70,000 shares are stunned!3 shares a day: the worst plunge 99%!

Author:China Fund News Time:2022.06.28

China Fund Newspaper Jiangyou

Zero Rong Ren+Strict Supervision, the delisting stocks are significantly increased. Today there are 3 stocks. After the last day of the transaction, we must say goodbye to A shares!

Today, Dewei retires, the public should retire, and the head of heaven retires. The last trading day of the three -market stocks will be delisted from A shares to other A shares to enter the national stock transfer system transaction. At the end of the first quarter before delisting, the number of three shareholders of three stocks was 33,000, 24,800, and 14,300, and there were more than 70,000 households.

Three delisting stocks, the worst crowd should retire. From the high level in 2015, the stock price has fallen 99%. Let's take a look at the stories of these three companies.

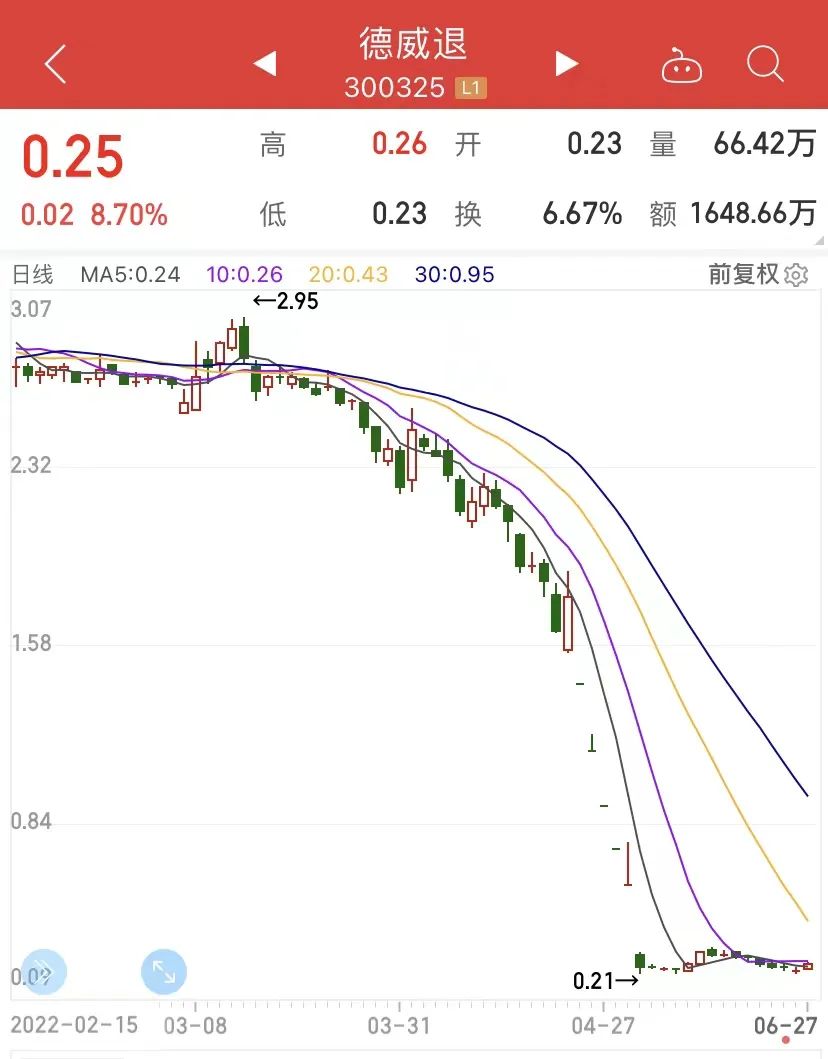

Dewei retreats: Zeng Haoyan is the "Second Ningde Times", and now he has fallen to delist

The market value of Ningde Times, known as "King Ning", has a market value of more than 10 trillion yuan. Only 0.25 yuan, the market value fell to only 250 million yuan.

Ningde Times was a lithium battery giant. Dewey New Materials had wanted to make some achievements in the field of hydrogen energy. Hydrogen energy was a blue ocean market with good prospects. In 2016, the main business was the development, production, and sales of the main business of the cable to enter the hydrogen energy track.

Dewei New Materials signed a strategic cooperation agreement with the new source power to officially enter the fuel cell market; in November 2016, the US fuel cell company was acquired to introduce 80 kilowatts of high -power engine technology to China. It was also very beautiful.

Zhou Jianming, the actual controller of Dewei New Materials, has publicly stated that Dewey wants to be the "second Ningde era" in the hydrogen energy industry.

However, not only failed to make the second king of Ning, but also fell to the market to retire.

From 10.42 yuan in 2015 (previous repetition), to the latest stock price of only 0.25 yuan, the stock price of Dewei retired has fallen by 97.6%.

On May 5 this year, the Shenzhen Stock Exchange also informed*ST Dewey (Dewei New Materials) that the company's audited net assets in 2021 was -490 million yuan, and the audit report issued by the audit institution could not express their opinions. Terminate the listing situation and intend to decide to terminate the company's stock listing transaction. And subsequently received the decision of delisting.

*ST Delwei's stock entering the delisting period is June 7, 2022, and the delisting period is fifteen trading days. The final transaction date is expected to be June 27, 2022. That is, today is the last trading day.

*ST Delwei's problem. The 2018 annual report, the 2019 annual report, and the 2020 report of the 2020 reports have major omissions and false records in information disclosure such as related procurement procurement matters, related party funds occupation matters, providing guarantee matters, and major litigation matters.

According to the China Securities Regulatory Commission survey, in 2018, the related transaction amount of*ST Dewei and supplier Phils was 238 million yuan; at the same time, on December 31, 2018,*ST Dewey's related party Filpsus' funds The balance of 795 million yuan. On December 31, 2019, the balance of the affiliated Flps funds was 969 million yuan. As of July 8, 2020 (investigation day), the balance of the affiliated Flps funds was 978 million yuan.

In order to cover up the matter,*ST Dewey's 2018 annual report, 2019 annual report, and 2020 annual reports even took risks to disclose false information.

In addition, due to the illegal fault and violations of the law,*ST Dewei was fined 2 million yuan by the China Securities Regulatory Commission; Zhou Jianming, the company's actual controller, was fined 4.5 million yuan and was banned from entering the securities market for 5 years. Yuan, and was taken for three years of securities market ban.

Congress retreat: Supervision is still investigating, the most tragic plunge 99%

The three stocks of the final transaction today, after a high level, the decline in the retreat (*ST Zhongying, Zhongying Interconnection) is the largest, from 26.56 yuan in 2015 (previous repetition). %. The latest market value is only 136 million yuan.

Earlier,*ST Zhongying (Zhong Ying retired) announced that the company received the Shenzhen Stock Exchange's "Prior notice" on April 29, 2022. The specific content of the "Notice of advance" is:

"On April 26, 2021, due to the negative value of your company's audit at the end of the audited period in 2020, your company's stock transactions were warned by delisting risk.

On April 29, 2022, the first annual report after your company's stock transaction was implemented after the delisting risk warning showed that your company's 2021 Financial Accounting Report was issued by the accounting firm that it could not express an audit report. Your company touches the stock termination situation stipulated in Article 9.3.11 (3) of Article 9.3.11 (3) stipulated in Article 9.3.11 of the Institute of Stock Listing. "

Later, the crowd should be retreated.

The stock was also investigated by the regulatory authorities, and the investigation is still underway.

On June 13 this year, Li Huaiang, chairman of the Zhongying Internet and the Chairman of the Company, received the "Notice of Filing C case" on December 3, 2021, respectively. Due to the illegal information disclosure of information, the China Securities Regulatory Commission decided to facing the company and Li Huaiangliang to Li Huaiangliang File the case. As of the announcement at the time, the investigation of the China Securities Regulatory Commission was still ongoing, and the company had not received the conclusion or decision of the China Securities Regulatory Commission on the above case.

Heavenly retreats: Four Directors have accused the audit institutions and let the management team work hard to pay

A company to be delisted, and multiple directors of the company accused the accounting firms that pointed to the audit institution that was delisted.

Today is also the last trading day of Tianshou's retreat (*ST Heaven and Heaven Development). The stock price closed at 1.39 yuan, and the market value closed at 447 million yuan, a high of 18.82 yuan in 2015, down 92.6%.

On May 27 this year, the Shenzhen Stock Exchange announced that the development of the heavenly development due to the negative value of the audited in 2020 and the operating income of less than 100 million yuan. Essence

On April 30, 2022, the 2021 annual report disclosed by the company showed that the company's audited net profit in 2021 was -24.9065 million yuan and the business income after deducting was 0. The audit report touches the stock termination situation. Determine the delisting of the stock.

It is worth noting that when the accounting firm gave an audit report that could not be expressed in the end, the directors of*ST Heaven were still making the final "struggle" and did not recognize the report given by the audit institution.

The four directors said that although there are certain problems in the company's internal control, there are no major defects. Today, the company's audit report cannot be issued. status.

On April 30, 2022, the company released the 2021 annual report. In the annual report, Lianda Accountants could not express their opinions on the company's 2021 audit report. The reason is:

1. Continuous operation: The company's net profit after deduction for many years is negative, and the new key compound material business has not improved this year; the impact of major lawsuits last year has not been eliminated, and the uncertainty of the molybdenum mine construction organization, funds, and progress is uncertain. Large borrowing is about to expire. Whether the various response measures formulated by the management can implement significant uncertainty.

2. Key compound material business: The company's new key compound material business in 2021, the revenue of the key composite material business accounted for 94.09%of the total operating income of Tianshou's development. For key components business, Lianda Accountants implemented audit work including internal control understanding and testing, letter, interviews, on -site observation, and analytical review in accordance with the provisions of the Chinese Certified Public Accountants Audit Guidelines. Because the Lianda Accountants believe that there are major defects in the relevant internal control of the bonding material business, the corporate material business evidence and explanation provided by the company cannot judge its authenticity and rationality. The Lianda Accounting Firm believes that failed to obtain sufficient and appropriate audit evidence, and cannot judge the authenticity and rationality of the key compliance business.

In the end, in the company's 2021 operating income deduction of special review opinions, the operating income of the company's key material project of the company's key material project was deducted from the “difficulty in forming a stable business model” for the company's key material project.

The four directors of the company Qiu Shijie, Chen Fengli, Li Xiaobin, and Zhang Xian believed that Lianda Accountants had unsteady and incompetence during the audit process, and did not recognize the audit results of the audit institution.

However, this has not changed the final result and the fate of the company's delisting.

Edit: Joey

- END -

Our city carried out inclusive financial activities to help rural revitalization

In order to strengthen the party building and leader to optimize the allocation of...

New era of new journey to build a new era | "crossing economy" transitions to "landing economy"

On the 13th, at the site of the Mudanjiang Battlefield Railway Special Line Project project, the builders were indirectly growing the main structure of the construction area and crossing the G11 highw