Bank of Nanjing once touched the daily limit!Big shareholders are foreign Bank of France, Bank of France

Author:City world Time:2022.06.30

On June 30, Nanjing Bank's stock price fell quickly in the early trading of the limit, and 80,000 shares were stunned.

As a city commercial bank with a scale of 1.8 trillion assets, the limit of this time was caught off guard. Many people asked in the stock bar: "What happened?"

In fact, on the evening of June 29, Bank of Nanjing issued an announcement that the company's director and president Lin Jingran had submitted a resignation report to the company's board of directors due to work needs and other useful use. Council members, presidents, heads of financial leaders, and company authorized representative positions. The company's president's duties are temporarily performed by Chairman Hu Shengrong.

Lin Jingran joined the Bank of Nanjing for just two years and had previously worked in Bank of China and Minsheng Bank. The Bank of Nanjing said that it is closely paying close attention to the latest trends of the capital market. At present, everything is normal, and there is no further information.

Before the news was announced, the stock price trend of Bank of Nanjing was rising. From January 4, 2022, from 8.58 yuan/ share to 11.93 yuan/ share on April 25, an increase of 40%. On June 30, the stock price increased after the break in the early trading. The closing price of the day was 10.42 yuan/ share, a decrease of 6.46%on the day.

It is worth mentioning that the largest shareholder of Nanjing Bank is currently the Bank of Paris, France. The origin of the two can be traced back 15 years ago.

In 2007, Bank of Nanjing was listed, and the Bank of Paris became the second largest shareholder of Bank of Nanjing; in 2012, the Bank of Paris, France, increased its holdings of Nanjing Bank as QFII (qualified foreign institutional investors). The largest shareholder.

Many foreign capitals have bought Chinese bank shares due to foreign -funded shareholding policies introduced by bank stock reforms. At present, the listed banks of A shares have foreign -owned shares in banks including Bank of China and Bank of Beijing.

The Bank of France is not only the largest shareholder of Nanjing Bank, but also dispatched to Nanjing Bank of Foreign Governor Mi Le in June 2020. The deputy president is still in office. In addition, in March of this year, the two banks also cooperated to acquire Suning Consumer Financial Control Strategy and received consumer financial licenses.

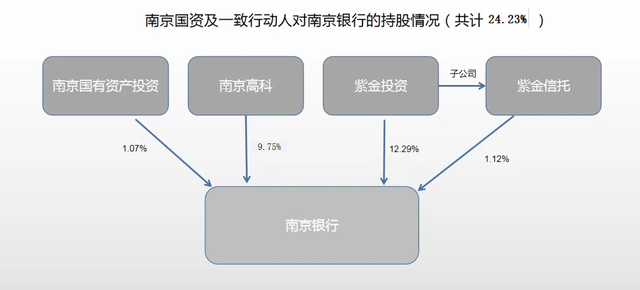

The original largest shareholder of Nanjing Bank was the Department of State -owned Assets of Nanjing. Nanjing state -owned asset investment, Zijin Investment, and Nanjing Hi -Tech are unanimous actors. At present, a total of 24.23%of the equity is held in a direct and indirect way (calculated by penetrating the shareholding ratio).

The annual report of Bank of Nanjing shows that the company has no controlling shareholders and actual controllers.

(As of May 17, 2022)

In order to maintain the advantages of holding the shareholding, since 2022, Nanjing Zijin Group, Nanjing Zijin Group, Nanjing Hi -Tech and Jiangsu Transportation Holdings have increased their holdings on Bank of Nanjing. As of May 17, 2022 (the latest disclosure date), Nanjing Zijin Group, Nanjing Hi -Tech, and Jiangsu's transportation holdings were 13.41%, 9.75%, and 9.73%, respectively.

(Author 丨 Editor of Zhou Yihang, the city industry 丨 Langming)

- END -

"Big Data" helps preferential policies precise drip irrigation

In order to optimize the optimized tax business environment, the State Administrat...

National Development and Reform Commission: The price of pigs does not have the foundation of continuously rising

China Economic Net, Beijing, July 4th. According to the website of the National Development and Reform Commission, in response to the recent rapid rise in the price of pigs, the Price Department of th