Bill interest rates now since May, new high experts believe that the credit structure improvement in June can be expected to be expected.

Author:Securities daily Time:2022.06.24

23JUN

Wen | Liu Qi

Since June, the transfer of silver tickets for State Stocks has shown the "V" trend. From the perspective of several specific periods, Wind data shows that the transfer of the current interest rate of 1 month, 3 months, 6 months, and 1 -year national stocks will be reduced from June 9 to the low point of the month. 0.94%, 1.01%, 1.23%, and 1.35%began to rebound. As of June 21, the existing interest rates of the above -mentioned cash tickets of State Stocks rose to 1.64%, 1.66%, 1.68%, and 1.65%, respectively, all of which were new highs since May. In this regard, the chief economist of CITIC Securities clearly said in an interview with the Securities Daily that the transfer of silver tickets for State Stocks may be related to the low volume credit and capital interest rates at the beginning of the monthly interest rate. Considering that there is no significant adjustment of funds, interest rates have rebounded from June 10. It may be more because bank credit is better, and bills are no longer needed to increase the scale of credit. Tan Yiming, the chief analyst of the Hanging Securities Harvest Harvest, told a reporter from the Securities Daily that the current interest rate of the transfer of the silver ticket of Guoshu is recently upward. In fact, the bill of bills can be tracked through the bill interest rate. Bill interest rates are generally determined by two parts: one is the willingness of banks to use bills to financing. The more bill financing issued by banks, the lower the interest rate of bill financing. If a bank is unwilling to put the bill, the higher the financing interest rate of the bill. The other is the debt cost of the bank itself. The higher the debt cost, the higher the interest rate of bank bills. The corresponding relationship between the volume and price of bills is also clearly reflected in financial data. According to the data of the Shanghai Bill Exchange, the current interest rate of the Silver Ticket of State Stocks in one month is 0.0102%on May 23, and the current interest rate of the Silver Ticket for the three -month period is 0.0645%on May 24, which is close to " 0 interest rates. In particular, the current interest rate of the Silver Ticket of State Stocks in one month is less than 1%in May in May. Judging from the financial data in May, bill financing in May increased by 712.9 billion yuan, reaching the highest single monthly increase since statistics, plus a short -term loan increase of 264.2 billion yuan. The increase in loans accounted for 64%of 1.53 trillion yuan. Therefore, analysts believe that the credit structure performance in May is still poor. Wen Bin, chief researcher of Minsheng Bank, told the Securities Daily that the increase in short -term loans and bill financing volume reflect that the demand for the real economy is still weak. Further observation of the situation in June, in order to reflect the situation of banks to invest in, first of all, the impact of the cost of liability for banks needs to be filtered. Theoretically, if the cost of bank liabilities has not changed significantly, and the bill interest rates are up, it shows that banks are more willing to give credit quotas to loans, which can also reflect the strong physical financing demand from the side. From the perspective of 3 -month Shibor (Shanghai Banking Interim Rights Rate), which can reflect the cost of bank liabilities, the data of the inter -bank interbank borrowing center of the country shows that the 3 -month SHIBOR reported 2%on June 22, and its 5th The average value and 10 -day average are also 2%, indicating that the cost of bank liabilities has been stable since June. In this context, can the current interest rate transfer of silver tickets in China stocks have risen since June 10, which can indicate that physical financing needs are increasing? Obviously holding a certain point of view. He said, "As mentioned earlier, the bill interest rate rebound may be because bank credit is better, and the current demand side is the main restriction of credit investment. It brought. "Li Qilin, chief economist of Hongta Securities, also said in an interview with the Securities Daily that the aforementioned data can reflect the improvement of credit demand and credit structure. In the later period, the trend of the prospects obviously believes that the bill interest rate may continue to rise, but the last week of each month is often an important window period for banks to adjust the scale of credit. Therefore, the bill interest rate may also fluctuate down, but the estimated range is expected. Considering various types of credit stimulus policies, the credit structure is expected to improve from previous June.

Recommended reading

The three major index shock differentiation of more than 2 billion yuan into a large order into a photovoltaic equipment institution: the A -share market has a solid foundation

The electric vehicle industry has accelerated the CEO of many car companies in Red Haihua said that the price war is coming?

Photo | Site Cool Hero Bao Map Network Production | Zhou Wenrui

- END -

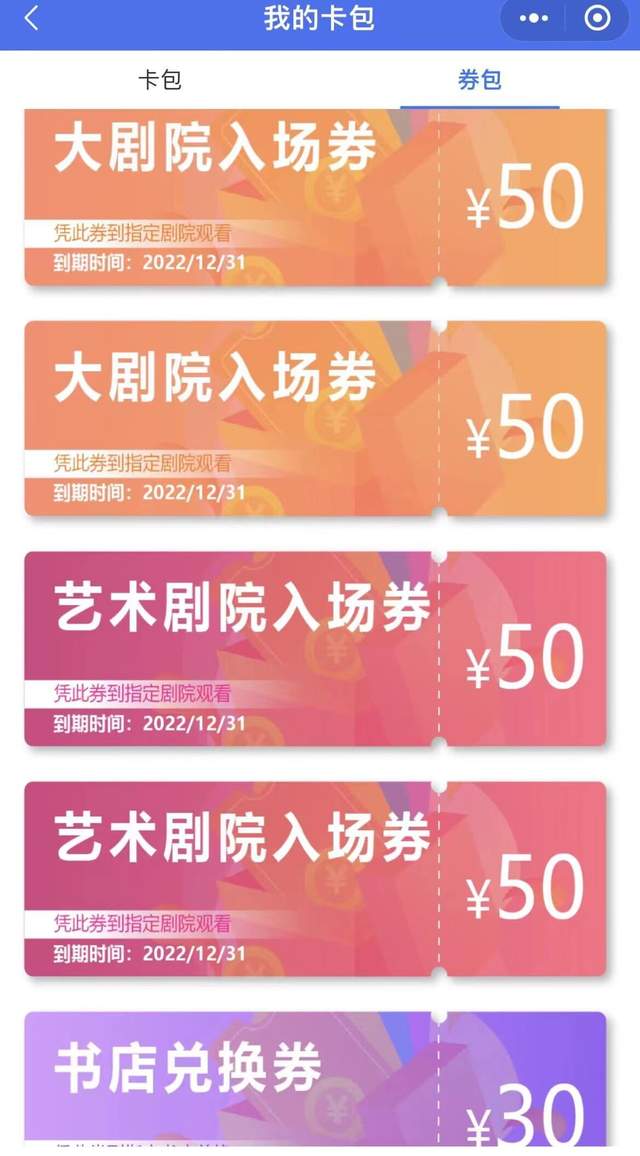

12 hours sold out!"Anshan Cultural Huimin Card" is sought after

Since the press conference of the Anshan Cultural Huimin Card on June 13, the Muni...

Harm e -commerce efforts to solve the "Rubik's Cube" of the high -end cherry cherry cherries

(YMG reporter) There are scale, capable, channel, and brand -based high -end sales...