Shanxi: Research on tax refund and energy enterprise development rejuvenation

Author:China Economic Network Time:2022.06.30

Since the implementation of the large -scale value -added tax deduction policy, the State Administration of Taxation's Shanxi Provincial Taxation Bureau at all levels of taxation departments focuses on the taxpayer's payer urgent and worried about the problem, and continuously refine the implementation measures for combined taxes and fees to support policies. When landing, it effectively boosted confidence in the development of market subjects.

"Knock on the door" to send benefits, the policy dividends are directly reached and enjoyed

In order to effectively improve the accuracy of the policy propaganda and counseling of the policy, the tax department relying on the promotion interactive platform, comprehensively sorting out and screening data, accurately "directed delivery" various policies, realizing preferential policies to find enterprises, and actively "knocking on the door" to send benefits.

Qinshui Yuanjinghuihe Wind Electric Co., Ltd. is a company engaged in the development and construction of wind power and photovoltaic power generation projects. The tax department found in the process of checking the household -by -house inspection by the tax department that the company can enjoy the VAT tax refund policy, but it has not been submitted For the application, the staff got in touch with Mr. Su, the person in charge of the company's financial leader as soon as possible. After learning that the company was worried about the retention tax refund policy, he could no longer enjoy the VAT, which was a preferential policy. Eventually, the concerns were dispelled and the tax refund application was submitted.

"When we are still inaccessible to the policy, the tax department actively contacted us and sent a policy interpretation 'big gift package'. Essence

"Living water" nourish, help enterprises to restore their vitality

"The funds 'live water' brought by the value -added tax retaining tax refund has allowed the production and operation of enterprises to make the cash flow smoothly, and truly helps our enterprises to compound energy, reduce burden, and increase their power!" Recently, more than 3.6 million yuan in value -added tax reserved tax refund payables arrived. Later, Zhao Li, the financial leader of Qinhe Pharmaceutical Co., Ltd., Huangchengfu, Shanxi, specially called the Qinshui County Taxation Bureau to express his gratitude.

It is understood that due to the impact of the epidemic, the company has faced problems such as insufficient production personnel, shortage of medicinal materials, and difficulty in transportation of drugs. This VAT's reserved tax refund has helped enterprises quickly restore its vitality.

Qinshui County Hengda City Development Investment Co., Ltd. is a construction enterprise engaged in real estate development, sales, construction construction, etc. It has been affected by the epidemic situation in recent times. In addition, the price of raw material prices and increase in employment costs has encountered difficulties.

"We are worried. The staff of the tax department actively promoted the tax refund policy to us and helped us make a tax refund application online. The person in charge of the enterprise happily expressed his gratitude to the tax department.

Promote "advance" with "retreat" to stimulate corporate innovation vitality

"The capital chain is the lifeline of the enterprise, the good policy of the country, and the efficient service of the taxation department, which allows us to enjoy the policy dividend and stimulate the innovative vitality of the enterprise." Zhang Peng, the financial staff of Shanxi Yigao Gas Co., Ltd., said.

The return is the tax, which increases the vitality. The "time rain" of tax refund is used to increase investment, or to purchase equipment, and continuously stimulates the vitality and motivation of corporate innovation and development.

Zhang Peng said: "A large amount of retaining tax refund has been reached in time, and the capital flow of the enterprise is revitalized. We will use all the funds for the research and development and upgrading of the coal seams of gas liquefaction technology."

Li Yuan, a member of the Party Committee of the Shanxi Provincial Taxation Bureau and the chief economist, said that since this year, in order to ensure the tax refund and dividend dividends directly to the market, the tax department has established "at least pay for the highest efficiency, and the minimum error has been achieved. "Satisfaction" work goals help companies to relieve difficulties, and empower enterprises to sail. (Zhang Qi)

- END -

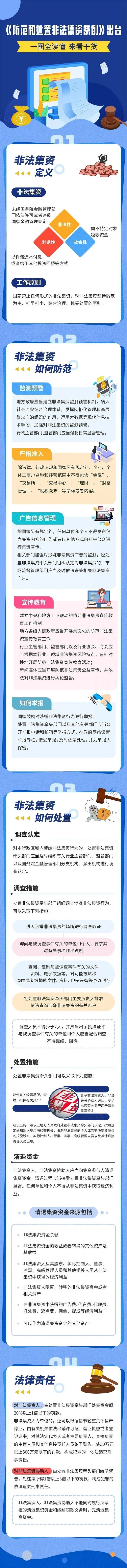

The Regulations on Prevention and Disposal illegal Funding will be officially implemented on May 1st!One picture understands

The Regulations on Prevention and Disposal illegal Funding will be officially impl...

Capable style construction year | Bin County: let project construction a new engine of high -quality

The feed and logistics park project invested by Zhengda Group, from negotiation an...