Notice on the scope of the implementation scope of the implementation of social insurance premium policies to expand the implementation of social insurance premiums

Author:Peace news Time:2022.06.27

Pass

Know

Regarding the expansion of phased implementation of social insurance premiums

Notice of the scope of policy implementation

1. Scope of application and implementation period

(1) 5 special trapped industries

1. Scope of application: Catering, retail, tourism, civil aviation, highway waterway transportation enterprises, you can apply for the payment part of the three social security premium units. In the above -mentioned industries, individual industrial and commercial households and other units of employees who participate in social insurance are submitted by reference to corporate measures.

2. Implementation period: The term of the basic endowment insurance premiums of the enterprise employee is from April to December 2022, and the term of the unemployment insurance premium and the cost of work injury insurance premiums from April 2022 to March 2023. During the period, enterprises can apply for a different period of time -limited payment. During the slow payment period, it is exempted from late fees. If the basic pension insurance premiums who have already applied for the employee employee can be applied for a period of slow payment from July 2022 to December 2022.

(2) 17 slow -payment expansion industries

1. Scope of application: 17 difficult industries such as agricultural and sideline food processing industry (see attachment 1), which belongs to it, the difficulty in the case of more than 1 month before applying for a loss before applying for a loss (including 1 month) of losses can be applied for slow payment. Three social insurance premium units payment section.

2. Implementation period: The term of the basic pension insurance premiums of enterprise employees is from June to December 2022, and unemployment insurance premiums and industrial injury insurance premiums will be paid from June 2022 to May 2023. During the period, enterprises can apply for a different period of time -limited payment. Enterprises that have been paid in June 2022 can apply for a return fee for the June. During the slow payment period, it is exempted from late fees.

2. Apply for processes and expenses

(1) Simplify the application process: Enterprise application should issue a written commitment that meets the conditions: the newly applied for the enterprise of the 5 special trapped industries and the 17 slow -payment expansion industries that are difficult to fill in the industry. (New Edition).

(2) Make -up payment time: The basic pension insurance premiums of the employees who are slowly paid shall not be paid at the end of May 2023; The payment time shall not be at the end of April 2023 (if the monthly payment month is postponed for one month, the repayment time is delayed accordingly), 17 slow -payment and expansion industries must not be replenished at the end of June 2023, and small and medium -sized enterprises must not pay time to pay time to make up the time. Later at the end of January 2023.

(3) Effectively safeguard the employee rights: For employees' individuals should pay, enterprises shall fulfill their obligations for deduction and payment according to law; they shall not affect the personal rights and interests of employees due to slow payment of social insurance premiums.

Pinghe County Human Resources and Social Security Bureau

June 24, 2022

appendix

List of difficult industries that expand the implementation of slow payment policies

Agricultural and sideline food processing industry

Textile industry

Textile clothing, clothing industry

Paper and paper products

Printing and recording media replication industry

Pharmaceutical manufacturing

Chemical fiber manufacturing

Rubber and Plastic Products Industry

General Equipment Manufacturing

Automotive Manufacturing

Railway, ships, aerospace and other transportation equipment manufacturing

Instrument and instrument manufacturing

social work

Broadcasting, television, movies and recording operations

Cultural and art industry

physical education

Entertainment industry

-

- END -

The State Administration of Taxation: 258 trillion yuan, small and medium -sized enterprises account for nearly 70%

China Economic Net, Beijing, June 30th. The State Administration of Taxation held a press conference today. The relevant person in charge of the State Administration of Taxation said that as of June 2

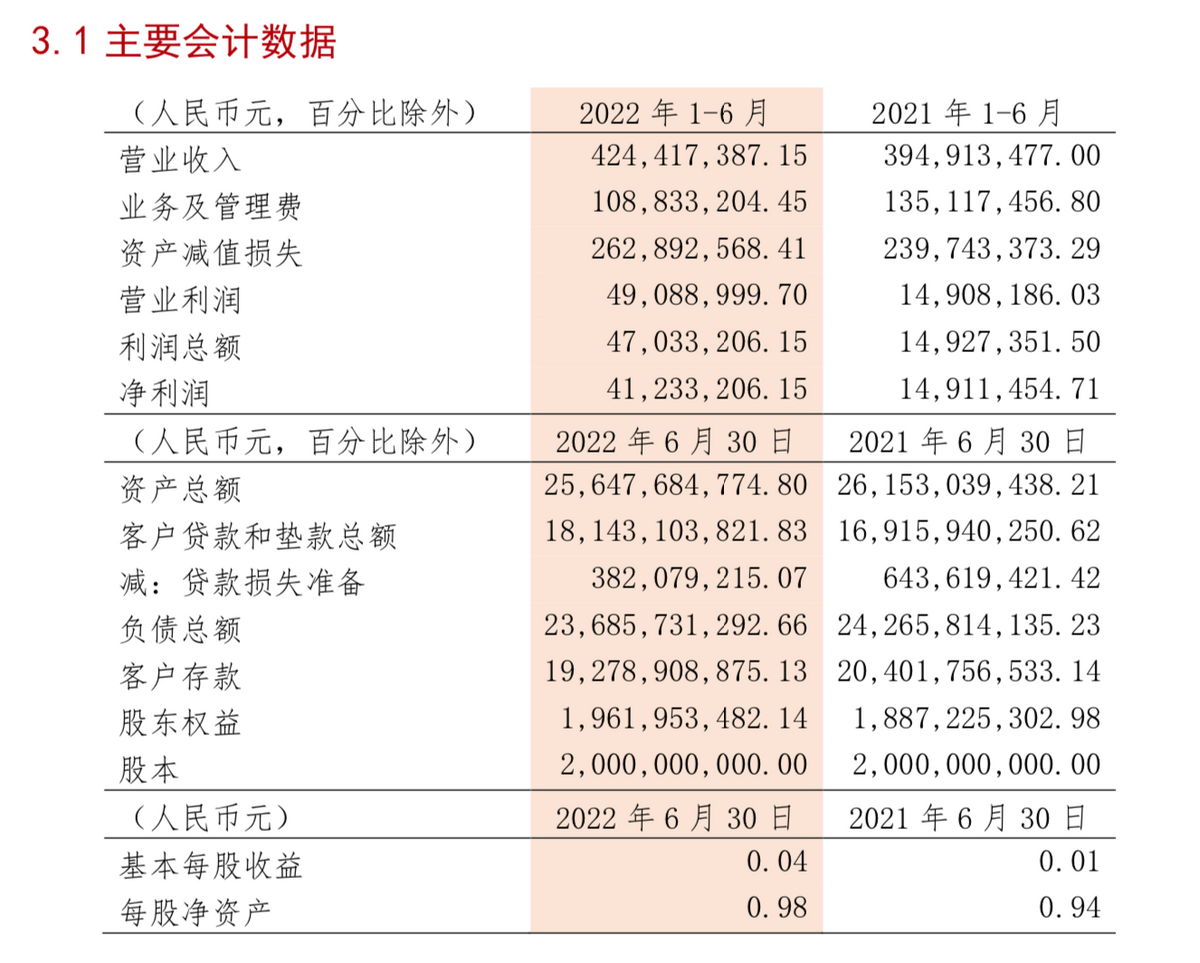

The first private bank's half -year report was released: Liaoning's revitalization bank's assets shrink, net profit increased by 176.52% year -on -year

Produced | WEMONEY Research RoomWen | Liu ShuangxiaThe first semi -annual report of ...