The first domestic category REITs may breach contract, and Red Star Macalline is facing a dilemma

Author:City world Time:2022.09.29

Recently, a number of investors broke the news that they bought a special assets released by the original Red Star Macalline as the basic assets in 2017. In the period, as of the current principal, it has not yet paid the principal or has constituted a breach of contract.

The asset support special plan was released in the name of "the first domestic single home Mall class REITS product". If the subsequent substantial thunderbolt will have a significant impact on the relevant parties of the product. The "REITS" product is different from REITs in the strict sense. They are issued by the market and part of the REITs standards in the market. Therefore, they are called "REITs" products. There are certain differences in scope and other aspects.

Specifically, on September 12, 2017, Red Star Macalline (1528.HK) issued an announcement that the first domestic single home Mall class REITS product- "Changxing-Gaohe Red Star Home Asset Support Special Plan" (hereinafter referred to as The "Changxing-Gaohe Asset Plan") was successfully completed, and the subscription target of 2.65 billion yuan was subscribed for September 13, 2022.

In the design of this product, Red Star Macalline sold its two home malls to Tianjin Changhe Equity Investment Fund Management Co., Ltd. management fund management Co., Ltd.. Dipped and played from Red Star Macalline.

From the perspective of structure, Changxing-Gaohe Asset Plan has been split into three parts, including priority A-grade asset support securities, priority B-grade asset support securities and sub-asset support securities.

The institutional qualified investor subscribes priority assets to support securities, while Red Star Macalline indirectly holds subordinate assets support securities. That is, during the duration of the partnership, the partners of the priority limited partners achieved the amount of investment income targets that could not reach the partnership agreement to calculate the partnership agreement through allocation. Red Star Macalline must make up the difference from the priority limited partner.

For Red Star Macalline, the "Changxing-Gaohe Asset Plan" is a new way for its exit and at the same time. If this model can be continued, it may be possible to change Red Star Macalline from the "heavy asset" model to a "light asset" model.

However, due to the changes in the market environment, the product is rampant.

In November 2020, the manager Bohai Huijin disclosed the product disposal plan and intends to withdraw the second phase of the second phase of the special plan. In this regard, Macron (601828.SH) released a credit increase announcement in October 2021, saying that the first phase of the special plan is about to expire, and the company plans to continue to cooperate with relevant parties such as Bohai Huijin Securities Asset Management Co., Ltd. -Gaori Red Star Home (Phase II) asset support special plan (tentative name), and the special plan will be transferred to the relevant assets held by the first phase of the special plan. At the same time, the company's board of directors passed the "Proposal on Providing Credit Measures for the Special Plan for Changxing-Gaohe and Red Star Home (Phase II) Asset Support Special Plan" on September 15, 2021.

It seems that the first phase is carried out in the rhythm, but the special plan of the second phase of the problem has not been issued as scheduled.

As of now, 16 days have passed since the "Changxing-Gaohe Asset Plan" agreed, and there are no new news about the second phase of the special plan. On August 26, 2022, the "Changxing-Gaohe Asset Plan" 17 Changxing 01, 17 Changxing 02, and 17 Changxingji have been suspended because there are "major matters."

The city community asked the listed company Merren in this regard. The other party only stated that the relevant asset plan was an off -the -shelf financing, and he was no longer the main body of the relevant asset plan.

The semi -annual report of 2022 showed that Macalline's asset -liability ratio reached 56.98%. At the end of June, the company's interest debt reached 35.277 billion yuan, of which the interest debt due within one year reached 11.707 billion yuan. On the other side, at the end of June 2022, Macalline's book currency funds were 6.135 billion yuan, which was the lowest level since 2017, and the pressure on funds was obviously greater.

Public information shows that Che Jianxing is the actual controller of Macalline. The actual control of Red Star Macalline Holdings Group Co., Ltd. is the largest shareholder of Merren's current 60.12%. Of the 2618 billion shares of Kailong, 70.96%have been pledged, accounting for 42.66%of the total share capital of listed companies, and the relevant stock price decline has reached 45.98%since the pledge date.

As of now, Red Star Macalline has not responded to the treatment measures for the "Changxing-Gaohe Asset Plan". If the product is thunderous, it will have a significant impact on the market on the market.

Many investors said they would actively protect their rights. The city community will continue to pay attention to this.

(Author Yuyu)

- END -

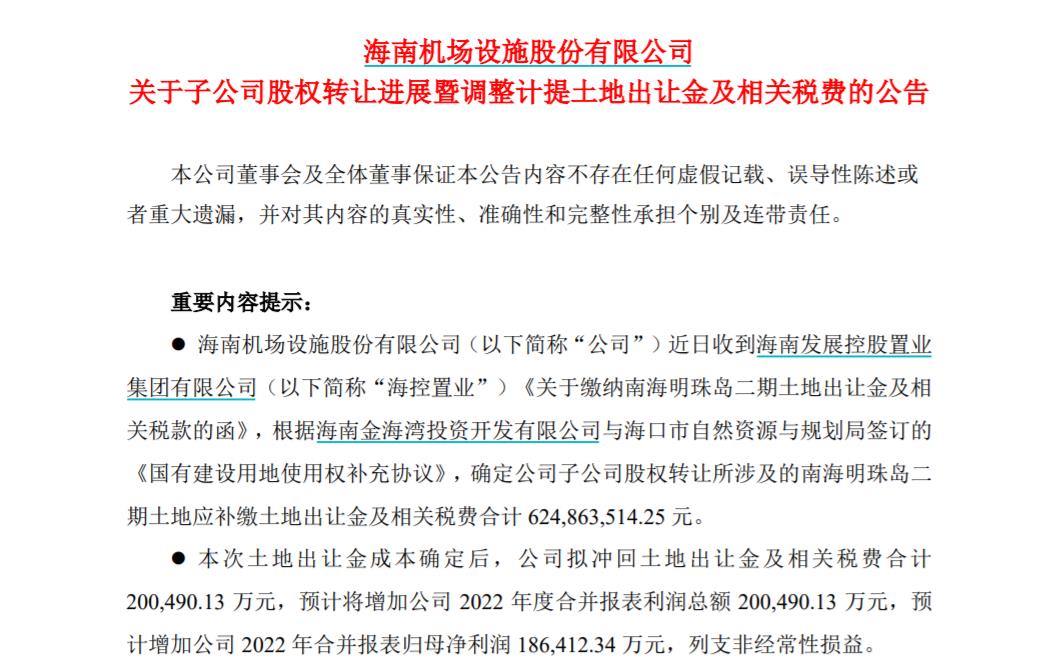

V Guan Finance Report | ST foundation is expected to increase the annual net profit of 1.864 billion yuan. What happened?

Zhongxin Jingwei, September 26th. On the evening of the 26th, ST Basic (Hainan Air...

Unmanned care of infants and young children is the primary factor that hinders fertility. 1/3 of the families in the city have nursery demand

On the morning of August 17, the National Health and Health Commission held a press conference to introduce the Guiding Opinions on Further Improve and Implement Active Paternal Support Measures. Ha