Fight directly at the shareholders' meeting 丨 Shareholders care about the industry to dig the horn of the industry, Yang Chonghe: Rely on projects, treatment, corporate culture

Author:Daily Economic News Time:2022.06.28

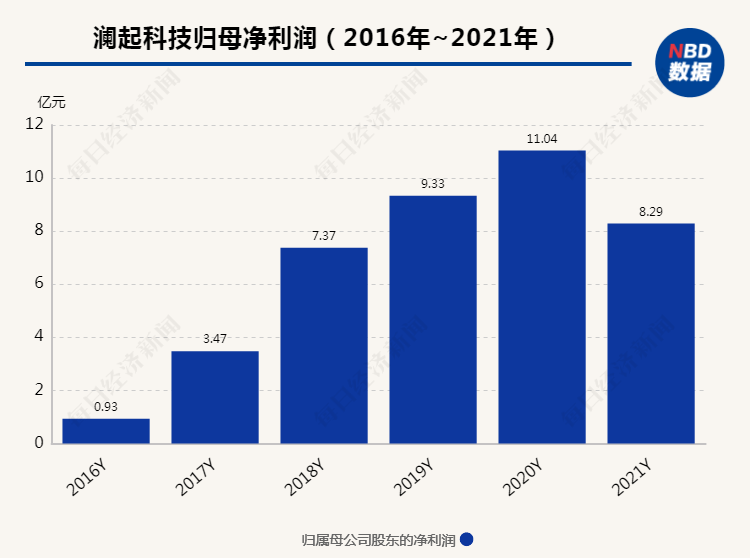

On the afternoon of June 28, Lanqi Technology (SH688008, a stock price of 58.91 yuan, and a market value of 66.735 billion yuan) held the 2021 annual shareholders' meeting. Due to the demand for the prevention and control of the epidemic, Lanqi Technology was also moved to the online shareholders' meeting to be held online.

Lanqi Technology is a data processing and interconnection chip design company. In recent years, as the semiconductor industry has become hot, the problem of talent shortage has become more and more serious. Especially in the field of chip design, high salary of peers often occur.

For a chip design company, talent is one of the core competitiveness. Among the only two questions at the shareholders' meeting, some shareholders care about how Lan Qi Technology cope with the horn of peers.

How to cope with peers digging?

In the Q & A session, some shareholders said that the equity incentives play a role in Lanqi Technology, and the salary of talents in the semiconductor industry has risen. How can listed companies deal with the industry?

In this regard, Yang Chonghe, chairman and chief executive officer of Lanqi Technology, said that there is no doubt that equity incentives have increased the sense of owner's awareness and increased the cohesion of the team. Work together to make the company well.

Regarding the horn of the peers, Yang Chonghe said that on the one hand, the company continued to absorb fresh blood and increase recruitment; on the other hand, the company's original core team and business backbone also remained stable.

At the end of 2018, the total number of employees in Lanqi was 255. By the end of 2021, the total number of employees in the company reached 527. Yang Chonghe said that more than 70%of them are R & D technicians. In general, the company is constantly establishing and improving its own talent echelon. The scale of the team has gradually expanded, and the overall strength has gradually increased, laying a solid talent foundation for the company's future business development.

Regarding the question of how the aforementioned shareholders care about how to retain talents, Yang Chonghe believes that there are three main points. The first is to keep people from projects and careers. "The products we develop and develop are at the leading level of international or industry. The employees of the job have a strong attraction. They can get a good chance of studying and growing during the work. Then, once they succeed, they will also have a great sense of accomplishment and pride. "

Followed by treatment. Yang Chonghe said that Lanqi Technology also rely on treatment to stay. Listed companies provide salary and benefits with market competitiveness. At the same time, implementing equity incentive plans can increase employees' sense of gain.

The third is corporate culture. Yang Chonghe believes that the company has created a good working environment and working atmosphere, allowing employees and companies to grow together. At the same time, the company also encouraged innovation, emphasizing the spirit of craftsmen and paying attention to equality. These corporate culture and working atmosphere are strongly attractive to outstanding talents.

The 2021 corporate social responsibility report disclosed by Lanqi Technology showed that its equity incentive coverage rate was 75%. In addition, the company has 71%of the proportion of R & D technical personnel, and 65%of the master's degree in R & D technicians and above.

Some shareholders pay attention to future performance

At the shareholders' meeting, another shareholder also asked, the shipments of DDR5 products, the continuous volume of the product products of Jin Catch, and the blessing of dual power, what kind of performance will Lanqi Technology usher in this year?

In this regard, Stephen Tai, general manager of Lanqi Technology, said that from the first quarter report of this year, we can see that with the continuous shipments of the first -child memory interface and module supporting chip of DDR5, including the stable development of the product line of Jin catch server platform The company's first quarter performance has gained better growth.

The company's first quarterly report showed that Lanqi's scientific and technological revenue of this quarter was 90 billion yuan, an increase of 200.61%year -on -year, and net profit was 306 million yuan, an increase of 128.23%year -on -year. Among them, the company's interconnected chip product line realized revenue of 575 million yuan, an increase of 94%year -on -year; the product line of Jin catch server platform achieved revenue of 325 million yuan, an increase of 99 times year -on -year.

It is worth mentioning that the income of Lanqi Technology's main business interconnected chip has declined from the previous month. In this regard, during the investor exchange activity in May 2022, Lan Qi Technology stated that the company's income in the first quarter of 2022 declined slightly from the previous quarter because of quarterly fluctuations. Fresh season; disturbance in special periods, the logistics efficiency of some products was affected by static management in Shanghai and surrounding surroundings in late March, and delayed to ship in April. After active coordination, the current logistics efficiency has basically returned to normal.

In addition, the gross profit margin of Lanqi Technology Jinjin Catch Server Platform is only 12.44%. In the above -mentioned investor exchange activities, some investors also asked Lanqi's future market space for the CPU business, and whether the gross profit margin increased.

At that time, Lanqi Technology stated that for the CPU of Jinjin, because the market space was very large, the company's primary goal in the initial stage of the product was to pursue the amount, put the product into the market as soon as possible, strive for more market share, and obtain more customers. Acknowledge. Due to the large value of the product, the absolute amount of gross profit will be considerable once after the amount is available. At the same time, after customers who accumulate a certain amount and reach a certain income scale, the company will develop new features in the needs of customers to enhance the added value of the product and actively optimize the cost, so as to eventually increase the gross profit margin of the product line.

Looking forward to 2022, Stephen Tai believes that the company will focus on two aspects. First, the production capacity arrangement and market expansion of existing products to promote the stable development of related businesses; the second is the research and development of new products, which will make new products in the future.Performance growth points.Daily Economic News

- END -

From January to May of 2022, national fixed asset investment (excluding farmers) increased by 6.2%

In the tertiary industry, infrastructure investment (excluding power, thermal, gas and water production and supply industry) increased by 6.7%year -on -year.Among them, the investment of water conserv

Huaqiang Fang specially cost 3.1 billion to open a new paradise, but he has to raise funds for salar

Huaqiang Fangte (834793), known as China Disney, has been deeply trapped in mud.On...