After "demon nickel", zinc is unstable?LME zinc inventory drops greatly, and the spot premium reaches 30 years.

Author:Daily Economic News Time:2022.06.24

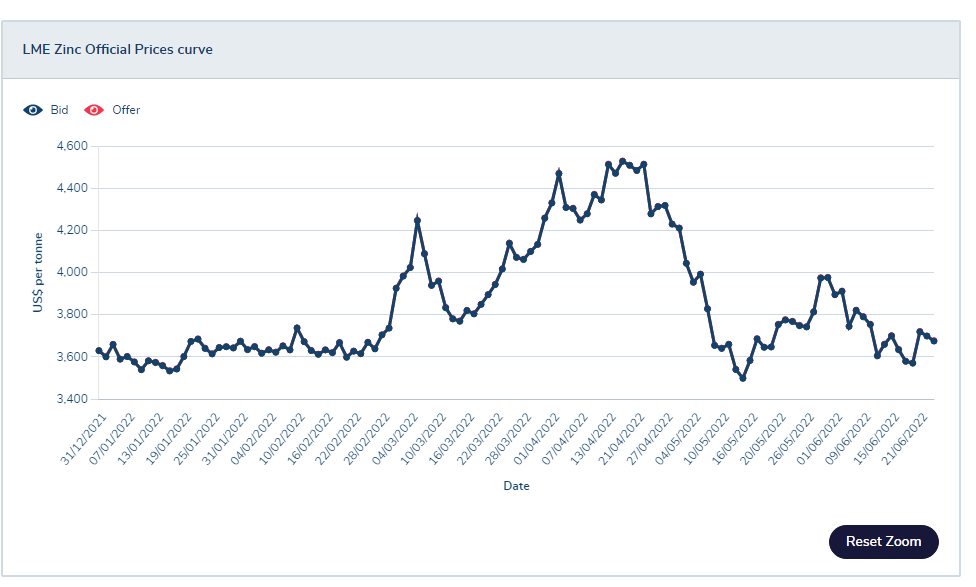

The previous battle about "demon nickel" was booming. Will zinc "repeat the same mistakes" now? According to Wind data, the spot price of zinc (London Metal Exchange) on June 23 has reached $ 3677/ton, which is 202 US dollars/ton higher than the price of LME zinc three -month futures.

Throughout historical data, the spot premium premium of LME zinc has reached the second high since 1989 (up to $ 305/ton on April 28, 2006). At the same time, the inventory of the LME zinc is also declining. On June 23, it was 79,900 tons, a decrease of nearly 70 % from the 258,600 tons of the same period in 2021.

The spot premium is obvious, the inventory is constantly lower, will zinc fall into the crisis like nickel before? Yang Jinghao, chief economist of Kang Kai Data Technology, said in an interview with "Daily Economic News" reporter: "At least the macro background has changed deeply, so metal zinc appeared 3 months ago. The possibility of being out of the market is very small. "

Picture source: LME screenshot

How is the contradiction between the supply and demand of zinc?

Zinc is one of the common non -ferrous metals, with production and consumption second only to copper and aluminum. Because zinc has excellent resistance to the elegant corrosion, it is mainly used for galvanized industries, plating coatings that are used for corrosion, and widely used in automotive, buildings, ships and other fields. In addition, it is also used in the fields of brass, zinc alloys, dry batteries and other fields.

In April this year, the price of zinc has rushed to a high point in the past 15 years. According to Wind data, the spot price of LME zinc on April 19 reached about 4,530 US dollars/ton, secondary to the end of November to early December 2006. Recently, although the price of zinc has fallen a small decline compared to the high point in April, compared with the price level of the past 30 years, it is still relatively high.

Why is zinc priced higher? Price is a manifestation of the relationship between supply and demand. Although from the perspective of demand, the downstream market of zinc has been hit by factors such as epidemic conditions, the decline in the supply side is more obvious, resulting in zinc supply tight.

According to SMM data, my country's downstream zinc consumer regions are mainly concentrated in East China and North China, accounting for 70%. The East China market centered on Shanghai and the Tianjin -centered North China market this year has been impacted by the epidemic.

However, compared with the needs of the demand side, the supply side of zinc suffered a stronger blow. It is understood that the zinc smelting industry is a "big energy consumption". Under the background of the rise in international energy prices, upstream manufacturers have chosen to reduce production.

Guoxin Securities Research Report shows that lead zinc producers Nyrstar's three zinc smelting factories in Europe were affected by the sharp rise in electricity prices. The production was reduced by 50%from October 13, 2021. According to statistics, the production capacity of the three smelting factories was 700,000 tons. The market is concerned that the profit of zinc smelting is difficult to bear high electricity prices. The scale of production reduction is expected to further expand, and zinc prices have risen sharply.

Last year, the mining giant Jianeng also announced the news of zinc factory reduction. In the first quarter of this year, Jianeng's own zinc output was 241,500 tons, a decrease of about 15%from the same period in 2021. It was mainly affected by the epidemic and some zinc mines.

Therefore, the recent research report of the Zijin Tianfeng Futures Research Institute stated that the zinc supply gap after demand expectations is still significantly significantly.

The supply of zinc also reflected in the futures market. The total inventory of LME zinc has continued to decline recently. According to Wind data, the LME zinc inventory was only 79,900 tons on June 24, a decline of nearly 70 % from the same period last year.

A research report from Guangfa Securities on April 10 showed that the LME zinc inventory was greatly removed during the week. At the same time, the reason behind the listing of the warehouse receipt was added. The warehouse extracts zinc inventory to make up for the company's supply gap caused by European production.

Will zinc have like "demon nickel"?

At the beginning, when "demon nickel" was forced to empty, the inventory was lower and the spot premium was obvious. Now this situation occurs on zinc. Does it mean zinc will repeat the same mistake?

Yang Jinghao believes that there is still a substantial difference between the metal zinc and the metal nickel futures market, and the nickel nickel vacation in early March this year is the result of the occasional factor and the special macro background. The possibility of the level of jamming is very small.

What is the difference between zinc and nickel in the futures market?

Yang Jinghao said: "An important reason for metal nickels to take off in LME is that the main industrial needs of nickel nickel are nickel -iron alloys represented by high ice nickel, while nickel elements used by major transactions around the world are electrolytic nickel. Although the prices of the two are synergistic, strictly speaking, electrolytic nickel is not the perfect set of nickel industrial enterprises, which directly leads to the fact that my country's industrial enterprises represented by Qingshan cannot use the inventory of the enterprise for delivery. On the other hand, the metal zinc. The degree of adaptation of industrial demand and cutting products is much better than metal nickel. "

At the same time, Yang Jinghao believes that the global financial market in early March faces the occasional factor of Russia and Ukraine's geographical conflict. Specifically, why does this "occasional factor" cause the "demon nickel" vacation market to be difficult to occur on other metals today?

Yang Jinghao said that because the conflict between the conflict is the world's main energy and agricultural exporter of agricultural products, this directly pushes the world's global supply of food and oil represented by crude oil and natural gas and the supply of grain and oil represented by wheat, corn, and sunflower seed oil, and concern Food supply is concerned about biofuel supply, and further pushing the expected energy price expectations. Therefore, the basic metal prices represented by electrolytic technology have also risen. "On the other hand, due to the comprehensive sanctions on Russia and its economic entities in Europe and the United States, Russian nickel delivery has been seriously affected. Although the Russian -Ukraine conflict continues, the temporary expectations caused by the occasional factors have been fully digested by the market. Therefore, the expected impact no longer exists. This is the second difference between the metal zinc and the metal nickel market in early March. " Yang Jinghao said.

In addition, Yang Jinghao also believes that although LME zinc inventory is less than 100,000 tons, zinc in my country also has the inventory and social inventory of the previous period. With the decline in global shipping prices, the tension of shipping capacity is relieved, and the market foundation of the hype of LME exchanges in low positions is low. In summary, Yang Jinghao believes that "the possibility of metal zinc repeatting the nickel of the nickel is very small."

According to Debon Securities Report on June 20, domestic zinc -zinc social inventory was 08,200 tons to 223,600 tons from November 10.

Daily Economic News

- END -

There are countless sayings | May wealth management market product distribution has stabilized

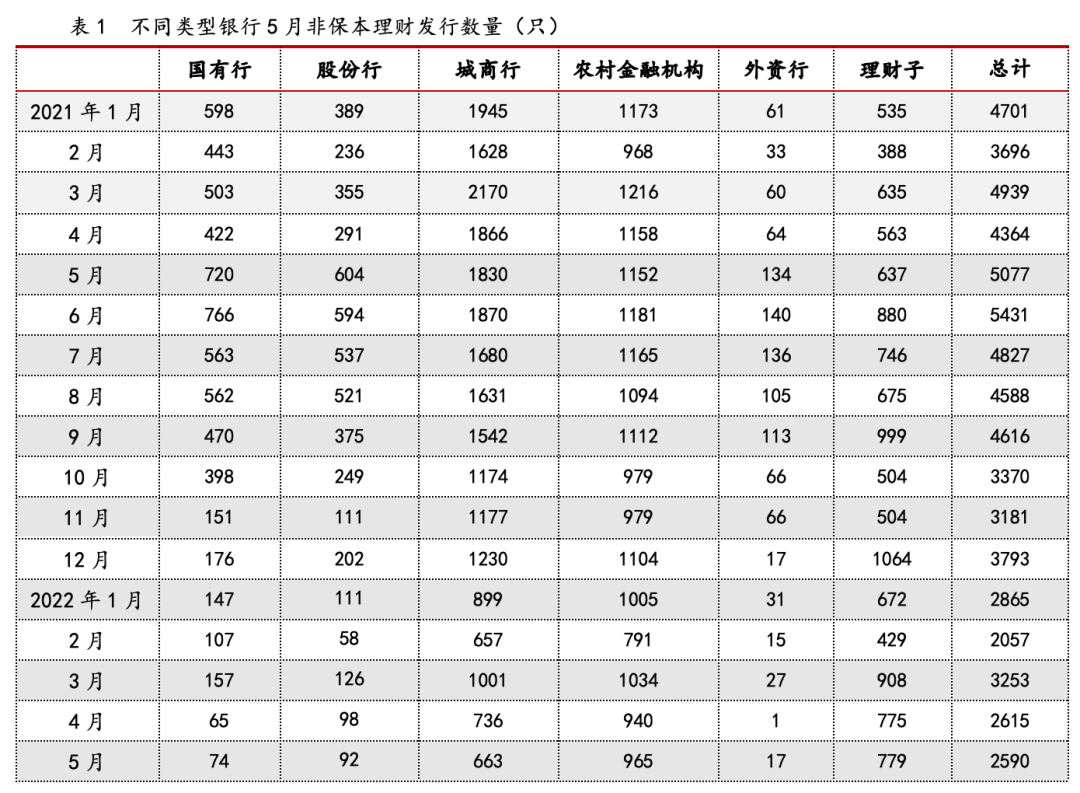

According to the statistics of Puyi Standard Standard, 2,590 non -guaranteed finan...

A year -on -year increase of more than 40 % of the first May of the Chengdu Air Port freight throughput reached a record high

Well- At 19 o'clock on June 14, Wang Shu, the manager of Hongyuan Chengdu, suddenl...