Many information disclosure of Tongdahai has been doubtful, and the shares were assaulted before the declaration of listing

Author:World Wide Web Time:2022.06.29

[Global Network Zero Profile] Nanjing Tongdahai Technology Co., Ltd. is a comprehensive service provider focusing on providing customers with information construction in the field of electronic government affairs. The company is currently applying for listing, and the sponsor is Haitong Securities.

Tongdahai implemented two directed issues and introduced external shareholders in September 2020. Firstly, September 1 agreed that Fang Yurong and Ge Huailiang naturally subscribed for 937,500 shares and 312,500 shares of Tongdahai at the prices of 18.75 million yuan and 6.25 million yuan, respectively. The subscription price is 20 yuan/share, and the latter is September 24th Xunfei Investment, Shengyuan Zhichuang, Rongjun Huishan, Drum Tower Development Fund, Points and Xu Jingming, a total of 74.75 million yuan Sea, subscription price is 23 yuan/share. Later, Tongdahai first released a prospectus and declared listing in June 2021, which also means that Fang Yurong and Ge Huai Liang's natural persons were appreciated by 15%in less than a month after the capital increase.

Public information disclosure shows that Fang Yurong, a natural person who participated in capital increase, was a post -90s. Since June 2017, he has been the general manager of Shenzhen Bentao Education Co., Ltd.. The public information also shows that Fang Yurong is still "Shenzhen Renren Financial Service Co., Ltd." The controlling shareholders and legal representatives, and the 9th largest shareholder of Limu Co., Ltd. Lisido; "Shenzhen Bentao Education Co., Ltd." also jointly invested in "Shenzhen Benzhu Investment Co., Ltd." with Fang Yongtao, and Earlier disclosure information, Fang Yongtao and Fang Peijun, the largest shareholder of Lai Mu, were uncle and nephew.

It is worth noting that the sponsors of Limu's previous IPO and the Tonghai IPO are both Haitong Securities, and the audit institutions are also Tianjian Accountants.

Looking at the operating information of Tongdahai, the company's largest customer in 2021 is Agricultural Bank, with a sales amount of 35.8017 million yuan. According to the prospectus released by the company in June 2021, as of the time, the company and the Agricultural Bank of China Wuhan Donghu Sub -branch at that time The contract amount of the "Hubei Provincial High People's Court" contract amount is 13.986 million yuan, and the signing date is September 2020.

However, according to public information, the "Announcement of the Procurement of the Procurement of the Procurement of the Procurement System Construction Project Construction Project Procurement of the Hubei Provincial High People's Court of China Agricultural Bank of China Wuhan Branch" shows that Tongdahai did win for 13.986 million yuan, but the announcement date of the announcement of the winning results was 2020 in 2020 On October 27, in this context, Tongdahai can sign contracts with customers on the project in September 2020. As for the reason why the bidding results announced at least a month in advance, Tongdahai did not accept interviews with reporters.

Not only that, although the Agricultural Bank is the largest customer in Tongdahai in 2021, in the "representative customers of the customer group" disclosed on page 138 of the prospectus, the bank classification only listed the Bank of Communications, the CCB, and the Bank of China, and the Bank of China, and the Bank of China, and the Bank of China, and the Bank of China, and the Bank of China, and the Bank of China, and the Bank of China. The first largest customer agricultural bank.

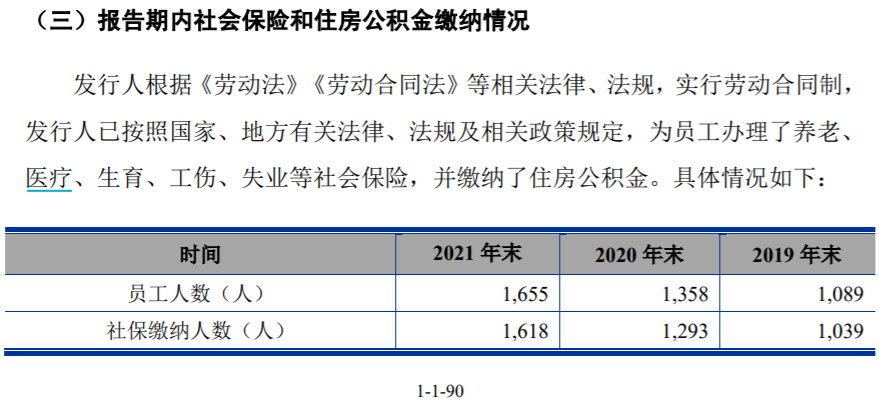

According to the prospectus, as of the end of 2021, there were as many as 1655 employees, of which the number of social security payments was as many as 1,618. Except for the parent company, the subsidiaries within the scope of the merger include Nanjing Siyuan, Jiangsu Prosecuta, Sichuan Complaint Dada, and Heilongjiang Professional. According to the annual report information publicized by the "National Enterprise Credit Information Publicity System", the number of social security payments for the at the end of 2021 was only 457. 21 people and Heilongjiang have been complained to 3, and the total of less than 600 people and subsidiaries are still less than 600, which is significantly different from the information disclosed by the prospectus.

In addition, Heilongjiang Prosecution is a Sun company, which is the Sun company, which is held by Tongdahai Holding subsidiary Jiangsu. Daeda holds 60%of the shares. The prospectus revealed that the Heilongjiang Complaint was 119,100 yuan in net profit in 2021. However, according to the annual annual report released by "Sky Eye Inspection", the net profit of Heilongjiang's complaint in 2021 was as high as 458,500 yuan, which was significantly different from the prospectus.

In addition, Tongdahai also has a shareholding company, which is Liaoning Express Data Technology Co., Ltd.. This company was established in July 2019. It was held by Jiangsu Prose and held 20%. The company paid only 1 million yuan in actual capital at the end of 2021, but the net profit in 2020 and 2021 reached 2.1153 million yuan and 8.815 million yuan. In contrast to this, Tongdahai Holdings's three complaint companies are not profitable. Jiangsu's complaints, Sichuan complaints, and Heilongjiang complaints in 2021 are 3.6629 million yuan and 227,700 yuan, respectively. And -2.948 million yuan. As for what is the reason why Liaoning Express Data Technology Co., Ltd., which has a high profitability of Liaoning Express Data Technology Co., Ltd., Tongdahai has not responded.

- END -

Is it a good business: the operating system chapter

Edit Guide: Investment, consumption, and exports as three driving carriages that d...

De Run Electronics: Holding subsidiaries have obtained domestic automobile customer development designated projects. The estimated total amount of the project is about 1.5 billion yuan

On June 29, Capital State learned that A -share companies were announced by the A -share company (002055.sz) that the holding subsidiary Mida Electric has reached a cooperation with a new energy vehic