The technology index rose by more than 4%!The latest voice of the Hong Kong Monetary Administration and the Securities Regulatory Commission!Industry giants break over 20%

Author:China Fund News Time:2022.06.25

China Fund reporter Ivan

On Friday, June 24th, the US stocks closed overnight, and China stocks performed brightly, and US debt yields decreased, which promoted the rise of scientific and technological stocks. Hong Kong stocks opened today.

As of the closing, the Hang Seng Index closed up 445.2 points to 2.09%to 21719.06 points; the Hang Seng State -owned Enterprise Index rose 2.22%to 7629.06 points; the Hang Seng Technology Index rose 4.05%to 4844.58 points, and returned 4800 points. In terms of capital flow, the net inflow of funds in the southward today is HK $ 3 billion, with a large market turnover of 148.405 billion Hong Kong dollars.

Since the beginning of this week, the Hang Seng Index has risen more than 3.06%, and the technology index has risen by 4.11%.

In terms of market and important stocks, the national antitrust law landed, and large -scale technology stocks rose to boost the market. Station B rose more than 6%, Alibaba rose more than 5%, fast -handed rose more than 4%, Baidu, Netease, Xiaomi rose more than 3%, Tencent, Meituan, and JD.com rose more than 2%; the biotechnology sector rose sharply, medicine before, medicine The stocks have risen strongly, and multiple stocks are now double -digit; car stocks have risen well, and "Wei Xiaoli" has closed throughout the board; sports goods stocks, catering stocks, and military stocks have performed well.

On the other hand, the non -ferrous metal sector plummeted, and energy stocks such as coal and oil were weak.

Looking forward to the market outlook, Great Wall Securities pointed out that since the beginning of the year, the "steady growth" policy has continued to develop, and it is currently being landed. Infrastructure+new infrastructure is necessary in both A shares and H shares. Huasheng Securities analysts pointed out that recently, science and technology stocks have been seen slightly, mainly the inflow support of Beishui funds. I believe the promotion can last until the end of the second half of the year. If there are plenty of funds in the inflow support, the HSI will be pushed to the peak.

Hong Kong Financial Management Bureau and the Securities Regulatory Commission:

Try to discuss cross -border financial management and the mainland regulatory agency

At the 15th Forum of the Hong Kong Investment Fund Association, Hong Kong HKMA and the Securities Regulatory Commission stated that they are discussing with the People's Bank of China and the China Securities Regulatory Supervisor to include licensed brokers into the cross -border financial management plan.

Liu Yingbin, vice president of the Monetary Management Bureau, reiterated that the industry hopes to relax the regulatory requirements of the Ministry of Finance, but the plan needs to meet the supervision requirements of three jurisdictions. In addition, many citizens have not tried cross -border investment, so the plan must be gradual. In the future, the HKMA will review product types, risks, sales arrangements, etc., and explore potential relaxation and optimization directions. He mentioned that the launch of the Northbound Bonds also needed a steady start a few years ago, but the plan to take off quickly after 3 years. He hopes that the market will be patient. Come.

Cai Fengyi, Executive Director of the Investment Products Department of the CSRC, said that the current discussion with the China Securities Regulatory Supervisor is working well and is trying to handle the medium- and long -term expansion of financial management, but the process cannot be in place.

In addition, when asked by Hong Kong's impact brought about by the Global Bank of Financial Telecommunications Association (SWIFT), Liu Yingbin responded that the HKMA had developed emergency plans for different scenarios and was not worried that they could not cope with extreme situations. He emphasized that the Hong Kong banking system is stable and has enough to prepare for the challenge.

As for virtual assets, Liu Yingbin said that the HKMA plans to regulate relevant institutions and activities with the method of "the same risks and the same supervision". The process will refer to the practice of other jurisdictions.

It once risen nearly 5%a hit three months at a new high

The Hong Kong Stock Exchange said that the new stock market is continuously warming up

In the afternoon of this afternoon, the Hong Kong Stock Exchange rose nearly 5%, and the stock price hit a new high since the end of March. As of the close, the increase has fallen, but it still closed up 4.12%to HK $ 372.2/share, with the latest market value of 474.4 billion Hong Kong dollars.

According to the new IPO newsletter released by the Hong Kong Stock Exchange yesterday (June 23), in 2021, the Hong Kong stock market IPO market continued to maintain a global leading position. A total of 98 new shares were listed throughout the year, and the financing volume exceeded 330 billion Hong Kong dollars, most of which came from the new economic company, a total of 59 new economic industries issuers successfully listed, the financing amount reached 291 billion Hong Kong dollars, accounting for 88% of the total IPO financing of the year. Essence In the first half of this year, due to the impact of the macro environment, the global IPO activities slowed down from the same period of 2021. However, the Hong Kong stock market IPO market still showed a certain toughness. As of the end of May 2022, more than 170 companies have submitted new shares listing applications.

The Champions League of the Executive CEO of the Hong Kong Stock Exchange was promoted today after attending the fast dog listing ceremony and said in a media interview that the Hong Kong new stock market seems to be heating up. It is expected that there will be more listing activities in the future. Make sure it is one of the most competitive capital markets in the world. He believes that the number of companies currently submitted to the listing application is at a historical high.

When asked whether the fundraising amount of new shares in Hong Kong in the first half of this year fell more than 90 % year -on -year, it would put pressure on him, the Champions League said that new shares are usually closely related to the macroeconomic and investors' emotions. The global market is very weak, not only the unique phenomenon of Hong Kong, but also occurred in the United States and other global markets. He mentioned that in the past six months, the exchange of more than 90 % of the trading of the United States and the Hong Kong stock market has fallen by more than 90 %, so it is difficult to evaluate it based on the data of half a year, emphasizing that it must focus on the long -term development.

As for the continuous Sino -US audit storm, the Champions League has pointed out that this problem is expected to be resolved. I hope to see the company that can be listed anywhere in the world, including the United States, Europe and other places, which can bring a positive role in the Hong Kong Stock Exchange in the long run. He continued to say that in the short term, Chinese stocks come to Hong Kong to go public in the short term will indeed bring stimulating effects, but in the long run, the exchange is concerned about increasing the connection between China and Western countries. Therefore The better, support the two parties to negotiate, and hope to get a satisfactory ending.

Fall more than 20 % to break

"Planting" on the first day of "the first freight in the same city"

Under the gradual warming of the Hong Kong stock market IPO, the listing of freight giants in the same city in the Mainland has attracted much attention from investors. In addition, fast dog taxis knocking on the clock in the entity of the Hong Kong Stock Exchange. This has also been the first physical knocking company in the Hong Kong Stock Exchange in the past two years.

Quick Dog's taxi was listed, and the morning rose by more than 7%. In the afternoon, the diving in the afternoon fell more than 3%.

According to the announcement of fast dog taxi on the Hong Kong Stock Exchange, its Hong Kong IPO sale price is HK $ 21.50 per share, and the net fundraising is HK $ 567 million. The company's public offering is 3.05 times, and the international distribution sale is 0.4 times.

Fast dog taxi is a merger company. Before the merger, the fast dog taxi was 58 Express, and GOGOVAN main battle overseas market. After Alibaba, the two merged in 2017. The former was renamed fast dog taxi, and the latter was changed to GOGOX.

It is worth noting that the company is currently not profitable. In 2018, 2019, 2020, and 2021, fast dog taxis were RMB 1.071 billion, RMB 184 million, RMB 658 million and RMB 873 million, respectively. During the same period, the company had adjusted losses to 784 million yuan, RMB 397 million, RMB 185 million and RMB 311 million, respectively.

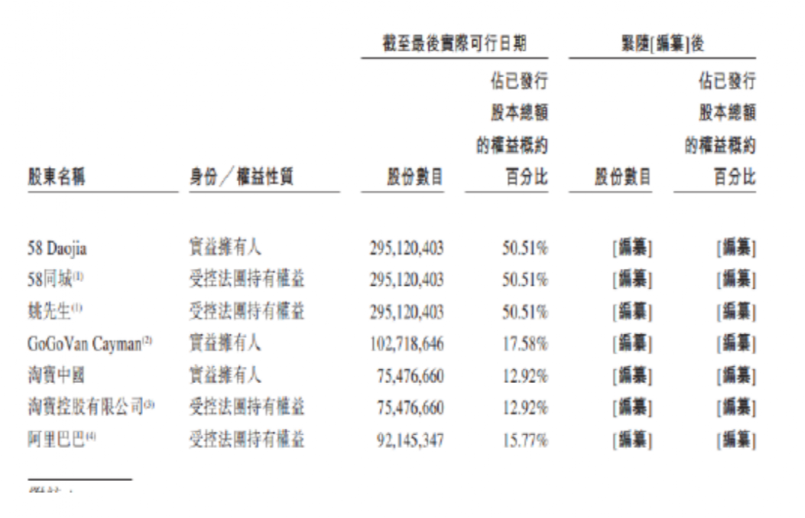

As of the last feasible date, Yao Jinbo's 58 -home shareholding of 50.51%of the shareholders was the company's controlling shareholder; Taobao held 12.92%of the shares, and Ali controlled 15.77%of the equity. As of now, the company has raised a total of 1.429 billion yuan.

(Source: Fast Dog Taxi Hong Kong Stock Exchange Prospectus)

Medical stocks "Hi"

100 billion pharmaceutical giants soar 30 billion yuan

Synchronization with A shares is that Hong Kong stock pharmaceutical stocks have also risen today, and the Hang Seng Medical Health Care Industry Index rose 6.93%, and multiple stocks increased to double digits.

Yaoming Bio rose 10.4%, led a blue chip stock, with a market value of about 30 billion Hong Kong dollars, and the latest market value of 325.7 billion Hong Kong dollars. Guotai Junan International issued a report saying that Yaoming's biological business has a strong growth rate, and the current valuation and price are relatively reasonable. It is recommended to buy it at dips.

The report states that the driving factor of Yaoming Bio's future performance growth includes continuous strong business growth, product pipelines and platform advantages, and production capacity advantages. Among them, in order to meet the growing demand, the company's total production capacity will increase from the current 154,000 liters to 262,000 liters at the end of the year, and it will reach 430,000 liters after 2024. Recently, the company has increased the production capacity of a pre -charged syringe (PFS) to 17 million yuan per year.

Many pharmaceutical stocks rose together, Aikang Medical rose more than 24%, Xintong Medical rose 23.4%, Koji Pharmaceutical rose 20.9%, minimally invasive robots rose by nearly 20%, minimally invasive medical care rose by over 16%, Chunli medical treatment rose up More than 15%, Chaoju Eye Department rose more than 12%, and Yao Ming Kangdo rose more than 10%.

The Institute of Huachuang believes that the leading enterprises in the pharmaceutical industry, especially in various segments, generally have strong growth momentum. At a lower level of valuation, the ability of enterprises to transform performance growth into stock price income is greatly strengthened.

Edit: Captain

- END -

Liu Qiao: These five major momentum are the most important sources of productivity growth in the fut

China Economic Net, Beijing, June 13th. On June 11th, Liu Qiao, Dean of the Guanghua School of Management, Peking University, said on the Guanghua Thought 2022 Summer Forum that the source of high -

Enping's 68 key projects have stimulated surging motivation and promoted economic stable growth

In order to thoroughly implement the work requirements of the superiors on singing...