Cinda Securities IPO is approved, and the second AMC listed broker is coming

Author:Zhongxin Jingwei Time:2022.06.30

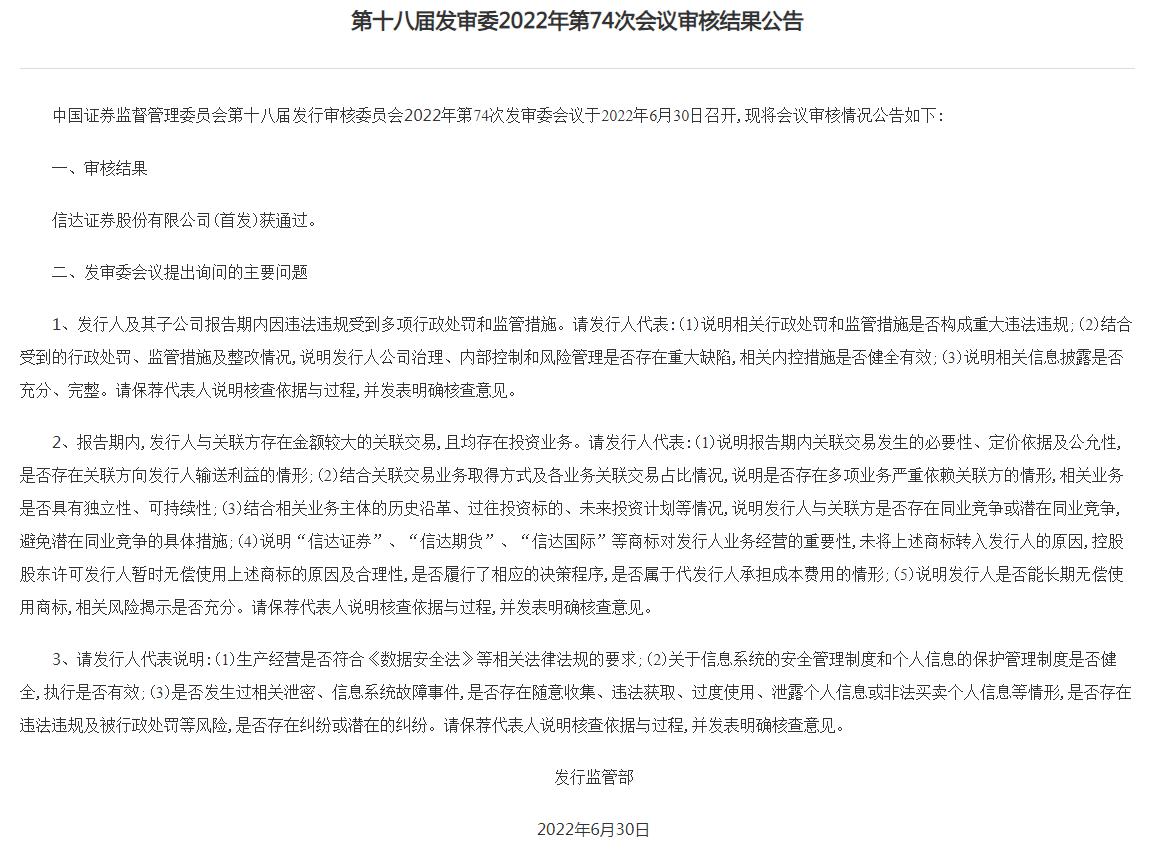

Zhongxin Jingwei, June 30th (Ma Jing) On the 30th, Cinda Securities received a listing of "admission tickets". Announcement of the review results of the 74th meeting of the 1822 of the SFC's 18th session showed that Cinda Securities was launched. At this point, A shares may usher in the 43rd listed broker, and Cinda Securities will also become the second AMC listed broker after Dongxing Securities.

Cinda Securities was launched by Source: The official website of the CSRC

The second AMC is a listed broker Dream Yuan

Cinda Securities was established in September 2007 with a registered capital of 2.919 billion yuan. China Cinda holds a Cinda Securities of 2.551 billion shares, accounting for 87.42%of the total share capital before the issuance. China Cinda is one of the four major domestic AMCs (financial asset management companies). Cinda Securities and Dongxing Securities and Great Wall Guorui Securities are also AMC brokers. Among them, Dongxing Securities has been listed in 2015. It has been nearly two years since the China Cinda announced that it intends to split the Senta Securities has been listed on A shares. The Cinda Securities, which has experienced frequently and more executives, finally "dreams".

The prospectus shows that the number of shares to be issued publicly in this place to publicly issue not more than 973 million shares (the proportion of the company's total share capital after the issuance of this offer does not exceed 25%). After the issuance of fundraising funds is deducted Gold, increase operating funds and develop main business. The sponsor securities firms are CITIC Investment, and the joint underwriters are Zhongtai Securities.

It is reported that the meeting of the issuance committee mainly raised three major issues to Cinda Securities: one is that the issuer and its subsidiaries were punished and regulated by multiple administrative punishment and regulatory measures during the reporting period of reporters and their subsidiaries, requiring the impact and rectification situation. The second is that the issuer and the related parties have a large amount of affiliated transactions, and both have investment business. It is required to explain the necessity, price basis and fairness of related transactions, and whether there is a situation in the direction of the issuer's transportation benefits. The third is related to information security. It is required to explain whether production and operation meets the requirements of relevant laws and regulations such as the Data Security Law, whether the personal information protection management system is sound, and whether the implementation is valid.

According to public information, Cinda Securities has received four tickets for the Securities and Supervision System in the first half of 2022, with a total of 7. The general manager Zhu Ruimin was twice issued a supervisory conversation measure. Among them, the two tickets are violations of overseas business. The general manager Zhu Ruimin and the person in charge of compliance Wu Liguang were fined; the three departments of asset management and brokerage business were illegal, and the two local business departments were issued a warning letter; the 2 tickets were ABS business Insufficient control of illegal regulations and investment banking business, the company and general manager Zhu Ruimin took one. The dense level of the ticket once made the outside world "sweat" whether the Cinda Securities could succeed.

Performance is more dependent on the market

Cinda Securities has achieved steady growth in recent years. According to the data disclosed by the comprehensive prospectus and the China Securities Association, Cinda Securities increased from 1.659 billion yuan to 2.577 billion yuan from 2018 to 2021; net profit increased from 90 million yuan to 1.172 billion yuan, with an average annual growth rate of approximately being approximate. 15.82%and 35.17%. According to the industry rankings in 2021, revenue and net profit are 42nd and 37th respectively.

However, the issues mentioned in this trial committee have once again revealed that although Cinda Securities is independent of the controlling shareholder, its performance has a considerable degree of dependence on China Cinda, especially the investment banking business. The prospectus shows that from 2018 to 2020, Cinda Securities provided the income obtained by China Cinda and related parties with underwriting sponsorship business, accounting for 77.88%, 71.95%, and 60.66%of the types of business fees and commissions of this type of business; The proportion of income from investment consulting and financial advisory business provided by related parties accounted for 85.54%, 75.21%, and 40.60%, respectively.

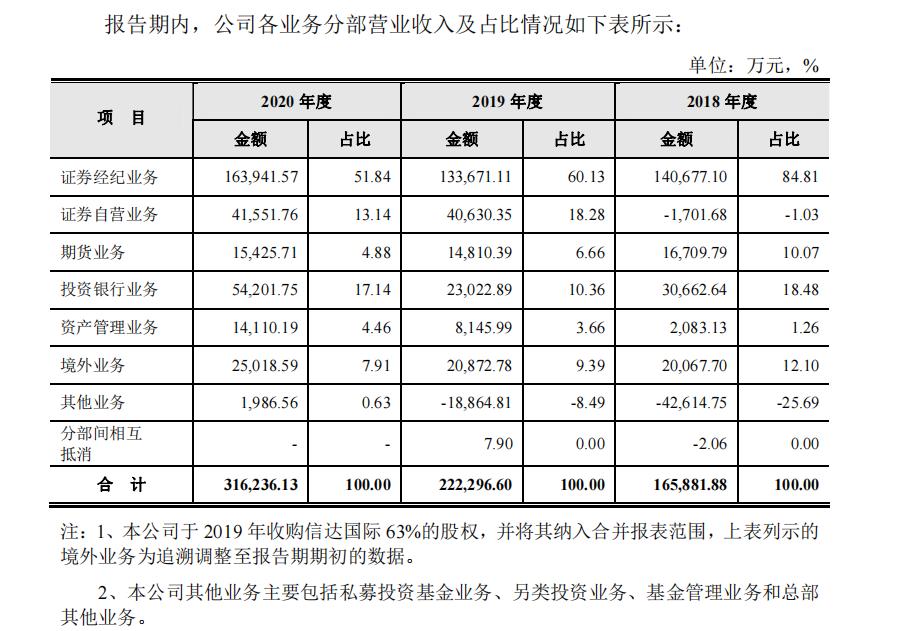

In addition, Zhongxin Jingwei also noticed that Cinda Securities' overall performance is more dependent on the market. Data show that Cinda Securities's largest business sector is a securities brokerage business, including traditional securities brokerage business and credit trading business. Although the proportion of the sector's revenue from 2018 to 2020 dropped from 84.81%to 51.84%, it still occupied half of the rivers. In addition, the proportion of securities self -operated business from 2019 to 2020 is relatively high, with 18.28%and 13.14%, respectively.

Source of the business types of Cinda Securities from 2018-2020, the proportion of revenue sources: Cinda Securities prospectus

In this regard, Cinda Securities stated in the prospectus that in the future, it will vigorously carry out business product innovation, actively develop overseas business, continuously form new profit growth points, and expand the scale of innovation business and diversified business income.

After Cinda Securities got the "admission ticket" this time, there were 10 brokerage companies in the IPO queuing. Among them, there are three new developments: Caixin Securities IPO application materials have been accepted by the Securities Regulatory Commission, and IPO application materials submitted by open source securities and Huabao Securities have been received. Among the remaining 7 queuing brokers, the first securities and Bohai Securities were the pre -disclosure updates and feedback status, respectively. (For more report clues, please contact the author Ma Jing: [email protected]) (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

Editor in charge: Li Zhongyuan

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

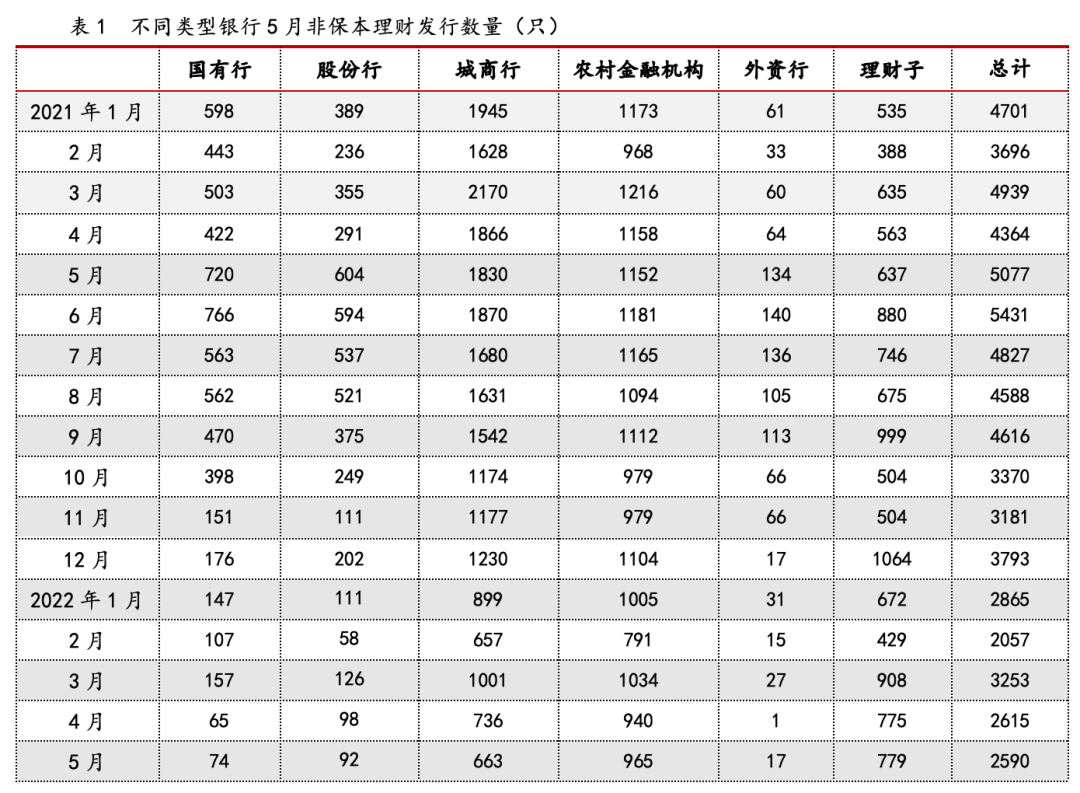

There are countless sayings | May wealth management market product distribution has stabilized

According to the statistics of Puyi Standard Standard, 2,590 non -guaranteed finan...

Dazhou: Send "Timely Rain" and "Charcoal in Snow" to the enterprise