Heavy!It is related to millions, and the securities qualification examination has been renamed!What do you take after adjustment?Who can sign up?Does the previous certificate still use it?

Author:Daily Economic News Time:2022.06.25

On June 24, the China Securities Association announced that in accordance with relevant regulations, the "Securities Practitioner Qualification Examination" for nearly 20 years was officially renamed "Level Evaluation Test" (hereinafter referred to as "horizontal test").

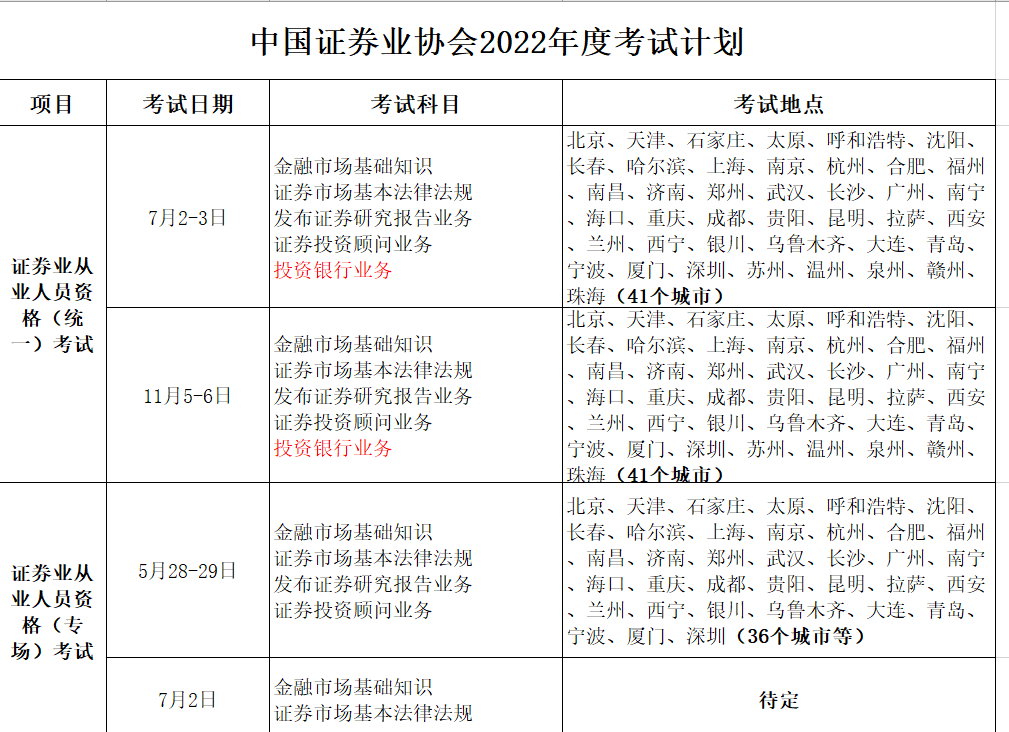

At the same time, the original scheduled horizontal test (including the unified examination and the Xinjiang, Tibet, and Qinghai special examinations) was extended until the end of August this year (plan). Specific time and test arrangements will be announced 1 month in principle.

According to the previous solicitation draft, the level test after renamed the rename is an evaluation test for non -standard professional capabilities. The focus of the level test is to focus on whether the professional ability of the employees meets the industry and corresponding position requirements. At the age of 18, the degree or above of college degree or above, and more than 3 years of work, or those who have been hired by brokers can register.

Formally renamed "Level Evaluation Test of the Securities Industry Professional Staff"

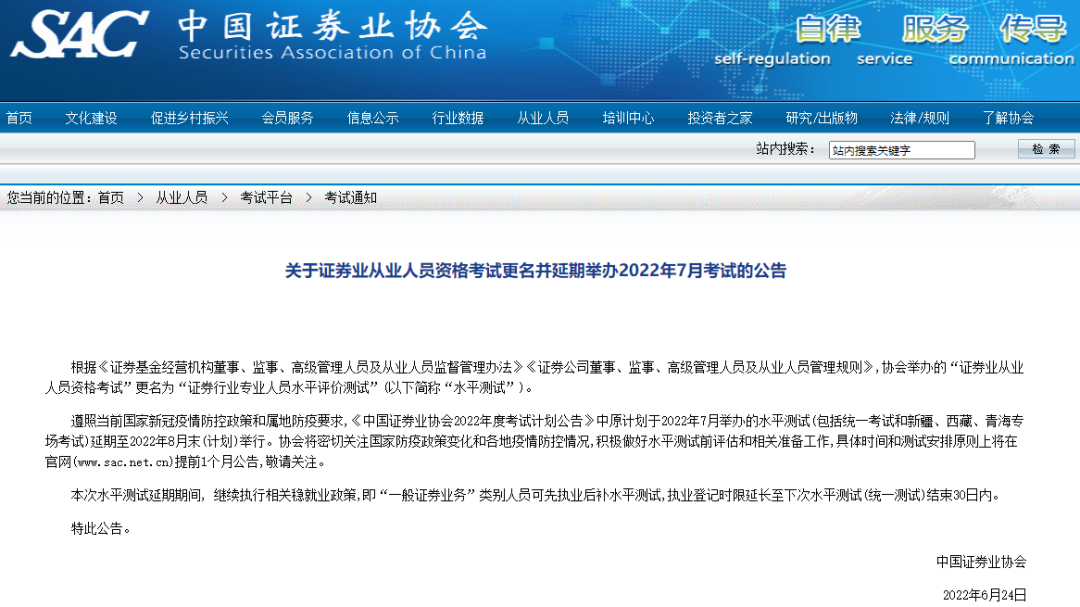

Yesterday, the China Securities Association issued the "Announcement on the Refining the Qualification Examination of the Securities Industry Practitioner Qualification Examination and Extension of the July 2022 Exam".

According to the announcement, according to the "Measures for Supervisor, Supervisor, Senior Management and Senior Management of Securities Fund Management", "Measures for Supervision and Management of Senior Management, and Practitioners", "Directors, Supervisors, Senior Management Persons and Management Rules of Securities Companies, and Management Rules of Senior Management", the "Securities Industry Police Staff" organized by the China Securities Association Qualification Examination was renamed "Level Evaluation Test".

In accordance with the current national new crown epidemic prevention and control policy and territorial epidemic prevention requirements, the "China Securities Industry Association's 2022 Examination Plan Announcement" is planned to be held in July 2022 (including unified examinations and Xinjiang, Tibet, Qinghai special examinations) to extend to extend At the end of August 2022 (plan). China Securities Association will pay close attention to changes in national epidemic prevention policies and the prevention and control of the epidemic in various places, and actively do a good job of pre -test assessment and related preparations. Specific time and test arrangements will principically on the official website (www.sac.net.cn) ahead of advance 1 in advance 1 in advance Announcement.

The China Securities Association stated that during the extension of this level test, the relevant stable employment policy continued, that is, the "general securities business" category personnel can practice first and then make up the level test, and the time limit of the practice registration is extended to the next horizontal test (unified test) ends 30 at 30 30 Within the day.

It is understood that the securities industry employee qualification examination has been implemented for more than 20 years, and the selection of employees in the securities industry has held "entry customs", and about 100 million people have entered the securities industry to engage in securities business. At the same time, a large number of public has learned and mastered securities law and basic knowledge through the examination. The qualification examination of the securities industry played a positive role in cultivating the capital market.

With the development of the capital market, the reform of the State Council's "decentralization of service" has continued to advance, the promulgation and implementation of the new "Securities Law" has entered a new period of development. The management method of securities practitioners has changed. Through the examination is no longer a necessary condition for the securities business, the examination management system based on qualification management has significantly lagged behind the situation changes, and it is urgent to adjust and improve accordingly.

According to regulations, horizontal testing is divided into two types: professional ability level evaluation testing and high -level managers' level evaluation testing. Evaluation test tests for employees include general business level evaluation testing and special business level evaluation testing. The level of senior management personnel evaluation and testing is divided into general senior management personnel level evaluation and testing and the level evaluation testing of special senior management personnel.

The basic subjects corresponding to the general business level evaluation test of employees' professional ability level assessment test include: basic laws and regulations of the securities market and basic knowledge of financial markets. Professional subjects corresponding to special business level evaluation tests include: investment banking business, securities investment consulting business, and issuing securities research reporting business, etc.

Based on the general business level evaluation test and testing, the special business level evaluation test respectively examines whether it is proficient in the relevant professional knowledge levels of securities investment consultants, securities analysts, and sponsor representatives, including the corresponding professional capabilities, including the professional ability of securities investment consultants Level evaluation test, securities analyst professional ability level evaluation test, sponsorship representative professional ability level evaluation testing, etc.

The test score is valid for one year

Meeting conditions can be exempted

According to the "Implementation Rules for Evaluation Testing and Testing the Professional Professional Capability of Securities Practitioners (Draft for Comment)" released in March this year, with the development of my country's capital market, relevant laws and regulations are continuously improved, business (products) are innovative, and employees need to understand in time to understand them in time In order to master new rules, new businesses, and new products, we can effectively serve the management of real economy and social wealth and protect the interests of investors. At the same time, in order to guide the public to "test", the "Test Implementation Rules" comprehensively compose the practitioners of the past and the securities industry. The actual needs of talents, learn from other levels of evaluation examinations, adjust the registration conditions and performance management systems, and set the validity period of results.

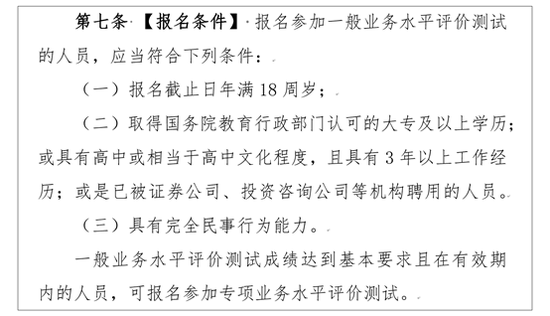

Specifically, in terms of registration conditions, the "Test Implementation Rules" emphasized that those who register for general business level evaluation and test must be at least 18 years old, have full civil behavior capabilities, and obtain a college degree or above recognized by the education administrative department of the State Council; Or have high school or equivalent to high school culture, and have more than 3 years of work experience; or personnel hired by institutions such as securities companies and investment consulting companies. This also means that the registration of students may be restricted.

In terms of performance management system, the "Test Implementation Rules" also made more specific arrangements.

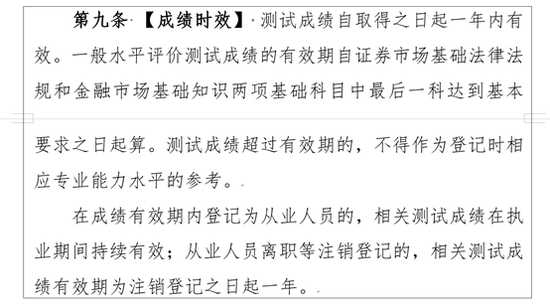

The first is the definition of the standard standards. The "Test Implementation Rules" stipulates that the basic requirements of the test score refer to "the accuracy rate of the reference subject is more than 60%." The general business level evaluation and test results meet the basic requirements. The two basic subjects of "basic laws and regulations of securities markets" and "basic knowledge of financial market" within one year have met the basic requirements. The second is the delineation of the validity period. The "Test Implementation Rules" stipulates that the test results are valid within one year from the date of obtained. The validity period of the general level evaluation and testing is from two basic subjects: "Basic Laws and Regulations of the Securities Market" and "Financial Market Basic Knowledge", and the last subject will be calculated from the date of the basic requirements. If the test score exceeds the validity period, it shall not be used as a reference for the corresponding professional ability level when registering.

It is worth noting that if it is registered as employees during the validity period, the relevant test scores will continue to be effective during the practice period; if the employees leave, etc., the relevant test results are valid for one year from the date of cancellation and registration.

At the same time, in order to do a good job of the connection management of the new and old system, the "Test Implementation Rules" also gave the person who passed the examination for 5 years transition period (except for registering this score as a practitioner and being practicing), and entered the securities industry for the willingness to enter the securities industry. The old candidates retain a certain preparation time. At the same time, the connection arrangements of the relevant subjects before the reform in 2015 will be determined in accordance with the "Connection of the Reform of the Eligibility Examination and Testing System of the Securities Industry Practitioners".

According to the test violations and new characteristics found in recent years, the classification of the "Test Implementation Rules" has refined illegal responsibilities, and strives to handle more accurate and reasonable.

Specifically, according to the severity of the violations, the processing category is adjusted to slight, general, serious, and particularly serious, and the processing measures such as canceling the performance of the spot, canceling all test results, and prohibiting participation in testing within a certain period of time are adopted. For particularly serious violations, the cancellation of all scores and prohibited tests for 5 years. At the same time, it is emphasized that the above -mentioned illegal information will be included in the securities industry's reputation and reputation incentive and restraint mechanism.

At the same time, the "Test Implementation Rules" also clearly increased the test violations from 17 to 21, and the newly judged test results were added abnormal, and the situation that did not participate in the test as required was "minor violations"; The situation of paper materials is "general violations"; the two situations that have been intentionally damaged and destroyed for testing equipment, and the two situations that candidates assisted by the staff during the test process were "serious violations."

On February 18, the CSRC issued the "Measures for Supervisor, Supervisor, Senior Management and Senior Management of Securities Fund Management Institutions" (hereinafter referred to as the "Administrative Measures"). The personnel of the personnel and practice behavior are made specific.

The "Administrative Measures" stated that the chairman, vice chairman, chairman of the board of supervisors, and senior management personnel of the business of securities fund operation agencies may participate in the level evaluation and testing of the industry association as a reference to prove that its familiarity with the laws and regulations of securities funds.

What is more noticeable is that the "Administrative Measures" also stipulates that some persons who meet the corresponding conditions can be exempted.

According to the "Administrative Measures", there are domestic work experiences such as securities, funds, finance, laws, accounting, and information technology related to their proposed positions, and have never been admitted to administrative penalties or administrative supervision measures by the financial regulatory authorities. For senior managers, the person in charge of the Securities Fund Management Organization shall be less than 5 years, or have considerable job management experience; and other conditions stipulated by the China Securities Regulatory Commission and the industry association, may Evaluation test.

Edit | Duan Lian Gai source

School Division | Wang Yuelong

Cover picture: Photo Picture Network_501152028 (has nothing to do with graphics)

Daily Economic News Comprehensive Self -Securities Times, the website of the China Securities Industry Association, every network, public information, etc.

Daily Economic News

- END -

In the past May of Xinyang, the economic operation data announced fixed asset investment increased by 13.2 % year -on -year

In May, Xinyang City conscientiously implemented the decision -making and deployme...

Sea Brigade Duty Free Infuse of more than 5 billion in injection in Haiqi Group's "Second Duty Free" arrow on the string

21st Century Business Herald reporter Zhao Yunfan Shanghai reportOn June 21, Haigou Group (603069.SH) disclosed the preliminary consideration of the issuance of the purchase of Haigou's tax -free. Acc...