Local banks are constantly!122 village and township banks nationwide are high risks

Author:China Well -off Time:2022.06.23

Since the beginning of this year, the "Difficulties" incident in Wujia and Town Bank of Henan has continued to ferment. At the same time, the risk management and control of village banks has also attracted widespread attention from all walks of life.

Although the scale of village banks is not large, the number has become the largest category of banks in China. According to data from the CBRC, as of the end of 2021, the number of villages and towns across the country was 1,651, accounting for about 36%of the total number of banking financial institutions across the country.

Thanks to regional advantages and relatively high deposit interest, village banks' deposit products are favored by some users. However, with the stricter supervision of the Internet platform deposit products, the suspension of the interest -stricken product, and the pressure of structural deposits, the pressure of village banks is limited by fewer offline outlets, a single source of funds, and weak comprehensive strength and other reasons. Faced with a large pressure on savings, so fancy storage is frequent.

At the same time, due to various factors, the risk level of a few villages and towns risks rapidly, and related issues are more prominent.

122 village and township banks nationwide are high risks

According to the statistics of the central bank, as of the second quarter of 2021, a total of 122 village banks were high -risk institutions, accounting for about 29%of all high -risk institutions.

According to the recent data disclosed by the regulatory authorities, the non -performing loan ratio of village and township banks is about 4%, and the cover coverage rate is about 110%. As far as these two numbers are concerned, there is a lot of room for improvement in the level of risk control and control of village and township banks.

The central bank also announced at least two financial institutions' rating before the four rural banks of Henan from 2020 to April 18, 2022. On April 24, 2021 and March 25, 2022, respectively.

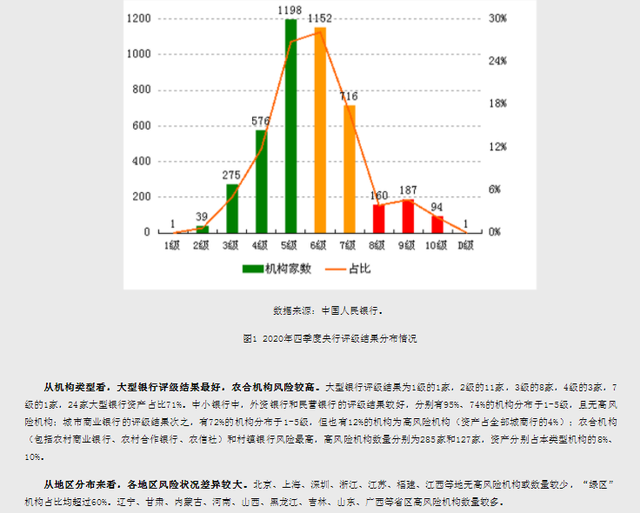

On April 24, 2021, the People's Bank of China announced the results of the central bank's financial institutions in the fourth quarter of 2020.

From the perspective of institutional types, large banks have the best rating results, and agricultural co -organizations are more risky. Large bank rating results are 1 level 1, 11 level 2, 8 level 3, 3 level 4, 1 level 7, and 24 large bank assets account for 71%. Among the small and medium-sized banks, the rating results of foreign banks and private banks are better, with 95%and 74%of institutions distributed at level 1-5, and there are no high-risk institutions. The agency is distributed at level 1-5, but 12%of institutions are high-risk institutions (assets account for 4%of all urban commercial banks); agricultural cooperative institutions (including rural commercial banks, rural cooperative banks, agricultural credit cooperatives) and village and towns banks risks The highest, the number of high -risk institutions is 285 and 127, respectively, and assets account for 8%and 10%of the types of institutions, respectively.

From the perspective of regional distribution, risks in various regions are large. Beijing, Shanghai, Shenzhen, Zhejiang, Jiangsu, Fujian, Jiangxi and other places have no high risk institutions or fewer quantities, and the "green area" institutions account for more than 60%. Liaoning, Gansu, Inner Mongolia, Henan, Shanxi, Heilongjiang, Jilin, Shandong, Guangxi and other high -risk institutions have a large number of high -risk institutions.

In other words, as of April 2021, domestic high -risk financial institutions were concentrated in agricultural cooperative institutions (including rural commercial banks, rural cooperative banks, agricultural credit cooperatives) and village and town banks, respectively. 12%of the urban commercial banks are high -risk (133 urban commercial bank rating, 12%are 16).

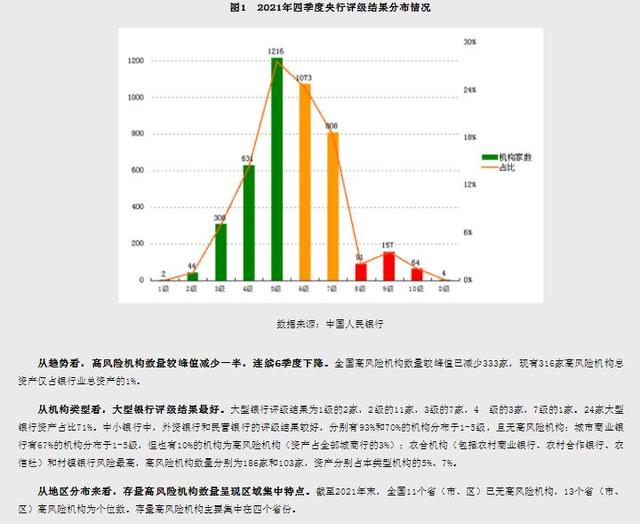

On March 25, 2022, the results of the central bank's financial institutions were announced in the fourth quarter of 2021.

From the perspective of institutional types, large bank rating results are the best. Large bank rating results are 2 level 1, 11 level 2, 7 level 3, 3 level 4, and 1 level 7. 24 large bank assets account for 71%. Among the small and medium-sized banks, the rating of foreign banks and private banks is better, with 93%and 70%of institutions distributed at levels 1-5, and there are no high-risk institutions; 67%of urban commercial banks are distributed in 1-5 Level, but 10%of institutions are high -risk institutions (assets account for 3%of all urban commercial banks); agricultural cooperative institutions (including rural commercial banks, rural cooperative banks, agricultural credit cooperatives) and village and town banks have the highest risk, and the number of high -risk institutions There are 186 and 103 respectively, and the assets account for 5%and 7%of the types of this type.

From the perspective of regional distribution, the number of high -risk institutions in stock presents regional concentration characteristics. As of the end of 2021, 11 provinces (cities, districts) across the country had no high risk institutions, and 13 provinces (cities, districts) high -risk institutions were single -digit. High -risk agencies are mainly concentrated in four provinces.

In other words, as of March 2022, domestic high -risk financial institutions are still concentrated in agricultural cooperative institutions (including rural commercial banks, rural cooperative banks, agricultural credit cooperatives) and village and town banks, respectively. 10%of urban commercial banks are high risk. 128 urban commercial bank rating, 10%is 13.

Therefore, in the announcement of the central bank's financial institution rating information, from 2020 to March 2022, high -risk financial institutions and distributed areas have clearly told everyone to see if they are interested.

Village and township bank difficulties are prominent

In recent years, a few village banks have been affected by various factors, the level of risk has risen rapidly, and related issues have more prominent issues, which seriously affect and restrict their sustainable development and financial services.

Among them, decentralized equity and chaos in governance are a common issue facing village and town banks. Among all banks, the threshold for the establishment of village banks is the lowest, and the requirements for shareholders are also extremely low, but because of this, village banks have a "initiator" system different from other banks. Judging from the problems exposed by the "difficulty of withdrawal" of Henan and Anhui Village Bank, the initiative not only failed to effectively control the risk of village banks they controlled, but even had quite a lot of equity governance. In terms of adverse rates, according to the statistics of Hua'an Securities Report, the non -performing rate of village banks is significantly higher than that of urban commercial banks and rural commercial banks. The "2021 Village and Town Bank Research Report" shows that in 2018, 2019, and 2020 village banks' non -performing loans were 3.66%, 3.7%, and 4%, respectively. According to data from the China Banking Regulatory Commission, as of the end of 2020, the non -performing rate of the state -owned bank was 1.52%, the non -performing rate of the shares was 1.50%, the non -performing rate of urban commercial banks was 1.81%, and the adverse rate of the Rural Commercial Bank was 3.88%.

In terms of regulatory punishment, the First Financial Reporter According to the statistics of corporate early warning, since 2018, there have been about 1,500 information involving village and township bank punishment. Including illegal operations, violations of money laundering, incomplete internal systems, false or serious misleading statements, serious incompetence on loans, loans of loans across operating areas, illegal sales agency insurance products, etc.

The main business deviates the problem. At the beginning of the establishment of village and township banks, it was to solve the problem of rural finance. It was hoped that village banks would realize "rural deposits, rural loans", and effectively use rural funds to build rural areas and develop rural economy. However, many village banks are "leaving far away from farmers."例如浙江省审计厅2018年对浙江48 家村镇银行涉农贷款用途审计发现,2015 年至2017 年间,有12 家村镇银行的涉农贷款投向房地产、“两高一剩”企业、证券期货市场、 The government financing platform is nearly 400 million yuan, and some village banks have invested the central bank's supporting farmers to the non -agricultural field.

Combined reorganization to resolve risks

In order to resolve risks, the mergers and reorganizations of some village banks are also steadily advancing.

On January 5, 2021, the China Banking Regulatory Commission issued the "Notice on Further Promoting the Reconstruction of Village and Town Bank to Resolve Risk Reform Reorganization".

The notice mentioned that the merger and reorganization of village and township banks is properly promoted in an orderly manner. Village banks with good regulatory rating, outstanding management capabilities, and distinctive small characteristics of the agricultural support, and high -risk villages and towns in the county (district) or county (district) near the province are converted into sub -branches.

On April 19, the Xia Yin Insurance Regulatory Bureau approved the consent of the Ningxia Pingluo Rural Commercial Bank to absorb and consolidate the Pinglosha Lake Village Bank. According to the relevant approval, after the absorption of the combination, the Pingluo Shahu Village Bank will dissolve.

At the end of 2020, the two villages and towns banks of Chongqing and Ningbo (Chongqing Wanzhou Binjiang Binjiang Binjiang Binjiang Fudden Village Bank, Ningbo Ninghai West Store China Yinfunden Village Bank) was approved by the local Banking Insurance Regulatory Bureau to dissolve. The market is regarded as the first batch of national village and towns with a case of investigation.

At the ventilation meeting held in May this year, the CBRC also mentioned the risk disposal of small and medium banks. According to the CBRC, since 2018, a total of 627 small and medium -sized banks in rural areas have been disposed of with a total of 2.6 trillion yuan in non -performing loans, which exceeds the sum of the previous ten years. The China Banking Regulatory Commission also stated that it will continue to promote the reform of small and medium -sized banks in rural areas; in addition, it will mention "encouraging high -quality banks, insurance, financial asset management companies and other institutions to participate in mergers and acquisitions of small and medium -sized banks", and will be encouraged to encourage encouragement Small and medium -sized banks merger and reorganization support policies.

At present, the major mergers and acquisitions and reorganizations between large and medium -sized banks have basically come to an end, and the competitive pattern has basically formed. In the future, integration between grass -roots banks such as village banks may be the trend of low -level structural adjustments in the banking industry.

From the perspective of analysts, the integration between village banks and other banks in the future will become a trend. Most village banks may be controlled by larger banks or introduce strategic investors to ensure capital supply, control risk control management costs, strengthen their own convergence themselves Continuous operation capabilities.

Talking about the future development trend of village and township banks, experts point out that the development of village banks in the future will generally show two situations. Some village banks with better development momentum may maintain a small and strong business position. Large bank holders or introduce strategic investors, thereby ensuring the supply of capital supply, controlling risk control management costs, and strengthening their own compliance continuous operation capabilities.

For the current village banks, it is experiencing the biggest crisis since its birth. As a bank user, we must not blindly veto the security of the bank, or simply and rudely believe that all small and medium banks are not safe, or blame the problem on the Internet channels, and completely refuse to invest online wealth management. Instead, we must look at the problems rationally, prevent risks, and protect their legitimate rights and interests in a correct way.

(China Xiaokang.com Comprehensive China Government Network, CCTV News, First Finance, Finance, the website of the Financial Stability Bureau of the People's Bank of China, Beijing Commercial Daily, etc.)

- END -

Tonghe Black fungus counterattack successfully | "Ping" ecological rice goes south to the market

In the midsummer in Bingcheng, the agriculture is busy. In the rice seedling green...

Shanxi Yuncheng Economic Development Zone Discipline Inspection and Supervision Working Committee: Precision supervision and escort help enterprises to relieve difficulties

Shanxi Economic Daily reporter Zhai Buiting correspondent Wang XiangRecently, the ...