Move out the "physical list"!20 billion giants "The word daily"

Author:China Fund News Time:2022.06.29

Source: E company

Two years after being included in the "entity list" by the US Department of Commerce, Nanchaphi Ophi Optical Technology Co., Ltd. (hereinafter referred to as "Nanchang Ophelia"), a wholly -owned subsidiary of Ophi Guang (002456), is now removed from the "physical list". It has been eliminated by Apple's supply chain, and its Apple business -related assets have also been sold. In addition, Ophi Guang's stock price has fallen 65%in the past two years.

On June 29th, with the stimulus of this news, the stock price of Ophelia opened a daily limit.

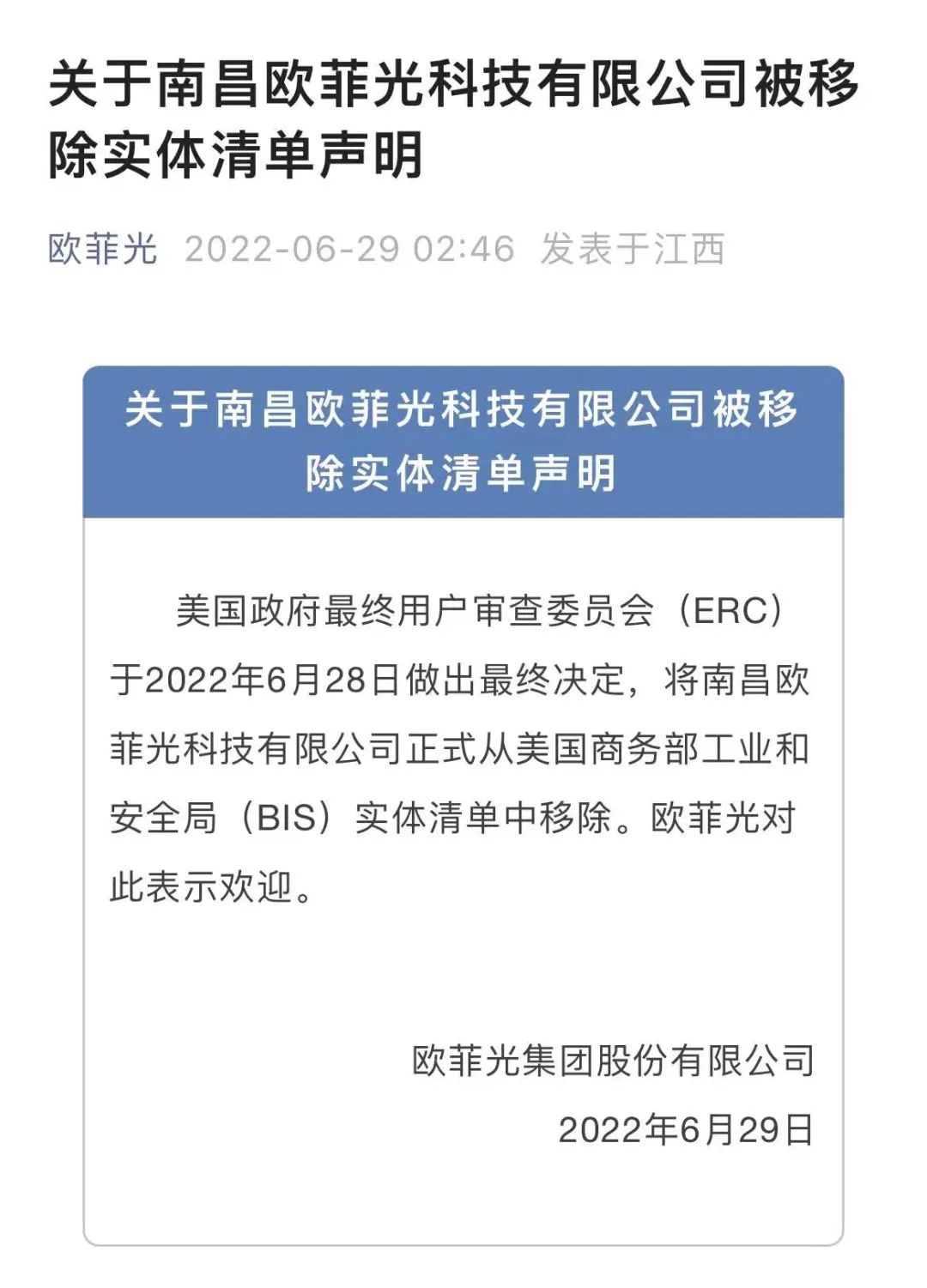

Ophei was removed from the "physical list"

At 2:46 am on June 29th, the official WeChat public account of Ophi Light issued the "Statement on the Removal of the Removal Entity List of Nanchang Ophi Optical Technology Co., Ltd.", stating that the U.S. Government Final User Review Committee (ERC) made it on June 28, 2022, 2022 The final decision will be removed from Nanchang Ophi Optical Technology Co., Ltd. from the U.S. Department of Commerce (BIS) entities (BIS) entities. Ophei welcomed this.

Stimulated by this favorable news, on the morning of June 29, Ophel opened a daily limit. As of press time, there were still nearly 500,000 hands -on paying orders. The company's latest stock price was 6.8 yuan/share, and the latest market value was 22.2 billion yuan.

Ophi Guang has always been a stable supplier of Apple lens business. On July 20, 2020, the US Department of Commerce updated the "physical list" two years ago.

According to relevant regulations, the U.S. government can restrict the export, imports or re -exports of these institutions in accordance with the "Export Management Regulations", and then it can continue to bring uncertainty to Apple's supply.

Regarding the "entity list", Opheli stated at the time that the decision made by the US Department of Commerce did not meet the actual actual situation, and called on the United States to re -examine it. Essence

On the evening of March 16, 2021, Ophi Guang announced that it was recently notified by a specific customer of overseas customers that the specific customer planned to terminate the procurement relationship with the company and its subsidiaries, and subsequent companies will no longer obtain existing business orders from the specific customer. This specific customer is Apple.

The next day, Ophel opened the limit and fell. As of the close of the day, Ophelogang closed at 9.14 yuan/share, and the seller had closed 1.518 million hands. Since mid -July last year, Ophi Guang's stock price has fallen nearly 60%, and its market value has evaporated over 20 billion yuan.

Ophi Guangqi Smart Car, VR and other businesses

After being eliminated by the Apple industry chain, Ofi Guangqi was injured. According to the previous announcement of Ophei, its operating income from the audited related business from Apple (the company claimed to be the specific customer) in 2019 was 11.698 billion yuan, accounting for 22.51%of the total audited operating income in 2019.

In 2021, Offei achieved operating income of 22.844 billion yuan, a year -on -year decrease of 52.75%, a net loss of 2.625 billion yuan, and the losses expanded by 34.99%year -on -year.

In this regard, Opheli explained that the impact of the termination of the termination of the procurement relationship from specific customers overseas, etc., led to a significant decline in the shipments of the company's multiple products year -on -year.

In addition, after being kicked out of the "fruit chain", Ophi Guang quickly sold 100%equity of Guangzhou Teleta Imaging Technology Co., Ltd., which has the lens business, and the related equipment owned by Jiangxi Jingrun Optical Co., Ltd. was sold to Wintai Technology (600745). The asset delivery ceremony was officially held on May 10, 2021.

It was in November 2016 by the acquisition of Guangzhou Deta Image Technology Co., Ltd., Ophelia entered the Apple supply chain. According to public reports, the products provided to Apple to Apple include touch modules (applied to low -cost iPads) and optical products (applied to mobile cameras).

As for the company's existing business and future development plan, before, Ophi Guang released the "Strategic Plan for the Five Years (2021-2025) in the Five Years (2021-2025)". In the next five years, we will strive to achieve the following three strategic goals. , Maintain the market leading positioning; the second is to pioneer for new businesses such as smart cars, VR/AR, and the proportion of income has significantly increased, becoming the company's new growth momentum; third to increase research and development and innovation, use the industrial chain integration capabilities, and unswervingly unswerving Extension to the upper reaches of the industrial chain.

In mid -May of this year, Ophi Guang said during investigation by the agency that it is expected that the smart automobile industry will enter the golden development period in the next five years. Resource allocation will strive to achieve the industry's leading scale by the scale of smart automobile business by 2025.

In addition to the smart car business sector, Ophei will continue to strengthen the development of products in new technology fields. Multi -directional optical optoelectronic business The core advantages of market size, good customer reserves and advanced research and development capabilities have significantly increased the proportion of revenue in new areas, making it an important area of the company's future growth contribution.

Copyright Notice

- END -

Daoda Investment Notes: The market is accelerated!Be sure to pay attention to three points

Last weekend, the National Financial and Development Laboratory and the Institute of Finance of the Chinese Academy of Social Sciences held a symposium on the reform of a comprehensive registration sy

The Shanghai Index recovered 3,300 points, the rise of financial stocks, and the net purchase of funds in the north was over 13 billion yuan!Institution: Continue to find opportunities for value regression

Wen | Zhang YingOn Wednesday (June 15), the three major A -share index fluttered a...