Detoning a major case of financial fraud, the "artificial diamond king" delisted!4 delisted a day, and the number of delisting in June was recorded

Author:Dahe Cai Cube Time:2022.06.27

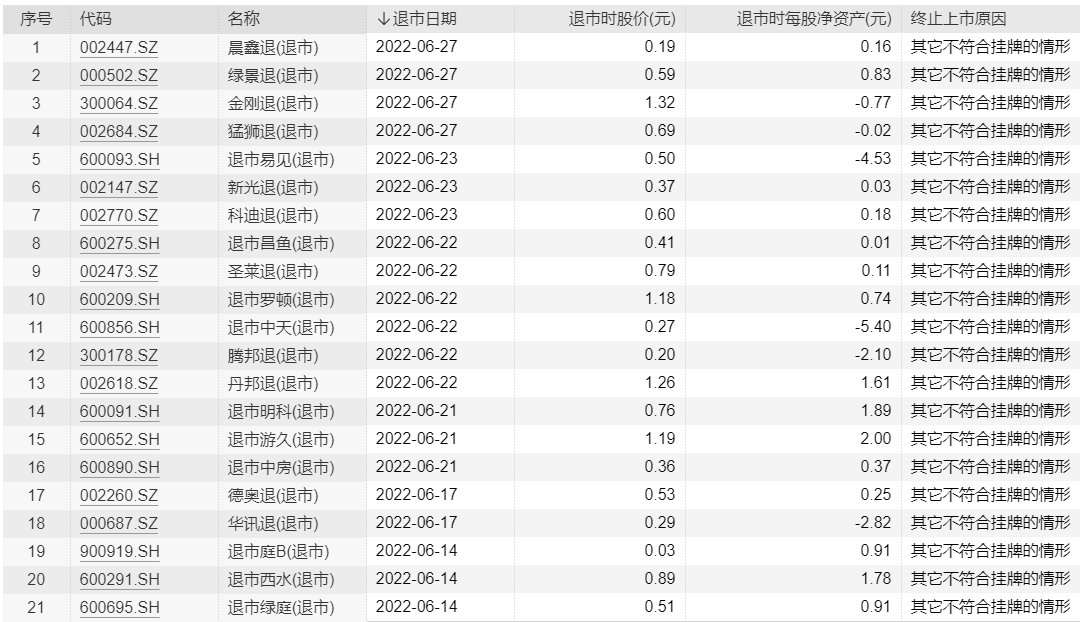

On June 27, Lvjing retired, Chen Xin retired, Mammoth retreat, and Vajra retreating four companies were delisted on the exchange and said goodbye to A shares on the same day.

Since June, the number of A -share delivery companies has reached 20, and the delisting of Xiahua and the delisting Global will also be delisted this week. The number of delisting in June will set a record. With the implementation of the most stringent delisting rules, it is expected that more than 40 companies will withdraw from the A -share market this year.

Photo source: Wind4 company was delisted on the same day

On the evening of June 26, Lvjing retired, Chen Xin retired, lion retreat, and Vajrayana issued an announcement. The company's stock will be delisted by the exchange on June 27.

According to the announcement, the above four companies' shares entered the delisting period on June 6, 2022. It has been traded at the dealer of fifteen transactions during the delisting and finishing period. The final trading day is June 24, 2022. The company's stock has been decided to terminate the listing and will be delisted on June 27, 2022.

Data show that during the delisting period, the price of green scenes, Chenxin retreat, and lion retreat all dived sharply. However, King Kong retreated to the "Doomsday Carnival", and the last 10 trading days continued to skyrocket, with a cumulative increase of nearly 90%.

According to Wind data, as of June 24, the stock price of only Vajrayana withdrawn from the above four companies exceeded 1 yuan, and the rest were less than 1 yuan, of which the lowest was Chen Xin retired, and the final stock price was only 0.19 yuan. In addition, the net assets per share of the four companies at the time of delisting are also less than 1 yuan, and the highest green view is only 0.83 yuan. -0.02 yuan.

Triggering financial delisting red line

According to the announcement, Chen Xin's retirement, green scene retirement, King Kong retirement, and lion retreat were forcibly delisted for triggering the red line of financial delisting. The above four companies have their own glorious history. Some have been veteran companies in the industry, some have been in the industry leaders for many years, and some have been hot -bull stocks in the market. In the crisis, I eventually had to say goodbye to A shares.

According to the data, Lvjing Holdings is one of the earliest listed real estate companies in China. It was listed in A shares in 1992 and has been nearly 30 years. However, due to various reasons, the real estate development bonus was missed, and he was taken over by Evergrande in 2002, and was once renamed "Evergrande Real Estate", but after a few years, he changed hands to transfer. After 2010, the company gradually withdrew from real estate and began to transform education and medical care industries, but failed to succeed.

Vajrayana has been a leading enterprise in the domestic artificial diamond industry. It is mainly known as super hard materials such as artificial diamonds and artificial diamond accessories. It is called "artificial diamond king". However, the results suddenly changed their faces in 2019 and detonated a major case of financial fraud. Due to long -term systematic financial fraud, the amount of the case was huge, and the illegal nature was serious. In the end, 13 related parties including the company and the actual controller were severely punished.

Photo source: Wind lion retreat to the Shenzhen Stock Exchange in 2012. Because of the many popular concepts such as lithium batteries, charging piles, energy storage, etc., it was enthusiastically sought after after listing. The stock price soared 6 times from 2014 to 2015 6 times. Essence Since then, the lithium battery sector has been expanded, and the company's territory has expanded sharply, but the problem of the event chain caused a debt crisis.

There will be more than 40 delisting in the year

In 2021, the number of A -share delisting companies was 22. With the implementation of the most stringent delisted new rules, this year A shares ushered in the largest delisting wave.

With the collective delisting of the above four companies, since June, 20 companies have been forcibly delisted. Since the end of the 2021 annual report, the pace of delisting on the Shanghai and Shenzhen Exchange has continued to accelerate, and 40 companies have received a decision on the termination of the exchange.

On the evening of June 26, Tianchuan retired, Dewey's retirement, and public retirement also issued an announcement saying that the final trading day is expected to be June 27. In addition, Poode retirement and Donghai A's expected final trading date is June 28; the final trading day for the retirement of the network is June 29; the delisting Xiahua and delisting Universal will be delisted on June 30.

Responsible editor: Yang Zhiying | Audit: Li Zhen | Director: Wan Junwei

- END -

Special action!Comprehensive investigation and governance →

A few days ago, the Hubei Provincial Market Supervision Bureau focused on the impl...

Gansu Gannan Prefecture issued an action plan to accelerate the construction of the rural delivery logistics system

Recently, the Gannan Prefecture Government of Gansu Province issued the Gannan Prefecture to accelerate the construction of the rural delivery logistics system construction action plan (hereinafter