Rui Xing and Starbucks "Common Friends" Hengxin Life Sprint IPO: It is intended to raise funds to expand capacity, but there are difficulty digestion risks

Author:Daily Economic News Time:2022.06.27

Hengxin Life Technology Co., Ltd. (hereinafter referred to as Hengxin Life) is an enterprise engaged in the research and development, production and sales of paper and plastic catering tools. Products cover fast food, takeaway, drinks and other catering industries. The downstream customers include coffee brands such as Ruixing Coffee, Starbucks, tea brands such as tea, honey snow ice city, and McDonald's, Hamburg King and other chain fast food brands.

At present, Hengxin Life is sprinting with the GEM IPO. It is planned to raise 828 million yuan for three projects and supplementary mobile funds, including an annual output of 30,000 tons of PLA to compost green environmental protection biological products projects, intelligent upgrade and transformation projects and R & D technology Central project.

Although the company intends to raise funds to expand production this time, from the prospectus (declaration draft), the previous production capacity has not been fully used.

Photo source: prospectus (declaration draft) screenshot

Nearly 90 % of the voting rights of the family

According to the prospectus (declaration draft), Hengxin Life's largest shareholder is Fan Yiru, which holds 36 million shares of the company with a shareholding ratio of 47.06%. Holding 18 million shares and 6 million shares of Hengxin Life, holding 23.53%and 7.84%. The relationship between Fan Yiru and Yande's husband and wife, the daughter of the two people in Yan Shujing, that is, a family of three holds 78.43%of Hengxin Life.

In addition, Hengxin Life's third largest shareholder and seventh largest shareholder are Hefei Hengping Enterprise Management Partnership (Limited Partnership) (hereinafter referred to as Hengfei Hengping), Hengye Hengyan Enterprise Management Partnership (Limited Partnership) Say), holding 6.72 million shares and 1 million shares of Hengxin Life, holding 8.78%and 1.31%.

Among them, the employee holding platform of Hebei Hengping Company and the actual controller holding platform of Hengye Hengyan Company, both of which were controlled by Yan Deping. Therefore, the proportion of Hengxin Life voting rights controlled by Fan Yiru, Yan Deping, and Yan Shujing was as high as 88.52%.

Photo source: prospectus (declaration draft) screenshot

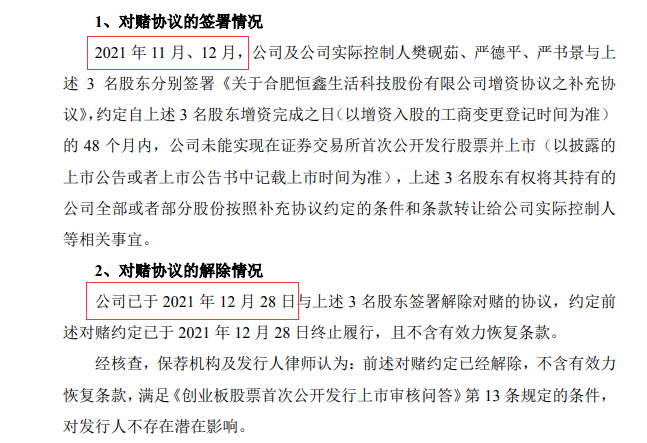

Hengxin Life has also signed a gambling agreement with the investor, and about half a year before submitting a prospectus (declaration draft) to the company.

In November 2021, Hengxin Life introduced investors Hefei Yueshi Jinglang Equity Investment Partnership (Limited Partnership) (hereinafter referred to as Yue Shi Jinglang), Hefei Yue Shi Jinghui Equity Investment Partnership (Limited Partnership) (hereinafter referred to as Yue Yue Shi Jinghui), the share capital increased from 72 million shares to 75 million shares. In December 2021, Hengxin Life introduced the investor Wuxi Fosun Entrepreneurship Investment Partnership (limited partnership) (hereinafter referred to as Wuxi Fosun Venture Capital), which increased from 75 million shares to 76.5 million shares.

Two capital increases, the price per share is 11.68 yuan, which is determined by Hengxin Life's expected net profit in 2021. As of December 14, 2021, Hengxin Life has received a total of 4.5 million yuan in new registered capital paid by Yue Shi Jinglang, Yue Shi Jinghui, and Wuxi Fosun Venture Capital, all of which are contributed by currency. The capital was 76.5 million yuan.

Hengxin Life submitted the prospectus (declaration draft) in May 2022, that is, the aforementioned two introduced strategic investors were only half a year from its submission of the prospectus (declaration draft).

According to the prospectus (declaration draft), three shareholders including Yue Shi Jinglang, Yue Shi Jinghui, and Wuxi Fosun Venture Capital signed a gambling agreement with the company's actual controllers while investing in Hengxin's life. (In the 48 months of the registered registration time of investment in capital increase), the company failed to realize the first public offering of shares and listing on the stock exchange (based on the disclosed listed announcement or the listing time of the listing announcement), prevailing), prevailing), prevailing), prevailing), prevailing), prevailing for listing time), prevailing). The above three shareholders have the right to transfer all or part of the company or some shares in accordance with the conditions and terms stipulated by the supplementary agreement to the company's actual controller and other related matters.

However, on December 28, 2021, Hengxin Life agreed with the above three shareholders that the aforementioned gambling stipulation has been terminated and performed, and it does not include effective recovery clauses.

From time to time, Hengxin Life signed a gambling agreement with three shareholders, either for more than a month, or "quickly" that month.

Photo source: prospectus (declaration draft) screenshot

Can the new capacity be digested?

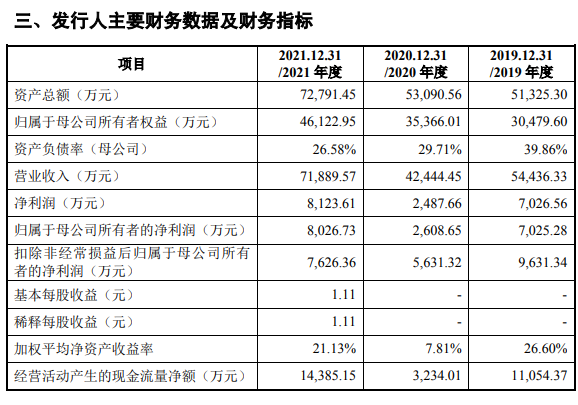

From 2019 to 2021, Hengxin Life realized operating income of 544 million yuan, 424 million yuan, and 719 million yuan, respectively, and realized net profit of 70.2528 million yuan, 260.86 million yuan, and 80.267 million yuan.

This time, the 538 million yuan raised by Hengxin Life will be used for an annual output of 30,000 tons of PLA. The project, which is also 150 million yuan to supplement liquidity.

From 2019 to 2021, the capacity utilization rate of Hengxin Restaurant catering tools was 95.47%, 69.77%, and 77.64%, respectively, and the capacity utilization rate of plastic catering utensils was 70.97%, 52.35%, and 72.29%, respectively. In terms of products, the capacity utilization rate of paper cups, cups, and plastic cups in 2021 was 77.04%, 81.22%, and 73.05%, respectively.

The production model of Hengxin Life is combined with "sales of production" and "reasonable inventory", that is, formulating production plans and organizing production based on customer orders and its needs, customized products and inventory conditions. Hengxin Life stated that in 2020, affected by the new crown epidemic, overseas orders declined, the company's operating rate decreased, and the company's product output and sales declined; in 2021, with the normalization of the new crown epidemic and the company's vigorous development of the domestic market, the company's output was The sales volume has gradually rebounded, but due to the tight shipping capacity caused by international trade, the stressful shipping capacity caused by the epidemic situation, the production capacity climbing phase of the new subsidiary Hainan Hengxin Shang, and the electricity limit in the second half of 2021, the company's output is still subject to certain restrictions. The capacity utilization rate of some products is lower than 2019.

Earlier production capacity has not been fully utilized.

Photo source: prospectus (declaration draft) screenshot

Hengxin lived in the prospectus (declaration draft) that the company's capacity scale needs to be further expanded. The company said that with the continuous advancement of the prohibited plastic restriction policy and the "double carbon" goal, large -scale catering companies and other downstream customers have gradually increased the application of environmentally friendly catering tools. With many years of technical accumulation and advanced production technology, the company's main products are at home and abroad. The market has strong competitiveness. The company's main product market has a broad prospect. In order to meet the growing order needs of core customers or newly developed customers, the company needs to further expand the scale of production capacity.

The prospectus (declaration draft) introduces that one of the "annual output of 30,000 tons of PLA can compost green environmental biological product project" plan to build a smart factory. Bowls, knife fork spoons, straws, etc. The project will expand the capacity of the company's PLA to decompose catering tools, increase the company's share in the biodegradable catering market, and consolidate the company's advantageous position in the biocrangable catering market.

However, Hengxin Life also prompts risks. After all the investment project raised funds is reached, the company will add an annual output of 30,000 tons of PLA to decompose the production capacity of dining tools. The company's capacity digestion is mainly affected by changes in the demand of downstream industry. If the company's downstream market demand is unfavorable, or the market is inadequate, the company may face the risk that new production capacity is difficult to digest.

Daily Economic News

- END -

Cangzhou Renqiu: Explore a new model of rural static traffic safety management

Ji Shi client reported (Hebei Taitai Ren Yadong Li Decai Xu Bing Road) Recently, i...

Shandong Province Enterprise: Increase scientific and technological innovation to serve the major development strategy of the province

Qilu.com · Lightning News, June 23, Shandong's innovation assessment and distrib...