Opportunities under the global food crisis: the first IPO of the science and technology board of Science and Technology Board was at the time 丨 Zhi Yan

Author:36 氪 Time:2022.06.24

The plant protection business is the key to supporting the performance of Xianzhengda Group this year. Seed business is the biggest highlight in the future.

Wen | Huang Yida

Edit | Zheng Huaizhou

Source | 36 氪 Finance (ID: krfinance)

Cover Source | Enterprise Official

In July last year, the world's largest plant protection company and the third largest seed company Xianzhengda Group (hereinafter referred to as: Shengzhengda) announced the prospectus, planned to land on the science and technology board, and planned to raise 65 billion yuan. This financing scale will surpass SMIC's first financing record set by SMIC with 53.2 billion yuan, and may become the largest IPO of A shares in the past 10 years.

However, unlike many high -listed science and technology board companies, it has been nearly one year since the submission of the prospectus to the present, and has experienced a three -wheeled inquiry of the exchange during the period. It is still on the queue. Here is not to repeat the exchanges' inquiries about Xianzhengda. From the results, the listing time of Xianzhengda has been postponed from last year to this year.

If Xianzhengda is able to go public this year, this year's market environment has changed a lot compared to last year, which will affect the actual fundraising amount of Xianzhengda. The 65 billion financing amount that was widely reported last year was actually the sum of the main fundraising of Xianzhengda, which can be understood as the psychological price of Xianzhengda at that time. In the prospectus, only the upper limit of the number of public offering shares was disclosed. In the end, it was true how much financing can be obtained through this IPO. It also depends on the market response and macro environment.

So, if Xianzhengda is listed this year, what impact will it have on the A -share market? And for investors, how to understand the investment value of Xianzhengda at the moment of standing at the moment?

First throw a conclusion that if you can go public this year, the opportunity may be better than last year.

Correct understanding of the impact of cycle misplace on Xianzhengda's performance

In our previous two articles about Xianzhengda's IPO, "65 billion, the largest IPO of A -share in the past 10 years, will the first brother of science and technology become the next PetroChina? "," Science and Technology Giants are getting closer, isn't it worth buying at the bottom value? 》》, Given the most core plant protection (including An Daomai) and the species industry that gives the former relatively empty and latter strategy.

However, with the persistence of the epidemic and the changes in the macro environment, these two major businesses have undergone certain marginal changes. The core driving factor is the continuous high prosperity of the planting industry, which has driven the supporting industry and plant protection industry of the planting industry. Landscape. However, in terms of rhythm, the prosperity cycle of the planting industry is not completely synchronized with the seed industry and the plant protection industry. The poor rhythm may have an impact on the valuation of Xianzhengda.

First of all, the changes in the planting industry in the past two years. Since the epidemic in 2020, the overall liquidity of the global capital market caused by currency over issuance has greatly pushed the price of grain. At the same time The trend, the impact of the epidemic on trade, has supported the continuous rise in grain prices, and the planting industry stepped into the prosperity cycle.

CBOT soybean, corn, wheat price trend

Source: Wind, 36 氪

In 2021, with the Fed's expected Price In, the liquidity factors of pushing food inflation gradually weakened. However, the main agricultural production areas such as the United States and Brazil have undergone drought climate. The sales ratio of core economic crops such as soybeans and corn declined, and it just happened to catch up with the recovery of the feed demand, which directly led to significantly increased the prices of major crops from 2021. The degree of prosperity of the planting industry was further raised.

Soybean, corn, wheat custard sales ratio

Source: USDA, 36 氪

Looking back on the trend of the main varieties in 2021, although soybeans and corn rushed to fall in the middle of the year, the price still remained at a historical high, and wheat shook up all the way to historical high. The high grain price is high, stimulating the sharp rise of farmers' planting, is the core reason for driving seeds and pesticide demand.

However, the key to the big year of grain is not the same as the seed of seeds and pesticides. The key is that the cycle is not synchronized, and the core factors that determine the profit of seeds and pesticide profits are not only demand. For seed enterprises, good demand is to drive supply and consumption inventory, and it can also increase profits by raising prices. Therefore, rising volume and price is the core kinetic energy of seed companies in 2021.

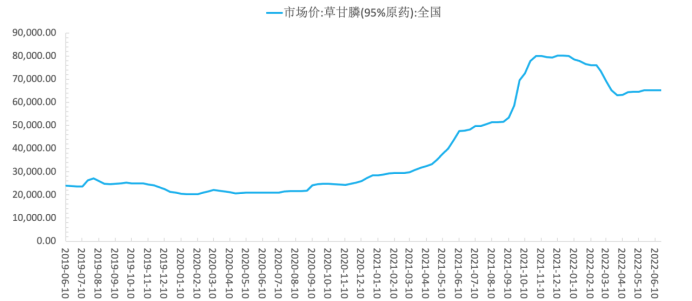

Domestic grass glyphosate (95%original drug) price trend

Source: Wind, 36 氪

Looking at the pesticide cycle, it can be observed that the price increase of large pesticides represented by Caoganju began after September 2021, and the price increase of preparation companies was almost behind, and it was significantly lagging behind grain prices. In the background of great inflation in the past two years, the significant rise in upstream raw materials has led pesticides, so pesticide companies have been under pressure for a period of time.

Therefore, from the perspective of the performance changes of the A -share pesticide sector since last year to the present, as the pesticides began to increase their prices around September last September, the pesticide sector showed a significant improving the trend of performance. Therefore, price increase is the core momentum of the growth of pesticide enterprises, and the prosperity of the pesticide industry has also increased significantly after the extensive pesticide price increase.

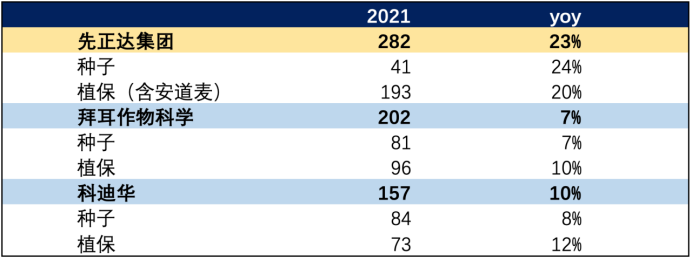

The operating income of each unit in 2021

Source: Shengzheng Dazhong's official website, 36 氪

Although the prosperity of the seed industry and pesticide industry is misplaced in rhythm, Xianzhengda showed quite good growth in the background of the overall high Beta industry in 2021. In terms of performance, in 2021, Xianzhengda revenue was 28.2 billion US dollars, an increase of 23%year -on -year, which was much higher than 5%in 2020. From a structural point of view, the four major business units have maintained a higher level of growth, and the revenue of 48%of the implant protection business units revenue of 48%of the revenue of 19%year -on -year is the basic market to support the growth of the company's performance. The year -on -year growth rate of seed business is as high as 24%, which is not only higher than the company as a whole, but also higher than the plant protection business of the same period. It just reflects the cycle dislocation of the seed industry and the pesticide industry.

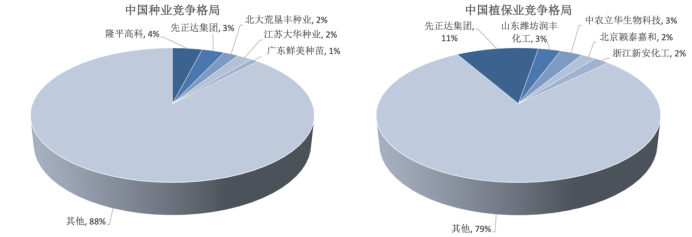

The Chinese branch has maintained the level of growth far exceeding other business units throughout the year, which indicates that the Chinese market is one of the core kinetic capacity of Xianzhengda's performance growth. In the long run, the domestic seed and plant protection industry, the market is relatively scattered, and there is a large space for integration. The reorganization of Shengzheng has a large number of Chinese assets, which is more conducive to the exhibition industry in China and will enjoy industry integration in the industry. Dividend.

The competition pattern of China's seed industry and plant protection industry in 2020

Source: Company Announcement, 36 氪

In terms of comparison in the industry, with its strong growth momentum, Xianzhengda continued to maintain the throne of global agricultural chemical brothers in the revenue scale at the end of 2021 in terms of income scale. Even if the non -plant protection and seed business income of the Chinese branch is excluded from the inconsistent caliber, the scale of Sanda's business is still the first.

From the perspective of the business, the revenue growth rate of the same period was significantly higher than that of the seed business or plant protection business. Moreover, the high growth of plant protection business last year made Xianzhengda's advantage in the field of plant protection more stable. Although the size of Shengzhengda's seed business is smaller than competitors, the growth has opened away from the opponent.

Xianzhengda, Bayer crop science and Cepya's income and growth rate in 2021

Source: Company Financial Report, 36 氪

The pesticide volume and price rises have driven Xianzhengda's Q1 performance volume growth this year

Entering 2022, the impact of the misalignment of the breeding industry and the agricultural industry again appeared again, and the marginal changes produced also affected the performance expectations of Xianzhengda this year.

Continue to look at the seedling industry first. Eastern European situation, repeated epidemic, trade protectionism, and rising planting costs have led to the increase in expected to reduce production by global food this year. As the contradiction between supply and demand deepen, grain prices have risen sharply again. Corn, refresh the historical high, or close to the peak of history.

However, the price bull market does not mean that related companies can get high profits at the same time. Food reduction will reduce the level of demand for seeds and plant protection products. Due to the cycle characteristics of grain planting, its supply mainly depends on the planting area. Even if the price of grain prices is high and the farmers' willingness to grow, the possibility of greatly expanding the planting area in a short time is very limited.

Global agricultural productivity growth

Source: USDA, 36 氪

So, can improve production efficiency quickly increase production in the short term? The answer is still negative. The development of agriculture to the moment, the improvement of productivity is based on the full use of agricultural technology and investment. However, the average annual growth rate of agricultural productivity in the past 10 years is only 2.5%. Although efficiency is continuously improved, this level does not have short -term explosive power.

Therefore, in the short term, if you want to expand the planting area and improve production efficiency, it cannot hedge the impact of large -scale reduction. This logic is exactly the situation of this year, that is, the price of grain has maintained a high level, but due to the strong expected reduction of planting needs to some extent, the increase in planting costs caused by superimposed inflation, and the profit of the planting industry and related industries.

Shengzheng reaches 2022q1 unit operating income of each unit

Source: Shengzheng Dazhong's official website, 36 氪

Xianzhengda's performance this year can also confirm this view. Affected by the slowdown in planting demand, the seed business revenue of the same period was 15%year -on -year, which was significantly lower than the level at the end of last year. The growth rate of the main competitors Koidi in Q1 this year is even only 1%. Its business center of gravity has strong production reduction expectations in North America and Europe this year. Essence

Looking at the marginal changes in the pesticide industry, the extensive increase in pesticides has reduced the suppression of corporate profits by raw material inflation. Due to the changes in the cycle of planting during the year, the demand for winter storage and spring broadcast at the beginning of the year assists the Q1 performance of pesticide companies. Therefore, the amount of pesticide demand in the short term has risen significantly, which has greatly improved the degree of prosperity of the pesticide sector.

Xianzhengda's plant protection (including An Daomai) has a strong growth in Q1 this year. The year -on -year growth rate of the two major business units was 25%year -on -year. During the same period, the revenue of the plant protection business of C is 23%and 42%year -on -year. The effect of rising costs has boosted the increase in performance volume.

From the perspective of the company, Xianzhengda's revenue this year is still leading the two major competitors, and revenue growth has accelerated on the basis of last year. Moreover, compared to the high fluctuations of competitors in the same period, the growth of Xianzhengda is more stable.

Shengzhengda, Bayer crop science and Ceya 2021Q1 income and growth rate

Source: Company Financial Report, 36 氪 Investment strategy: GMI is the biggest imagination in the future

In the context of the misalignment of the seed industry and the agricultural industry, this year the global planting industry has faced a strong output expectations and planting costs. As the seed industry of the planting industry, the growth of its industry BETA is expected to be inferior to last year than last year than last year than last year Essence In terms of pesticides, the extensive price increase is before. During the year, small cycles increased, and the environmental protection production restrictions on chemical products will be superimposed. To a certain extent, the supply will be suppressed, thereby supporting pesticide prices to maintain high operation.

Due to the strong expected food reduction expectations this year, and food safety has been mentioned at the high level of national strategic security, the planting demand will still maintain a strong level, which has driven the demand for pesticides. It is expected that this year's pesticide industry will usher in a situation of rising volume and price, and the performance of pesticide companies will be optimistic this year.

For Xianzhengda, the key factor in supporting valuation this year is expected to switch from the seed industry to the plant protection business (including An Daomai). The main reason for premium. However, Xianzhengda's imagination is not limited to the stock, and the incremental space brought by the land -based commercialization will be the core reason for the market for a long time.

Since the beginning of this year, with the continuous promotion of relevant policies, especially the recent determination of the criteria of genetically modified varieties, this year is expected to become the first year of genetically modified commercialization in my country, and the prosperity of the seed industry is expected to greatly increase.

As the third largest seed company in the world, Xianzhengda has the number of genetically modified properties in the world at a leading level in the world, and as an asset of strategic acquisition, and a Chinese neutralized endowment blessing. Once the genetically modified is landing in China, Xianzheng is the first place. The growth space of the seed business in China is truly opened.

The gray -genetic trait itself has extremely high technical barriers and compliance barriers. The special traits such as insect resistance, herbicide, and saline -resistant land can not only achieve efficiency and reduction, but also have strong alternatives to non -genetically modified genes. Essence Therefore, by virtue of the advantages of genetically modified properties, Xianzhengda will eat the bonus of the domestic planting industry's structure once its product has obtained a safety certificate.

At the same time, due to the particularity of genetically modified properties, the price of genetically modified seeds is usually higher than the non -rotor variety, and the increase in product prices can also increase income. It can be seen that the commercialization of genetically modified genetics will be the process of rising volume and price to improve performance for the large transgenic households in Xianzhengda, and the adjustment of the structure is long -term.

This returns to the point of view thrown from the beginning. In the short term, Xianzhengda is in this year of food this year. Big view.

When it comes to the impact of Shengzheng's listing on A shares, due to the huge volume, it is likely to get more than 65 billion financing. The market has previously believed that it may put pressure on the liquidity of the science and technology board. However, the recent market rumor of science and technology boards will be adjusted from 500,000 to 200,000. At that time, the liquidity of the science and technology board will be greatly improved, and concerns about the financing of agricultural chemical giants.

Note: The income units in Figure 6 and 9, Xianzhengda and Kody,: 100 million US dollars, Bayer is: 100 million euros.

*Disclaimer:

The content of this article only represents the author's opinion.

Market risk, the investment need to be cautious. In any case, the information in this article or the opinions expressed in this article does not constitute investment suggestions for anyone. Before deciding to invest, if necessary, investors must consult with professionals and make careful decisions. We have no intention of providing underwriting services or any services that need to be held in the transaction parties.

36 氪 Public account

Here is a "share, like, watch"

- END -

The Tianjin Economic Development Zone has established more than 240 companies in the Policy Policy Policy Policy Policy Policy List to participate online and offline

Recently, in order to promote the implementation of the Tianjin Economic and Techn...

BCG Tuanjian Sword Qianhai International Talent Port helped the Greater Bay Area enterprises to go to the sea to "ride the wind and break the waves"

Recently, the fourth phase of the Qianhai International Talent Port 2022 Enterpris...