Why do you abandon Australia?Chinese -funded disclosure

Author:Global Times Time:2022.06.29

Affected by Australia's excessive review, Chinese enterprises have continued to decline in local resources investment in recent years. The picture shows a local coal mine in Australia. Heavy machinery is loading and unloading coal, and piles of coal waiting to be transported.

The newspaper in Australia, a special reporter, Daqiao Li Future

Editor's words: Australian media recently quoted a latest report saying that due to the deterioration of bilateral political relations between China and Australia, Chinese investors quickly abandoned Australia. The report has aroused widespread concern. The trend of Chinese capital in Australia has caused Australian media to worry that Chinese capital will "turn to EU countries." In an investigation and interview with the Global Times reporter, a number of Chinese companies who invested in Australia said the reason for "abandoning" Australia, and the over -review of the Australian regulatory authorities caused Chinese capital to dare not promote more investment. The vague statement of the Australian and New government has also made Chinese investors watching.

It is not necessary to hang on this "one tree"

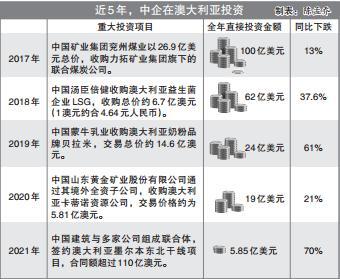

According to the latest research reports released by KPMA and the University of Sydney, China's investment in Australia last year has significantly reduced by nearly 70%and the lowest level since 2007. Hans Hendrishk, a reporter of the report and a professor of Chinese business and management at the University of Sydney, said that investment from China was "surprising." In fact, the report issued by the above agencies last year also showed that in 2020, China Enterprise's investment in Australia fell to Australia $ 2.5 billion (about 4.64 yuan), and returned to the level before China's investment in Australia's mining in 2007. According to the report, the main reasons for the decline in investment in Australia include the new crown pneumonia epidemic, Australian -China -China bilateral relations, and the deterioration of geopolitical bureaus, and China's stricter foreign exchange management. At the same time, Australia has also tightened foreign -funded audits.

Australian Broadcasting Corporation (ABC) reported that according to statistics, from 2007 to 2021, Chinese state -owned enterprises and private enterprises invested in Australia in Australia reached $ 158 billion. However, since the Australian government announced in 2018, it has banned Huawei from participating in the Australian 5G network construction, and Chinese companies have shown a rapid decline in investment in Australia and investment projects.

Australian regulators are increasingly reviewed by Chinese investors, suppressing investment scale from China. A representative of a Chinese listed company in Australia told the Global Times reporter that the Australian Foreign Investment Examination Commission (FIRB) requested the information submitted by the company even more than the listing information provided by domestic requirements. Some information may involve personal privacy or Trade secrets. For example, FIRB claims that in accordance with the provisions of "anti -money laundering", the investment applicants are required to provide a complete and traceable funding certificate, including the legal source of all major shareholders of the company. In the submitted information, the source of the funding of a major shareholder is displayed as the sale of its own real estate, and the housing contract contract and the bank transfer record are attached. However, what Chinese companies did not expect was that FIRB then asked the company to provide the company's legal source of funds when buying a house, and the house purchase behavior was already more than 10 years ago, and the information is difficult to find. In the end, the Chinese company decided to abandon the plan to invest in Australia. The representative also helplessly told reporters that during the process of going out of the sea, facing multiple opportunities for choice, it was not necessary to hang on the "one tree" in Australia.

In addition, the outbreak of the new crown pneumonia allowed Australia to be in a long -term and repeated state of border blockade and the domestic city. Objectively, Chinese investors and industry experts cannot enter Australia for inspection and negotiation. By the end of last year, unless there is an Australian citizen or permanent resident, Chinese investors cannot apply for a visa to come to Australia's business inspection, and it is even more difficult to reach a million or even hundreds of millions of investment agreements.

About 1/4 Chinese capital shifted from the United States and Australia to EU countries

In March last year, the Ministry of Commerce of China found that the "imported related wines had dumping and subsidies" native to Australia, and China's domestic wine industry was "substantially damaged." Therefore, in the five years since 2021, China levied up to 212%of anti -dumping duties on Australian wine products. This normal trade measures have been misunderstood by the Australian government as "economic coercion" in Australia and initiated a lawsuit against China in the World Trade Organization (WTO).

A Chinese investor who runs the wine estate in South Australia told the Global Times reporter that since 2021, Australia's exports to Chinese wines have fallen sharply. Another consequence is that Chinese companies with potential investment intentions to Australia wine The manor is "discouraged" and is worried that the wines that produce will not enter the Chinese market smoothly. "As far as I know, in South Australia alone, at least 3 Chinese -funded investors have abandoned the wine estate acquisition plan that they are talking about in the past two years," said the investor, "Australia's Agricultural and sideline products such as wine, beef, lobster, and seafood are good in China. However, the more and more anti -China attitude of the Morrison government makes Chinese entrepreneurs who intends to invest in these areas. "

According to the US CNBC report, the exports of Chinese wines have reached $ 1.2 billion per year. However, as of March this year, the annual export volume fell to A $ 200 million. The Australian News states that although Australian wine manufacturers have vigorously developed a new market, they still cannot make up for losses in the Chinese market. Taking the main region of wine, South Australia is an example. As of March this year, the state of wine exports in the past year alone reached A $ 638 million, compared with the total increase of all new development markets in the past year. Many merchants engaged in wine production and exports in Australia have said that they "do not understand" the Australian government's wine export policy. New market.

Statistics show that about 25%of Chinese investment has shifted from the United States and Australia to EU countries. Berg, a senior economist at the Australian National Bank, said that in the early days of foreign investment, Chinese companies tended to be densely resource -intensive industries, which made Australia with rich iron ore and coal resources became hot areas for early foreign investment in Chinese companies. However, Berg noticed that the investment direction of Chinese companies has begun to turn to high -tech in recent years. At the same time, some analysts believe that considering the fierce geopolitical competition between China and the United States, and the role of Australia as an anti -China "pioneer" in the United States, the consideration of Chinese investors has shifted from "bigger" to "safer".

Many investment intentions are in a state of shelving

What is the influence of some politicians in Australia and some politicians in Australia? Since 2018, China has replaced New Zealand to become the largest source of tourists in Australia, accounting for 30 % of all tourists in Australia. Beginning in March this year, Australia opened the border. But practitioners are not optimistic about this year's tourism situation. The main factors are still difficult to see Chinese tourists.

A number of Australian tourism practitioners interviewed by the Global Times reporter said that they long for the return of Chinese tourists. A senior tour guide told reporters that Australian Tourism companies hope that China -Australia relations can return to normal, promote the growth of Chinese tourists' return and Chinese investment.

On May 23 this year, Albinese officially became the 31st Prime Minister in Australia, and the Australian education community also had more expectations for the new government's issues of improving international students. Australia and New Education Minister Jason Claire recently said that in the first quarter of this year, the number of Chinese students who began to study in Australia had decreased by 24%, saying that "this is a huge decline." He said that Chinese students not only created billions of dollars for the Australian economy, but also from the perspective of "soft power", they are also very important.

A Chinese investor who has been engaged in wine and other food exports in Australia for nearly 20 years told the Global Times reporter that at present, many Chinese enterprises' investment intentions for Australia are on hold, and investors also have a "wait -and -see" attitude. He said that the Australian -New government has an unclear attitude towards China, and sometimes it is positive, which eases more than the previous government. However, in some principles, especially the "China needs to lift sanctions against Australia" to improve the premise of improving Sino -Australian relations, many Chinese enterprises and investors are disappointed and confused. ▲

- END -

Coron Pharmaceutical is expected to increase by 66.39%to 80.59%year -on -year in the first half of 2022

On July 6, Capital State learned that the A-share listed company Coren Pharmaceutical (code: 002422.sz) released the semi-annual report performance forecast. The profit was 820 million to 890 million

Wanrong County Market Supervision Bureau carried out the "ten sets of archives" to implement the work training meeting of food production enterprises

Recently, Wanrong County Market Supervision Bureau organized 24 food manufacturers...