This can not rely on China!

Author:Global Times Time:2022.06.29

Sri Lanka triggered a crisis of US $ 78 million in foreign bonds in April.

Some mainstream Western media, think tanks, and even many government officials described Sri Lanka Hangban Tota Port as the main example of the world's well -known "Chinese debt trap diplomacy" (Editor's Note: Japanese Prime Minister Kishida Kishita at the G7 summit will issue Sri Lanka debt issues I have contacted China), although the facts prove that this is completely lies.

As our research shows that "China is the main source of debt in Sri Lanka" is completely fabricated by the story.

Who owns Sri Lanka's foreign debt?

Western media ignored two basic facts when dealing with Sri Lanka debt: the composition of debt and the real reason for debt. In Sri Lanka's foreign debt, China occupies only 10%, and Western financial institutions (including the private credit market) and its allies Japan hold most of Sri Lanka's debt.

According to data from the Ministry of Foreign Affairs of Sri Lanka, Sri Lanka's foreign debt composition in April 2021: 47%of the international capital market borrowing, 13%of Asian Development Bank, 10%of China, Japan 10%, World Bank 9%, 2%of India, others, others, others 9%. As long as you simply look at these facts that are usually ignored or covered, you will find that the real culprit is the Western countries that make the "Chinese debt trap" statement.

What causes Sri Lanka debt crisis?

The first is the international capital market borrowing.

After the civil war in 2009, the Sri Lankan government obtained high loans from the international bond market for the reconstruction process. Most of these sovereignty loans come from Western financial investors, such as the United States Blackle Corporation and Ashmore in the UK. It is to repay the debt that expired in 2017 that the Sri Lanka government will propose to rent Handon Tota. China accepted this proposal at the time that the Sri Lankan government's funds for this purpose were used to repay debts from China instead of repaying debts from China.

There is a cruel profit -seeking force in the bond market.

It has a secondary market. Investors sell the sovereign debt of the "problem country" to the so -called "Virgin Fund". The latter purchases debts from investors with a large discount, and then requires the full repayment of the debt country. The repayment must be carried out on time, otherwise the country will be cut off. The "Virgin Fund" may also sue sovereign debtor in the British and American courts. At this time, the courts usually make a judgment that is conducive to the "Vulture Fund".

The second is trade deficit.

Sri Lanka seriously relies on imported oil and natural gas and its refined products for transportation and power generation. In recent years, their global prices have continued to rise and soared from 2021 to 2022. In 2020, the total export of Sri Lanka was US $ 10 billion, and the import volume was 16 billion US dollars, producing $ 6 billion in deficit. In 2021, the deficit increased to $ 8 billion, because exports reached $ 12 billion, and imports were US $ 20 billion. Therefore, Sri Lanka's often expanded to 4.0%of GDP in 2021, and this number was 1.5%in 2020.

Third, the collapse of the tourism department.

The Sri Lanka Tourism Bureau said that for many years, tourism income has been the main source of the country's service account surplus. Travel income calculated by foreign currencies in Sri Lanka, as well as the employment brought by tourism is considerable.

However, in April 2019, the "Islamic State" terrorists at the same time committed a suicide bomb attack on a church and a well -known hotel in Colombo, causing many locals and foreign tourists to die. This is a heavy drop in Sri Lanka's tourism industry. In 2020, with the outbreak of the new crown pneumonia, the number of tourists visiting the country decreased sharply.

Related numbers show this.

In 2018, the number of foreign tourists entering the country was 2.333796 million, generating about 4.4 billion U.S. dollars, creating 169,000 direct employment opportunities, and about 220,000 indirect employment opportunities. In 2019, the entry tourists were 1.9137 million, and the income generated about 3.6 billion US dollars. In 2020, the two numbers fell to 50.7704 million and US $ 682 million, and in 2021 continued to decline to 1.94495 million and $ 507 million.

Fourth, overseas remittance decreases.

In the past 20 years, Sri Lanka's annual foreign remittance accounts for nearly 1/4 of the total external account credit. This proportion is 35%in 2020. Nowadays, foreign remittances have fallen from $ 7 billion in 2020 to $ 5 billion in 2021.

For decades, the Sri Lankan government has been suffering from continuous fiscal deficit, which has forced the government to continue to borrow from domestic and foreign markets and accumulate public debt. Therefore, a large part of the government's income and foreign exchange flows flowing into the country need to be used to repay debts, and there is almost no room for productive investment.

Increasing productivity is the key to solving the debt problem of Sri Lanka.

However, this requires a lot of investment in the modernization of infrastructure, industry and agricultural sector. Finding alternatives for expensive oil imported products is another important factor in solving the problem of Sri Lanka.

China has not changed the magic stick of other countries.

The reason why China is able to eliminate absolute poverty and establish the world's most productive economy is because the Chinese work hard to improve the level of labor through education, and invest a large investment in infrastructure. China's role in Sri Lanka is generally considered active because it focuses on the development of economic production, such as modernization of infrastructure.

In contrast to the "debt trap", China is not Sri Lanka's largest creditor, but the country's largest foreign direct investor.China's investment in Sri Lanka is a long -term project, and they will gradually increase Sri Lanka's economic productivity.What the United States needs to do is not to spread the conspiracy theory of "China's debt trap" everywhere, but to join forces with China's "Belt and Road" initiative to jointly invest in infrastructure projects, industrial and modern agricultural production and long -term low interest rates.Credit help Sri Lanka quickly improve production capacity.

Author: Sweden Hussein Ascari/Sweden's "Belt and Road" executive team (BRIX) co -founder

- END -

The unemployment insurance is stabilized and returned to increase the efficiency to increase the efficiency of 12.9 billion yuan to 2.73 million households

The Ministry of Human Resources and Social Security has resolutely implemented a policy measure of the State Council's stabilization of the economy, and promoted the implementation of the policy of st...

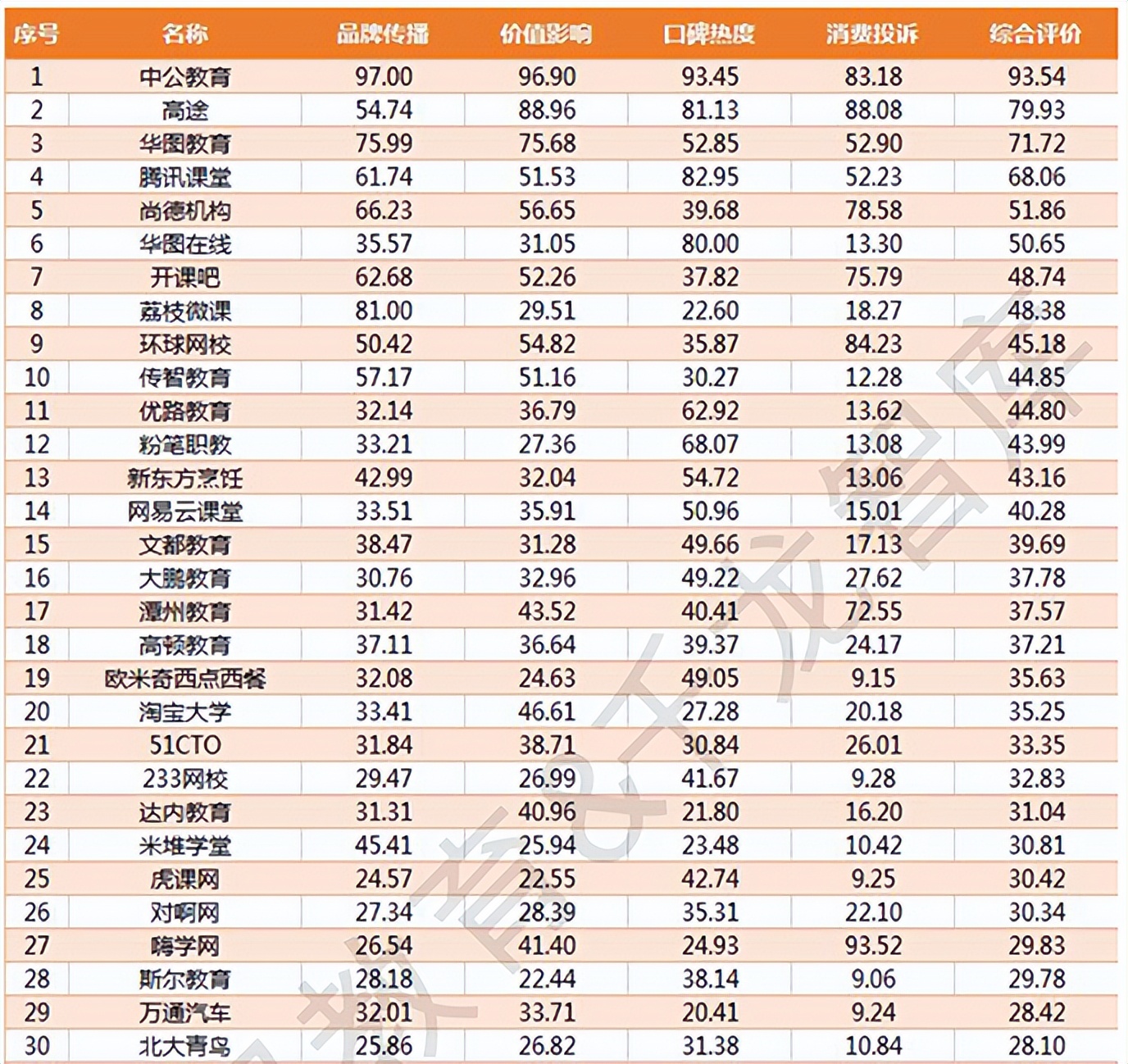

After returning to the flood era, the three elements of the education industry have risen again

For the whole education training industry, since the tracks such as K12 discipline...