives" in 2019, and in the past two years, they have only maintained micro -profit. 0.17%and 0.4%.

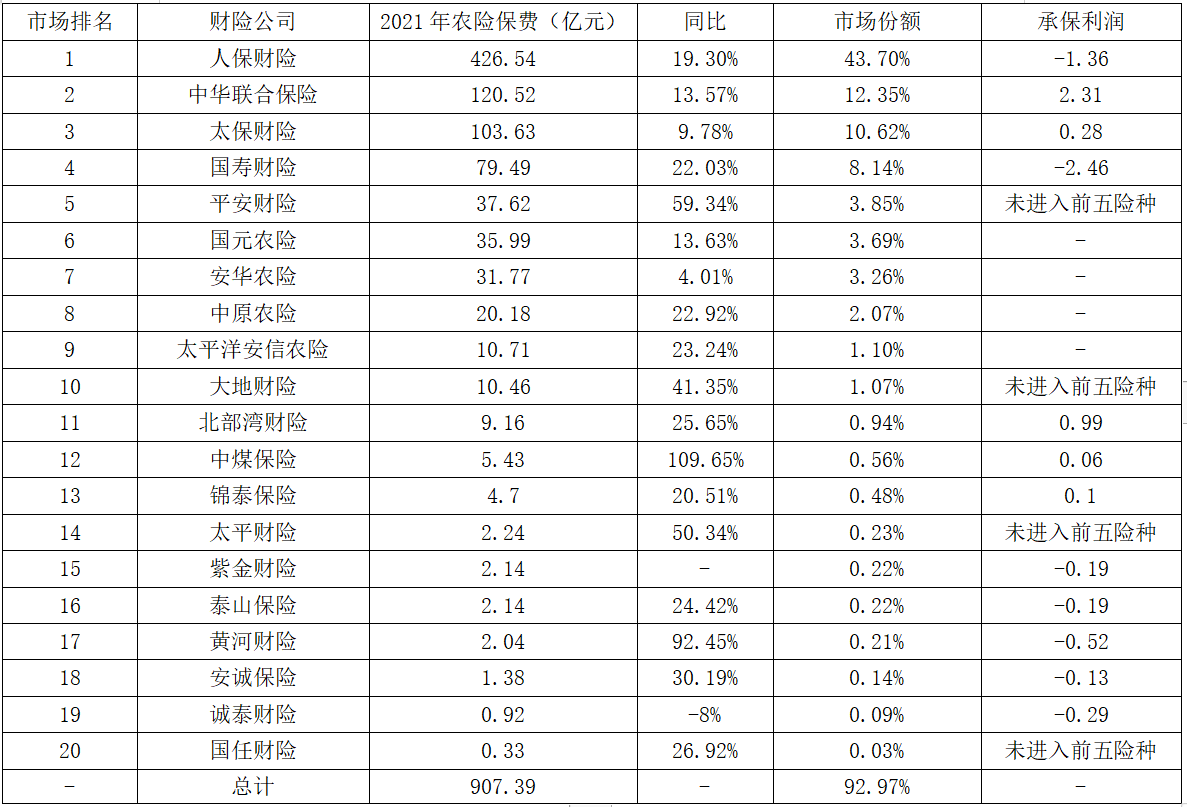

"Daily Economic News" reporter statistics from the agricultural insurance operation data of major property insurance companies in 2021 found that 20 companies that disclosed agricultural insurance premiums accounted for about 93%of the market share. Many insurance companies increased by more than 50%last year. From the perspective of profitability, the comprehensive cost rate of many companies exceeds 100%.

What is the market pattern of agricultural insurance business? What are the explorations in the industry in the industry to seek the long -term development of future long -term development? "Daily Economic News" reporters in -depth interviews with relevant insurance companies involved in agricultural insurance business, and discovered these issues.

20 financial insurance companies occupy 93%of the market share

In 2004, Pacific Anxin Agricultural Insurance was established in Shanghai as the first professional agricultural insurance company in my country. The Anwar Agricultural Insurance was established in the same year as Pacific Anxin Agricultural Insurance, which is registered in Jilin.

At present, there are already five professional agricultural insurance institutions in the market, namely Anwar Agricultural Insurance, Guoyuan Agricultural Insurance, Pacific Anxin Agricultural Insurance, Central Plains Agricultural Insurance and Sunshine Agricultural Insurance.

Judging from the development of professional agricultural insurance institutions, its business has basically covered all over the country. Specifically, the business scope of the Pacific Anxin Agricultural Insurance is mainly in Shanghai, Zhejiang, and Jiangsu Province; the business business scope of Anwar Agricultural Insurance includes Jilin Province, Inner Mongolia Autonomous Region, Liaoning Province, Shandong Province, Beijing, Qingdao, Dalian, Dalian, Dalian Municipal, Sichuan Province, Hebei Province, Heilongjiang Province, Guangdong Province; the business business scope of Guoyuan Agricultural Insurance includes Anhui Province, Henan Province, Hubei Province, Guizhou, Shanghai, and Shandong; Provincial, Inner Mongolia Autonomous Region and Heilongjiang Province.

While gradually expanding the scope of business business, the premium income of professional agricultural insurance institutions has increased year after year. In 2021, in addition to Anwar Agricultural Insurance's premium income compared with the same period of the previous year, the number of agricultural insurance companies such as the National Yuan Agricultural Insurance, Pacific Anxin Agricultural Insurance, and Central Plains Agricultural Insurance Company increased double -digit growth. The overall premium income growth rate of property insurance companies during the same period was only 0.68%.

From the perspective of market share, professional agricultural insurance companies are only "second echelon" in the agricultural insurance market. 《每日经济新闻》记者梳理2021年财险公司年报显示,20家财险公司占据了约93%的市场份额,其中,人保财险、中华联合财险、太保财险、国寿财险和Five companies in Ping An Property & Casualty Insurance exceeded 78%, accounting for 42.654 billion yuan in property insurance insurance premiums with the largest market share, accounting for more than 40%of the share.

Agricultural insurance companies with the top 20 of the agricultural insurance market agricultural insurance premiums

Take the Shanghai Agricultural Insurance Market as an example. At present, a unique pattern has been broken. Beginning in 2021, 4 property insurance companies including PICC Property & Casualty Insurance, Ping An Property & Casualty Insurance, State Life Property & Casualty Insurance, and Earth Insurance have joined the market and and Pacific Anxin Farmers. Insurance jointly serves the Shanghai Agricultural Insurance Market.

"Increased market suppliers will greatly help the improvement of products and service capabilities. It is foreseeable that the marketization of the Shanghai Agricultural Insurance market will inevitably become higher and higher in the future." Some markets told reporters during the interview.

From the perspective of the growth rate of premiums, in 2021, the premiums of Yaitai Property & Casualty Insurance alone decreased by 8%year -on -year, and other insurance companies increased year -on -year. , PICC's property insurance in the market ranking increased by 19.3%year -on -year.

From the perspective of underwriting profits, China United Insurance, Tai Insurance Property & Casualty Insurance, Beibu Bay Property & Casualty Insurance, China Coal Insurance, Jinsai Insurance and other companies in 2021 are the state of insurance, and many companies have losing losses last year.

The rapid development from 0 to nearly 40 business attracts insurance companies to enter the bureau

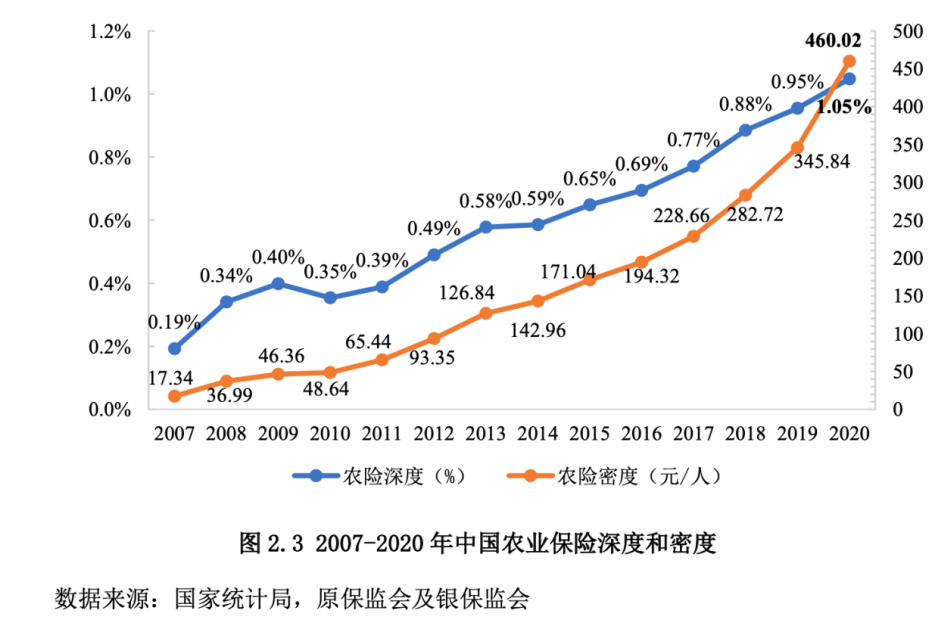

Since 2004, the Central Document No. 1 has always paid attention to the development of agricultural insurance. The "Science and Technology Help Agricultural Insurance High -quality Development White Paper (2022)" (following the "Science and Technology Help Agricultural Insurance High -quality Development White Paper (2022)" (hereinafter co -founded by the Rural Economic Research Center of the Ministry of Agriculture and Rural University, and Tsinghua University "White Paper") shows that the financial subsidies of the central and local agricultural insurance increased from 4.06 billion yuan in 2007 to 74.64 billion yuan in 2021. In recent years, financial subsidies at all levels account for about 75%of agricultural insurance premium income, which has effectively supported the development of agricultural insurance. Data show that the scale of agricultural insurance premiums in my country reached 81.5 billion yuan in 2020, surpassing the United States to become the largest country in global agricultural insurance premiums. In 2021, the scale of agricultural insurance premiums in my country was 97.6 billion yuan, an increase of nearly 20%year -on -year, and continued to maintain its position as the largest country in global agricultural insurance premiums.

At the same time, in 2020, my country's agricultural insurance depth was 1.05%, an increase of three times from 2008. The goal of agricultural insurance in 2022 was proposed in the "Guiding Opinions on Accelerating the High -quality Development of Agricultural Insurance" in advance.

State Life Property & Casualty Insurance stated that agricultural insurance, as an important force management tool and risk management method in the protection of rural revitalization strategic system, has played in the process of ensuring the security of the agricultural industry, stabilizing farmers' income, and winning poverty alleviation in recent years. Important role.

"my country is a large population country. It stabilizes the basic agricultural disk. The foundation of the 'agriculture, rural areas, and rural areas is the cockpit stone of the response bureau and the opening of the new bureau. It is related to the overall strategy of national rejuvenation. It is a strategic base point and space for building a new development pattern." Anwar Agricultural Insurance believes that in the future, the growth and proportion of my country's agricultural insurance industry will continue to increase, and a more complete top -level institutional system will be introduced to promote the high -quality development of agricultural insurance in my country.

The broad prospects of the agricultural insurance market have attracted more and more business entities to enter the bureau. In recent years, agricultural insurance operating institutions have increased from the initial single digit to nearly 40 today, including 5 professional agricultural insurance companies and more than 30 comprehensive insurance companies operating agricultural insurance business. Many insurance companies use agricultural insurance as one of the key directions for the company's non -auto insurance business.

The White Paper predicts that the scale of my country's agricultural insurance premiums in 2025 is expected to reach 162071 billion yuan to 187.539 billion yuan. In 2025, the scale of agricultural insurance premiums will surpass liability insurance, becoming the second largest non -auto insurance types after health insurance. According to data from the CBRC, in 2021, the scale of liability insurance and agricultural insurance premiums was 101.8 billion yuan and 97.6 billion yuan, respectively, with a growth rate of 12.99%and 19.75%, respectively.

Interviewed insurance institutions are also optimistic about the market prospects of agricultural insurance. China United Property & Casualty Insurance stated that by 2022, the scale of my country's agricultural insurance market will exceed 110 billion yuan, a growth rate of more than 20%. By 2030, the scale of agricultural insurance is expected to exceed the 300 billion yuan mark.

The "stabilizer" of the rural revitalization strategy

With the further advancement of the rural revitalization strategy, agricultural insurance has been given more and more expectations.

Anwar Agricultural Insurance said that the "two bottom lines" proposed by Document No. 1 this year are itself a huge opportunity for the insurance industry. Specifically, keeping the bottom line of the national food security needs to further expand the full cost (income) insurance pilot of the three major main grain crops, and help the implementation of grain and the implementation of the grain and the implementation of the grain.

"Under the strategy of rural rejuvenation, agricultural insurance is more available, and has great potential." PICC Property & Casualty Shanghai Branch said that increasing farmers' income is necessary to discover the space for farmers' operating income, and there is a lot of articles to increase farmers' operating income.

To increase operating income, the first is to help farmers prevent production risks and market risks, stabilize the expectations of farmers' development and production, and strive to build a foundation for internal income increase in agriculture. At present, the production of some agricultural products is in a state of zero -profit or even losing money, and agricultural insurance is urgently required to provide stable guarantees.

At present, the protection level of my country's agricultural insurance is far from meeting expectations. Farmers in the grain area generally report that the insurance amount of corn, wheat, and rice is about 1,000 yuan per acre. Very limited. If income insurance is performed, the disaster can still be compensated according to the agreed income of food, and it will not work for one year.

The company also proposed that a large number of local specialty agricultural products lack insurance protection. In some places, even if the special agricultural product insurance has been carried out, there are problems such as small varieties, low coverage, and low guarantee levels, and it is difficult to meet the high protection needs of farmers. Sheep, cattle, chickens and other animal products that have a greater impact on farmers and agriculture, aquatic products such as fish, shrimp, crabs, and fruits such as apples, citrus, grapes, etc., urgently need to be included in the scope of agricultural insurance premiums for the central government.

"Agricultural insurance is an extremely important part of the insurance company's product system. It is an important tool for the policy of strengthening the agricultural and benefiting agriculture. It is also a 'stabilizer' to promote the strategy of rural revitalization."

"The insurance industry serving the countryside has a unique institutional and mechanism advantage." Anwar Agricultural Insurance said that through the insurance market -oriented mechanism, accurate compensation for the people of the affected difficulties and assistants, and the "point -to -point" drip irrigation of insurance compensation. Help improve the scientific and accuracy of supporting rural rejuvenation. In addition, through the large number of laws and risk dispersing mechanisms of insurance, the effect of amplifying the use of fiscal funds can be enlarged, and the optimized allocation of rural revitalization resources can be achieved in a larger scale. In addition, policies such as rural infrastructure construction, implementation of rural human settlements, and vigorously promoting digital rural construction policies have been carried out, which not only creates a huge demand for the rural non -auto insurance market, but also provides a favorable environment for the digital transformation of the insurance industry.

According to the Chinese United Property Insurance, the implementation of the rural revitalization strategy has put forward specific goals for the development of financial services "agriculture, rural areas, and rural areas, and in the process of ensuring national food security, increasing farmers' income, improving the ecological environment, and rural governance. It is necessary to play an important role and will also usher in major opportunities for development.

In the past two years, the overall industry operation of the industry has maintained "capital protection"

The increase in participating subjects, while increasing the degree of marketization of agricultural insurance, also exacerbated the industry's competitive pressure.

"White Paper" shows that around 2007, there were not many insurance companies operating agricultural insurance in the market, and the competition pressure was not much. At that time, the cost of agricultural insurance was not more than 15%. However, the cost cost of most companies today is more than 30%, and the company with the lowest cost rate is more than 22%. If the "premium reserve" deduction and reinsurance expenditure are added, almost a level of about 40%. In the past two years, the simple payment rate of agricultural insurance is about 75%in the country, and the comprehensive cost rate of many companies exceeds 100%.

The rise in operating costs has caused significant decline in underwriting profits, and the pressure of agricultural insurance operations is prominent. In 2019, agricultural insurance suffered underwriting losses. In 2020 and 2021, the profits of agricultural insurance insured were only 101 million yuan and 277 million yuan, respectively, and the underwriting profit margin was only 0.17%and 0.4%.

According to the "White Paper" survey and calculation, the average underwriting cost of wheat insurance in five cities in Henan Province was 5.3 yuan, which has far exceeded the self -payment premiums of 3.6 yuan per acre of farmers. In accordance with the claims of multiple risk insurance based on individual farmers, insurance companies must conduct three surveys at different time points. The survey volume is huge, the fixed loss procedures are cumbersome, and the cost will be overwhelmed.

"At present, the agricultural insurance market pattern mainly reflects three characteristics: a market structure of moderate competition; the business structure of the principal and micro -profit; the refined management structure." China United Property Insurance said. In 2019, the Ministry of Finance and other four departments issued the "Guiding Opinions on Accelerating the High -quality Development of Agricultural Insurance", which basically identified the business principle of "capital protection" of agricultural insurance.

It is reported that compared with general property insurance, the discrete coefficients of agricultural insurance are almost 9 times larger than the discrete factor of ordinary property insurance, and the risk of disaster is obvious. As a result, it has brought difficulties to the risk calculation of agricultural insurance operations.

"In the context of frequent natural disasters and the expansion of agricultural insurance bidding, the risks faced by insurance institutions are continuously gathered, and sustainable development has been unprecedentedly challenged." From the perspective of Anwar Agricultural Insurance, the establishment of China's agricultural reinsurance company is right. The scattered risks of agricultural insurance in my country have played an important role, but the current demand for risks of each insurance subject is still insufficient.

"In recent years, international reinsurance companies have been more cautious about my country's agricultural insurance business, and the underwriting capabilities have continued to reduce their underwriting capabilities. The top priority of the industry is to improve the diversified mechanism of agricultural insurance disaster risks and provide important basic guarantees for the high -quality development of agricultural insurance." The company believes.

"White Paper" also shows that the operation of agricultural insurance is also facing challenges such as low efficiency, information asymmetry, irregular insurance claims, and extensive pricing. For example, in practical operation, agricultural insurance compensation has become more and more obvious, showing a high probability of payment and low payment of per mu, which has made insurance a "subsidy".

Taking the full cost and income insurance pilot as an example, the insurance profit rate (compensation area/insured area) of two pilot counties in the Inner Mongolia Autonomous Region reached 100%, while the simple payment rate of that year was only about 60%, indicating question. Although the profit margin of one county in Liaoning Province has not reached 100%, it is higher than the simple payment rate of agricultural insurance. The compensation obtained by the affected households in the county is only 47 yuan/mu. The practice of "small disaster and less compensation, big disasters", so that insurance companies cannot effectively accumulate funds to deal with huge payments in the year of the disaster.

Agricultural machinery picture of agricultural machinery operating in farmland: Xinhua News Agency

Refined management Explore the long -term development path

Facing the challenges of healthy and sustainable development, insurance institutions have actively responded in recent years, exploring refined management and scientific and technological empowerment measures, and put forward specific suggestions for the long -term development of agricultural insurance.

In response to the difficulty of survey in agricultural insurance business, China United Property & Casualty Insurance has implemented a number of targeted measures: actively use satellite remote sensing, drone, biometrics and other technical treatment services, use technology hand to reduce traditional resources input; establish a complete large -scale large large large Disable mechanism for disaster risk. Through national, internal and external reinsurance markets, futures markets, and recruitment of disaster reserves, the natural risks of cost insurance, price index insurance and market price risks are effectively dispersed.

The PICC Property Insurance Shanghai Branch suggested that on the premise of effective risk control, actively strengthen the cooperation with several major phaseers, continuously increase the expansion and increase of "insurance+futures", and continuously innovate and develop "insurance+futures" and indexes. Commercial agricultural insurance such as insurance and other commercial agricultural insurance has been strengthened. Anwar Agricultural Insurance starts with the aspects of reducing operating costs, attaching importance to preventing greater than compensation, and improving reinsurance arrangements to further strengthen internal operating cost control.

Take the attention of "prevention than compensation" as an example, strengthen disaster prevention and damage and rescue investment, carry out hail and rain, drought and drought, built dams, dredge flood discharge channels, and comprehensive prevention and control of pests. In terms of agricultural technical guidance, agricultural and animal husbandry and the civilians are hired by agricultural technology experts, providing technical guidance and scientific management of agricultural production and living in farmers and herdsmen, and helping farmers and herdsmen to increase yield and income and income.

Regarding how to achieve the profitability of underwriting, the Shanghai Branch of PICC Property & Casualty Insurance stated that it has paid close attention to the refined management of agricultural insurance, strengthened processing control, adheres to the efficiency of internal management, and consolidates the foundation of agricultural insurance reform and development. Tominations and enhancement efficiency, continuously improve the ability of agricultural insurance services, operation management capabilities, risk prevention capabilities, and cost management and control capabilities; upgrade and improve the management system in various fields of agricultural insurance, promote the standardized management of full chain, strengthen scientific and technological empowerment, accelerate the agricultural insurance line online Capacity, promote digital transformation, and create an efficient service platform.

In terms of science and technology to promote high -quality development, Ping An Property Insurance has initially explored the application of digitalization in helping the revitalization of rural industries. For high -value economic crops, we are the first to set up IoT equipment in the planting area, and use the traceability of IoT devices to monitor the risk of targeting. Created a platform for agricultural enterprises to support poverty control, loan enterprises regularly upload corporate financial materials, conduct online monitoring of all -processes of corporate loans, and fully combine the characteristics of insurance enterprises. ", Established a" hematopoietic "model, reducing the threshold for loans, reducing the pressure on repayment, leveraging more industrial development funds to help enterprises in various places to sustainable development, and driving farmers to increase their income and poverty alleviation for a long time.

In addition, the industry has also called for the improvement of relevant policies and regulations to regulate the development of agricultural insurance business.

Anhua Agricultural Insurance suggests to revise the "Agricultural Insurance Regulations" or start the legislation of agricultural insurance laws to improve agricultural insurance laws and regulations. The institutionalization and systemization of policies are used to rationalize the relationship between the agricultural insurance and the subject, and reasonably define the boundaries between the government and the market behavior, and clarify the responsibilities and rights relationship between the central and local governments. Further enhanced the position of agricultural insurance in the policy of strong farmers and rural farmers.

Daily Economic News

- END -

2.58 trillion yuan of taxes and dividends to account for small and medium -sized enterprises to benefit more small and medium -sized enterprises

There are both large -scale VAT reserved tax refund, as well as small -scale taxpa...

Figaro: How to deal with the cost of transporting raw materials for inflation to transfer the price of raw materials for inflation

China Well -off Network, June 23. In an industry with strong demand, the company m...