China Railway Cumulative Cash more than 30 billion yuan, stabilizing investors stabilized

Author:China Railway Time:2022.06.24

China China Railway Co., Ltd. is a comprehensive construction industry group integrating design consulting, engineering construction, equipment manufacturing, special real estate, asset management, resource utilization, financial property and trade and emerging businesses. As one of the world's largest construction engineering contractors, China Railway China Railway has entered the Fortune 500 in the world for 16 consecutive years, ranking ranked 35th in the Fortune Fortune 500, 500 in China, and "Engineering and News" (ENR) Global Global The largest contractor is No. 2. Since its listing, China Railway has distributed a cash dividend of over 30 billion yuan to investors (including the 2021 dividend plan).

The form of returning investors in the listed company includes a variety of methods such as distribution cash dividends, stock dividends, share repurchase, and enhanced the company's internal value. The distribution of cash dividends is an important way for investors to get returns, and it is also a long -term investment attraction of the stock market. The necessary conditions are an important support for the establishment of the "investment value" concept of the capital market.

√

First, be able to cultivate value investment concepts

Continuous and stable cash dividend mechanisms can continuously improve the income structure of investors, enable investors to form rational expectations for the company's business prospects, and guide investors to form a stable dividend preference, which will help cultivate value investment concepts and reduce speculative behavior.

√

The second is to be able to attract super -time funds to enter the market

For example, long -term funds such as pension, corporate annuity, insurance and provident fund, etc. need long -term stable investment returns. Continuous and stable cash dividends can increase the scale of long -term funds and the proportion of investment and promote the stable market development.

√

The third is to promote the protection of investors' rights and interests

From international experience, continuous and stable cash dividends are usually the "signal" of the stable operation and financial status of listed companies. It also marks that the financial information disclosure of listed companies can truthfully reflect the company's cash flow situation, which is conducive to investors to make the right reason to make the right. Investment evaluation.

Since the listing on the Shanghai Stock Exchange and the Hong Kong Joint Exchange on December 3 and December 7, 2007, China Railway has always regarded "providing investment returns to shareholders" as the responsibilities and obligations of listed companies. While continuing to improve operating benefits, investors will be given back to the majority of investors.

The first is to continue to improve the construction of the profit distribution system to effectively protect the legitimate rights and interests of investors.

At the beginning of the listing, the company strictly entered the institutional arrangement of profit distribution in accordance with laws and regulations such as the "Company Law of the People's Republic of China" and "The Securities Law of the People's Republic of China" and other laws and regulations. In accordance with the requirements of the China Securities Regulatory Commission's "Notice on Further Implementation of Cash Dividends Related to Listed Companies" (Securities Supervision [2012] No. 37), the "Company Articles of Association" was revised and further clarified the specific conditions of the company's profit distribution and the specific conditions of cash dividends Detailed clauses such as proportion; since 2012, the company has continuously formulated and disclosed the 4th issue of the "Plan for Shareholders' Return of the Three Years".

The second is to focus on the long -term sustainable development and continue to implement profit distribution.

The company's industry is the construction industry, which is a full competition industry. With the increasingly fierce market competition in recent years, the continuous operation of raw material prices, the continuous improvement of safety quality and environmental protection standards, the industry's gross profit margin generally maintains a lower level. However, when the company formulates the annual profit distribution plan, it still adheres to the long -term sustainable development concept and takes into account all types of shareholders. Based on the comprehensive consideration of the company's strategic development goals and the wishes of shareholders, combined with the company's profitability and cash flow status, business development planning and business development plan Factors such as the development stage of the enterprise, the demand of funds, the cost of social capital, and the external financing environment, adhere to the continuous, stable, and scientific investor return planning and mechanism. %, And overcomes the proportion of the new crown epidemic since 2020, showing the responsibilities and responsibilities of listed companies in central enterprises.

Third, the profit distribution amount is steady, and the results of the development of development with investors are shared with investors.

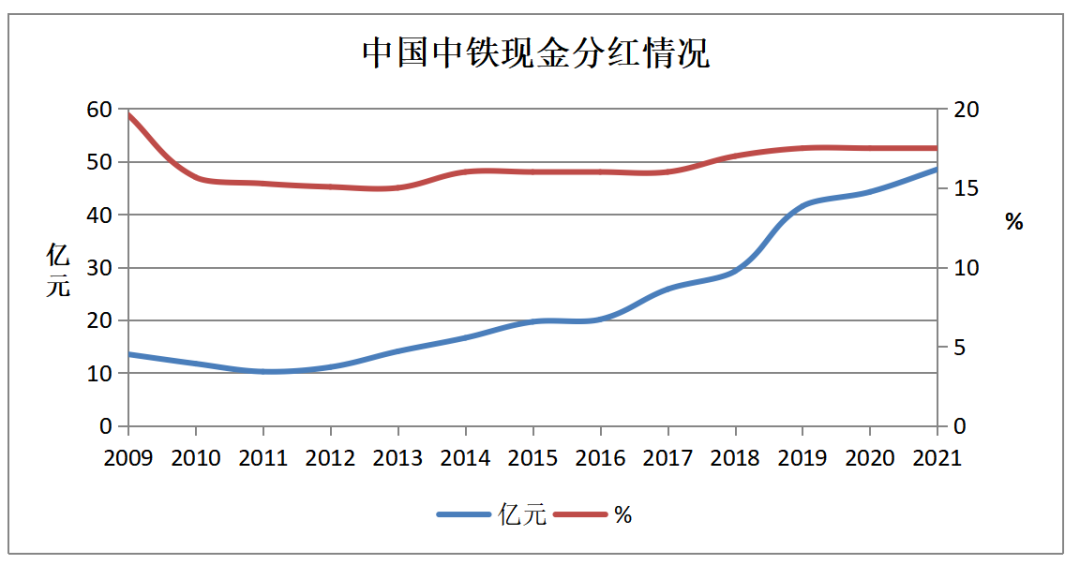

In the past three years, the company has distributed a total of about 13.424 billion yuan (including the 2021 profit distribution plan of 4.849 billion yuan), and the annual profit distribution amount accounted for approximately 17.5%of the company's net profit of the shareholders of the listed company. The amount increased from 0.169 yuan/share in 2019 to 0.196 yuan/share of the 2021 plan, an increase of 15.98%. Since listing, the company has distributed a total of about 30.624 billion yuan (including the 2021 profit distribution plan of 4.849 billion yuan). While the cash dividend ratio has risen steadily, the absolute amount of cash dividends has increased from 1.35 billion yuan in 2009 to 2021. The plan of 4.849 billion yuan, with an average annual compound growth rate of 10.34%; the average A -share price of 5.69 yuan/share in 2021 calculated a dividend rate of 3.44%, and the average price of H shares was 3.961 Hong Kong dollars/share The middle price is 0.81760) The dividend rate of about 3.24 yuan/share calculation is 6.05%, which has better realized the "sense of participation and gain" of investors sharing the company's high -quality development results.

In the future, the company will comprehensively consider factors such as the characteristics of the industry, the development stage, its own business model, the level of profitability, and whether there are major capital expenditure arrangements.Strive to protect investors' rights and interests, and continue to continue to give back to the majority of shareholders while improving operating benefits, and work together with investors to a better tomorrow!Editor -in -chief 丨 Li Yuan, Shen Su

Editor in charge 丨 Xu Huimin

Content source 丨 Office of the Board of Directors of the Co., Ltd.

China China Railway Finance Media Center

- END -

The gift package is here!Kunming introduced a stable economic growth of 25 policies and measures

On June 24, the Kunming Municipal People's Government issued the Implementation Plan for Solid Economic Growth to refine and implement the policy measures of the State Council and the Yunnan Provinc...

The 60th anniversary of the founding area, Zaozhuang Xuecheng's "three driving carriages" stepped on the hoof

Qilu.com · Lightning News, June 21st News On June 21, the News Office of the Xuec...