Business tickets are overdue?Greentown response: Disputes have been handled

Author:21st Century Economic report Time:2022.06.29

21st Century Business Herald reporter Tang Shaokui Shanghai report

A few days ago, according to the Shanghai Bill Exchange (referred to as the "Shanghai Ticketing Exchange"), it was disclosed that from December 1, 2021 to May 31, 2022, more than 3 payments appeared more than 3 times, and as of May 31, 2022 Or in May 2022, the number of acceptances overdue in May 2022 was 2,553. The list appeared "Greentown Yiche Real Estate Co., Ltd. (" Greentown Yihe ").

The "Details of the Credit Information of Bill Acceptance" of the Shanghai Ticketing Exchange shows that the cumulative overdue amount of Greentown Yihe was 13.59 million yuan, with an overdue balance of 400,000 yuan.

"Greentown" and "400,000 yuan", rumors instantly pushed Greentown China (03900.HK, referred to as "Greentown") to push the vortex of public opinion. The contrast brought by "overdue" is too large. In this round of real estate liquidity crisis, Greentown is one of the few mixed companies that can be alone. The industry is optimistic about its subsequent development with the endorsement of the Greentown Group and the accumulated stance after the adjustment period.

On June 28, China Integrity International maintained the credit rating of Greentown's main body to AAA, and the rating outlook was stable. At the same time, the debt credit rating of "19 Greentown 02", "19 Greentown 03", "20 Greentown 01", "20 Greentown 03", and "20 Greentown 04" is AAA.

China Integrity International stated that shareholders have given strong support to Greentown in terms of business management and financing. At the same time, they also pay attention to the risk of the real estate industry, the exchanges of joint enterprises, the large scale of the guarantee of related parties, and the level of profitability. The impact of credit status.

"400,000 business votes overdue", which can not help but pay unprecedented attention to the liquidity of Greentown. The 21st Century Business Herald reporters learned from people close to Greentown that at first Greentown did not master its business tickets overdue. In fact, Greentown Yiche Real Estate Co., Ltd. was only many years ago. A platform company established together.

After the "overdue of business tickets" incident, the insiders insiders of the Greentown found that the dispute between Greentown Yiche and the ticket owner had been dealt with at the end of May. The more than 13.59 million overdue displayed by the Shanghai Ticketing Exchange has actually been redeemed in May. Due to the lagging information of the information, it has aroused attention and fermentation in the industry.

Industry and commercial information shows that Greentown Yihe was established on March 24, 2015 with a registered capital of 100 million yuan. According to insiders in Greentown, Greentown actually invested 10 million yuan, and the actual shares were 10%. The company is a platform company established by Greentown and the cooperation party. At the time of its establishment, it was clear that Greentown's shareholding ratio was 10%(41%held by Green Hehe Real Estate Co., Ltd.). It did not participate in daily operation and management. Greentown has previously held 41%of the shares. According to the aforementioned Greentown, the two parties have been lifted on June 14 this year and completed the industrial and commercial changes. At present, Greentown holds 10%of Hangzhou Greentown Investment Co., Ltd.. However, individual industrial and commercial information platforms are lagging behind.

Greentown, as a small shareholder with only 10%of the shares, except for 10 million registered capital, there is no other capital investment, and it is not the actual controller of this platform company.

It is understood that in May of this year, the company's cumulative 13.59 million yuan commercial acceptance bill was issued to pay for the guarantee project funds. However, the ticket recipient endorsed the bill and the ticket owner's system was misused. To this end, on June 28, Greentown Yiche issued a clarification statement, saying that the company had contacted the holder for proper redemption work for the first time, and all overdue issues at the end of May had been handled.

The outside world has also questioned whether Greentown Yicheng's competent enterprise. From the perspective of only 10%of the equity, the company is not in the list of the main subsidiary disclosed by the Greentown Annual Report. In addition, people in the industry have questioned the company in Putuo Greentown, Zhoushan City, Ningbo Thai Valley, Dalian Jinshi, Zhuji Yuedu and other companies that have not disclosed in the report. Green City also responded. The misunderstandings generated can only disclose the list of major subsidiaries in accordance with international reporting standards. In fact, the debt of the above -mentioned companies has been disclosed in the Greentown Annual Report in accordance with the international reporting standards.

In recent years, Greentown's good performance in the soil auction market and sales has attracted much attention in the industry. Especially when housing companies generally face the crisis of liquidity, the hard -won development of Greentown has sample significance.

- END -

Sickle girl AI intelligent writing | June 30th Hunan stock rising and falling 5

Changsha Evening News, Changsha, June 30th News As of June 30: The Shanghai Index ...

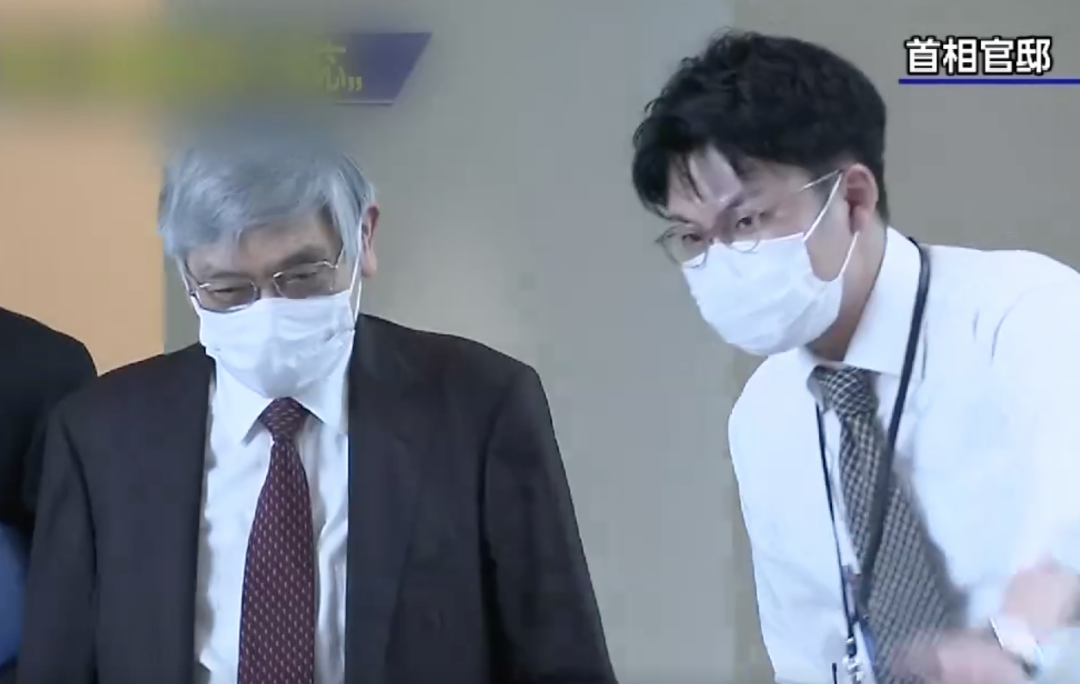

The yen exchange rate has reached a new low in the past 24 years!The Japanese Prime Minister and the Governor of the Central Bank urgently consult ... Foreigners swept the goods in Japan: Apple mobile phones are 1300 yuan cheaper!

According to CCTV news reports, on the afternoon of the 20th local time, according...