It was the largest shareholder but helplessly auctioned the shares, and missed the nearly 10 times increase in King Kong Glass!Former private equity champion circle of friends, lamented screens

Author:Daily Economic News Time:2022.06.27

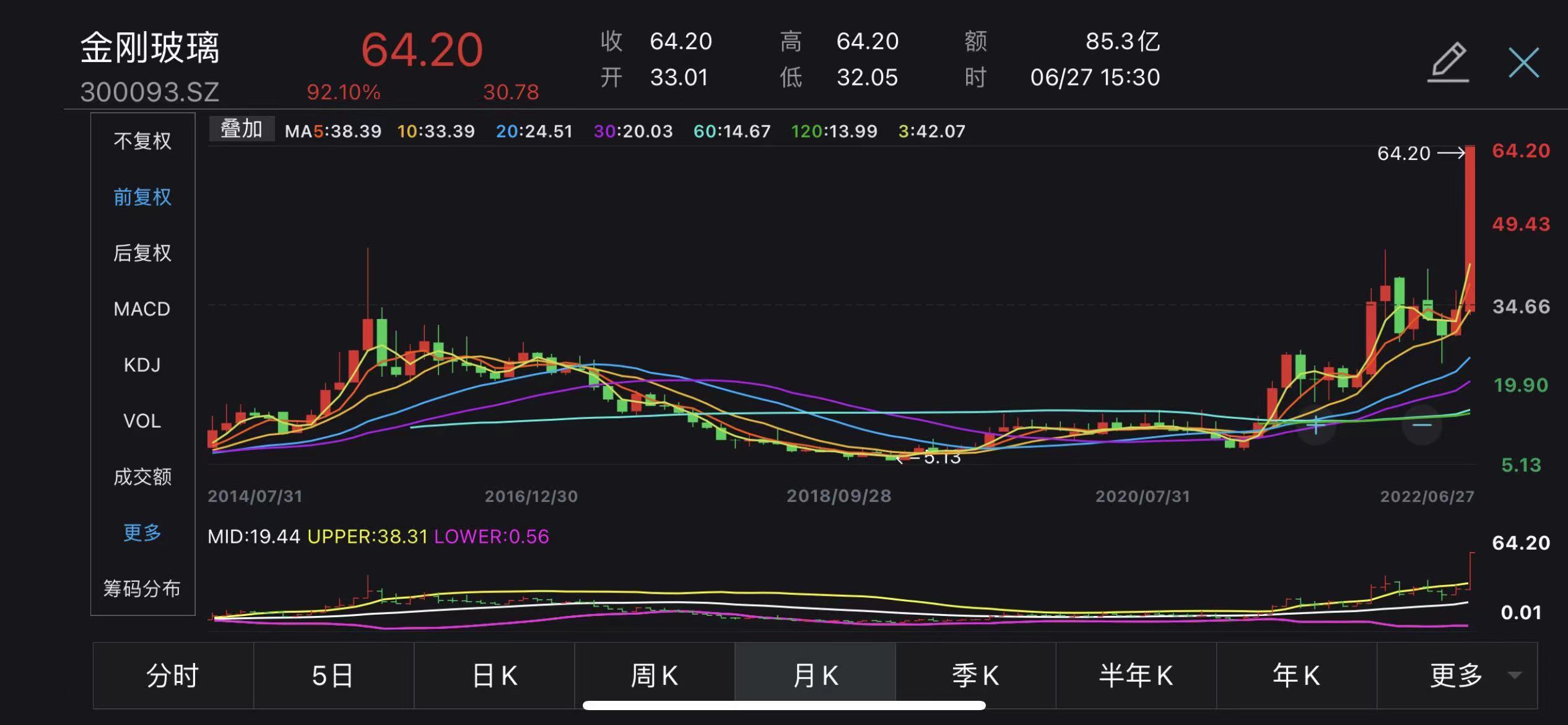

Due to market funds because of the heterogeneous route, the stock price of King Kong Glass has completed nearly 10 times the myth of rise.

Recently, the former private equity champion Luo Weiguang sighed in the circle of friends: "Watching the children who have been in their families who have been in their families have been adopted to study abroad after being adopted by other local tyrants and have a successful career." In fact, King Kong Glass is Luo Weiguang's career. One of the Waterloo, after Luo Weiguang bought a major shareholder at a high price of 21 yuan, he was auctioned at a price of 7.8 yuan.

Today, the stock price of King Kong glass has hit a new high of 64 yuan, and the current market value is nearly 14 billion yuan. He Guangxiong, who had taken over Luo Weiguang's shares with nearly 170 million yuan, may also staged a myth of 8 times the myth.

Vajra glass has risen 10 times, and the former private equity champion Luo Wei Guang sighed

Recently, the photovoltaic sector in the A -share market has gone out of the bull market. Diamond Glass (300093, price of 64.2 yuan, market value of 13.87 billion) Start prices starting from 6.96 yuan on February 9, 2021, as of today's closing to 64.2 yuan.

For former private equity champion Luo Weiguang, King Kong Glass is undoubtedly "eternal pain" in his heart. On June 24th, the new value of the former private equity champion invested in Luo Weiguang in the circle of friends and sighed: "Looking at the children who have been in the family for a period of childbirth, they have gilded their careers after studying abroad after adoption. I feel relieved. "

Luo Weiguang also said in the circle of friends: "It's terrible, Vajra has risen from 7 and a half to 64 yuan a year. After so many years, there are signs of luck. "

"Actually, the background is still the fundamentals of the entire photovoltaic sector industry entering the explosion period, like electric vehicles two years ago, and the heterogeneous knot route of the treasures of the King Kong is expected to stand out and defeat the TOPCON route, like the lithium -lithium line of lithium battery a year and a half ago 'Cases of defeating the Sanyuan route, history is such a coincidence. "

Luo Weiguang also said: "Those who know me should know that King Kong Glass is one of my career Waterloo. In early 15 years, at a price of 500 million yuan per share, I bought a big shareholder status from the founder of King Kong. The hidden price of the owner of the listed company also rose to 50 yuan, but I must admit that I was still stupid and naive at that time. The year of the year was 5 yuan, and it was forced to sell it to the major shareholders of the current Shunde background at a price of 7.8 yuan in August 1998. Two years watched it reborn, hit a new high of 50 yuan last Friday, 63 today. Imitation. Imitation. As in the next world, I can't get back. "

In this regard, the reporter tried to contact Luo Weiguang by phone, but prompting the number to be shut down. A private equity person who had worked with him told reporters, "I also noticed the view of the circle of friends of President Luo. (But I) have left the new value for a long time (inconvenient to comment), but Luo Weiguang's Douyin has a photovoltaic photovoltaic for photovoltaic photovoltaic. Comment on the plate. "

Recently, the stock price of King Kong glass has exploded strongly, and it has risen by 92.1%in June. Behind the strong performance of the stock price, the company's layout of high -efficiency heterogeneous knotting solar cell technology industrialization research and development. , Accelerate the realization of large -scale industrialization. On June 16 this year, Diamond Glass announced that the company intends to jointly invest in the establishment of Gansu King Kong Dedu Lights Co., Ltd., the controlling shareholder Guangdong Ou Hao Group. 4.8GW Efficient heterogeneous battery piece and component project. To this end, the company received a letter of attention from the transaction on June 20, asking the company to verify and explain whether the project meets the local regulatory requirements, and supplement the disclosure of the feasibility research report and other issues.

He Guangxiong nearly 170 million shot Luo Weiguang's shares, now worth nearly 1.4 billion

As for Luo Weiguang's sigh, it was also necessary to start from 2016. At that time, Lhasa King Kong, the largest shareholder of Diamond Glass at the time, wanted to invite Luo Weiguang, the new value chairman of the private placement. At that time, Luo Weiguang held a large number of shares of the company. On the evening of January 22, 2016, the diamond glass announced that the company's then shareholder Lhasa King Kong was transferred to Luo Weiguang on January 22, 2016. Stocks account for 1.333%of King Kong Glass. After the transfer of the shares, Luo Weiguang became the company's largest shareholder.

Regarding the follow -up plan, the announcement stated that Luo Weiguang will start from the perspective of enhancing the sustainable development capabilities and profitability of listed companies and improving the asset quality of listed companies. On the premise of compliance with the capital market and other relevant laws and regulations, it may be twelve in the next twelve in the future During the month, plan to purchase assets to purchase assets.

According to the reporter's understanding, since 2011, Luo Weiguang's new value investment has begun to transform. From the secondary market, he returned to the first -level market. After that, Luo Weiguang suddenly explored a set of new gameplay of "first -level and two linkages". This was the strategy of "first -level market invitation, two -level market payments" in the market at that time. The so -called first -level linkage is actually acquiring equity in the first -level market, and then the stock price of listed companies has risen through capital operations such as listed companies, and then exited.

At that time, the A -share market was popular. As long as the company was reorganized, the stock price rose immediately. Therefore, the products managed by Guangdong New Value Investment achieved a private placement championship in 2009 with a yield of 192.57%. It is worth noting that, in addition to King Kong glass, among the top ten shareholders of*ST East China Sea A, Bearing Gene, etc., they can see the new value of Luo Weiguang's private equity funds. Later, in the context of the regulatory crackdown of flicker reorganization, the concept of shell resource concept stocks of listed companies was hit hard, which made Luo Weiguang's strategy of "first -two linkage" at that time could not play. Soon after Luo Weiguang settled in, due to regulatory campaign to the shell company, the company's stock price fell sharply. Later, Luo Weiguang appeared in a pledge crisis, judicial frozen, and equity. Due to the dispute over the illegal contract of equity, the diamond glass stock held by Luo Weiguang was auctioned on the judicial auction network platform three times by the court. In the auction, He Guangxiong's bid for nearly 170 million yuan.

According to diamond glass, after the auction of the shares of the diamond glass held by Luo Weiguang, with the shares held by He Guangxiong, He Guangxiong will hold 23.765 million shares of King Kong glass, accounting for 11 of the total stock of King Kong glass. %. After He Guangxiong received 23.765 million shares of diamond glass on September 10, 2019, until September 30, 2021, He Guangxiong has always held 23.765 million shares. 2.16 million shares. However, it still holds 21.6 million shares. If He Guangxiong does not continue to sell, as of June 27, his market value has reached 1.387 billion yuan.

Daily Economic News

- END -

Exciting interest rate hike expectations to increase the yield of 10 -year US debt yields

The benchmark 10 -year US debt yields that are regarded as anchors of global asset...

Announcement of the Gansu Provincial Market Supervision Bureau on the Customs Clues of illegal behavior in the field of special equipment

Scope01Hidden reports, lies on special equipment safety accidents02Unauthorizedly ...