Zhao Tingchen: How to accelerate intellectual property pledge financing business

Author:Zhongxin Jingwei Time:2022.06.23

Zhongxin Jingwei June 23rd Question: How to accelerate intellectual property pledge financing business

Author Zhao Tingchen Dr. China Bank of China Research Institute

Intellectual property financing is continuously valued by countries around the world, but it also encounters several obstacles. Some are common obstacles faced by countries. For example, financial institutions are difficult to accurately valuation on intellectual property rights, difficult to deal with financial institutions after the debtor's defaults, and the intellectual property pledge financing business under the current regulatory system is significantly consumed.

For the current China, there are still bottlenecks such as intellectual property rights and low value of pledge financing. Generally speaking, low value, difficult evaluation, difficulty in monetization and the regulatory system to a certain extent that business development is the main obstacle facing China's development of intellectual property pledge financing.

In 2021, the scale of China's intellectual property pledge financing exceeded 300 billion yuan, and the proportion of total bank assets was still low, and the above problems were not significant. In the future, with the further development of business, difficulties may become increasingly prominent.

China's development of intellectual property pledge financing faces multiple obstacles

First, the commercial value of China's intellectual property rights is low as a whole.

According to the "Audit Report of the State Council's 2019 Central Budget Execution and other fiscal revenue and expenditure", only about 8.4%of all the invention patents of 464,100 colleges and scientific research institutes were put into commercial applications. There is still much room for improvement in the overall conversion rate.

The low commercial value has led to a great reduction in the number of intellectual property that China can be applied to pledge financing. The main reason for the analysis is that the invention of many patents is often based on the promotion of professional titles and applying for government projects. A negative impact.

The second is that intellectual property evaluation is difficult.

At the same time, as an intangible asset, it is difficult to objectively evaluate intellectual property. According to the "Asset Evaluation Practice Standards -Intellectual Property Rights (Draft for Opinions)" issued by the China Asset Evaluation Association, intellectual property assessment can mainly use the cost method, income method and market law.

Because intellectual property rights are different from physical assets, the same intellectual results cannot be guaranteed after a certain cost of investment. Therefore, the cost method evaluates that intellectual property rights can be greatly limited; Evaluating asset prices is the current main intellectual property evaluation method, but in practice, a series of difficulties will be encountered. For example, intellectual property rights are difficult to divide from the carrier and are not easy to valuation. Added evaluation costs and so on. At the same time, the future income of intellectual property rights faces many uncertainty, and technological innovation is fast. In a few years, the patent "moat" of the original corporate patent may be broken, which is common in high -tech fields. From a legal perspective, the legal risks involved in intellectual property evaluation are very complicated, and multiple factors may affect future returns.

Evaluate intellectual property rights can also adopt market law, that is, according to the market price of intellectual property rights in recent transactions, consider the effects of differences on prices, and then determine valuations. The market law cannot reveal the inherent value of assets from the fundamental aspect, but it can be relatively objective to reflect the price that may be obtained after asset transactions. It is a good method of intellectual property valuation. The current problem is that there are still many inadequate trading markets for China's patent and trademarks, and it is difficult to provide accurate and objective price reference.

In addition, the current development status of China's asset evaluation industry is also unsatisfactory, and it is difficult to meet the needs of the rapid development of intellectual property pledge financing.

Third, there are difficulties in the bank after providing financing.

If the corporate breach of contract, how to deal with the pledged intellectual property rights should be realized, it is another important issue that banks are considered. There are five main ways to monetize intellectual property rights. The first is to invest in production. If you become a shareholder of a company by investing in the price, you will put intellectual property into production and operation and obtain profits; the second is to authorize other enterprises to use patents and obtain permitted fees; Praising financing; Fifth is to directly sell intellectual property rights. Taken together, commercial banks do not have the comparative advantage of operation and management of intellectual property rights, and the best way to monetize is still directly sold. However, there are still many shortcomings in the construction of China's intellectual property trading market.

For example, there are many types of intellectual property trading platforms in the country, unclear positioning, and unloading of each other. There is no market with distinctive characteristics and great influence, and there is no unified market, and there is no price that can reflect the overall market trend. index. When evaluating or trading intellectual property rights, the bank should refer to the existing transaction price of the market? Or which market should you enter? It is often difficult to judge accurately.

The intellectual property transaction process is complicated, and generally requires a professional third -party intellectual property service agency to consolidate the merger to provide relevant services. At present, there are a large number of such institutions across the country, but the experience and capabilities of intellectual property supply and demand and the needs of high -quality intellectual property transactions are still lacking.

In addition, due to the monopoly of a large amount of transaction information, while some service agencies have promoted transactions, they also have chaos such as malicious speculation, low -buying high sales, etc., disrupting the order of intellectual property trading market.

Fourth, the regulatory system cannot fully meet the needs of business development.

The regulatory system cannot fully adapt to the development needs of intellectual property pledge financing business. This is a common problem facing countries. According to China's "Capital Administration Measures for Commercial Banks", the intellectual property rights under the weight law are not qualified loan pledge; if the internal rating method is used, the risk weight must be determined by calculating the probability of asset default and the losses of breach of contract, but the pledge of intellectual property lacks historical data Risk is difficult to accurately measure. Therefore, the current intellectual property rights cannot be regulated as qualified pledge. This has led to the bank's loan after the loan is issued by the bank. When calculating the capital adequacy ratio, it is still regarded as a pure credit loan and increased bank capital consumption.

In accordance with the current regulatory regulations, when calculating capital adequacy ratios, commercial banks must deduct intangible assets in full level of capital. At this time, if the bank's assets hold an intellectual property right, it will significantly affect the capital adequacy ratio.

Accelerate the improvement of intellectual property pledge financing system

First, improve the intellectual property market transaction and promote intellectual property standards. The first is to update and improve relevant regulations; the second is to establish a unified and standardized intellectual property trading platform across the country, further formulate a clear threshold for supervision, and assess the current platforms of various types of platforms from various aspects such as information disclosure, infrastructure construction, and standardized operations. If you do not meet the standards, you should clear or rectify, and the platforms meet the standards of the unified market; the third is to increase its efforts to standardize the construction of intellectual property service agencies and promote the high -level development of the industry.

Second, strengthen the construction of intellectual property evaluation agencies and talent training. First, relevant departments improve the guidelines for intellectual property evaluation, and recommend that relevant departments issue the evaluation guidelines for the whole society and cover various intellectual property rights, and continue to update according to business development to provide standardized unified operation processes and standards for intellectual property evaluation; The asset evaluation industry supervision, improve social credibility, guide the industry to improve the concentration, and cultivate more national assessment agencies with strong strength, good reputation, and large scale; third, strengthen talent training and improve the professional literacy of intellectual property evaluation personnel; Subsidies to form an evaluation cost sharing mechanism, reduce corporate financing costs, and promote the development of intellectual property evaluation agencies.

Third, increase policy support and improve the risk sharing mechanism. In response to the issue of intellectual property pledge business under the current capital management system, it will consume a lot of capital. It is recommended that the regulatory authorities and commercial banks jointly negotiate and discuss feasible solutions. Based on comprehensive consideration Proper wide limit. In addition, the pledge of intellectual property rights occurs in economically developed areas such as North, Shang, Guang, Zhejiang, and local financial conditions are generally good. It can give full play to the funding support and risk sharing of local financial and local policy guarantee companies. Specifically, the first is the establishment of a policy intellectual property service agency, which specializes in cooperating with commercial banks to carry out intellectual property pledge business in accordance with the principle of capital protection. The second is to explore intellectual property rights to become qualified pledge of central bank monetary policy. In addition to the existing scientific and technological innovation and re -loan, consider creating a new intellectual property pledge financing and re -loan, and provide financial support for banks to carry out business. The third is to encourage guarantee companies and insurance companies to further expand the guarantee of intellectual property pledge financing and guarantee business. In particular, the banking insurance company has a broad prospect for expanding intellectual property pledge financing business with her mother bank.

Banks should strengthen intellectual property pledge business

Intellectual property pledge financing business is innovative and risky. Commercial banks can take measures from several aspects, and should strengthen cooperation with intellectual property service agencies to carry out intellectual property pledge business and continue to promote business development.

First, continuously improve the professional capabilities of business personnel and improve the business mechanism. It is necessary to establish a compound talent team that understands finance, law, and technology, and form a sound talent training system and a market -oriented salary system, so that employees' income is linked to their own ability and performance. Otherwise, even if you cultivate outstanding business talents, there will be a loss of talents. In addition, it is necessary to explore the credit process and risk control system that is adapted to the pledge of intellectual property.

Second, strengthen cooperation with professional intellectual property service agencies. Due to the lack of intellectual property evaluation and disposal professional capabilities and experience, commercial banks should strengthen cooperation with intellectual property service agencies in the process of carrying out business, conduct intellectual property evaluations by service institutions, and assist banks to carry out intellectual property disposal.

Third, explore the establishment of a subsidiary to carry out intellectual property pledge business. In view of the risk of intellectual property pledge business, and may be seriously consumed by capital, it can explore the establishment of subsidiaries (joint ventures that can be jointly carried out with other financial institutions or intellectual property service institutions). Essence When calculating the capital adequacy ratio, how the subsidiary should compare with the parent company and should communicate with the regulatory authorities early. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Wang Lei

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Check the hidden dangers and keep the safety

Recently, the Putian City Chamber Public Security Branch United District Maritime ...

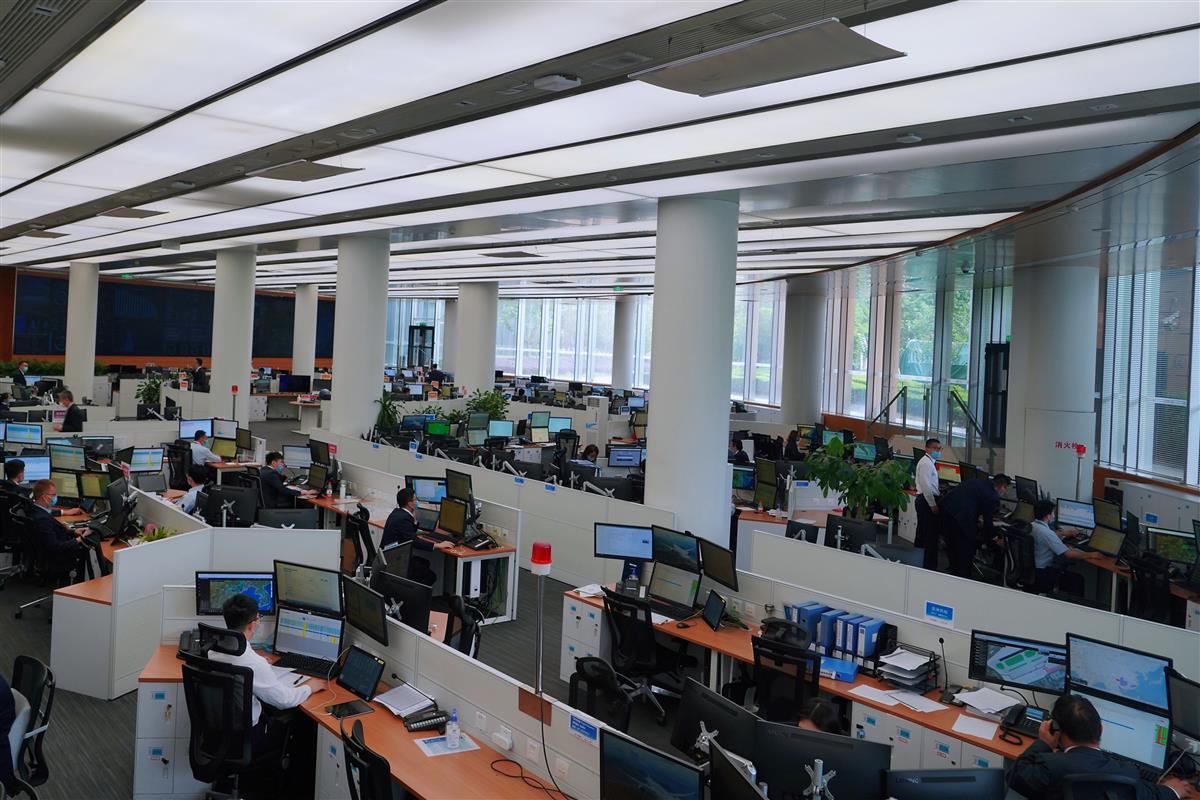

11 days in a row!Eastern Airlines average flight volume restores a innovation high

Jimu News reporter Shi QianOn June 20, China China Eastern Airlines Democratic fli...