In June, the brokerage firms have rebounded. Everbright Securities and Huaxin shares may increase by more than 35%.

Author:Capital state Time:2022.06.30

On June 30, the Capital State learned that on the last trading day of the end of the year, the brokerage stocks were active again. When the opening of the market, among the ingredients stocks, Huaxin shares opened the daily limit three times in the morning and closed the daily limit after 10:30 am.

As of press time, Guolian Securities has risen by more than 4%, CITIC Construction Investment and Oriental Wealth have risen by more than 2%. Great Wall Securities, Shanxi Securities, and CICC have risen.

(Choice)

Choice statistics show that since June, the phenomenon of rotation of individual stocks in the brokerage sector is extremely obvious, including Everbright Securities (6 days 5 boards), Hongta Securities (4 days 3 boards), Great Wall Securities (2 days 2 boards), Huaxin shares, Huaxin shares (6 days 3 boards), CITIC Jiaotou (8 days 2 boards), etc., multiple stocks recorded multiple daily limit.

As of the close of June 29, of the 50 A -share listed brokerage stocks, a total of 48 increased rose in the month, 43 stocks increased by more than 5%, and 15 stocks increased by more than 10%.

Everbright Securities and CITIC Construction Investment are still in the top 2 of the increase list, which recorded 36.36%and 26.04%within the month.

Huaxin shares are the third increase of more than 20%. If the statistics of the current increase on June 30, Huaxin's increase in June will exceed 35%, and there will be no accident or the first two positions of the monthly increase list of securities companies.

Regarding the rising market of securities firms, Central Plains Securities analyzed that since June, the securities firm index has a stronger complement to rebound, and once became the focus of market attention. Performance is strong. During the short cycle, in the context of the continuous rebound of various equity indexes, the overall operating environment of the brokerage sector has greatly improved, and the brokerage index has the potential to create a new high in this round.

Regarding the trend of the brokerage sector after the year, Caixin Securities analysis pointed out that the macro economy in the second half of the year is expected to gradually stabilize and recover, liquidity will remain reasonable and abundant, and the monetary policy space in the second half of the year will provide a good environment for the development of the securities industry. With the further deepening of the capital market reform, the marketing of science and technology boards is expected to accelerate the implementation of the market, and the expectations of the implementation of a comprehensive registration system will be strengthened.

- END -

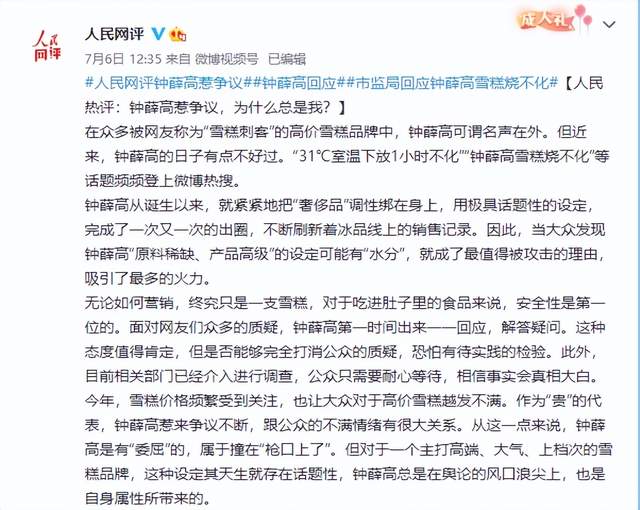

People's Hot Comment: Zhong Xue Gao provoked the controversy, why is it always me?

Among the high -priced ice cream brands that are called ice cream assassins by net...

Southern Airlines: The second quarter of "China Southern Airlines Treasury Bonds" to about 15,700 shares in the second quarter, and the cumulative transfer of about 1.619 billion shares

Every time AI News, Southern Airlines (SH 600029, closing price: 6.78 yuan) issued...