After more than 3 months, the Shanghai Index returns to 3400 points!The big guy said, the "good day" of A shares is still very long

Author:Daily Economic News Time:2022.06.28

In the generation of Z, Brother Z is the most realistic.

Today's market is very exciting and the amount of information is also very large.

The market in the morning was still weak, and it felt like a sluggish, but the market only fell for an hour, and then counterattacked. In the afternoon, the Shanghai Index returned to 3,400 points in the past four months, and the transactions of the two cities exceeded trillion in four consecutive trading days.

From 2863 points on April 27, to today's rebound to 3,400 points, A shares only took two months, an increase of 18.7%. Obviously, the good days of A shares have come. Today, Gao Shanwen, chief economist of Anxin Securities, posted that "the rebound will continue for a long time, and the long -term prosperity of the stock market depends on whether it can continue to generate new great companies." The remarks of the "big guy" undoubtedly have a lot of confidence in the market.

Let's review yesterday's article. Yesterday, Brother Z shared the three robotic concept companies. Among them, McG's stock continued to daily limit today, Eston's 10cm daily limit, and the green harmonic disk once increased by more than 11%. Although the increase in the afternoon narrowed, it still performed well. It seems that the market is good, and the market is really active. Even if it is speculatory, the continuity is relatively strong. The continuity of the hotspot sector determines whether the rebound of the broader market can go further. Will the concept of robotic concepts continue to rush? I don't know clearly, but at least there are opportunities to retreat from the whole body.

Look at Gao Shanwen's latest point of view. Today, Anxin Securities held a medium -term online strategy meeting. The chief economist of Anxin Gao Shanwen shared his latest view on the current market with the title of "Blowing the Sand to Gold".

Gao Shanwen believes that at the end of April this year, no matter from which valuation indicator, the market has fallen to an extreme level; at the same time, from the transaction level, A shares have completely passivated a series of looting. It is the most significant feature of the market's decline in this round of declines that it has not appeared on the level of liquidity and is widely tightened.

From the perspective of the present perspective, Gao Shanwen believes that we tend to believe that the market is still in the normal rebound process that is relatively normal, from valuation repair and fundamental factors. Gao Shanwen also said that such a rebound, from the perspective of trading, fundamentals, etc., we believe that we will continue to maintain for a period of time, a longer period of time.

The above views are the main conclusions of Gao Shanwen today. Generally speaking, it is still optimistic about the future. In fact, when the broader market rebounds from more than 2800 to today's point, many people have begun to hesitate to the market. I don't know if the rebound can continue. Today, Gao Shanwen's judgment on the market has played a great role in the entire market.

Next, say another heavy news that appears on the market today.

According to the National Health and Health Commission issued a notice on the prevention and control scheme of the new type of coronary virus pneumonia (ninth edition): adjust the time and control time of close contact and entry personnel from "14 days of centralized isolation medical observation+7 Heavenly Home Health Monitoring" to "Seven days of centralized isolation medical observation+3 Heavenly Home Health Monitoring".

As the Shanghai epidemic has gradually been effectively controlled, today I finally saw that the isolation and control time of closeness and entry personnel began to shorten. It used to be "14+7", which was shortened to "7+3". The favorable is travel, aviation, hotel and other sectors.

There is also a news that Shanghai Disneyland will resume operations on June 30. This is not only because it is about to take summer vacations. The tourism industry enters the peak season. The most important reason is the adjustment of the epidemic prevention and control policy.

In terms of the tourism hotel sector, the daily limit of tourism in the Western Regions, Junting Hotel, Xi'an Diet, Jiuhua Tourism, Xi'an Tourism, Zhongxin Tourism, Lijiang Co., Ltd., Huatian Hotel's daily limit, Tianmu Lake, Dalian Shengya, Songcheng Performing Arts, Tibetan tourism, etc. There are more than 7%increase.

On May 29th a month ago, Niu Yanjun posted an article "The Dawn is the beginning, the good things are close to the tourism stock", which focused on analyzing the control of the epidemic, which will bring important opportunities to tourism. Looking back, this article seemed to be earlier. After the sharing, tourism stocks performed average, and there were many other opportunities in the market. But as long as the logic is clear, the stock price will sooner or later perform.

In the end, the "good day" market of A shares made the happiest thing, and the most happy one is still holding a new energy theme fund. Although the new energy theme funds were miserable in the first few months of this year, the maximum retracement was more than 30%. But as of today, several new energy theme funds with a scale of over 10 billion yuan have finally become popular during the year.

First of all, look at the theme of the new energy theme of 22.4 billion yuan in scale. It was previously managed by Zhao Li. After Zhao Ying left, he was replaced by Xing Junliang, a fund manager. In the past three months, the theme of the new energy theme of Agricultural Bank of China has performed strongly. As of June 27, the return of returning this year was -1.78%. Today's net value estimation rose by 1.62%.

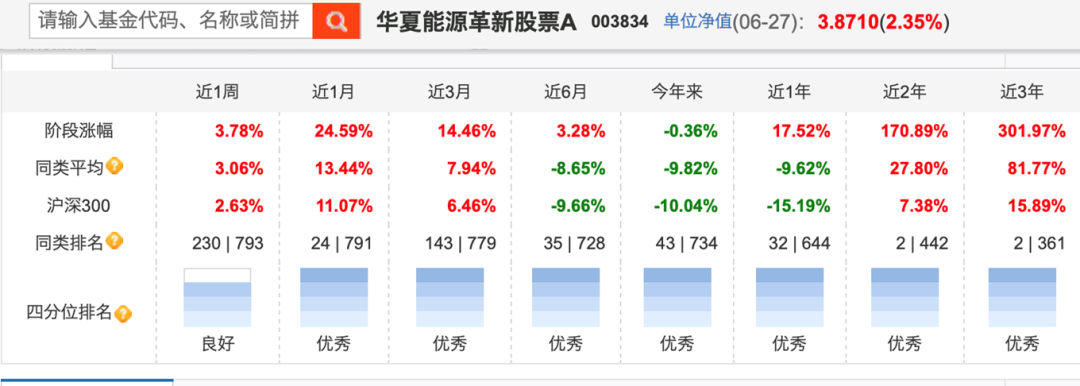

Secondly, Zheng Zehong's management of Huaxia Energy has a scale of 18.4 billion, and his performance in the past 6 months has become popular. As of June 27, the revenue during the year was -0.36%. The net value of today's net value rose 1.62%. That is to say, the net value announced tonight has achieved red performance.

Another powerful point of Zheng Zehong was to seize the big bull stock of Changan Automobile, holding 63.3 million shares at the end of the first quarter. Although Changan Automobile has fallen miserable a few months ago, it is undoubtedly one of the kings of the new energy vehicle sector recently. Third, the Oriental New Energy Vehicle managed by Li Rui was mixed with a scale of 18.5 billion. As of June 27, the performance since this year is -0.73%. Today's net value estimation has increased by 1.14%, and the high probability of performance has become popular.

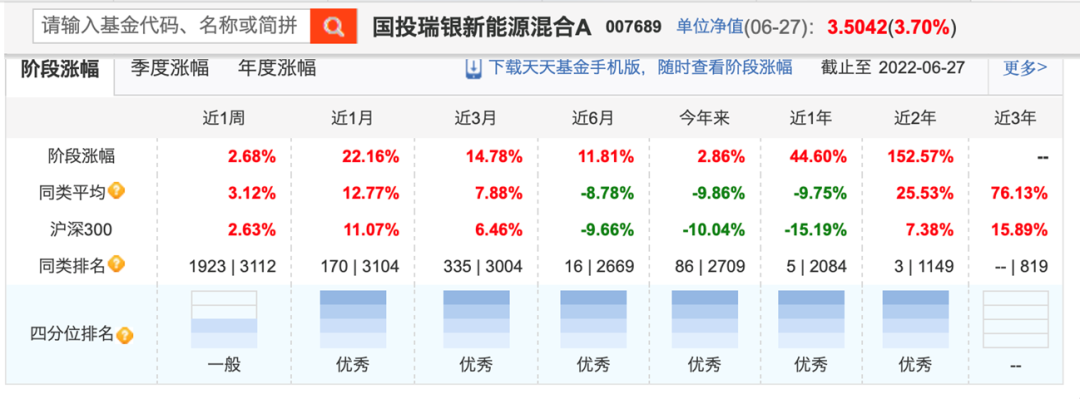

Among the new energy theme funds, the best performance is that Shi Cheng's management of SDIC UBS New Energy is mixed. Yesterday's net worth has become popular, and today it will rise.

After the V -type reversal in the first half of this year, the theme of new energy has a strong recovery. Whether it can continue to write glory in the second half of the year may be the most anticipated at the moment. The performance of the New Energy Fund also proves that the best strategy may be patiently holding such a long -term (5 to 10 years) subject matter.

(Risk reminder: Equity funds are high -risk varieties, and investment needs to be cautious. This information does not serve as any legal documents. All information or opinions in the information do not constitute the final operation suggestions of investment, law, accounting or taxation. The content in the middle of the operation is made of any guarantee. In any case, I am not responsible for any loss caused by any of the content caused by any content in this information. my country's fund operation time is short, which cannot reflect the development of the stock market development. All stages. The performance of fixed investment past does not represent future performance. Investors should fully understand the difference between the fund's regular quota investment and zero deposit and other savings methods. Period quota investment is a simple and easy to guide investors to make long -term investment and average investment costs. The investment method. But regular fixed investment cannot avoid the risks inherent in fund investment, cannot guarantee investors to obtain benefits, nor is it an equivalent financial management method for savings.

Before investing in the fund, please read the fund's legal documents such as the fund contract and the recruitment manual, and comprehensively understand the fund's risk income characteristics and product characteristics. On the basis of the situation and listening to the appropriate opinions, judge the market rationally, and make investment decisions carefully according to factors such as their investment goals, periods, investment experience, asset status and other factors, and independently bear investment risks. The market is risky, and you need to be cautious to enter the market. The fund manager reminds investors '"buyers' self -responsibility" principles. After investors make investment decisions, the investment risks caused by the fund operation status, fund shares listed transaction price fluctuations, and fund net value changes shall be responsible for themselves. )

Daily Economic News

- END -

Pay attention to the Sichuan -Chongqing Party and Government Joint Association 丨 Another trillion industry will want to go out of Sichuan and Chongqing to stabilize the economic market

Chuanguan News reporter Zhang YixiAs the highest -level joint mechanism between Sichuan and Chongqing, at the construction of the Chongqing Sichuan party and government joint conference to build a co

Ministry of Commerce: Most key foreign -funded enterprises in Shanghai have achieved resumption of w

On June 8th, the deputy minister of the Ministry of Commerce Wang Shouwen stated...