Super heavy!How to buy public fundraising funds for personal pensions?Just now, the regulatory rules are here!

Author:China Fund News Time:2022.06.25

China Fund reporter Li Shichao

How to invest in public funds for personal pensions, the latest regulatory rules have come out!

On June 24, the CSRC drafted the "Interim Provisions on the Management of Business Management of Public Pension Investment Public Investment Fund (Draft for Soliciting Opinions)" (hereinafter referred to as the "Interim Provisions") and publicly solicited opinions from the society.

According to the "Interim Provisions", personal pension investment public funds will be included in the pension target fund to further expand the scope of the product in the future. The personal pension fund will set up a special share, does not charge sales service fees, discounts on management fees and custody fees, etc., reflect the "pension" attribute in product design, and make profit from investors. At the same time, corresponding requirements have been put forward in terms of fund sales, investor protection, asset security, and information platform construction, and "escorted" for personal pension investment public funds.

Insiders commented on this, and in order to start the public fund investment in public funds, the pension chose to operate more mature pension target funds during the pilot period. After the pilot is over, in the future, it may gradually be included in other types of public funds, dynamically adjust and gradually expand the scope of personal pension investment public funds, and provide a richer public offering product option for personal pension investment.

Incorporate it into the Pension Target Fund

Further expand the range of products in the future

In April of this year, the General Office of the State Council issued the "Opinions on Promoting the Development of Personal Pension" (Guoqi Fa [2022] No. 7, hereinafter referred to as "Opinions"), which established the basic institutional framework of my country's third pillar pension insurance. The CSRC conscientiously implements the spirit of the "Opinions". In order to clarify the institutional arrangement of the personal pension participants' investment funds, protect the legitimate rights and interests of investors, on the basis of fully investigating, the Securities Regulatory Commission has drafted the "Personal Pension Investment Public Funding securities investment investment. The temporary provisions of the fund business management (draft for comments) "(hereinafter referred to as the" Interim Regulations "), and publicly solicited opinions from the society.

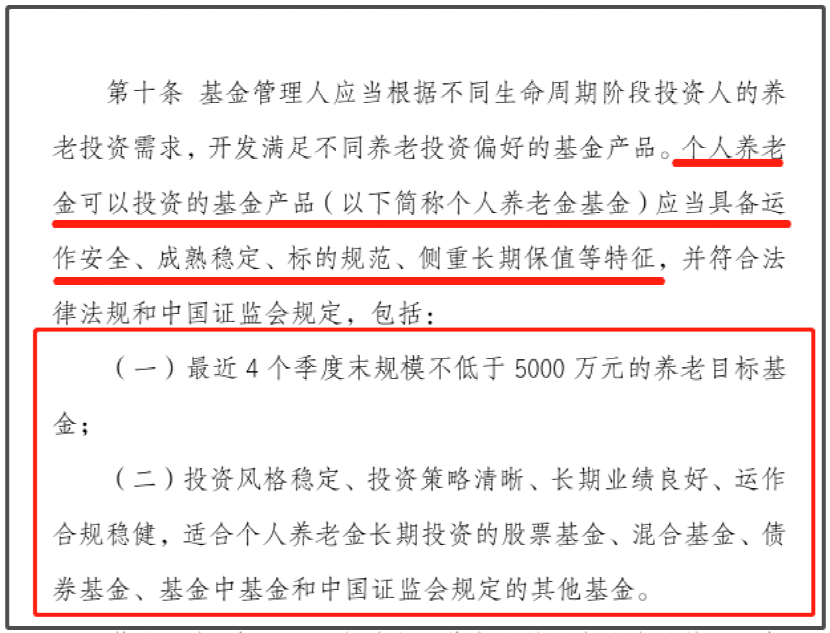

The "Interim Provisions" proposes that in accordance with the "Opinions" "combined with actual steps, select some cities for one year first, and then gradually push away" requirements, in the trial stage of the personal pension system, the first -time scale of the last 4 quarters will not be included in the first four quarters. Pension target fund below 50 million yuan.

Pension target funds are fund products with low and medium fluctuations and assets containing equity. In the future, with the gradual push of personal pension system, the CSRC will further expand the scope of the product, incorporate more investment styles, clear investment strategies, good long -term performance, and good long -term performance. Other types of public fund -raising funds that are stable and suitable for personal pensions for a long time. Related product lists are updated every quarter, dynamic adjustment and optimization, stimulating market players to participate in vitality, and better serve personal pensions for long -term value preservation and appreciation.

In fact, in the "Opinions on Promoting the High -quality Development of Public Fund" issued by the CSRC recently, it is also clearly stated that "increasing the development and creation of low- and medium volatility products, developing fund products that adapt to long -term investment in individual pensions", "," fund products that adapt to long -term investment in personal pensions ",", "fund products that are suitable It is expected that in the future, there will be more fund product innovation with equity attributes and low -oriented fluctuation characteristics.

Product design reflects the "pension" attribute

Relief to investors

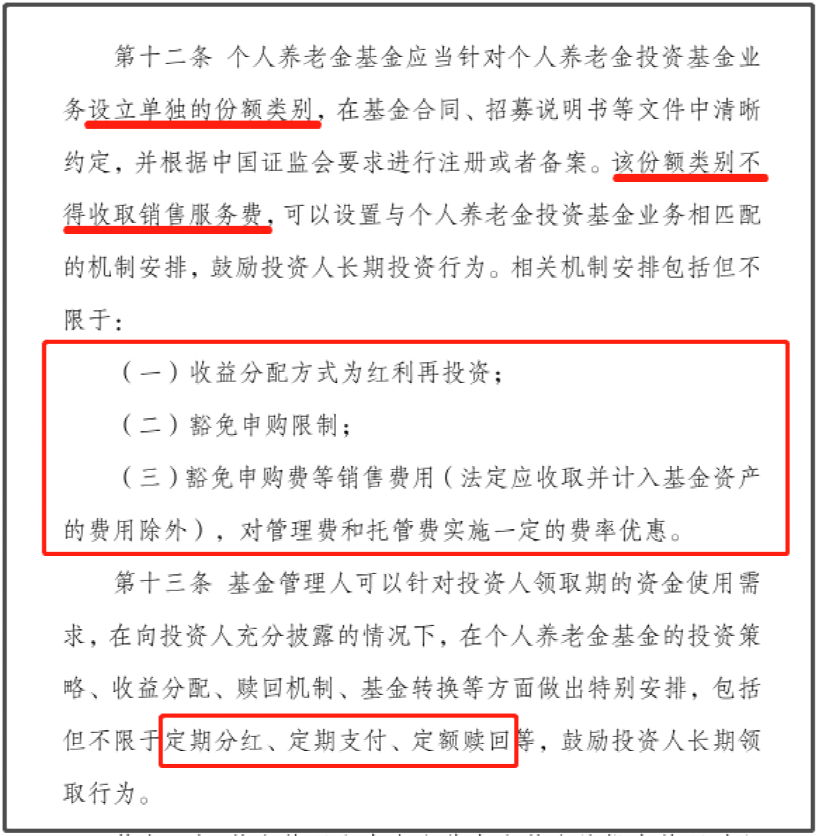

In order to enhance the "pension" attributes of personal pension investment in the pension target fund, the "Interim Provisions" proposes that on the one hand, in order to encourage participants for long -term investment behavior, the personal pension fund sets a special share, does not charge sales service fees, and does not charge sales service fees. With sales fees such as preferential implementation fees, sales fees such as preferential rates, exemption fees, and exemptions, exemptions, and exemption of large -scale purchase restrictions, and adopt dividend reinvestment income distribution methods.

On the other hand, in the stage of participating in the collection and in order to encourage long -term and installment behaviors, fund managers can make special arrangements for investment strategy, income distribution, redemption mechanism, and fund conversion. , Fixed redemption, etc.

From the perspective of the development of domestic pension target funds, at present, the public fund industry has set up 178 pension target funds, with a total scale of 106.8 billion yuan. Among them, the target date fund was 16.5 billion yuan, the target risk fund was 90.3 billion yuan, and the number of holders exceeded 3.02 million, mainly for individual investors.

As of the end of 2021, the average annualized yield of the pension target fund for one year was 11.3%, which was more than 8 percentage points higher than the 10 -year national bond yield.

As early as March 2018, on the basis of the best practice based on my country's national conditions and drawing on the development of overseas pension funds, the CSRC launched the pension target fund.

Pension target funds have the following core characteristics: first, long -term nature, the holding period of the elderly target fund, encourage long -term holding, long -term investment and long -term assessment; second, asset allocation as the main investment strategy, through asset allocation and risk control, reduce Combining fluctuations to pursue medium- and long -term stable returns; the third is to attach importance to the role of equity investment in the value -added of assets, and have the characteristics of low and medium fluctuations, which meets the pension investment needs of participants in the early stage of the system. For solutions, investors can choose the appropriate pension target fund according to factors such as age, life expectancy, risk tolerance.

It is reported that as early as April 21 this year, the General Office of the State Council issued the "Opinions on Promoting the Development of Personal Pensions". The official introduction of this document is a powerful measure for the party and the country to promote personal pension development from the central level. The amount of information of the "Opinions" is very large. The per personal pension pays the upper limit of 12,000. Participants have tax discounts. Urban employees, urban and rural residents workers can participate, and the personal account system is implemented. Participants can choose to invest in bank financial management. Financial products such as savings deposits, commercial pension insurance, public fund funds ... The release of this document means the real arrival of the era of personal pensions.

The release of the "Interim Provisions" means that personal pension investment will really be implemented. The pension target fund will become a public offering product at the beginning to meet the needs of ordinary people's pension investment.

Require fund sales agencies:

The scale of equity funds is not less than 20 billion

Personal investors are not less than 5 billion

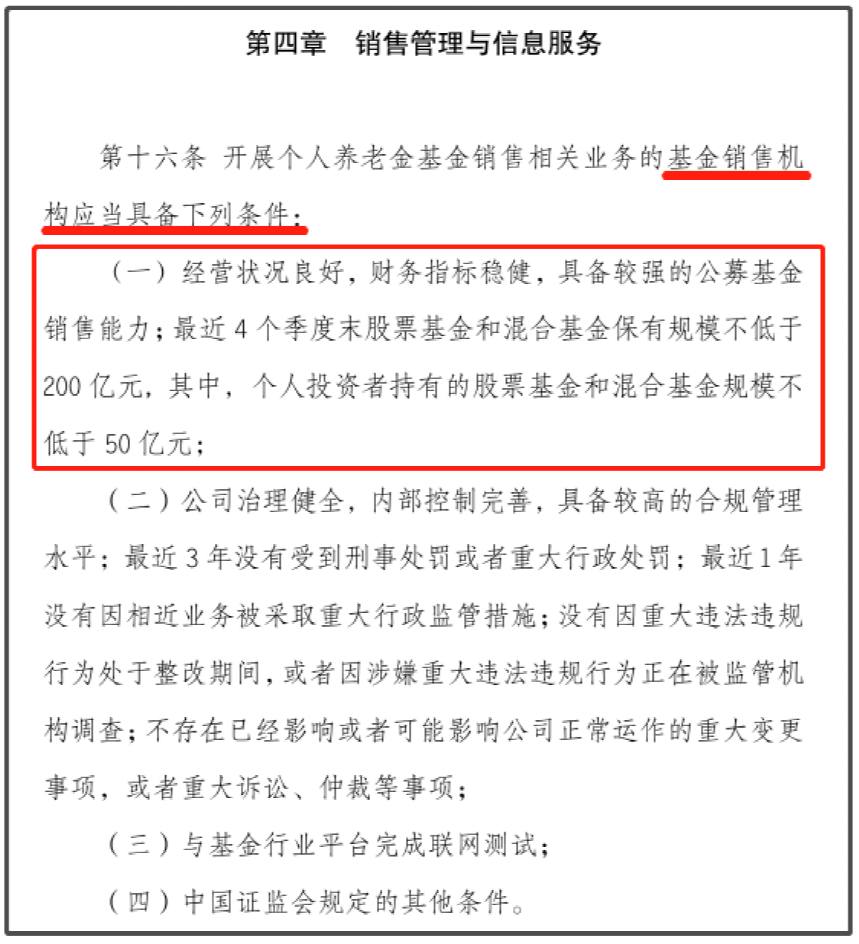

In terms of fund sales, the "Interim Provisions" requires that the personal pension fund sales institution has strong personal investor services, compliance majors and stable operation capabilities.

In view of the fact that the sales business of the personal pension fund has strong specialties, professionalism and long -term sales than traditional fund sales, the "Interim Regulations" put forward targeted requirements for participating fund sales agencies from the aspects of business indicators, corporate governance, and compliance internal control. It is necessary to meet the scale of stock funds and hybrid funds at the end of the last four quarters of the last four quarters. At the same time, the fund manager and its sales subsidiaries handle the personal pension fund sales related business raised by the manager. The sales institution list is updated every quarter. As the scale of the public fund industry increases and the sales of sales institutions increases, eligible sales institutions will continue to increase.

At the same time, in order to protect the legitimate rights and interests of investors and the safe operation of assets, the "Interim Regulations" make the following provisions:

The first is to emphasize information prompts. When investors invest for the first time, the fund sales agency shall fully remind the personal pension system and special requirements for fund investment business (such as long -term closed accounts, non -satisfaction conditions must not receive funds, etc.), and shall be confirmed by investors; fund sales institutions will complete the completion Investors who have opened accounts but do not invest in funds within 30 working days shall promptly remind them in a timely manner.

The second is to emphasize appropriate management. Based on the age, retirement date, income level, and risk preferences of investors, they recommend funds to investors.

The third is to emphasize closed and safe operation. Fund managers and fund sales agencies shall ensure that the fund shares are redemption and other funds transfer to personal pension funds accounts.

The fourth is to pay attention to pension education. Fund managers and sales institutions are required to carry out pension financial education, popularize the concept of pension investment, and strengthen investors' understanding of pension policies.

In addition, the "Interim Provisions" also emphasizes one -stop services for fund sales to facilitate investors to participate. The rules require the fund manager, fund sales agencies to set up pension areas through Internet platforms, mobile clients and other "one -stop" services such as business consulting, information inquiry, and pension and education to assist investors to open or designate funds in commercial banks to open or designate funds The account and the information platform of the Ministry of Human Resources and Social Affairs will open an information account.

In addition, the "Interim Provisions" also authorizes the fund industry platform service fund industry to carry out personal pension business to provide information support for regulatory authorities.

For the first time, the "Interim Provisions" clarified the information platform of the China Securities Regulatory Commission authorized China Securities Registration and Settlement Co., Ltd. to build and operate the personal pension investment fund business. Commercial banks, fund managers and fund sales institutions such as personal pension investment fund business have established system connections to provide support and implementation for personal pension investment fund business.

Edit: Captain

- END -

When the "Chengdu Consumer Coupon" met 618 Sichuan people "Buying", the purchasing power ranked 6th nationwide

The consumption enthusiasm of Chengdu people finally returned under the dual stimu...

Tax big data for the media to start the industrial chain supply chain

Help more than a thousand households to achieve the purchase sales amount exceed 5...