80 billion yuan in funds in the north!Moutai was hot again, and the net flow in the past 10 billion yuan!Such stocks have been reduced

Author:China Fund News Time:2022.06.26

Source: Data treasure

The net inflow of funds in the north was 80 billion yuan.

This week, the A -share market fluctuated, and rose slightly on Friday. The Shanghai Index rose 0.89%a week. This week, the funds from the north were flowing out and then flowing back. Among them, the net inflow of more than 12 billion yuan on Thursday was 4.064 billion yuan in net inflows in a week.

From the perspective of the industry, after many consecutive weeks, the capital position of the north has maintained a high level. This week, a total of 22 industries have been decreased by the shareholding of funds in the north. The weekly increase of power equipment, public undertaking, and car holdings increased by more than 1%.

Multiple resource sectors have been greatly reduced by funds in the north. Except for the comprehensive industry, steel, non -ferrous metals, petroleum petrochemicals, and basic chemical holdings have been at the forefront. From the perspective of the market, the reduction of resource stocks has a certain degree of callbacks this week. The non -ferrous metal and petroleum and petrochemical industry index fell 2.63%and 4.96%this week, respectively.

The decline in resource stocks is related to the recent price reduction of commodities. Statistics show that this week's 11 main contracts have fallen by more than 10%, including iron ore, coking coal, nickel, etc., and others are copper, PVC, methanol, 苯, etc. above. Looking at the world, the major overseas products have also showed a downward trend. The Federal Reserve has recently announced that it has raised the federal fund interest rate target range. Consumer commodity demand has weakened, and commodity prices are affected.

From the perspective of the continuity of the increase and decrease, the power equipment industry has continued to increase its position in the near future. Zhejiang Business Securities Research Report believes that since 2022, steady growth has become an important proposition, and power grid investment projects are expected to increase. During the "Fourteenth Five -Year Plan" period, the planned investment of State Grid and South Network invested nearly 3 trillion yuan, with an average annual 580 billion yuan, a new high. In 2022, the epidemic disturbance caused the investment progress to be delayed, and the increase in economic pressure and the implementation of stable growth policies, and subsequent planning projects are expected to land quickly. In terms of reducing holdings, the real estate industry has been reduced to the north to reduce its holdings in the north for nine consecutive weeks.

Guizhou Moutai has received 11.1 billion yuan in net funds in the north in recent times

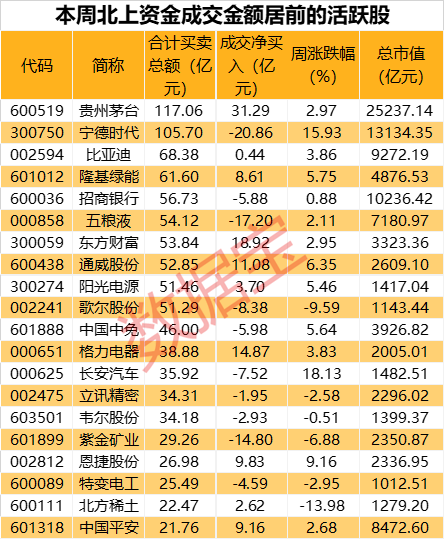

According to statistics from Data Bao, a total of 30 shares on the north will be on the list of active transactions in the north. From the perspective of its industries, the total volume of electrical equipment has exceeded 30 billion yuan, and food, beverage, electronics, and automotive stocks are also active this week. Above. Before the purchase of non -silver finance and household appliances stocks, electronics and non -ferrous metal stocks have obvious net outflows.

Guizhou Moutai has once again won the favor of the funds in the north. In the past, it has been increased to the north to continue to increase the funds. A total of 11.147 billion yuan was bought, and the stock price increased by 14.46%during the period. On Friday, the Moutai stock price station in Guizhou was 2,000 yuan, and the total decline since February has receded. Next week is the date of registration and division of Moutai dividends in Guizhou. The total dividend is 27.228 billion yuan. The company has been in the company for three consecutive years of total dividends exceeding 20 billion yuan, and it has increased year by year.

In contrast, the "Ning King" has been reducing its holdings in the north in the past two weeks, and this week's net outflow of 2.086 billion yuan ranks first. This week, the Ningde Times released a fixed -increase plan, which will raise 45 billion yuan of funds for 5 lithium battery R & D and production projects. After the announcement, the funds have returned to the north after the announcement. Except for the Ningde era, other lithium battery concept stocks have obtained warehouses in the north, and Enjie, Tianqi Lithium Industry, and Pioneer Intelligent have received net inflow this week.

On June 23, the Ningde Times released the CTP 3.0 Kirin battery, which will be exchanged and listed in 2023. This news makes the lithium battery sector active again. The concept index rose 5.39%in two days. Raise more than 3%. According to the public account of the Ningde Times, the volume utilization rate of the Kirin battery was increased to 72%, which was higher than 63%of the 4680 battery, an increase of 6%of the energy space. It is expected to lead the lithium battery sector to continue to develop.

According to the statistics of data treasure, in terms of increased positions, there are 37 shares this week increased by more than 100%. The largest increase in the month -on -month is Paineng Technology. 769.02%. Followed by Hailanxin, Yicida, and Thunderbolt, it increased by 520.27%, 410.33%, and 402.20%month -on -month.

Those who are incorporated into the Shanghai Stock Standard this month will hold the first quarter performance briefing. The company said that due to the epidemic cause in the second quarter, the company's production and logistics transportation was partially affected. Essence The company's current order is in line with expectations, and the capacity utilization rate is high. At the end of 2021, the company has formed an annual capacity of 3GWH, and the fundraising project will be completed and put into operation by the end of 2022.

22 shares were greatly reduced by funds in the north, and the shareholding volume decreased by more than 50%month -on -month. Shaanxi Black Cats, Weihai Guangtai, and Chinese Online Northern Funds decreased by 77.81%, 74.16%, and 71.21%, respectively.

Disclaimer: All information content of data treasure does not constitute investment suggestions, the stock market has risks, and investment needs to be cautious.

Li Xiaoga's latest heavy voice!

- END -

Xinhua Quan Media+| Pick up the heavy new wheat

As of June 14, the area of wheat has been harvested in the country, with a harvest...

Economics at the door: Why is the green onion oil cake stall on the roads lined up forever?

Why is there so many people in McDonald's? Why is the net red milk tea shop closed...