Lost stocks are coming!Involving 3D visual perception and smart retail!Does this new stock have a purchase value?—— New stock radar

Author:Daily Economic News Time:2022.06.27

Source: WeChat public account "Daida" (WeChat public account ID: daoda1997)

Recently, the broader market is extremely strong. The Shanghai Index has risen all the way after seeing the low of 2863 on April 27. By the current two months, it has increased by more than 17%.

During this time, the new stock market was also excellent. In addition to the breakage of several new stocks in the Beibei Stock Exchange, the new stocks in the Shanghai and Shenzhen market made money by making money. In the market, there are new shares with more than 50,000 yuan in revenue such as Yuneng Technology and Huaqing Haike.

On June 25, the National Financial and Development Laboratory and the Institute of Finance of the Chinese Academy of Social Sciences jointly held a symposium on a comprehensive registration system to discuss the relevant topics of the registration system. Some people in the industry have made it clear that the comprehensive registration system has gradually approached.

If the full registration system comes, the new stocks of the Shanghai and Shenzhen Main Board will have no limit on the decline in the first day, and there will be no current valuation restrictions. Next, when the market may fall into a shock, the new stocks of the Shanghai and Shenzhen Main Board may have a break. Therefore, in the future, learning shareholders will occupy an advantage. How to analyze and judge the value of new shares will become the key.

Closer to home, enter today's new stock radar. Recently, the new stock market is good. In addition to the good love, the valuation and texture of many new stocks are also very good.

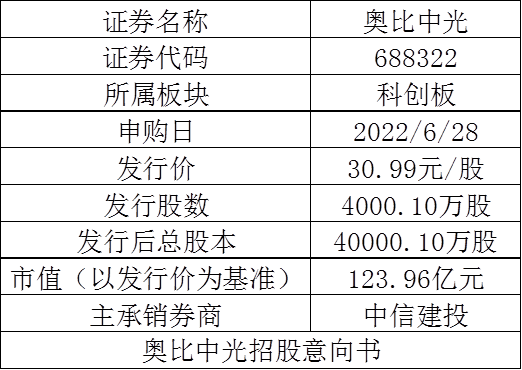

However, on June 28, there will be a loss stock Obi Zhongguang (SH688322, a stock price of 30.99 yuan, and a market value of 12.396 billion yuan). This company also involves the concept of smart cities and smart retail. So, does the company purchase value? Which partition will our new share radar divide it?

basic situation

Obi Zhongguang is the first to carry out the systemic research and development of 3D visual perception technology in China. It independently develops a series of deep engine digital chips and a variety of specialized photosensitive simulation chips and realizes one of the few enterprises with industrialization applications of 3D visual sensors. Companies that can provide core independent intellectual property 3D visual perception products are also a few companies in the world with six comprehensive layout of six major 3D visual perception technology (structured light, ITOF, double eyes, DTOF, LIDAR and industrial three -dimensional measurement).

From 2018 to 2021, the company's operating income was 210 million yuan, 597 million yuan, 259 million yuan, and 472 million yuan. The net profit of the same period was -101 million yuan, -516 million yuan, -615 million yuan, and -615 million yuan, respectively. -3.11 billion yuan. It can be seen that the company's revenue has increased steadily in recent years, while the loss limit has gradually decreased since 2020.

Industry situation

3D visual sensors can allow smart terminals to have 3D visual perception capabilities, so that smart terminals evolve from "seeing the world" to "understanding the world".

In China, the 3D visual perception industry is an emerging industry. After nearly ten years of exploration, research and development, and application, an industrialized chain of the upstream, middle reaches, downstream and application terminals has been formed.

With the continuous introduction of support policies and the continuous improvement of business maturity, 3D visual perception technology and products have gradually expanded to biometrics, AIOT, consumer electronics, industrial three -dimensional measurement, automobile autonomous driving, etc. Continuously growing, the industrial chain has become more perfect, and the attention and recognition of application scenarios have been continuously improved, which provides a favorable industrial macro environment and policy environment for the development of the company's related business.

According to the global 3D imaging and sensing market research report released by the French market research and strategic consulting company, the global 3D visual perception market size in 2019 is US $ 5 billion, and the market size will develop rapidly. It is expected to reach $ 15 billion in 2025. The compound growth rate from 2019-2025 is about 20%.

Obi Zhongguang's industry has grown rapidly, which has also increased the performance of the company's first day of listing.

Valuation comparison

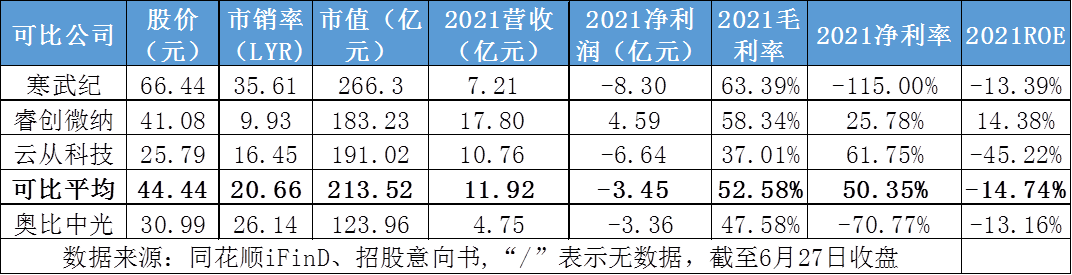

Because Obi Zhongguang is a loss stock, the comparative price -earnings ratio does not make much sense.

According to its prospectus, the company's comparison company includes Cambrian (SH688256, the stock price of 66.44 yuan, a market value of 26.63 billion yuan), Ruinko Weisen (SH688002, the stock price is 41.08 yuan, the market value is 18.320 billion yuan), Yuncong Technology (SH688327, the stock price, the stock price 25.79 yuan, a market value of 19.100 billion yuan). As of the closing of June 27, the average static marketing rate of these three companies was 20.66 times, while the static marketing rate of Obi Zhongguang was 26.14 times.

Therefore, the company's market sales rate is actually higher than comparable companies.

New emotions

Obi Zhongguang belongs to the science and technology board stock. In the last 10 trading days, the science and technology 50 index rose 1.38%. The company's computer, communication and other electronic equipment manufacturing industries have risen 5.37%in the past 10 trading days. In the last day, 10 new shares of science and technology boards have been listed, with a breaking rate of 10%on the first day.

It can be seen that the market trend of Obi Zhongguang's industry and sector is good, and it is better to play new emotions.

final conclusion

On the whole, although Obi Zhongguang is a loss -making stock, the loss limit is gradually becoming smaller. The company's industry is very imaginative, and the new emotions of the sector and the industry are very good.

Dogo's new observation group divided new shares into four sections according to small to large risks from small to large, namely a comfortable area, a strong neutral zone, a neutral weak area, and a cautious area.Based on the above information, it can be divided into a neutralized zone.(This article is only the analysis of the new shares of Dazo's new observation group. It is not operating guidance and investment suggestions. It is for reference only. Based on this, the risk is on the market.)

Daily Economic News

- END -

[Mind Guardians] Gulin County Administrative Examination and Approval Bureau: Do not worry about "cross -provincial running" to solve people's worries in different places

The medical expenses for reimbursement have been received. I didn't expect it to b...

One picture understands: 44 foreign trade and stable foreign tax support policies

109 preferential taxes and fees support rural revitalization!One picture to unders...