Several states of the Beijing Stock Exchange: Last year, it invested in R & D 3.3 billion patent intensity second only to the science and technology innovation board

Author:Cover news Time:2022.06.27

Cover Journalist Xiong Yingying

With the listing of Youji Co., Ltd. on June 24, the number of listed companies in the Beijing Stock Exchange officially exceeded a hundred. According to statistics from reporters, as of now, the total market value of a hundred listed companies has reached 209.987 billion yuan, of which the market value of three companies exceeds 10 billion.

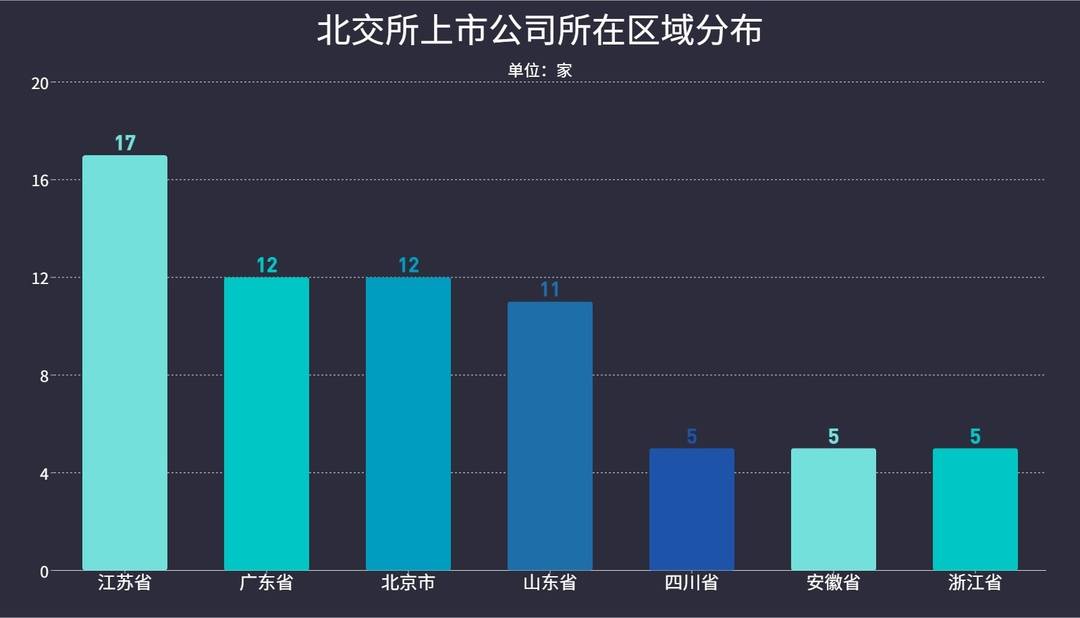

According to the region, 100 listed companies are distributed in 23 provinces and cities and autonomous regions in the country, of which the number of listed companies in 7 provinces and cities in Jiangsu, Beijing, Guangdong, and Shandong Province has reached 5 or more. From the perspective of regional distribution, it is mainly concentrated in the eastern coastal areas.

The number of listed companies in the North Stock Exchange of 7 provinces and cities reached 5 or above

According to the Shenwan industry, 100 listed companies are widely distributed in 19 industries, of which the number of enterprises in the machinery and equipment industry is the largest, with a total of 20 companies; followed by 11 automotive industries, 10 pharmaceutical creatures, 9 computer industries, 8 basic chemical industry, 8 basic chemical industry Essence

Nine companies last year's net profit exceeded 100 million yuan

Over 70 % of the cash dividend plan

From the perspective of market performance, Baijia listed company achieved a total of 70.466 billion yuan in 2021, and its net profit was 7.625 billion yuan, and more than 60 % of the company achieved a year -on -year increase in net profit.

Among them, Betry is the only company with a revenue of more than 10 billion yuan and a net profit of more than 1 billion yuan. In 2021, its revenue and net profit were 10.491 billion yuan and 1.441 billion yuan, the increase of more than 100%. In addition, eight companies have a net profit of over 100 million yuan last year.

Nine companies last year's net profit exceeded 100 million yuan

A few days ago, the company released a draft fixed -increase case to issue the total amount of funds raised by the shares of specific objects of not exceeding 5 billion yuan, and it was used for an annual output of 200,000 tons of lithium battery negative electrode material integrated base project project (first phase). This is also the largest re -financing of the Peking Exchange.

Betry said that the company ranked first in the world as the number of negative materials for many years of shipments. The product demand continued to be strong. At this stage, it has faced the bottleneck of the production capacity of negative materials. After the investment project raised by this time, its production capacity of its negative electrode materials will be greatly increased, which will help meet the needs of customers at home and abroad, and consolidate and enhance the company's profitability.

In addition, it is worth mentioning that last year, the Bei Stock Exchange exceeded 70%of the listed companies released a cash dividend plan, with a cumulative dividend amount of 2.094 billion yuan, and the cash dividend rate of 35 companies exceeded 40%.

Last year's R & D expenditure exceeded 3.3 billion yuan

Patent intensity is second only to science and technology board

As a gathering place for SMEs for "specialized specialty", 22 companies in the Beijing Stock Exchange have 22 members of the Communist Party of China.

What are the technological strength of these companies? Data show that the total R & D expenditure of Baijia listed companies last year was 3.339 billion yuan, and the average proportion of R & D investment was 6.87%. Among them, 22 companies have invested more than average R & D investment, 5 companies have invested in R & D investment exceeding 20%, and Noserland's R & D investment accounts for up to 75.98%.

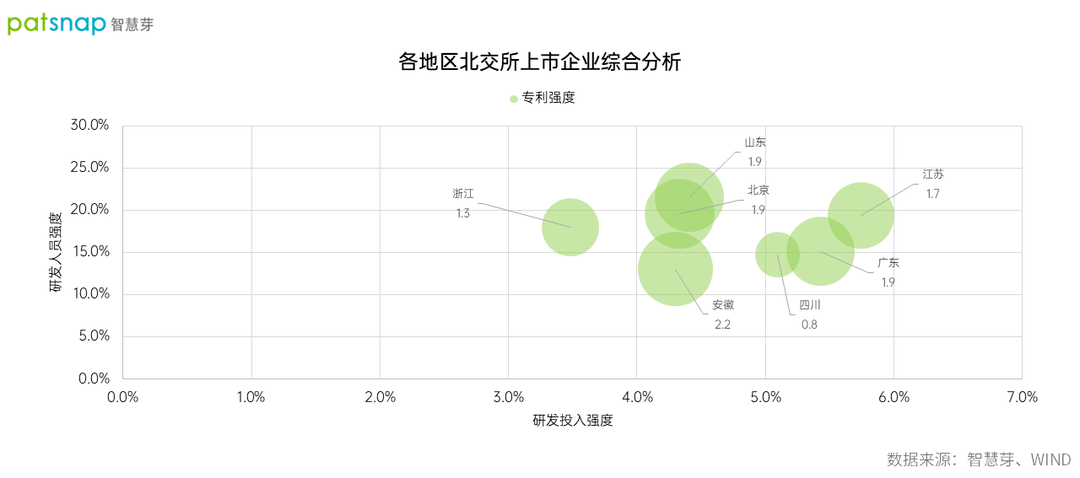

In terms of R & D investment intensity, the proportion of R & D investment in listed companies in three regions in Jiangsu, Guangdong and Sichuan Province accounted for more than 5%, respectively, 5.7%, 5.4%, and 5.1%, respectively.

Analysis of patent intensity of listed companies (pictures based on smart buds)

Patent is also one of the important indicators to measure corporate scientific and technological strength. According to smart bud data, as of June 24, the total patent application of 100 listed companies in the Beijing Stock Exchange was more than 9,200, and the total amount of effective invention patent was more than 1,300. On average, the patent application volume of the listed enterprise of the Beijing Stock Exchange is about 93, and the valid invention patent volume is about 13.

From the perspective of patent intensity, the average valid invention patent corresponding to the revenue of the listed company of the Peking Stock Exchange is about 1.9, second only to the science and technology board (4.5 pieces), higher than the motherboard (0.5 pieces), GEM (1.6 1.6 ) Among them, the patent intensity of listed companies in the four regions of Anhui, Beijing, Shandong and Guangdong is higher than the average level of the Peking Stock Exchange.

Public Fund Fund Plus Warehouse Beibei Stock Exchange

The quality of listed companies needs to be further improved

Judging from the market performance of listed companies in the Beijing Stock Exchange, the operation has remained stable, and the science and technology attributes are relatively obvious. At the same time, institutional investors have also improved the recognition of the Bei Stock Exchange.

According to data from the research report of Soochow Securities, the total market value of the Central Beibei Stock Exchange of Public Fund 2022Q1 Heavy Warehouse was 2.161 billion yuan, an increase of 91.33%month -on -month. Institutional investors actively participate in the investment of the Peking Stock Exchange will not only benefit the improvement and rationality of the market liquidity of the Peking Stock Exchange, but also show that the market's recognition of the Bei Stock Exchange is gradually increasing.

In the view of Zhou Yunnan, the founder of Beijing Nanshan Investment, it has been opened on July 27, 2020 for nearly 2 years. It has been on the market for nearly 2 years. After changing the large -scale expansion of the innovative layer, the pace of listing of the Beijing Stock Exchange will accelerate and the texture will become better and better.

"The texture of the listed company determines the texture of the exchange, so the Beijing Stock Exchange also urgently needs a number of high -quality enterprises to listed." Zhou Yunnan believes that it can improve the texture of the enterprise from three aspects. First, it is given a new special specialty of the national specialty. Little giants and single champion companies are more unobstructed to list "fast lanes"; the second is to attract more subsidiaries of listed companies to the North Stock Exchange; third, moderate release of industry restrictions, actively accept the cannot apply for science and technology boards, entrepreneurship, entrepreneurship, entrepreneurship, entrepreneurship The board but not a negative list of the Beijing Stock Exchange.

- END -

Hunan Lintong successfully signed 4 projects in the Pearl River Delta

From June 13th to 16th, Li Yuchu, the secretary of the Linyi County Party Committe...

How to innovate the marketing of pharmaceutical companies?| Jianzhi Big Coffee Live

Under the trend of policy transformation, what exactly is the marketing innovation...