Central Bank: The overall loan demand index in the second quarter was 56.6%, a decrease of 15.8 percentage points from the previous quarter

Author:China Economic Network Time:2022.06.29

China Economic Net, Beijing, June 29. According to the central bank's website, the bank questionnaire survey report was released in the second quarter of 2022. The report showed that the overall loan demand index in the second quarter was 56.6%, a decrease of 15.8 percentage points from the previous quarter.

Investigation and Analysis

Investigation report on the second quarter of 2022

In the second quarter of 2022, the National People's Bank of China conducted a national bank account questionnaire survey.

one

Banker macroeconomic heat index

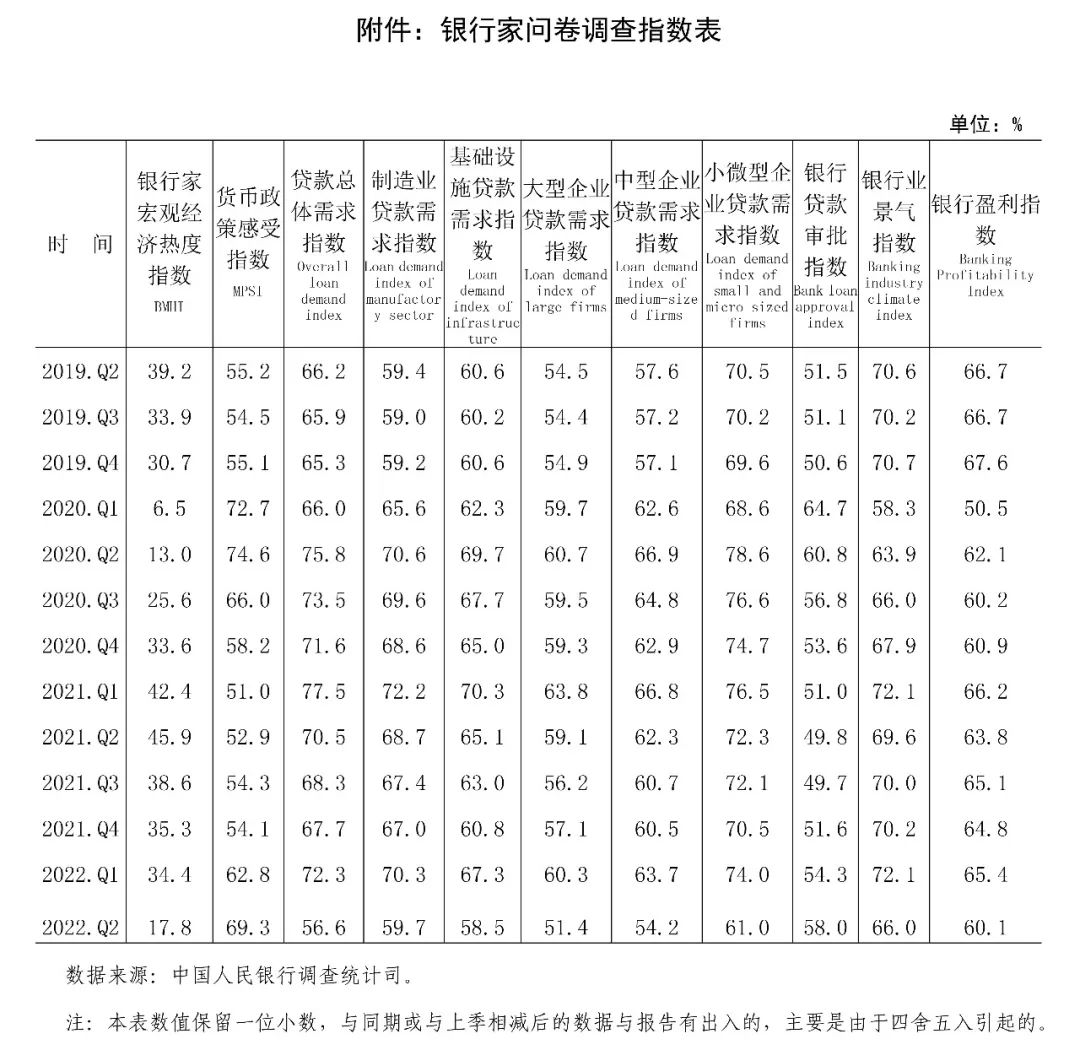

The macroeconomic heat index of the banker was 17.8%, a decrease of 16.6 percentage points from the previous quarter. Among them, 33.1%of bankers believed that the current macro economy was "normal", a decrease of 29.0 percentage points from the previous quarter; 65.7%of bankers thought it was "cold", an increase of 31.1 percentage points from the previous quarter. In the next quarter, the bank's macroeconomic heat expectation index is 31.9%, which is higher than 14.1 percentage points higher than this season.

two

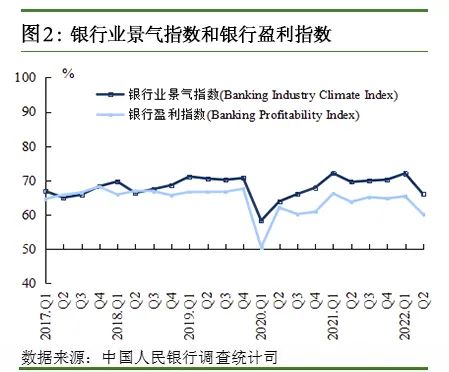

The banking prosperity index and banking profit index

The banking industry boom index was 66.0%, a decrease of 6.1 percentage points from the previous season, a 3.6 percentage point decreased by 3.6 percentage. The banking profit index was 60.1%, a decrease of 5.3 percentage points from the previous season, a 3.7 percentage point decreased by 3.7 percentage.

three

Loan overall demand index

The overall demand index of the loan was 56.6%, a decrease of 15.8 percentage points from the previous season, and a decrease of 13.9 percentage points from the same period last year. From the perspective of the branch industry, the manufacturing loan demand index was 59.7%, a decrease of 10.7 percentage points from the previous quarter; the infrastructure loan demand index was 58.5%, a decrease of 8.8 percentage points from the previous quarter; The season decreased by 8.9 percentage points; the loan demand index of real estate enterprise was 41.5%, a decrease of 5.7 percentage points from the previous quarter. In terms of the scale of the enterprise, the loan demand index of large enterprise loans was 51.4%, a decrease of 8.9 percentage points from the previous quarter; the medium -sized enterprise was 54.2%, a decrease of 9.5 percentage points from the previous quarter; Essence

Four

Monetary policy experience index

The monetary policy experience index was 69.3%, an increase of 6.5 percentage points from the previous quarter, an increase of 16.4 percentage points from the same period last year. Among them, 40.3%of the bankers believed that the monetary policy was "loose", an increase of 12.7 percentage points from the previous quarter; 57.9%of the bankers believed that the monetary policy was "moderate", a decrease of 12.6 percentage points from the previous quarter. For the next season, the expected index of monetary policy experience is 73.6%, which is higher than 4.3 percentage points of this season.

Preparation description:

The bank questionnaire survey was a quarterly survey established by the People's Bank of China in 2004. The survey adopts a combination of comprehensive investigation and sampling survey to adopt a comprehensive investigation of various banking institutions at or above the city level in my country to adopt a layered PPS sampling survey of rural credit cooperatives. A total of about 3,200 banking institutions in various banks are investigated. The survey targets are headquarters headquarters of various banking institutions (including foreign -funded commercial banking institutions), as well as the president of its primary branches, the president of the secondary branch or the deputy president of the competent credit business.

Most of the indexes of the banker survey report are calculated by the diffusion index method, that is, the proportion of each option is calculated, and the weight of each option is given different weights (given the "good/growth" option weight of 1, and the weight of the "general/constant" option weight is given to the "general/constant" option weight For 0.5, the weight of the "difference/decrease" option is 0), and the proportion of each option is multiplied by the corresponding weight, and the final index is added. The range of all indexes is between 0 and 100%. The index is more than 50%, reflecting that the indicator is in a good or expanded state; below 50%, reflecting the indicator is in a different time or contraction state.

The main index calculation method is briefly introduced as follows:

1. macroeconomic heat index: diffusion index reflecting the current macroeconomic status. The calculation method of the index is to calculate the proportion of "hot" and "normal" of the economic economic "hot" and "normal" in all the investigators, and then give me the weight of 1 and 0.5 respectively.

2. Monetary policy experience index: Index reflecting the degree of monetary policy experience. The calculation method of the index is to calculate the proportion of the monetary policy "partial loose" and "moderate" in this quarter, and then give the weights of the monetary policy "partial loose" and "moderate", and then give the weights after 1 and 0.5, respectively.

3. The overall demand index of the loan: reflect the diffusion index judged by the banker's overall loan demand. The calculation method of the index is to calculate the proportion of the bank's loan demand "growth" and "basically unchanged" in all the banks who have been investigated all the investigations, and then give the weight 1 and 0.5 after the weight of 1 and 0.5, respectively.

4. Manufacturing loan demand index: reflect the diffusion index judged by bankers' judgments on manufacturing loan demand. The calculation method of this index is to calculate the proportion of the bank's manufacturing loan demand "growth" and "basically unchanged" in all the banks who have been surveyed. out.

5. Infrastructure loan demand index: The diffusion index that reflects the judgment of the banker's demand for infrastructure. The calculation method of this index is to calculate the proportion of the Bank's infrastructure loan demand "growth" and "basically unchanged" in all the banks who have been investigated. out.

6. Large corporate loan demand index: reflect the diffusion index judged by bankers on the demand for large -scale corporate loans. The calculation method of this index is to calculate the proportion of the bank's loan demand for large -scale corporate loans and "basically unchanged" in all the quarters of the investigation. out. 7. Demand index of medium -sized enterprise loan: The diffusion index judged by the banker's demand for medium -sized enterprise loans. The calculation method of this index is to calculate the proportion of the bank's loan demand for medium -sized enterprises this season in this quarter of the banks who have been investigated. out.

8. Loan demand index of small and micro -enterprise: The diffusion index judged by the banker's loan demand for small and micro enterprises. The calculation method of this index is to calculate the proportion of the bank's loan demand "growth" and "basically unchanged" in all the banks who have been investigated. inferred.

9. Bank loan approval index: reflect the diffusion index of the banks' loosening conditions for loan approval. The calculation method of the index is to calculate the proportion of "relaxation" and "basically unchanged" for the approval conditions of the Bank this season, and then give the weights of 1 and 0.5, respectively.

10. Banking industry prosperity index: reflect the diffusion index of bankers' judgment of the overall business status of the bank. The calculation method of the index is to calculate the proportion of "better" and "general" of the bank's operating conditions this season in all the banks who are surveyed, and then give up and obtain after 1 and 0.5, respectively.

11. Bank profit index: reflect the diffusion index of bankers' judgment of bank profitability. The calculation method of the index is to calculate the proportion of the Bank's "increased profit (reducing losses)" and "unbo -level" in this season, and then give the weights of 1 and 0.5, respectively.

- END -

Preventing telecommunications network fraud and pension fraud, we are acting

We are actingWo men zai xing dongOn June 19, 2022Preventing telecommunications net...

Hefei will compete for the National Key Laboratory

Five major plans for implementing leading enterprise cultivation, major platform construction, leading talent introduction, optimization of the layout of the breeding capital, and the collection and p