There are many fraud routines for "pension", how do you know?Look at this, help our parents keep the house!

Author:Gansu Provincial Higher People Time:2022.06.27

"Uncle, let's listen to health lessons, get eggs when you listen!"

"Aunt, this investment is high, low -risk, the money is right!"

...

These words must be more or less heard of the elderly. Around the malls and communities, some seemingly enthusiastic salesmen always love to hold the uncle and aunt who can buy vegetables in various introductions. With a little carelessness, uncle and aunt may fall into the trap of fraud. What is even more vigilant is that in recent years, some criminals have become bigger and bigger. I remembered the living place of the old people.

News picture

According to media reports, with the rise of "old -age care", some fraud methods also "keep up with the times" as a camouflage and cover up.

The so -called "pension with houses" is that the elderly mortgage the housing owned by property to a specific financial institution and obtain loans for pension. The elderly still retain the right to housing in the house. The elderly who "real estate and cash in their hands" provided a new path of pension, and gradually became known.

Although many people know that the house can be aged, I don't know how to use the house for the elderly. As a result, some people smelled "business opportunities", and even advertised "raising children to prevent old age, and more reliable for the elderly with houses".

According to media surveys, some criminals use "house pensions" as an investment wealth management project, which specifically aimed at the "silver -haired family" sales of houses; Moon enjoy high returns at home.

News picture

Will there be such a fragrant "pie"? actually not.

Li Li, deputy president of the Beijing Financial Court, told reporters that in recent years, some illegal companies and personnel have undergone the banner of "pension with houses" to perform fraud against the elderly, which has led to being deceived in the situation of households. Will be sued in court by third parties.

She analyzed that one of the reasons why such "routine loans" are difficult to eradicate is that the perpetrators are generally familiar with the law. They use the characteristics of the elderly to trust others, weak evidence, and the urgent psychology of seeking investment and financing channels. Seeking illegal tools, putting on the "jacket" of confusing people into a "house -care" wealth management project, and then illegally possess the elderly real estate.

News picture

"For the first time I came into contact with this type of routine loan, the biggest confusion at that time was. From a formal point of view, the plaintiff’s evidence chain was complete and standardized, while the defendant's old man except for the statement in court. No. "Li Li said.

News picture

So, what is the operation of the household loan? What are the characteristics of this scam? How to identify it? How can I defend their rights? The reporter specially invited relevant legal experts to explain in detail.

Guest:

Wang Lei: Associate Professor

Shu Rui: Vice President of the Financial Street Court of the People's Court of Xicheng District, Beijing

ask:

How to identify fraud should be distinguished by the household -reinforcement business and loan fraud in the pension of the house?

Shu Rui: The formal "housing pension" is an insurance product. The full name is "Housing Reverse Mortgage Pension Insurance", and the false "house -care care" has its own routines. The difference is as follows:

First, formal insurance institutions will be operated by professional insurance institutions, and other financial institutions will appear in non -formal;

Second, the formal "old -age care" will not have loan contracts, house trading contracts, and financial contracts;

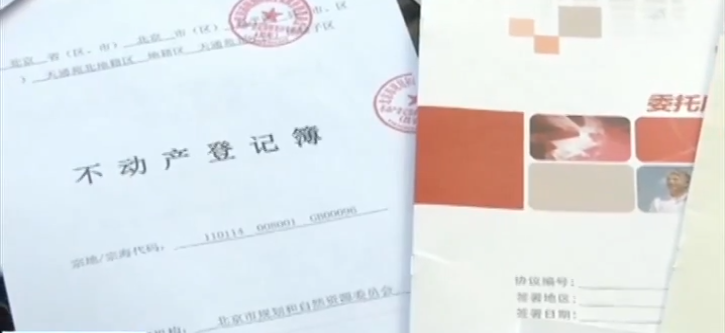

Third, the regular "house -care" insurance company only needs to mortgage the house, and the ownership of the house always belongs to the elderly (that is, the owner of the house). Only after the old man died, the insurance company can deal with it.

ask:

In practice, how do you operate with a pair of household loans?

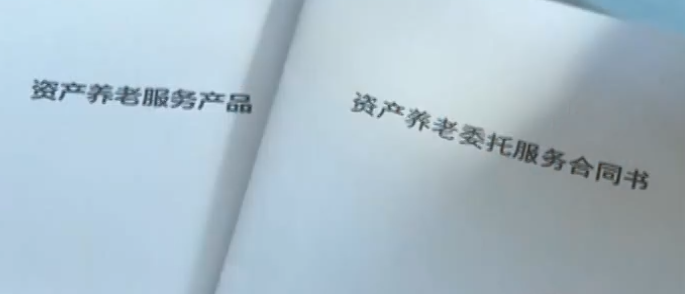

Shu Rui: Many criminals perform various interpretations of "old -age care", and even under the banner of national policies, and deceive the elderly with authoritative institutions as "gimmicks". For example, an institution called "Zhong'an Minsheng Pension Service Co., Ltd." sold the so -called "house -care products" to the elderly, which is the banner of national policy encouragement to declare that "house pension is an industry supported by the government." But in fact, the "old -age care" they said, and the pension encouraged by the country, is not the same thing at all.

In addition, the scammers not only induce high interest, but also seduce the elderly to participate in the name of free travel, free "famous teachers", and thank you meetings. In the process, the company's personnel will instill the "old -age care" to the elderly. All kinds of benefits.

Wang Lei: The criminal operators who land loans often exaggerate publicity, such as claiming that they have an official cooperation background, or they are called "national projects" to obtain the trust of the elderly.

The operators who land loans often arrange their staff as the trustees who sell or mortgage registration procedures such as agency houses or mortgage registration procedures.

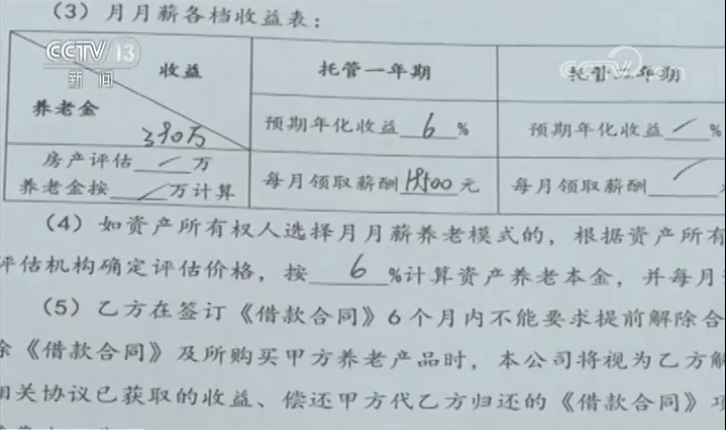

The contract structure is complicated, and there are many contracts and provisions to sign. Such as the loan contract, the mortgage contract, the commission contract, the repayment contract, the pension service agreement, etc. These contracts will form a "closed loop" in law, and it is difficult for people who do not have the ability to judge the corresponding professional judgment.

ask:

What are the forms of household scams? What is it?

Shu Rui: One is that scammers mix the house buying and selling contracts in various documents, touch the fish in muddy water, and deceive the elderly to sign; and the other is to trick the elderly to sign the commission notarization. This form will give the scammer to sell the elderly houses. In addition, in some "old -age care" scams, scammers will contact financial institutions to apply for house mortgage loans for the elderly. Loan; In order to stabilize the elderly, the scammers will pay off a few issues of loans first and pay the corresponding income to the elderly, and then go well; and the financial institutions that cannot receive the model will ask the elderly to repay, otherwise the auction house will be auctioned.

In this scam, if the financial institution does not know the scam and the subjective does not participate in the scam, the rights of the elderly will become difficult to maintain. The cash flow of the most convenient transfer was obtained.

ask:

What is this scam operation process that can form a "closed loop"?

Wang Lei: In this process, the elderly first mortgaged their own houses, signed a loan contract with the investors who paid money, and then "invested" the money borrowed into the so -called "financial management project" of the old house. The "income" as pension; the financial management party who launched the "financial project" pays interest to the investors who borrow money to the elderly.

In the process, the elderly will sign a series of related contracts under the arrangement of the so -called staff, and entrust the staff of the financial management party to handle the house sale and mortgage registration procedures on their behalf. Among them, some savvy criminals also bring the elderly to notarize, and the notarized mortgage contract is given mandatory execution.

The financial management party brought together a large amount of funds. After these funds were diverted by him, the financial party achieved its own purpose and began to "decume" and no longer repay for the elderly. For the house mortgaged by the elderly, the houses of the elderly are forced to execute.

ask:

How to identify the old house scams and how to prevent it?

Shu Rui: First of all, let's calm down, open his eyes while holding his pocket, and carefully distinguish it.

The tight pocket here, not only do you not allow the money to go out, but also to prevent those money (investment projects) who "come to the door" (investment project). The name of the name is to be careful, because the interests in front of you may just be bait.

Secondly, don't be greedy for cheap. As the saying goes, "Take the hands short", many scammers will "fishing big fish" with small lips, first attract attention with exquisite gifts, just reduce the psychological defense line, and then use the psychology of people who cannot open their face. Real.

Third, it is also necessary to keep in mind. "Pension with a house" is an insurance product, not investing in wealth management projects or products (at least not yet). If someone says that "the old -age care of the house" is a project for investment and financial management, and it is guaranteed to "make it stable and not pay", you must pay attention.

Wang Lei: In the face of a variety of pension products, the first is to analyze the business logic behind the service, which is vigilant enough for abnormalities. Sign your signature on the "House Pension" related contracts and be cautious when printing. It is best to seek professionals to help identify the content of the contract.

Second, to increase the awareness of preventing fraud, for pension investment projects that claim to be low -risk or even risk -free and high -yields, we must improve their vigilance and seek professional help in time for the problems that exceed their judgment.

Third, enhance the consciousness and ability to save and collect evidence.

ask:

How should I defend their rights after being cheated?

Shu Rui: If there is a dispute, it is recommended to report to the relevant departments and public security organs, and request recover the money to be cheated. This is conducive to timely preservation of evidence; at present, the 12337 intelligent reporting platform has opened the "pension fraud" report channel, and many places have set up a special class of "pension fraud" clues. The reporter can report the problem by logging in to the corresponding platform or directly call 12337 to reflect the problem to the 12337 intelligent reporting platform.

If these channels cannot be resolved, or if there are controversy and cannot make a judgment, they will sue to the court.

Here, Judge Li Li particularly reminded friends: When signing the contract, no matter how busy she is, no matter how tight the other party urges, and how much it needs to be signed, everyone should not be troublesome. See you carefully before signing. In the court, this is evidence. For multi -page contracts, it is recommended to sign for each page, and all agreements must be left in their own hands to prevent the other party from replacing it.

Be sure to remember two sentences:

If you remember the interest of others, others may be thinking about your principal.

There is no free lunch in the world, and the free one may be the most expensive.

Source: Rule of Law Daily

Author: Rule of Law Daily All Media Reporter Lin Nantu Liu Ziwei Chang Hongru

Editor: Ji Xueyong Ma Jianwei Editor: Fu Yanyu

- END -

Blowing high -quality development "Assault" -An Gansu Province in the second half of 2022, major projects concentrated on start -up activities

Starting the event site.New Gansu · Daily Gansu.com reporter Wang ZiyiJinchang Ji...

No. 95 gasoline entered the "10 yuan era"

Jimu Journalist Wang YongshengVideo editing Wang YongshengVideo/Snapshot, T_100, F...