Henan starts the pilot of the disaster insurance!Zhengzhou Anyang and other 6 cities first tried first, and 7 insurance companies underwritten

Author:Dahe Cai Cube Time:2022.06.28

[Dahecai Cube News] On June 28, the General Office of the People's Government of Henan Province issued the "Guiding Opinions on the Pilot Work of Disaster Insurance", which launched a huge in Zhengzhou, Anyang, Xinxiang, Hebi, Zhoukou, and Xinyang. The pilot work of disaster insurance, other provinces and municipalities and Jiyuan Demonstration Zone combined with the actual situation to independently decide to carry out pilot work of the disaster insurance. The premiums are borne by the city and county levels, and the provincial finance is subsidized at a ratio of 30%. The pilot provinces and municipalities are selected in one or at the same time in the actual compensation model and index model.

Giant disaster insurance consists of seven commercial insurance institutions for co -insured. The joint insurance units include: Chinese PICC Property & Casualty Insurance, China Life Property & Casualty Insurance, Pacific Property & Casualty Insurance, Ping An Property & Casualty Insurance, China United Property & Casualty Insurance, Earth Property & Casualty Insurance and Central Plains Agricultural Insurance Company. Among them, as the chief underwriter of the Communist Party, the Henan Branch of China PICC and Insurance Insurance, leads the specific work of responsible for the insurance insurance insurance claims of the disaster insurance.

Real compensation model.

(1) Guarantee object. Divided into two categories: one is all population in the administrative area (including the permanent population and the migrant population of temporary business trips, tourism, and migrant workers); the other is that all residential housing (registered as the registered) and its indoor subsidiaries (no) in the administrative area (not registered) (registered) and their indoor subsidiary facilities (not Including indoor decoration, indoor property and subsidiary buildings).

(2) Sales scope. Due to heavy rain, floods, and geological disasters such as sudden landslides, mudslides and other geological disasters, reservoir dams, waterlogging (including guest water) and other secondary disasters, causing personal death (missing) or housing damage, insurance institutions are followed by according to the instructions. The insurance contract agrees to pay the affected people.

(3) Trigger conditions. It is divided into two types: one is within two or more counties (cities, districts) of the same province under the jurisdiction of the same province. ) The above; more than 30,000 people (including) or more for emergency transfer and emergency life rescue; according to the "Dangerous House Appraisal Standards", the houses of C and D -level dangerous houses have reached 3,000 (including) or 1,000 households (inclusive). above. Second, in one county (city, district), disasters within the scope of protection occur, and one of the following situations occur during a disaster: more than 3 people (inclusive) or more; (Including) above; according to the "Dangerous House Appraisal Standards", the houses of C and D -level dangerous houses have reached 1,000 (inclusive) or 300 households (inclusive).

(4) Standards for premiums and claims. First, the insurance premium of personal death (missing) is 0.18 yuan/person/year. The compensation limit for each person is 100,000 yuan, each county (city, district) compensation limit is 10 million yuan, and the annual cumulative compensation limit for each province's jurisdiction is 100 million yuan. Second, the premium of housing inverted insurance is Zhengzhou 8.82 yuan/household, Anyang 7.22 yuan/household, Xinxiang 14.12 yuan/household, Hebi 11.55 yuan/household, 7.22 yuan/household, Xinyang 7.22 yuan/household. The Class C -level dilapidated house of steel concrete structures per square meter compensation limit is 300 yuan, the compensation limit for the D -class dangerous house is 600 yuan; the C -class dilapidated house of the brick and wood structure is 200 yuan per square meter. The compensation limit is 500 yuan; the compensation limit for the C -class dilapidated house of other structures is 100 yuan per square meter, and the compensation limit for the D -Class dangerous house per square meter is 400 yuan. The compensation limit for each house for each accident is 6,000 yuan, and the compensation limit for each household is 50,000 yuan. The annual cumulative compensation limit for each province is 100 million yuan.

(5) Related instructions. The above premiums are determined based on the premium rate of 6 pilot provinces. In the actual insurance, departments such as emergency, housing, urban and rural construction, in conjunction with the statistical departments verify the actual population and housing data in the administrative area. If the data difference between the data in the provincial statistical yearbook in 2020 is less than ± 5%, the unified premium rate remains unchanged.

Index pattern.

(1) Affairs scope. In administrative areas, after the rainfall caused the cost of emergency response, disaster rescue, post -disaster relief, reconstruction and reconstruction of public facilities after the disaster, and social relief after the disaster.

(2) Trigger conditions. When a national automatic meteorological station in the administrative area measures more than 150 mm (inclusive) for 3 consecutive days, it is considered an insurance accident.

(3) Standards for premiums and claims. Each pilot province is insured in accordance with the insurance amount of not less than 10 million yuan in each county (city, district). The number of counties (cities, districts) is determined in accordance with Henan Provincial Administrative Region, and the cumulative compensation limit is determined in accordance with the insurance amount.

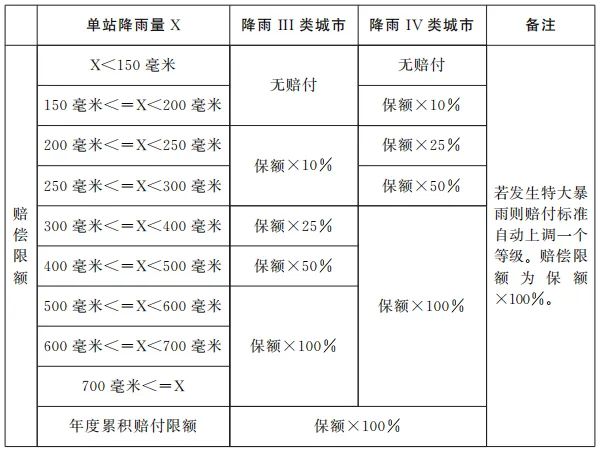

After the insurance accident occurs, the insurance institution shall make classification compensation in accordance with the insurance contract.

(4) Related instructions. If there are multiple national automatic meteorological stations in the administrative area, the total amount of compensation for a rainfall accident is the average value of the compensation limit corresponding to the rainfall of the rainfall in various countries. In principle, the compensation payment is allocated to the municipal finance, and the municipal finance is used for overall use. It is mainly used to compensate for the emergency response, disaster rescue, the restoration and reconstruction of public facilities after the disaster, the reconstruction of public facilities, and the post -disaster social society due to disasters and secondary disasters. Relief and other expenses.

Class III cities include: Pingdingshan, Anyang, Xinxiang, Xuchang, Luohe, Nanyang, Shangqiu, Xinyang, Zhoukou, Zhumadian. Class IV cities include: Zhengzhou, Kaifeng, Luoyang, Hebi, Jiaozuo, Puyang, Sanmenxia, Jiyuan.

The premiums are borne by the city and county levels, and the specific proportion is determined by the pilot provinces.Provincial finances are subsidized according to the proportion of municipal and county -level financial funds in place.Responsible editor: Chen Yuyao | Review: Li Zhen | Director: Wan Junwei

- END -

Ministry of Finance: In May, a total of 32.765 billion yuan sold in the country increased by 8.5% year -on -year

China Economic Net, Beijing, June 30. According to the website of the Ministry of Finance, in May, a total of 32.765 billion yuan in lottery tickets was sold, an increase of 2.563 billion yuan, an inc

Quanzhou's first Chongjun "Run" theme post office opened

Quanzhou Evening News · Quanzhou Tong Client, June 16 (Quanzhou Evening News repo...