The two departments clarify the sealing tax policies to implement the caliber!Starting from July 1, 2022

Author:State Administration of Taxati Time:2022.06.29

General Administration of Taxation of the Ministry of Finance

Announcement on the implementation caliber of the policy of stamp duty

The General Administration of Taxation of the Ministry of Finance Announcement No. 22, 2022

In order to implement the "Printing Duty Law of the People's Republic of China", the obtained caliber announcement will be implemented as follows:

1. The specific situation of the taxpayer

(1) Taxpayers who have paid taxable vouchers are units and individuals who have direct rights and obligations for the corresponding tax vouchers.

(2) The borrowing contract for the use of entrusted loan methods is a taxpayer, which is the trustee and borrower, excluding the client.

(3) The taxpayer is confirmed by the auction of the stamp duty based on the taxation contract or the property right transfer of the property rights.

2. Specific situation on taxable vouchers

(1) Taxable vouchers used by the People's Republic of China to be used abroad shall pay stamp duty in accordance with regulations. Including the following situations:

1. The target of taxable vouchers is real estate, the real estate should be in the country;

2. The target of taxable vouchers is equity, the equity of this equity is the equity of Chinese residents;

3. The target of taxable vouchers is the exclusive rights, copyright, patent rights, and proprietary technical use rights of real estate or trademarks, and their seller or purchaser is in the country, but it does not include overseas units or individuals to domestic units or individuals. Overseas real estate or trademark rights, copyrights, patent rights, and proprietary technical use rights;

4. If the target of taxable vouchers is serving, the provider or the reception party is in the country, but does not include overseas units or individuals to provide services exactly abroad to domestic units or individuals.

(2) Certificate of determining the purchase and selling relationship between the enterprises, the order of the rights and obligations of the two parties to buy and seller the two parties, and the request for the purchase order, and if there is no other book -based trading contract, the stamp duty shall be paid in accordance with regulations.

(3) The purchase and sale power contracts established between the power plant and the power grid and the power grid shall pay the stamp duty according to the sale and selling contract tax.

(4) The vouchers of the following situations are not the scope of stamp duty:

1. The effective legal documents of the people's court, arbitration documents of arbitration agencies, and supervisory documents of supervision organs.

2. The people's governments at or above the county level and their affiliated departments are requisitioned, recovered or compensated for the contract, agreement, or administrative documents of the real estate books in accordance with the administrative authority.

3. Between the head office, the branch, the branch, and the branch, the book is used as a voucher for the implementation plan.

3. The specific situation of taxation basis, taxation and tax refund

(1) The same taxable contract and taxable property transfer letter involves taxpayers above the two or more, and the amount of taxpayers involved in their respective taxes (excluding the list of taxable vouchers (excluding the list of listed listed claims (excluded VAT tax tax) determines the basis for tax calculation.

(2) The amount of taxable contracts and taxable property rights is not consistent with the actual settlement amount. The tax calculation after the change is tax. If the taxable certificate that has been paid by the stamp duty and the amount listed after the change, the taxpayer should increase the amount of the amount of the stamp tax on the amount of the amount; if the amount listed after the change, the taxpayer can apply for the reduction of the amount to the tax authority to refund or refund or refund or Pay stamp duty.

(3) If the taxable tax calculation error caused by the taxable tax of taxpayers will reduce or increase the taxable basis for taxable vouchers, the taxpayer shall adjust the value -added tax listed in the taxable vouchers in accordance with regulations, and re -determine that it should be re -determined Tax certificate calculation basis. If the taxable certificate that has been paid by the stamp duty and the tax calculation after adjustment increases, the taxpayer shall increase part of the amount to pay the stamp tax on the amount of the amount; if the tax calculation is reduced after adjustment, the taxpayer may apply for the reduction of the amount to the tax authority to refund or refund or refund or Pay stamp duty.

(4) The basis for tax taxi taxes for taxpayers to transfer equity shall be determined in accordance with the amount listed in accordance with the amount listed (excluding the submission of the listing, which has not yet actually contributed the equity part).

(5) If the amount of taxable vouchers is currency other than RMB, the intermediate price of the RMB exchange rate on the day of the renminbi on the day of the Certificate shall be equivalent to the basis for the tax calculation of the RMB.

(6) Multi -type transportation of goods in the territory, which uses the entire freight of the entire transportation site, and uses the entire freight as the basis for the taxation contract to pay the stamp duty from both parties to the freight. As a basis for tax calculation, the stamp duty shall be paid by all parties who handle the freight settlement.

(7) The incorporated taxable contract and property rights transfer of property rights, the stamp duty paid will not be refunded and paid taxes.

(8) The stamp tax ticket posted by the taxpayer will not be refunded and taxed.

Fourth, the specific situation of tax exemption

(1) If the corresponding tax voucher applies to the preferential stamp duty and exemption, the taxpayers who set the taxable voucher can enjoy the stamp duty reduction policy, except for the specific taxpayer's applicable stamp tax reduction discount.

(2) Family farms that enjoy the tax -free discount of stamp duty, the specific scope is the basic operation unit of the family, the farm production and operation as the main business, and the farm operating income as the main source of income from the family. , Family farm included in the national farm list system.

(3) Schools that enjoy stamp duty tax -free discounts are the specific scope of universities, middle schools, elementary schools, and kindergartens approved by the people's governments at or above the county level or their education administrative departments. And the technical college approved by the provincial people's government or its human resources and social security administrative department. (4) Social welfare institutions enjoying the tax -free discount of stamp duty, the specific scope is the elderly service agency, disabled service agencies, children's welfare institutions, rescue management agencies, and minors rescue and protection agencies registered in accordance with the law.

(5) Charity organizations that enjoy the preferential discounts of stamp duty, the specific scope is to be established in accordance with the law and complies with the provisions of the Charity Law of the People's Republic of China, and is a non -profit organization with the purpose of carrying out charity activities for the society.

(6) Non -profit medical and health institutions that enjoy the preferential discounts of stamp duty taxes are non -profit medical and health institutions approved or filed by the health administrative department of the people's government at or above the county level.

(7) E -commerce operators who enjoy stamp duty tax -free discounts shall be implemented in accordance with the relevant provisions of the E -Commerce Law of the People's Republic of China.

This announcement will be implemented from July 1, 2022.

Ministry of Finance

Taxation

June 12, 2022

- END -

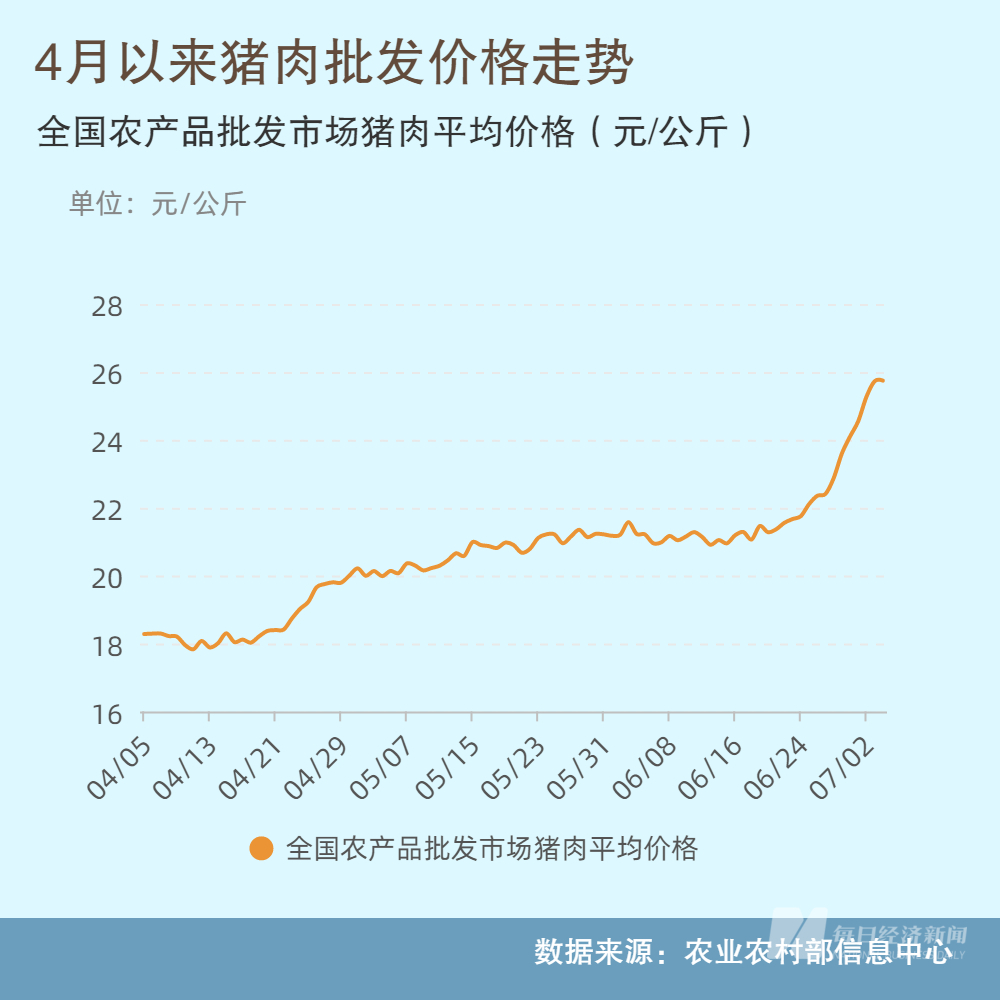

The "pig" on the wind flew up again?

After a year and a half downlink cycle, the domestic pig market has regained its r...

Jiyuhua is the secretary of the party committee of the Insurance Security Fund, and is intended to b

According to the information of the official website of the Insurance Security Fund, the company held a meeting of leading cadres a few days ago. , Choice of the board. The meeting also announced tha