Insurance allocation of stocks to the fund ratio rebounded many insurance companies "plus positions" and optimistic about the second half of the year's equity market

Author:Securities daily Time:2022.06.29

29jun

Wen | Su Xiangzheng

According to the data disclosed by the China Banking Regulatory Commission on June 27, as of the end of May this year, the balance of the capital allocation of stocks and securities investment funds was 2.98 trillion yuan, accounting for 12.4%, which was a rebound from 11.9%at the end of April, and the first 4 4, and the first 4 4, 4, 4, and the first 4 4, and the first 4 of the 4th 4th. The proportion of the allocation of these two equity assets continues to decline in the monthly insurance capital. Several people interviewee believe that the increase in the amount of allocation of insurance capital and securities investment funds is related to the two factors: First, the market value of the equity assets of the equity of insurance capital has been improved since May. The second is that since late April, many insurance institutions have begun to increase their positions against the trend, and the proportion of allocation has also risen. Many head insurance institutions are optimistic about the rights and interest markets in the second half of the year. From the middle and long term, the toughness of China's economy is unchanged, and the current equity assets with extremely low valuation have long -term attractiveness. The insurance capital has been selected to adjust or increase the position to late April, and the Shanghai Stock Exchange Index continues to fall. The rights investment department of the insurance institution feels pressure. Many relevant persons in charge of insurance institutions directly call "pressure mountains." Data show that as of the end of April this year, the proportion of the allocation of insurance capital and the securities investment fund has set a new low in the past three years, and many insurance companies' comprehensive investment yields in the first quarter were negative. However, with the gradual recovery of the equity market since May, the market value of the insurance capital holding has increased and the active increase in positions, and the ratio of the allocation of stocks and securities investment funds has increased. As of the end of May, the balance of insurance capital reached 24.04 trillion yuan, of which 12.4%of the stock and securities investment funds were 12.4%. One percentage point. In fact, starting in late April, insurance giants such as Ping An Asset Management and State Life Assets have stated that they will choose to increase the allocation of equity assets, and some insurance companies will increase their positions at the market low. Zhang Wei, general manager of everyone's asset equity investment department, told reporters of the Securities Daily that it is firmly optimistic about the long -term investment value of my country's capital market. In late April, when the market valuation was at the bottom and the lowest confidence, everyone's assets were large -scale in the market to increase their positions. In order to stabilize the market, they also played their own strengths. At the same time, they also achieved good performance returns. The reporter also learned from a medium -sized insurance company that when the valuation of A shares was at a low point, the company's equity department appropriately increased the proportion of allocation of equity assets. A large person in charge of a large -scale insurance institution told a reporter from the Securities Daily that since this year, after comprehensive consideration of the macroeconomic trend, the level of equity market valuation, the requirements for solvency, and liability income, Warehouse or position. Pay attention to the opportunity of new energy and other fields for the market trend of the rights and interests in the second half of the year, and multiple insurance institutions believe that "more optimistic". Zhang Wei said, "Overall, we have a relatively optimistic attitude towards the market. From the beginning of 2022 to the end of April, the stock market has fallen a lot. The early market low is likely to be the bottom. "The relevant person in charge of the National Life Security Fund told reporters that from the domestic perspective, with the advancement of various policies, the economy has now recovered, and automobile consumption and infrastructure investment have become the two major growth of stable growth. hand. While the economic recovery, the relatively loose liquidity environment has pushed the risk preferences of funds and supports the strengthening of the stock market. From the perspective of overseas, as the Fed's expected expectation has gradually increased, the market's concerns about the decline of the US economy are also heating up, and it is necessary to alert the negative impact of global policy interest rates. Zhu Xiaoming, assistant general manager of the Taiping Assets Research Department, said that the changes in the external situation have brought great disturbances, and IFRS9 is about to be officially implemented, which puts forward higher requirements for the income volatility and retracement control of insurance funds. From the perspective of external factors, we need to be alert to the risk of continuous "over -adjusting" or even out of control in the United States. From the perspective of internal driving factors, the decisive factor of the trend of China's stock market is policy and economic cycle. In most cases, external disturbance factors can only cause short -term effects and do not change the logic of the stock market. From the perspective of mid -term dimensions, the risk of further downward down to the stock market is basically controllable, and should be optimistic and positive on the basis of careful tracking and judgment. From the perspective of long -term dimensions, the impact of the epidemic will gradually weaken, the toughness of China's economy will not change its essence, and the current equity assets with extremely low valuation have long -term attractiveness. Recently, at the China Taibao shareholders' meeting, China President Fu Fan said that in the future, the company will continue to adhere to the strategic asset allocation strategy of dumbbell -shaped assets, appropriately increase the proportion of equity asset allocation and the proportion of non -production asset allocation to enhance long -term investment returns. Speaking of investment opportunities in the industry, Zhang Wei believes that many industries and individual stocks have fallen out of opportunities, and risk returns ratio ratio in new energy and other fields have increased significantly. For investment in stocks, we must focus on "penetration rate, market share, and domesticization rate" to seize the true opportunities of enterprises. In terms of value stock investment, it is recommended to pay attention to the structural opportunities brought by the shrinkage of the industry. The relevant person in charge of the above -mentioned large -scale insurance institutions also told reporters that in the future, investment opportunities in areas such as domestic alternatives, technology, "dual carbon", and big health are needed.

Recommended reading

deal! ETF is officially implemented in interconnection on July 4

Just at 24:00 today, oil prices have finally lowered!

Picture | Bag Picture Network Station Cool Hero Production | Zhang Xin

- END -

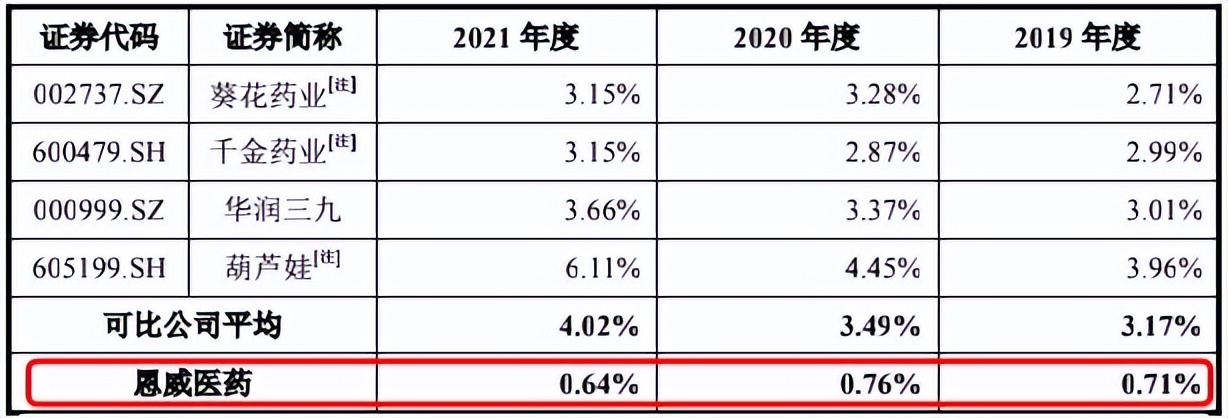

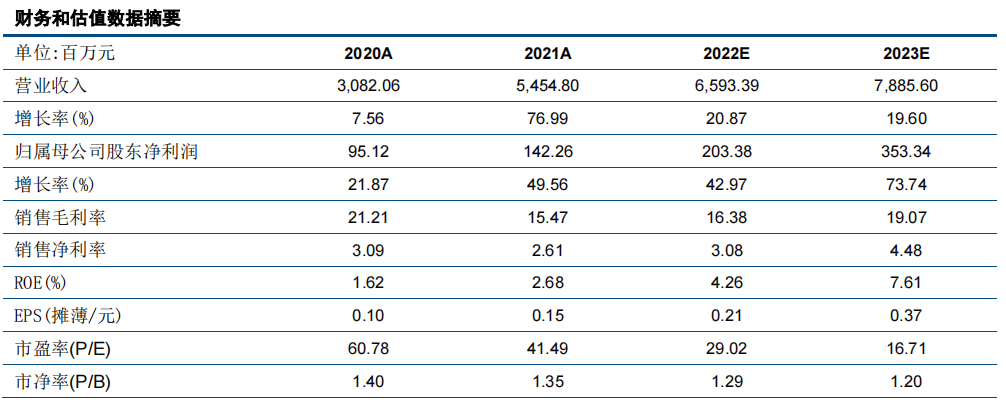

There are only 13 people in Enwei Pharmaceutical R & D team. One secret recipe has eaten for 20 year

There may be many people who may not know Enwei's medicine, but a product it produ...

"Fengkou Research Report · Company" automobile parts leader throw 17.5 billion!60,000 tons of new capacity will be released in the second half of the year!This company is the first supplier of the project, covering industry giants such as Ningde Times, with a net profit growth of 73%!

The leading part of the automobile parts throwing 17.5 billion full -effort to hol...