Tianqi Lith

Author:Capital state Time:2022.06.30

On June 30, Capital State learned that according to the company's announcement, Tianqi Lithium Industry Co., Ltd. (hereinafter referred to as: Tianqi Lithium Industry) plans to be listed on the main board of Hong Kong. The sponsor is China International Financial Hong Kong Securities Co., Ltd. Financing Co., Ltd., Morgan Stanley Asia Co., Ltd.. Earlier, the company handed over the table on January 28, 2022. This IPO is expected to issue 164 million shares, of which 16.414 million shares were released in Hong Kong, 148 million shares were available in international offerings, and there were 2,4618,200 shares.

The issue price range is 69.00 to 82.00 Hong Kong dollars per share. The listing date is expected to be on July 13, 2022, with 200 shares per hand.

In terms of funds, about 8,865 million Hong Kong dollars will be used to repay SQM debt's unpaid balance; about N1.7 million Hong Kong dollars will be used to allocate capital for the first phase of the Anju plant; about 785 million Hong Kong dollars will be used for The repayment interest is 4.35%to 5.49%and the expiration date is a number of domestic domestic bank loans from September 2002 to June 2025; the remaining HK $ 122 million will be used for operating funds And general company use.

The main business of Tianqi Lithium Co., Ltd. is the production, processing and sales of lithium concentrate and lithium chemical products. The company's main products are lithium ore, lithium compounds and derivatives. The company has won the awards and honorary titles such as the "2019 Outstanding Responsible Enterprise of the Year", "Outstanding Responsible Enterprise of the Year" selected by Yianhanwitt, "Outstanding Responsible Enterprise of the Year" and "Public Welfare Enterprise" awarded by the "Southern Weekend". According to the ROSKILL2019 report, the company's sales of merchants below 2018, the company is the third largest battery -grade lithium carbonate supplier in the world.

From January 1, 2022-March 31, 2022, the company's operating income was 5.213 billion yuan, and net profit was 3.956 billion yuan. As of the fiscal year and 2021 fiscal year of December 31, the company's revenue was 3.215 billion and 7.598 billion yuan, and net profit was -1.831 billion yuan and 3.649 billion yuan, respectively.

- END -

These companies in Xiamen do not affect credit reporting and free penalties!Details →

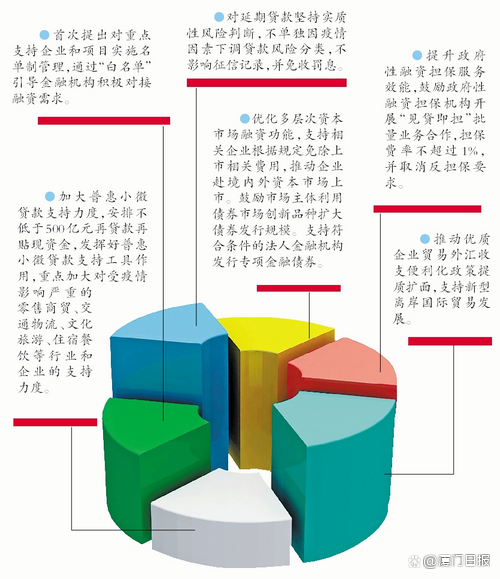

Xiamen City issued \Several Measures for Financial Supporting Economic Insurance...

Gu'an 6 · 28 Industrial Investment Promotion and Project Concentration Signing

Planting the sycamore trees, attracting the Phoenix. On June 28, Gu'an County held an industrial investment promotion and project centralized signing activities. There are 57 concentrated projects, wi...