The Industrial Bank Hohhot Branch was fined 1.31 million yuan, and six branches executives were also fined

Author:Radar finance Time:2022.06.29

Radar Finance | Editor Wu Yanrui | Deep Sea

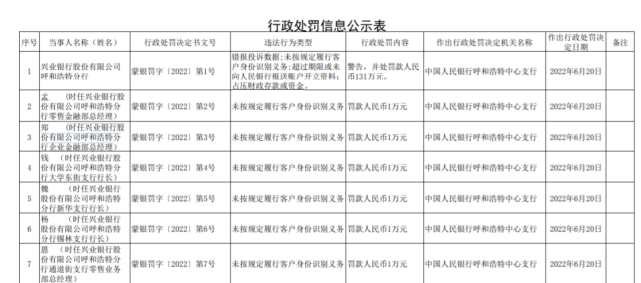

Recently, the first fine of the People's Bank of China Hohhot Center Sub -branch in 2022 gave the Industrial Bank Hohhot Branch. At the same time, the document number is Mongolian's penalties [2022] No. 2 to 7 of the ticket, and sent it to the Hohhot Branch of Hohhot Branch.

The document number is Mongolian Bank Punishment [2022] The administrative penalty decision of No. 1 shows that the Hohhot Branch of Hohhot Branch of the Industrial Bank has not fulfilled the obligation to identify the customer's identity in accordance with the regulations; Establishing information; accounting for financial deposits or funds, was warned by the People's Bank of China Hohhot Center Sub -branch and fined 1.31 million yuan. The date of administrative penalty decision was June 20, 2022.

The document number is Mongolian Bank Punishment [2022] No. 2 to 7 Decision shows that because of failure to fulfill the customer identification obligations in accordance with the regulations, Meng Mou, then the general manager of the Ministry of Retail Finance of Hohhot Branch of Hohhot Branch; Zheng Mou, General Manager of the Financial Department of Hohhot Branch of the Hohhot Branch of the Co., Ltd.; Qian Mou, the president of the East Street Sub -branch of Hohhot Branch of Hohehot Branch of Hohhot Co., Ltd.; Yang Mou, president of the Hohhot Branch of the Hohhot Branch of the Banking Co., Ltd.; Enmou, the general manager of the retail business department of Hohhot Branch of Hohhot Branch of Xingye Bank Co., Ltd., was fined RMB 10,000.

This is not the first time that the Industrial Bank Hohhot Branch has been punished for the first time.

In 2017, when the insurance sales practitioners of the Hohhot Branch of Industrial Bank, when selling insurance products, they used the statement of insurance product responsibility, functions and insurance during the use of insurance products, and involved 9 insurance policies. At the same time, the contact information of the 12 insurance orders sold by Xingye Bank Hohhot Branch in 2017 was not real. Ma Mou, then the general manager of the Retail Finance Department of the Hohhot Branch of Industrial Bank, was directly responsible for the above behavior.

Due to the aforementioned deception of the insurer, the insured, the insured, or the beneficiary, in September 2018, the Inner Mongolia Insurance Regulatory Bureau decided to order the Industrial Bank Hohhot Branch to correct it and impose a fine of 120,000 yuan.

It is worth noting that in the report of the Shanghai Banking Regulatory Bureau on June 15 this year on the 2021 banking consumer complaint situation, the complaint volume of the credit card center of Xingye Bank was the first place in the Shanghai licensed credit card center, up to 12506 cases It accounted for 19.45%of the total complaints of the Shanghai licensed credit card center.

On June 20th, the Fujian Supervision Bureau of the China Banking and Insurance Regulatory Commission's notice on the case of bank insurance consumption complaints in the first quarter of 2022, Xingye Bank was fourth in the complaint. In the average complaints of the joint -stock commercial banks within the jurisdiction, 231.2 pieces/thousand business outlets of the Industrial Bank were ranked fourth. The top 5 banking financial institutions of personal loan disputes are in the second place.

In the 2021 annual report, during the reporting period, the number of consumer complaints in the company was 143,287, with an average monthly complaint of each outlet of 5.91 and a complaint rate of 0.18%. Consumer complaint business category involves credit card business (86.48%), debit card business (7.24%), loan business (accounting for 3.19%), and other businesses (3.09%).

Consumer complaints mainly involve complaints caused by debt collection methods and means (accounting for 66.22%), and complaints caused by financial institutions' management systems, business rules and processes (accounting for 18.04%), complaints caused by marketing methods and means (8.20%) and so on.

From the perspective of regional distribution, consumer complaints are mainly distributed in economic developed areas such as the Yangtze River Delta (2.88%), Pearl River Delta (1.89%) and other economic developed areas. 1.14%) other provinces accounted for relatively high.

In recent years, the revenue growth rate of Industrial Bank has decreased year by year. From the first quarter of 2019 to 2022, the company's revenue growth rates were 14.54%, 12.04%, 8.91%, and 6.72%, respectively.

- END -

Can small -scale taxpayers give up tax -free and issue special VAT invoices?

In order to further support the development of small and micro enterprises, the Ministry of Finance and the State Administration of Taxation jointly issued the Announcement of the General Administrat

The "Xing" of Agricultural Insurance and "Sleeping": Nearly 40 insurance companies competed each other. Last year, the premium growth rate was about 20%, but the underwriting profit margin was only 0.4%

In February 2022, the State Council of the Central Committee of the Communist Part...